What Did You Learn from the Bear Market?

hive·@adamada·

0.000 HBDWhat Did You Learn from the Bear Market?

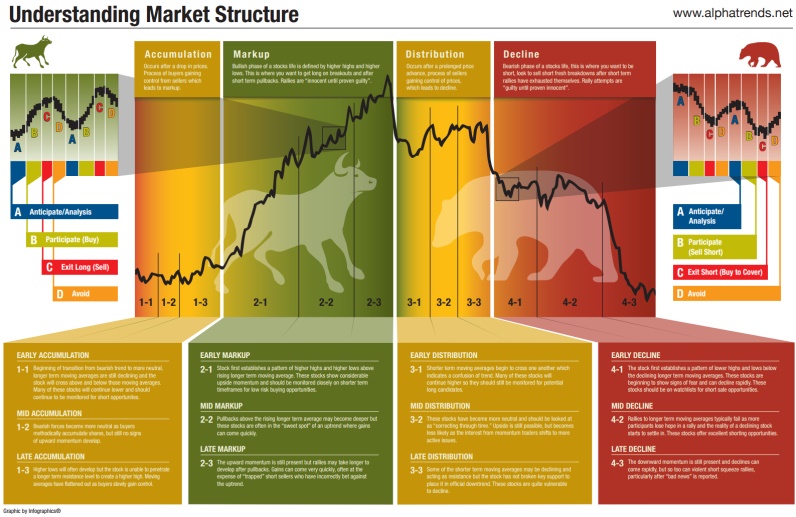

The market is in green, everything is right again. Seeing the same thing happen again was anticlimactic, at some point this was likely to happen given the hype and fundamental news backing this rally up. https://twitter.com/WatcherGuru/status/1764788487520211287 Yesterday's news: <center></center> I took some partial profits early but not really keen on considering it a victory since I'm anticipating another run up. I could be wrong but being wrong here wouldn't really end my world and I'm fine with how things are. > The bear market conditioned out heads that the first sign of breaking from consolidation is to sell for fear that it would dip again. Even when the overall market sentiment shows it's trending up, people will sell early because they are used to the bear market. It's an entry from my trade journal which I didn't pay heed to until I sold partial. I was tempted to do it again but took a step back and see the bigger picture. > If a token has been consolidating for a long time and broke a long term resistance, do you really think it would just behave and fall in line even when the overall market encourages it to go up? I'm not sure if I can apply the lesson on Hive but this is what I learned from other tokens that consolidated for a long time and broke their resistances. The large stakeholders had their fill accumulating at the lows and now are ready to sell so there's no incentive to keep pushing down prices. If Hive catches up, I wonder what people's excuse are when they had more than a year to accumulate. The same sentiment with BTC when it was at its lows. History already showed us that things tend to happen in cycles. <center></center> Whether BTC makes an uncharted territory up or dips below, I wouldn't really mind since lessons learned from the previous bull and bear markets should've made it clear what needs to be done. Markets happen in cycles. The last bull run, people were buying when they were supposed to be slowly selling. The bear markets should have been the time to accumulate and most people just need to wait. This is all good in hindsight and we can forgive ourselves from missing out because we were only acting in our best interests with what available information we have. But in the same hindsight, one should've at least had an inkling that things happen in rhythm. Don't get too caught in euphoria that you don't sell. Don't get too caught in fear and uncertainty that you missed out on the opportunity. Thanks for your time.

👍 reward.app, tpkidkai, zehn34, xanreo, kembot, randomblock1, joeyarnoldvn, zyx066, foreveraverage, upme, cryptkeeper17, kendallron, enforcer48, zhoten, sevenoh-fiveoh, mylibrary, madame-cyntaia, magsdiasilva, leo-btc, leo-hbd, leo-leo, hive2024, steemseph, solominer, romeskie, gunnarheilmann, juanvegetarian, trangbaby, wittyzell, freebornsociety, flxlove, ltcih, oac, golddeck, calatorulmiop, recoveryinc, markjason, jude.villarta, whangster79, wannderingsoul, babeltrips, samrisso, tomtothetom, dodovietnam, phuongthao98, thaolaven, thu172, cugel, lynnnguyen, kimloan, winnietran, dora381, crazy-bee, sunnyvo, hyhy93, motherof2dragons, lamphuong, ivypham, youdontknowme, wildarms65, ityp, logantron, wendyburger, hive-195880, dying, doomsdaychassis, fikif, koussbar, thanksforplaying, perceval, therealflaws, cthings, spice-c, wallets4sale, steemph.manila, nyxlabs, creodas, hiveph, annazsarinacruz, rye05, maverickinvictus, jazzhero, me2selah, steemph.uae, bella.bear, mami.sheh7, jonalyn2020, yoieuqudniram, aweee, cmmndrbawang, chileng17, scion02b, dawan, crimsonowl-art, asdfghjkiraaa, etselec23, ayane-chan, callmesmile, jenthoughts, jpatrick28, yzamazing, morenamarie, sherline, eylii, joycebuzz, appleeatingapple, bearone, diosarich, steemph.cebu, amayphin, arcgspy, sensiblecast, tonmarinduque, mutedgeek, bluepark, jeansapphire, pinkchic, jloberiza, khairro, alliebee, nachtsecre, coach-p, dafusa, matilei, joshglen, xylliana, jamiz, jenesa, starzy, rencongland, sam9999, frankydoodle, nikkabomb, psyo, ate.eping, sunshine, brotherhood, danokoroafor, ryleebear, itravelrox, bhdc, acantoni, mangos, itinerantph, hellene8, sbi5, enjar, chops.support, sbi-tokens, sneakyninja, mastergerund, anneporter, thedailysneak, cryptoknight12, wiggl3, mrnightmare89, kneelyrac, gohenry, rachelleignacio, iameden, metapiziks, alexandra1301, ilovegames, kothy, kharma.scribbles, fineartnow, nathen007, mengao, cebu-walkers, angelbless, leslierevales, orphansofdoom, adelair, amirtheawesome1, horriblesteemian, bullinachinashop, yuba.wallace, hilary.clinton, musicfan, drugsarebadmkay, teambull, macoolette, pishio, josejirafa, dickturpin, hivewatchers, themadgoat, steemtelly, michellpiala, junebride, jancharlest, marysent, christianyocte, feanorgu, glecerioberto, broncnutz, astrocat-3663, ybanezkim26, replicantua, speko, rafzat, vincentnijman, theindiankid, djbravo, iamjadeline, good-karma, esteemapp, esteem.app, ecency, ecency.stats, drwom, cherryng, auleo, filotasriza3, bananzell, takuri, leansorribas,