Modern financial system- is this a zero sum game?

hive-167922·@akdx·

0.000 HBDModern financial system- is this a zero sum game?

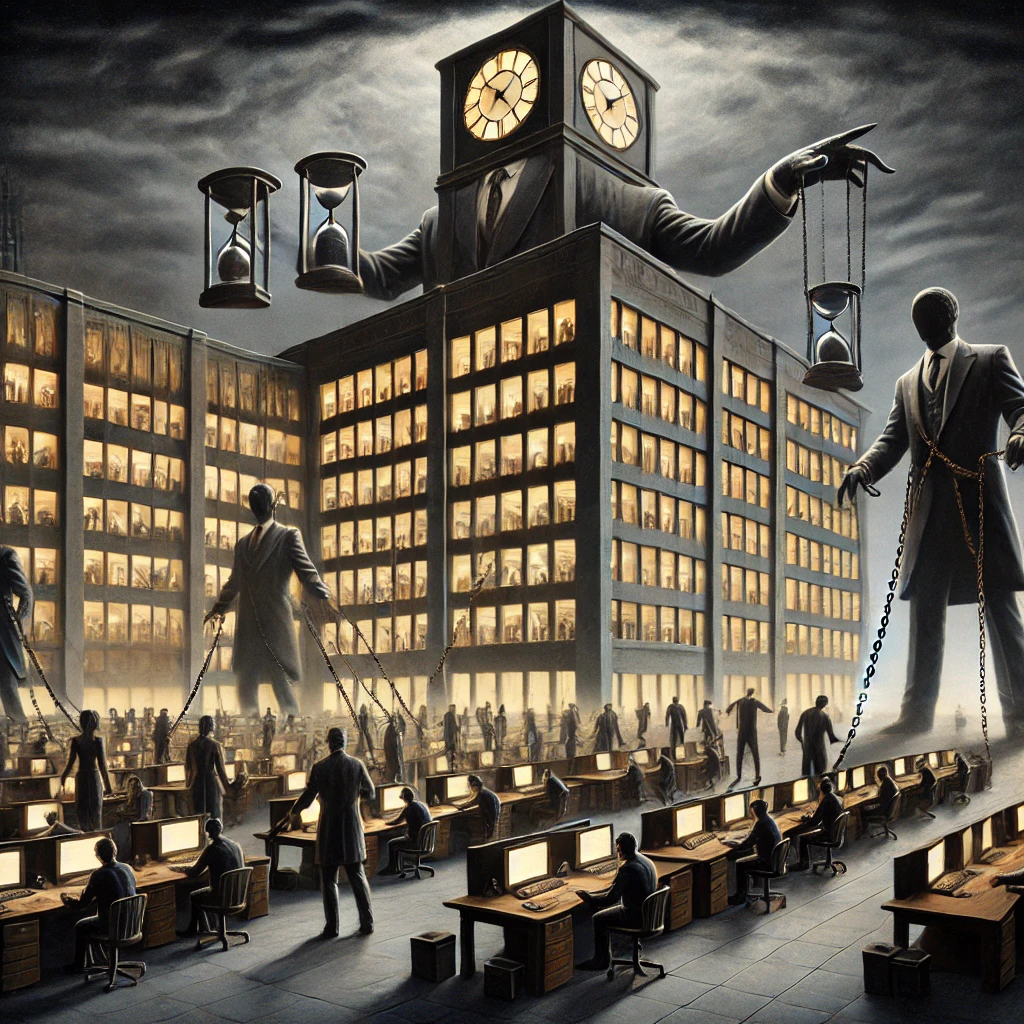

# Greetings friends! <div class="text-justify"> We often read in history books that the kings of the old and medieval ages were cruel rulers who imposed heavy taxes on their subjects. But is that entirely true?  (AI generated image) In ancient times, taxes weren’t collected in the form of currency, as there was no concept of paper money. Instead, people paid taxes through crops or free labor. Gold and silver coins were rare among common people, so their agricultural produce was essential to feed the army and support the government. Even then, taxation had its limitations. Kings had no practical means to store surplus crops for long periods, and there was often enough food to meet their needs. That’s why taxes were relatively minimal. Then came the modern era, bringing with it currency notes and a new age of taxation. With the invention of money came countless forms of taxes, all imposed on common people. These taxes left individuals with little choice but to work harder just to pay what was owed and spending whatever remained afterward to meet their basic needs. To grow their wealth in this system, people began investing in shares and various financial derivatives. The principle of a joint stock company is straightforward: it issues shares, which represent partial ownership in the company. Ownership is limited to the proportion of shares one holds. For example, if a company issues one billion shares with a face value of one dollar, the company's notional value becomes one billion dollars. If someone buys 1,000 of those shares, he or she own that specific fraction of the company. If demand for those shares rises, he or she can sell at a profit; if demand falls, he or she has to sell at a loss. However, despite owning shares, shareholders don’t truly have control over the company’s physical assets. Companies may share profits through dividends, but it’s not mandatory for them to pay dividends. Also, dividends are often lower than bank interest rates and are also considered taxable income. Compare this to tangible assets: you can use land for farming, live in a house you buy, or wear gold and silver as jewellery. But shares are paper assets. If no one wants to buy them at your asking price, they’re worthless or you have to sustain a loss. That’s why the system needs a buyer willing to take your risk, only then do shares have value. Yes, share prices can increase and yield good returns. But shares hold no real worth until you can actually cash them out. If a company is dissolved, shareholders are the last to be paid. They are paid only if anything remains after creditors are settled. Usually, companies that go bankrupt have more liabilities than assets, meaning shareholders often receive nothing. This is why I call the stock market a zero-sum game. For someone to profit, someone else must lose. That’s the hard truth of our modern financial system. This is a system that rewards a few while burdening the many with taxes and debt. It’s a structure that continues to make the rich richer and the poor poorer. And don’t forget that this is also true for the cryptocurrencies.</div> **Thanks for reading!**

👍 r1s2g3, steemitcentral, kotdwar, erica005, supriya.gupta, ripperone, abbak7, leoball, diverse, steemflow, indiaunited, hive-117638, hardikv, splash-of-angs63, bobinson, dynamicrypto, bhattg, oadissin, ragavee, khan.dayyanz, bozz.sports, muterra, disha30, gamerzaza, solumviz, ranjith98, bbypanda4, ashokcan143, codingdefined, sankysanket18, vishire, shonyishere, frames, raqibul, rainbowbala, indiaunited-bot, badfinger, dikshabihani, vandanabhatt, yogeshbhatt, deimage, emreal, pinkchic, imacryptogeek, abhay2695, bipolar95, mayor-001, good-karma, esteemapp, esteem.app, ecency, ecency.stats, ecency.waves, godfather.ftw, photolovers1, drwom, sunisa, sorin.cristescu, sayee, ahmadmangazap, cherryng, yoieuqudniram, sekani, bigorna1, ngwinndave, aslamrer, ene22, eolianpariah2, esmeesmith, silenteyes, balvinder294, bsameep, steembasicincome, buildingpies, briefmarken, powerego, drlobes, markone85,