Traceto: The New Global Market for the KYC System

cryotocurrency·@ambition1·

0.000 HBDTraceto: The New Global Market for the KYC System

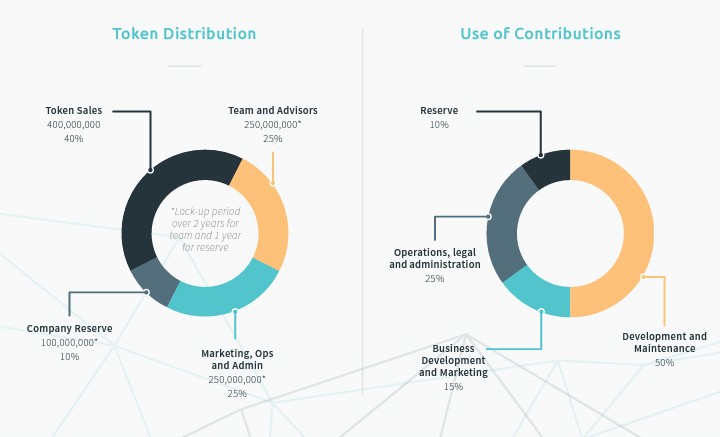

Since the last decade, regulatory measures identified with the anti-money laundering (AML), countering terrorism financing (CTF) and market misconduct measures have cost the banking and finance industry at least USD 321 billion acrued since the Global Financial Crisis1. While larger firms have been able to settle up to the rising cost of compliance, which many rather smaller banks and financial institutions have been unable to become fully compliant with the AML and CTF regulations. In the fellowship of larger firms, there have been a chain of high profile investigations, some of which have outcomed into hefty fines for it's participants. Around the world, this poses a number of challenges as the series of AML and CTF cases rise. Introductory Making the issue is the evolution of the digital world complex, in particular the boom of of cryptocurrencies, which have been designed around preserving the anonymity of the transacting parties, further adds up to the regulatory visaged by different financial institutions. In this game of finance, the financial institutions are not the ones who struggle; regulators themselves find it difficult to catch up with the advancement of technology and how they can be used to facilitate Illegitimate affairs. However, the cryptocurrency technology is still in its baby faze, and yet many regulatory bodies have been slow to fully understand its potential implications on AML and CTF. Due to this, many regulators present a shy face towards the adoption of such. The Big Question: WHAT IS KYC? KFC stands for Know Your Customer and it involves a chain of procedures where an organization shows to regulators that they have undergone several risks ( money laundering, terrorism financing, credit worthiness and product suitability) etc Before and throughout any business relationship with any customer. What Are KYC's Problems? Since the Global Financial Crisis, regulators and businesses have risen to KYC standards. And also with the rise of ISIS and other faces of terrorism to the surface , relevant bodies have become more careful and pay attention to AML and CTF. Most market participants have been quite reluctant to aggreviate towards E-KYC. However, the additional processes to be executed are not quite up to standard and they vary across jurisdictions. Majority of KYC present processes are manual. Customers have to fill up a variety of forms and declarations before they Can be granted access to the services they require. There is a potential step down of revenue from customers who tend to view the KYC process as too tedious. Because there are various personnels and functions involved in this KYC process, and so the manual KYC is often inefficient and error-prone. Analog KYC procedures are conducted and stored on physical documents. These bring extra costs related to the making preservation and destruction of paper-based records. Analog KYC processes therefore present compatibility issues to the parent organization who seeks to digitalise and move ahead to electronic KYC. THE WORLD OF CRYPTOCURRENCIES The year 2017 was a massive year for cryptocurrencies. A giant rise in price coupled with an increased focus from mainstream media has brought in different responses from regulatory bodies across the globe. The most common approach picked by governments is to err on the side of caution. Non-fiat currencies present increased risk of illicit activity funding. In May 2013, Liberty tReserve, a centralised digital currency service, was closed by the US government for money laundering. A few months later, the FBI shut down Silk Road, one of the first modern darknet markets. While the Financial Action Task Force (FATF) has issued several guidelines over the years, governments vary on their decision concerning cryptocurrencies. New developments related to regulations on cryptocurrency and ICOs move from bans to supportive licensing. Many crypto companies do not quite meet KYC standards traditionally required by financial institutions. Moreover these companies are founded by individuals with little or no technology or business backgrounds, and may not be armoured with the right tools and expertise tyo keep up with the ever changing regulations. We recognise two cases. Looking from a compliance view, there is a need to strike a balance between regulators, businesses and consumers. Also the space between the current AML, CTF and KYC processes governing cryptocurrencies and ICOs needs to be covered properly. Looking into these two issues will help increase the adoption of cryptocurrencies *KYC FOUNDING TEAM ADVISORS* Just like any successful business endeavor, the success of KYC has been the doing of a set of people making up the founding team and advisors. 1. Chionh Chye Kit: He is the CEO & Founder of Cynopsis (Co-founder & MD) and he belongs to other businesses such as Kyber Network (Advisor), RegPac Revolution (Advisor), ICTA / SFA (Lecturer), Compliance, Regulatory & Audit. 2. Prof. Ooi Beng Chin is the Technical Advisor, Chair Professor, NUS SOC. 3. Dias Lonappan is the CTO & Co-founder, Fintech/Blockchain, CTO – 5 Yrs, KYC & Credit – 3 Yrs. And a host of others such as Dr. Loi Luu, Nizam Ismail, Robin Lee, Dan Poh, Wong Lee Hong.  ETHICS AT KYC Leadership Leaders ensure that the business is conducted in an ethical, fair and transparent manner. Leaders also make sure to strategise, organise and lead the business and team in the right direction that is beneficial The Accountability Vision Leaders always makes sure that they are aaccountable and transparent. They make sure all activities conducted in honesty and take responsibility for it. leaders form a vision to promote KYC. THE traceto TOKEN The design of the traceto Network requires a token with value that is linked to the growth and expansion of the Network. Elements used to reward good behaviour and promote expansion need to be linked solely to the success of the Network.  CONCLUSION The Know Your Customer Network offers a wide range of advantages both to the small and big businesses and investors coming together to do business in a rather safe and comfortable environment as provided by KYC. Useful links WEBSITE: https://traceto.io WHITEPAPER:https://traceto.io/static/wp/traceto_Whitepaper_v1_35_en.pdf TELEGRAM: https://t.me/tracetoio TWITTER: https://twitter.com/tracetoio FACEBOOK: https://www.facebook.com/traceto.io BITCOINTALK: https://bitcointalk.org/index.php?topic=3439768.msg35860307#msg35860307 MEDIUM: https://medium.com/traceto-io LINKEDIN: https://www.linkedin.com/company/traceto-io-pte-ltd/ MAIL: tokensale@traceto.io WRITER: ambition1 BITCOINTALK PROFILE :https://bitcointalk.org/index.php?action=profile;u=1797812;sa=forumProfile

👍 ubg, collinberg, geminibaby, jannyh, swagger, credulous, phlaser, pinoy, royalt123, cryptoboss12, ambition1, philmovs, sweedy, capableuwa,