Different From Bitcoin Cash

bitcoin·@avinash957255·

0.000 HBDDifferent From Bitcoin Cash

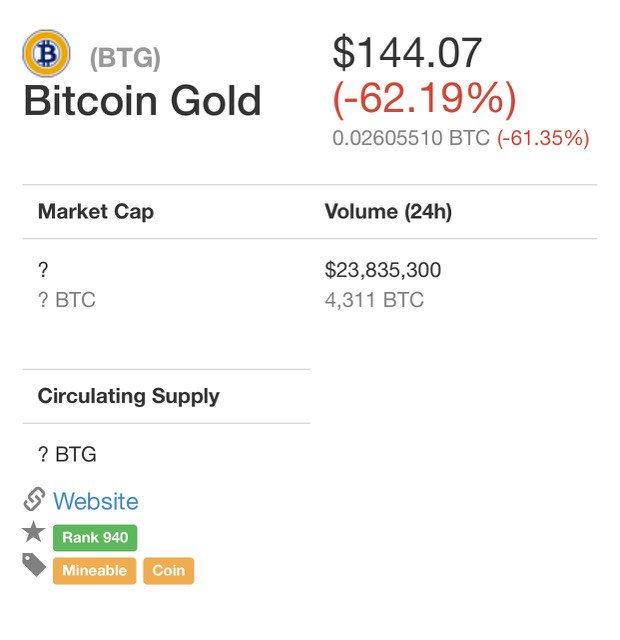

Bitcoin’s first hard fork (Bitcoin Cash) went decidedly smoother. A perceived benefit of forks is the 1:1 mirror in coins/tokens a holder receives, roughly similar to perhaps a stock dividend. Users can then retain the new token or profit-take, selling off either “share” of the original or forked coin. The BTG team has pushed out a proper launch, in the Bitcoin cash manner, until 1 November, which includes release of its code and essentially the ability to mine it. The same goes for a BTG 1:1 coin mirror. According to its now-live website, BTG will eventually differ in other ways as well from Bitcoin cash. BTG will use the proof-of-work algorithm Equihash, will adjust its difficulty at every block, and incorporate a unique address format. There are no BTG coins to speak of today (except the 100,000 pre-mined coins) nor a blockchain yet, but it trades as a future on the Bitfinex platform. As of this writing, it’s at 104 USD. BTG’s first day, however, Coinmarketcap reported it down over sixty percent. Bitcoin cash had its early downs and ups as well, reaching highs of over 800 USD since its inception, but has since stabilized at slightly over 300 USD (as of this writing) with a 5.5 billion market capitalization (fourth among cryptocurrencies). It has the second highest 24h trade volume of all cryptocurrencies. The source of the DDoS attack on BTG remains a mystery for now. That, combined with its soft launch plans in a couple of weeks, along with little knowledge of who its team members are (its lead developer goes by h4x3rotab), means the BTG project over-all retains a sense of mystery too.