Resource Pools and Asymmetric Risk

hive-169191·@azircon·

16.308 HBDResource Pools and Asymmetric Risk

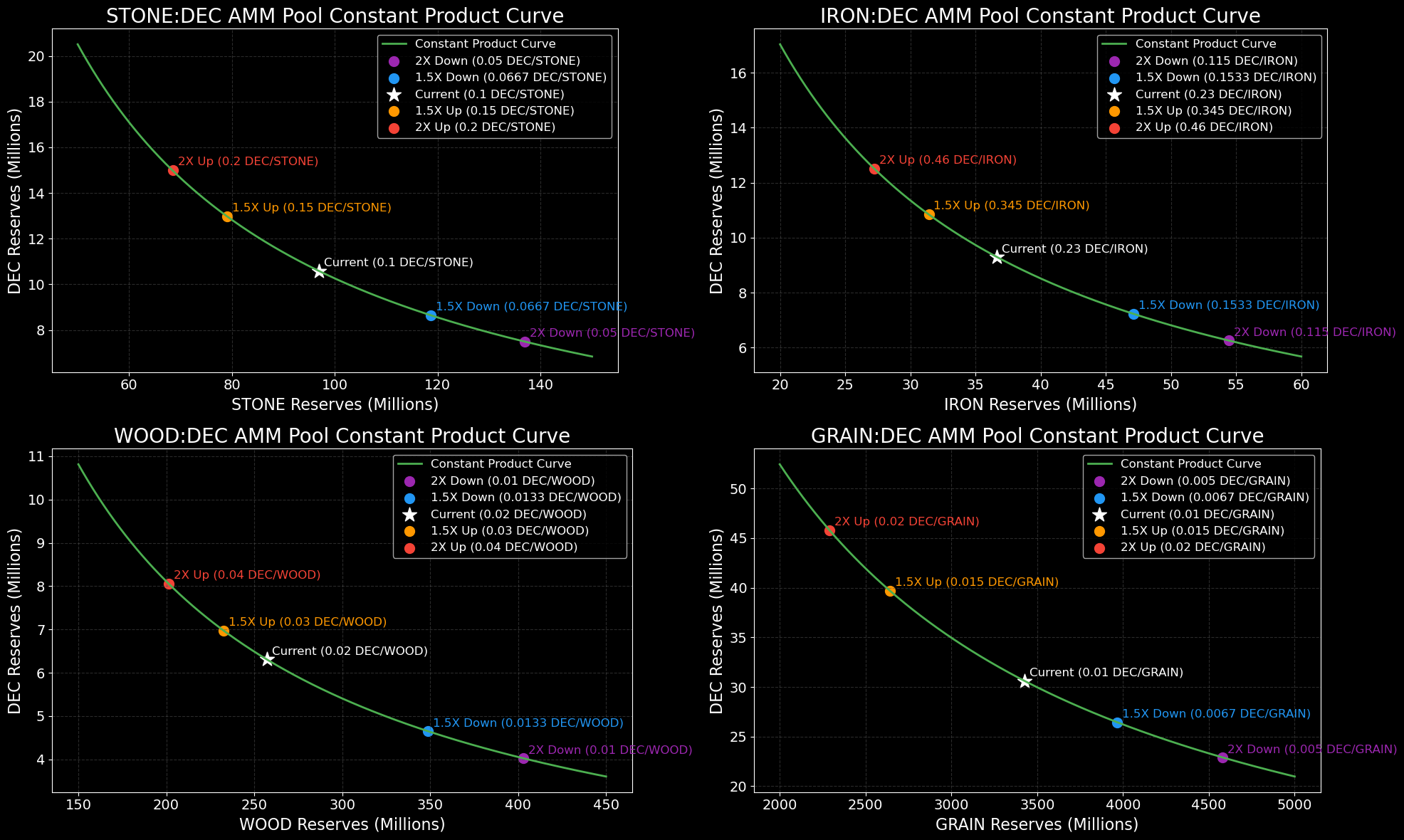

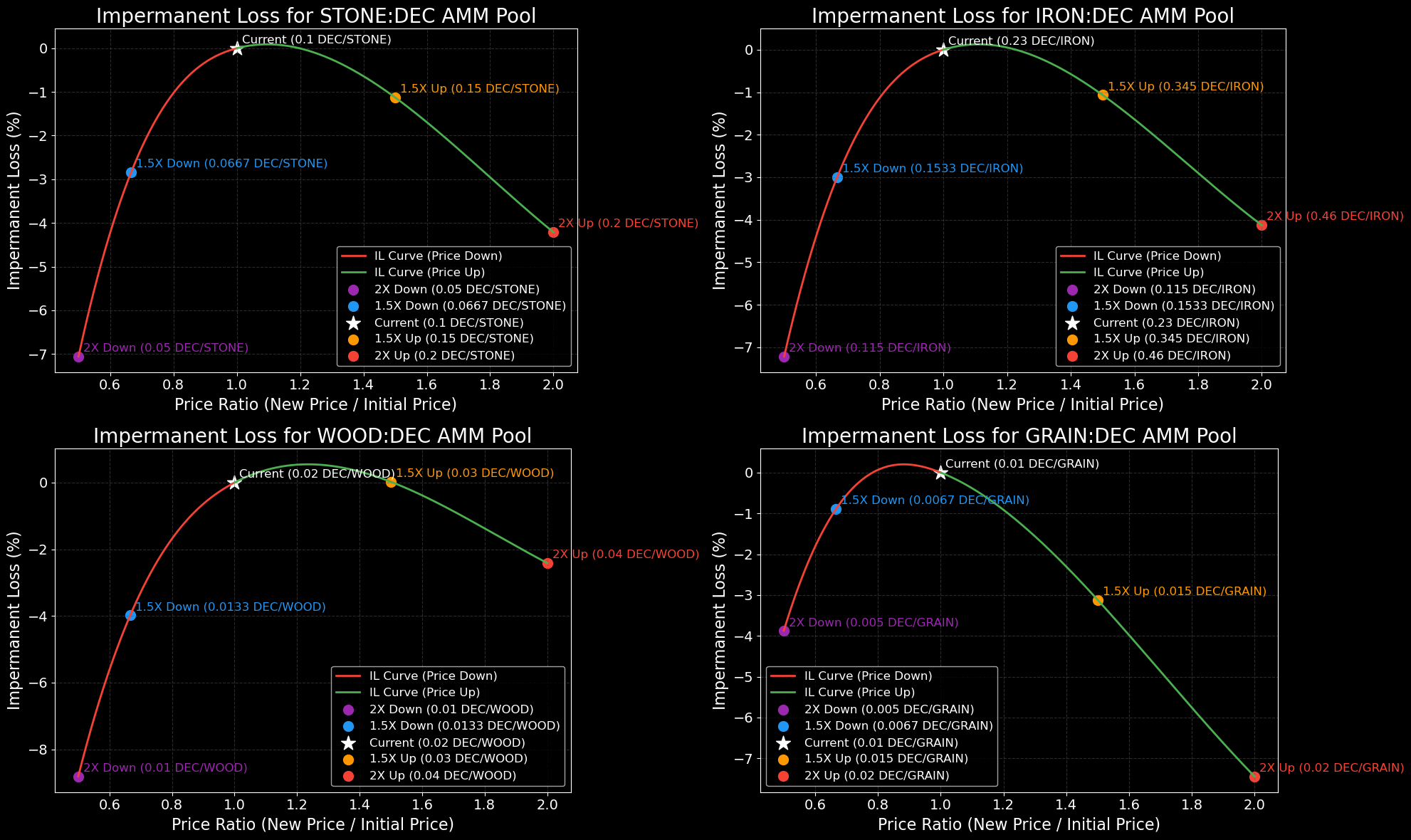

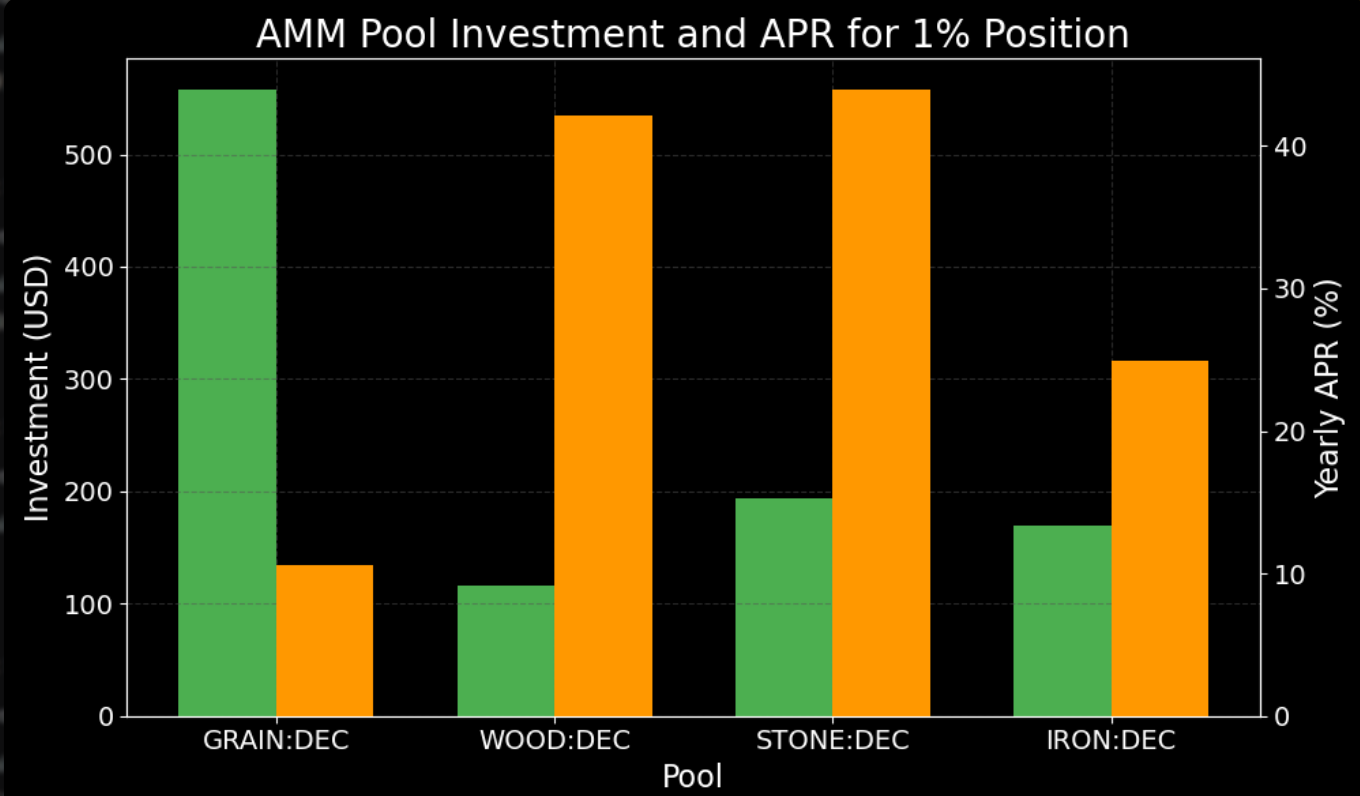

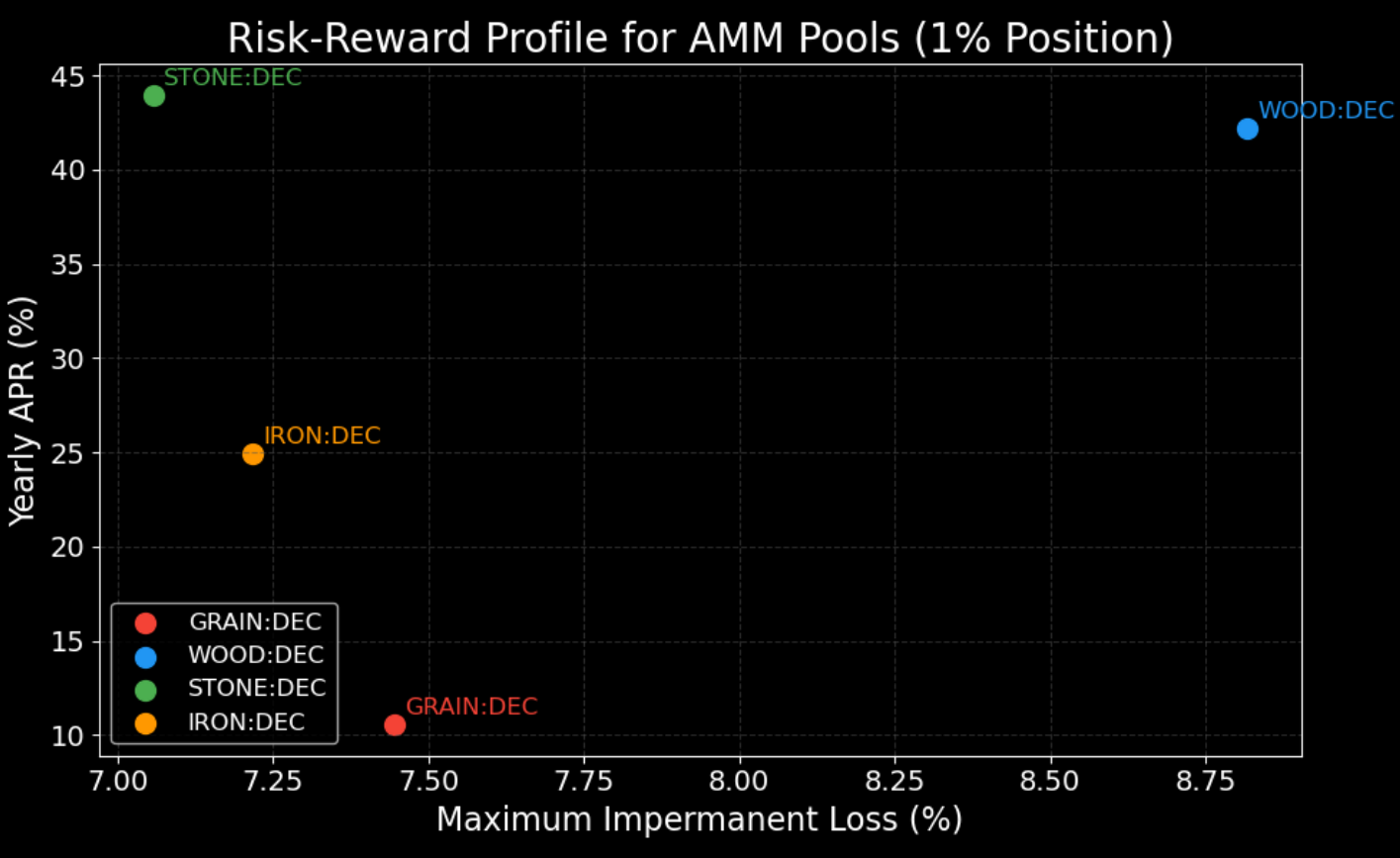

# Resource Pools and Asymmetric Risk If you are following my previous [post](https://peakd.com/hive-169191/@azircon/understand-the-asymmetric-risk) in the new community of [Praetoria](https://peakd.com/c/hive-169191/created), you might know that I have started investigating the in-game resource pools. I wanted to understand the risk profile of these AMM pools with the current exact TVL (Total Value Locked) of these in-game pools. I generated the constant product curve of the Stone:DEC pool in the previous post. Perhaps you saw it coming, but I am not going to stop there. So here are all the pools that are currently in-game.  All these plots investigates what happens to these pool if the price of these resources go up or down by 1.5X or 2X relative to their current prices. Below are the four respective Impermanent Loss (IL) curves for all the same pools with the same price movements.  As far as I know, you won't be able to find this analysis anywhere else. The purpose of these plots are to prepare land holders to all possible potential outcomes.  # Analysis Below is a table summarizing the current resources, prices, and 30-day trading volume for the four AMM pools. Grain pool is obviously the oldest and largest pool, but Stone pool generate the most trading volume. Remember, the fee structure of all these pools are as follows: > The fee earnings are calculated assuming a 10% total fee on trading volume, with 5% distributed to shareholders, (other 5% in burned) | Pool | Total Value (USD) | Token Reserves (Millions) | DEC Reserves (Millions) | Current Price (DEC per Token) | 30-Day Trading Volume (USD) | 30-Day Fee Earnings (1% Position, USD) | |------------|-------------------|---------------------------|-------------------------|-------------------------------|-----------------------------|----------------------------------------| | GRAIN:DEC | $55,730.64 | 3,427.94 (GRAIN) | 30.60 | 0.01 | $9,822.87 | $4.91 | | WOOD:DEC | $11,604.17 | 257.16 (WOOD) | 6.31 | 0.02 | $8,167.57 | $4.08 | | STONE:DEC | $19,393.37 | 96.88 (STONE) | 10.59 | 0.10 | $14,200.34 | $7.10 | | IRON:DEC | $16,937.40 | 36.64 (IRON) | 9.30 | 0.23 | $7,045.33 | $3.52 | If a stakeholder holds 1% position in each of the pool, it is easy to calculate the monthly earning from the monthly trading volume. Mind you 1% position in the Grain Pool is much higher investment compared to Stone pool, but the returns are higher in the stone pool. | Pool | Investment for 1% Position (USD) | Monthly Fee Earnings (USD) | Yearly APR (%) | |------------|---------------------------------|----------------------------|----------------| | GRAIN:DEC | $557.31 | $4.91 | 10.57 | | WOOD:DEC | $116.04 | $4.08 | 42.19 | | STONE:DEC | $193.93 | $7.10 | 43.93 | | IRON:DEC | $169.37 | $3.52 | 24.94 | I typically hate APR, because APR do not stay the same over 12 months for anything crypto. However, for LPs everyone wants to see the APR, so there you have it! - Grain has the highest investment requirement for the least return! - Wood and Stone has very similar return profile, if fact if I haven't plotted this, I would have never realized that Wood currently has the best return in the pool! - For only $116 investment, you get $4/month in the wood:dec pool  # So, what about the Asymmetric Risk? In AMM pools, asymmetric risk typically refers to the non-linear risk of impermanent loss compared to potential returns (e.g., fee earnings). Impermanent loss represents the potential downside (risk) due to price divergence, while fee earnings provide the upside (reward). The asymmetry arises because IL increases non-linearly with price changes, often outweighing fee earnings for large price movements, making AMM investments riskier in volatile markets. To quantify the asymmetry, we can compute the Risk-Reward Ratio as the absolute value of the maximum IL divided by the APR, which shows how much potential loss (risk) is borne per unit of potential return (reward). Mind you, this still underestimates the risk, as APR assumes that we are holding the assets in the pool for 12 months at least, which is a long time. There is high potential that all these resources can move outside the 2X window I assumed. | Pool | Maximum Impermanent Loss (%) | Yearly APR (%) | Risk-Reward Ratio | |------------|-----------------------------|----------------|-------------------| | GRAIN:DEC | 7.45 | 10.57 | 0.70 | | WOOD:DEC | 8.82 | 42.19 | 0.21 | | STONE:DEC | 7.06 | 43.93 | 0.16 | | IRON:DEC | 7.22 | 24.94 | 0.29 | Also we can do a scatter plot of this data.  There you have it, although Wood may look great on the raw data and very low entry investment, it does come with higher risk of IL. Stone gives the same return with a lesser risk profile. And grain pool? You are just Hufflepuff if you are in that pool! :)   https://media.giphy.com/media/v1.Y2lkPTc5MGI3NjExaDBldXhqODk4emZrcnNsMWFkZWhwbnc0OHI3OGxjcTdrdnJsc2hzeSZlcD12MV9pbnRlcm5hbF9naWZfYnlfaWQmY3Q9Zw/35pTQFiy14OeA/giphy.gif https://files.peakd.com/file/peakd-hive/zord189/Zcxlm2md-azircon.gif

👍 playagame, reazuliqbal, splinterboost, harkar, kellyane, eturnerx, fatman, dorian-lee, carl05, helpmate, brofi, altryx, nozem01, crypt0gnome, mondroid, becca-mac, shrazi.hold, thepeoplesguild, dahpilot, joeyarnoldvn, emrebeyler, therealyme, mmmmkkkk311, mariuszkarowski, bluesniper, primeradue, ctime, mk-photo-token, csport, gaskets, tenpik, zeltra, sonntags, ovlagik, labutamol, yameen, zaddyboy, netaterra, eii, sepone, kaibagt, jagged, valchiz, upfundme, bozz.sports, zwhammer, hivebeliever, tub3r0, captaindingus, creativepixie, merlin7, denizcakmak, bigmoneyman, iktisat, drricksanchez, lovelymusictube1, strenue, netaterra.leo, rafalski, kggymlife, tipsybosphorus, kgswallet, lordnasty, beardoin, teamvn, hugo4u, marianaemilia, idakarlsen, helcim, irregular-n, funnel, stefanialexis, shaidon, gabrielrr17, pardinus, gomster, synergized, anjanida, bastter, satoshil, goliathus, hive-world, carlosro, brucolac, brando28, adulruna, emd012, hkinuvaime, qyses, kojiri, lobaobh, jpleron, lucasqz, highfist, amazot2, genepoolcardlord, flowtrader, ichheilee, ackhoo, zayedsakib, loulou1987, blacklux, photosnap, kimzwarch, bozz, aurzeq, kgsupport, dab-vote, jjerryhan, steemincome, urtrailer, anttn, bigram13, steemitcolombia, jumbot, thepeakstudio, jlsplatts, foodfightfriday, kuku-splatts, splatts, w-splatts, brofund-witness, hive-189277, unity-freedom, coinmeria, agememnon, bluedwains, caribehub, muratkbesiroglu, ahmetchef, weirdheadaches, paulmoon410, wongi, quduus1, graciousvic, dr-animation, peakecoin, strangedad, terracore, peakecoin.bnb, solominer, whangster79, recoveryinc, samrisso, tomtothetom, dying, movement19, hive-195880, abcor, cards4rent, clubvote, lxsxl, lakawero, leaky20, acantoni, bulkathos, rombtc, photofriend, adaluna1973, nolasco, prometehum, idig, simplifylife, sc-fund, semihbalkanli, adam-aj, albephotos5, acidyo, xves, ghaazi, rendrianarma, vixmemon, dantrin, reen213, avataroflife, diannever, djccdigital, galenkp, bilpcoin.pay, galenkp.aus, hive-168869, blind-spot, hive-lu, logen9f, rach, chrysanthemum, celestegray, gollumkp, curatorem, feo, unatalmaria, unidos, pignus, allover, quigua, unitmaster, dexy50, miloshpro, ryanaa, monoc, marcevhc, fieryfootprints, tinabrezpike, beaker007, nyxlabs, florian-glechner, arc7icwolf, learn2code, dalz, freebornsociety, piotrgrafik, dyrt88, velazquezboy, kittykate, doobetterhive, elcholitosanto, lolz.spt, imno, dbooster.spt, spt.curator, pof.spt, tehox, razam, saydie, nvstly, tht, almi, shadowman1, axemaster88, dstampede, aftersound, georgeenting, oflyhigh, wherein, cnstm, likuang007, lianjingmedia, zerofive, starrouge, uadigger, newageinv, doombot75, himalayanwomb, tangmo, mrchef111, garute, ksteem, fighter4-freedom, ourfadedglory, aleister, enira, tarabh, deepresearch, szukamnemo, techguard, drstealth, ranjan02, bteim, warrentrx, alucian, kristall97, bobaphet,