Ripple vs Bitcoin Comparison

cryptocurrency·@bankthecrypto·

0.000 HBDRipple vs Bitcoin Comparison

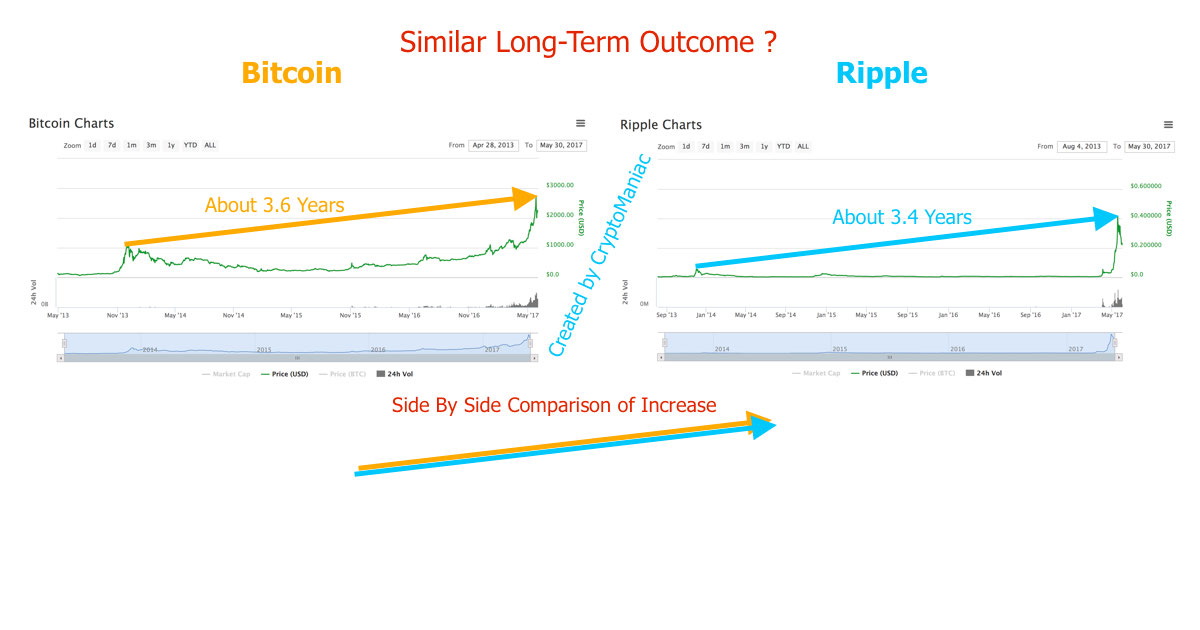

**Ripple versus Bitcoin: Solving Different Problems** In spite of the fact that Ripple imparts some comparative qualities to Bitcoin, it is an inconceivably unique venture. As a digital money, it utilizes cryptography to secure exchanges, yet it doesn't really have an open blockchain. Rather, it has a system of hubs that approve exchanges, yet these are not really mysterious P2P hubs, they are taking an interest banks and money related foundations. Ripple coins, referred to just as Ripple or XRP, were not mined into reality, they were essentially issued. What's more, not at all like Bitcoin which exists by excellence of a dispersed system of members, Ripple isn't just the name of the coin, it is additionally the name of the organization that built up the convention. Dissimilar to Bitcoin's pseudonymous author, Satoshi Nakamoto, the Ripple organizers created Ripple in the open, with Ripple notwithstanding applying for and being granted a New York BitLicense to work.  So from the get-go, we see this is an apples and oranges examination. **All in all, What Exactly is Ripple?** Ripple is viewed as a touch of a peculiarity among digital currencies since it doesn't have its own open blockchain. Inside, the XRP Ledger organize keeps running on an interior blockchain which they call an "Endeavor blockchain" record, it doesn't utilize verification of-work and little else is thought about it. Ripple was initially outlined as a benefit exchange framework, to send moment and secure exchanges crosswise over system members. The thought was that anything advanced of significant worth could be executed, including fiat, cryptographic forms of money, products, even reliability focuses and portable credits. The local Ripple cryptographic money token was included at a later phase of improvement and can be utilized for settling exchanges on the system. Ripple positively doesn't share the cypherpunk underlying foundations of Bitcoin and different cryptographic forms of money, however by this very ethicalness it was immediately more appealable to banks, budgetary mediators and institutional financial specialists looking for advanced installments arrangements. Ripple got heavenly attendant subsidizing to build up its convention. Right on time round speculators incorporate back industry goliaths, for example, Andreessen Horowitz, Pantera Capital, Google Ventures, IDG Capital Partners and Santander InnoVentures. Not being a commonplace blockchain and being overseen by an organization, it doesn't generally bode well to contrast Ripple and Bitcoin, highlight for include. Ripple being midway controlled, and with Bitcoin being a decentralized blockchain, there isn't quite a bit of a point setting them as opponents. In the event that anything, like different systems like Counterparty and Omni, Ripple can be taken a gander at as it's own autonomous stage which may even supplement the Bitcoin and other digital money systems. For example, you can store, send and get different monetary forms on the Ripple arrange. These parities are held in accounts, dissimilar to XRP which is the local cash with no counterparty chance. The Ripple venture really pre-dates the Bitcoin blockchain, and their central goal from the earliest starting point was not to offer a contrasting option to the world's monetary framework, but instead to redesign it and bring it out of the dim ages. **Ripple Key Specs and Features** Moment Payments – The worldwide installments foundation was worked before the web turned out to be monetarily across the board. The key installments interbank settlement occurs on the worldwide SWIFT system and furthermore on some littler national systems all the more locally. Exchanges and settlements can take a matter of days, and this is awfully humiliating in the computerized age. By differentiate, Ripple installments can bob far and wide promptly.  B2B Friendly Focus – as an organization, Ripple is keen on connecting with enter players in the money related industry including banks and monetary administrations suppliers. The system offers moment cross-outskirt settlements and installments. All exchanges on the Ripple organize are intended to be consistent with the bank's hazard and security prerequisites. Against tax evasion (AML) and Know Your Customer (KYC) hostile to psychological warfare consistence is incorporated with every exchange. Full End to End Payments Service – A bank could utilize the Ripple system to send a cross-outskirt installment specifically from the sending client's ledger through to the getting client's financial balance on the opposite end. The Ripple system can deal with the entire exchange, including the remote trade transformation. The Ripple system can likewise in a flash figure the cost of the exchange down to the closest penny, and flag the both partaking banks when the end client have gotten their store for the two banks to refresh their client's records. **Ripple vs Bitcoin: Other Key Differences** Ripple installments are close moment as they are approved by Ripple hubs. Dissimilar to Bitcoin, the Ripple cash is issued by Ripple Labs and not printed into squares. To date, 38 Billion of the cash is circling. The possible supply of Ripple will far surpass Bitcoins add up to coins by requests of greatness. This is reflected in its cost when you analyze the relative shortage of the two coins, that is Ripple's 100 Billion coins versus Bitcoin's 21 Million. At the season of production, the Ripple cash was just a small amount of that of Bitcoin sitting at simply under USD $0.22 pennies. All things considered, Ripple summons third position in the general market top. Each of the 100 Billion XRP have been made. Of the 100 Billion, the originators of Ripple held 20 Billion, with the rest of the 80 Billion XRP designated to Ripple Labs. Of these, lone 38 Billion XRP have been discharged up until this point. Ripple is super quick contrasted with Bitcoin and can perform 1000 exchanges for each second, contrasted with Bitcoin's 3 tx/sec, and it can finish a worldwide exchange in 3 seconds, contrasted with the normal square affirmation time of 10-minutes for Bitcoin. **Blended Market Feelings** Cryptographic money fans have had blended emotions about Ripple from the very begin. Ripple has a particular concentration, and that is for it to be embraced by the saving money framework for cross-fringe, interstate and interbank installments and settlements. At last, Ripple plans to be utilized as a part of place of the interbank SWIFT system. Along these lines, the cost of Ripple is vigorously impacted by any news that identifies with bank appropriation. It is a shoddy coin, so it has an enormous upside potential. In the event that it figures out how to end up plainly the bank's decision of crypto, it will probably take off in esteem. Be that as it may, for Ripple fans, this occasion is woefully past due and over the long haul, different contenders are likewise arranging to guarantee a similar title. Ripple is as of now in live beta stage with 75 banks, but it isn't the main undertaking vieing for the bank's consideration, with Digital Asset Holdings utilizing Hyperledger innovation and the R3 Consortium being the most understood driving a pack of 'would be' blockchain-for-banks arrangement suppliers.  **Last Thoughts** Ripple has set as a main 5 digital money and is nearly also known as Bitcoin. In any case if Ripple turns into the main blockchain-for-banks or not, there are a lot of different applications for its innovation. Not at all like Bitcoin, it is business well disposed as it conforms to control. While Bitcoin depends on client appropriation, Ripple is going for more boundless reception in every day business. This makes it more appealing to financial specialists that view digital forms of money like Bitcoin as defenseless against future administrative fights and thusly not prone to be embraced for general trade. On the off chance that Ripple manages to end up plainly the dear of the banks, its unassuming 20c cost could rapidly move into the dollars and overshadowing the market top of Bitcoin. So in the event that you are searching for something with a potential gigantic upside, Ripple is positively one to nearly watch. **Make sure to follow me for more**