Centralized exchanges with decentralized settlement offer both liquidity and stronger security

blockchainio·@beacryptominer·

0.000 HBDCentralized exchanges with decentralized settlement offer both liquidity and stronger security

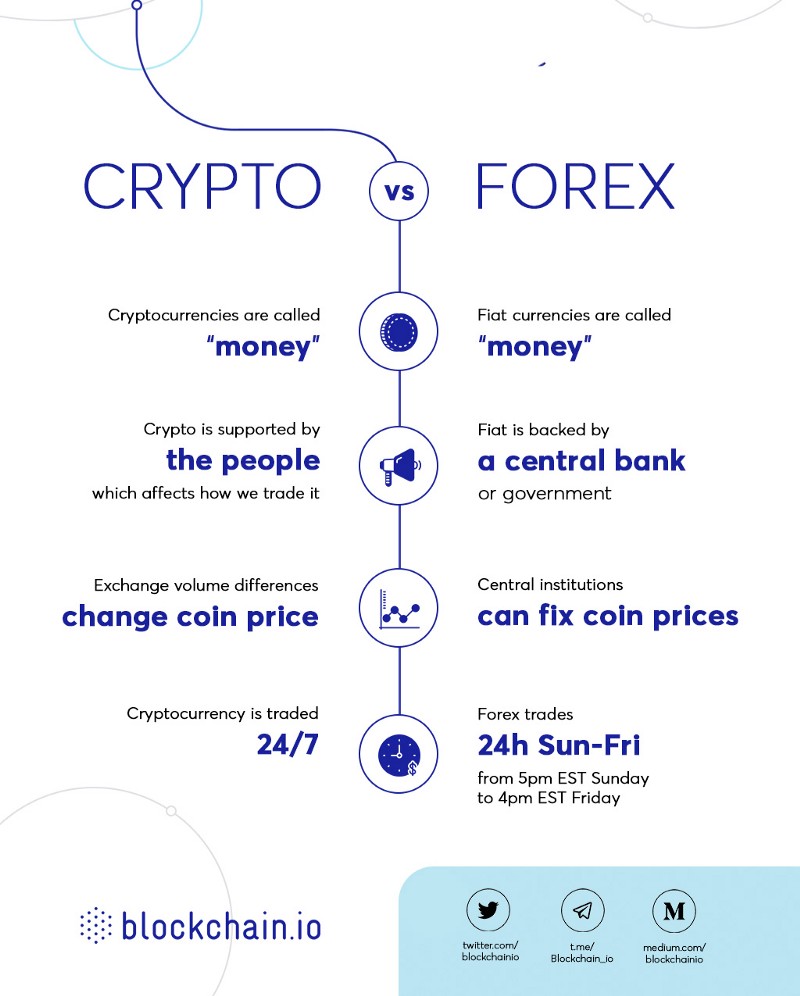

A new generation of exchange platforms, combining the technology of a centralized custodial exchange with a decentralized “trustless” cross-chain “fair exchange” settlement might very well be the best solution. Users enjoy the efficiency of a low-latency, fully-featured centralized exchange when they need quick and liquid trading for exchanging big volumes, and they are able to turn to decentralized options if they feel like settling a transaction without the supervision of a third party, and thus, without counterparty risk. This will represent a big departure from traditional markets and a major step forward in the Internet of Value.  With differences in price, volume and correlation, newcomers to crypto trade should above all practice patience, which can admittedly be challenging given that cryptocurrency is exchanged 24/7 while forex only trades 24 hours a day between 5 p.m. EST on Sunday to 4 p.m. EST on Friday. If you’re unfamiliar with forex, you’ll have some things to learn, and if you’re familiar with forex, you might have to unlearn some things. The key is to approach the cryptocurrency exchange market understanding that while it bears many of the same traits of forex, it is a currency exchange in its own right. Visit blockchain.io for more information and join our whitelist to become a part of the cryptocurrency exchange of trust on the Internet of Value.

👍