Inside the Minds Of No-Coiners, Bitcoin Maxis, and Shitcoiners

hive-167922·@brennanhm·

0.000 HBDInside the Minds Of No-Coiners, Bitcoin Maxis, and Shitcoiners

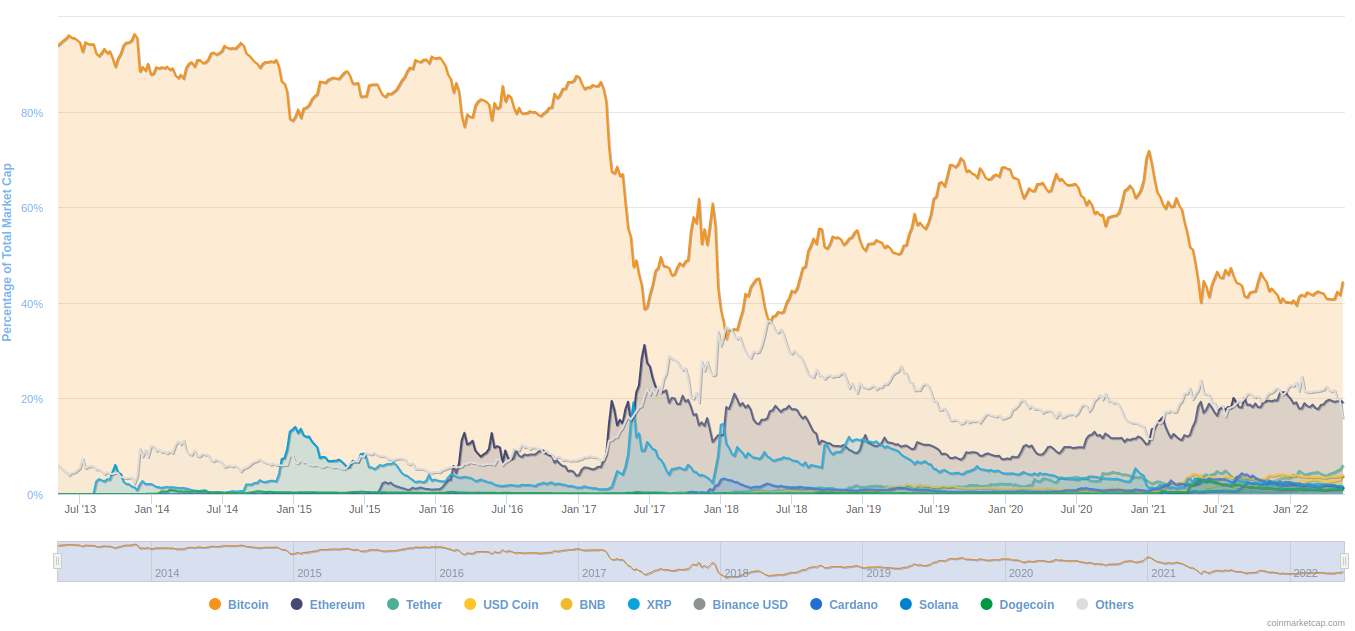

In this world there are three types of people - No-coiners, Bitcoin Maxis, and Shitcoiners. In this post I will describe each type of person, outline the psychology behind their unique perspectives, and argue for or against their points of view. The goal here is to predict the future as accurately as possible, so that we can make wise investment decisions based off of those predictions. # What is a No-coiner? In a Bitcoiner's mind, someone who doesn't own any Bitcoin is referred to as a "No-coiner". Often this is by choice, but sometimes it's simply due to ignorance of cryptocurrency and the financial system in general. We have the Normie No-coiners who lack any knowledge of the banking system and avoid crypto because they see it as strange, frightening and risky. And then we have the Goldbug No-coiners who understand the flaws of the traditional financial system but refuse to consider Bitcoin as a potential solution. ## Normie No-Coiners Ignorance is bliss. "I have my credit cards and my debit card and when I need to pay for something I just tap the machine and I get the goods and services that I need." This is the average mindset of a Normie No-Coiner. And although money plays an extremely important role in our lives, there's nothing wrong with this mindset per se. After all, not everyone is good at math and most people are not interested in uncovering the intricacies of the global financial system. Normies don't understand that lower interest rates, quantitative easing (money printing), and helicopter money are the cause of the higher prices they see at the gas station or the grocery store. They don't realize that the fiat currency they hold in their bank account has been losing purchasing power at 2% per year over the past decade, and is now losing closer to 20%. They may have heard of Central Bank Digital Currencies (CBDCs) briefly in the news, but they do not realize that they are being developed in preparation for an impending financial reset. Many older Normies have benefited from the central banking policies of the past decade. Thanks to constant low interest rates and quantitative easing their stock portfolios, retirement funds, and homes are worth a lot more than they used to be. Therefore, it's in their interest to ignore the negative ramifications of such monetary policies (centralization of power, inflation, and the eventual popping of financial bubbles). By the way, if you want to understand more about how we ended up in this dilly of a pickle, be sure to read my article on [why a paradigm shift in finance is coming sooner, rather than later](https://www.publish0x.com/crypto-investing/why-a-paradigm-shift-in-finance-is-inevitable-and-coming-soo-xkxkor). Normies are people who have heard about Bitcoin from their friends, in the news, or on social media, but find it weird and scary and therefore end up remaining No-coiners. This is understandable, because, after all, it's in human nature to fear the unknown and stick to the status quo. When Normies hear stories of people losing millions of dollars to bankrupt exchanges like Mt. Gox and QuadrigaCX, or failed projects like Bitconnect and Terra/LUNA, they categorize the entire crypto industry as risky, and something to be avoided. Normies see crypto as something unnecessary. What's the use-case? Their debit and credit cards are working just fine, so why would they want to pay with Bitcoin? In order for them to see the benefits of Bitcoin, they need to first understand the primary risks of remaining in the traditional financial system - namely losing their purchasing power to inflation and the danger of having their bank accounts frozen if they speak out against government policies. For the time being though, Normies don't need to get involved with crypto because they can still buy goods and services with the fiat they receive from the government or earn at their job. However, in time they will have to choose between being forced into totalitarian CBDCs or voluntarily adopting decentralized crypto. If a Normie has some savings, I often recommend that they invest 10% of it into a few solid cryptocurrency projects. The key to managing risk is diversification, so that if one project fails, they only lose a small portion of their savings. Even if one of the projects they invest in fails, or the entire crypto market dips significantly, they still have 90% of their wealth in traditional fiat and haven't "lost" their entire life savings (long-term HODLers typically win anyway), and they have taken their first baby step into decentralized finance. ## Goldbug No-Coiners Then there are the No-coiners who are experts when it comes to traditional finance. They understand that the central banks have painted themselves into a corner (by lowering interest rates the central banks will increase inflation, and by increasing rates they will crash the stock market and the economy). These no-coiners are conservative and value tradition, such as how fiat currency used to be backed by gold prior to the 1970s. They make arguments such as "gold has a track record of being money for thousands of years", whereas Bitcoin has only been around for a decade. And while that may be true, it doesn't mean that something innovative can never take gold's place. For example, the horse used to be man's main form of ground transportation for thousands of years until the invention of the automobile by Ford in the early 1900s. People also used to use candles to light their homes for thousands of years until the invention of the light bulb by Edison in the late 1800s. When a revolutionary invention is made, we need to recognize that it could very well disrupt they way things have been done for thousands of years in the past. It may be tough for us to relate since we weren't around during these major transitions in human history. But you may recall how a lot of people thought Twitter and YouTube were ridiculous ideas when they first came out, only for them to become ubiquitous publication platforms a decade or two later. Some No-coiners have gone so far as to label Bitcoin a "ponzi scheme", a scam in which you always need new people to invest new money in order to increase the wealth of the early adopters. They argue that the only reason people are buying Bitcoin is to sell it to a "greater fool" in the future at a higher price. The problem here is that these No-coiners are still thinking about Bitcoin from a fiat-based frame of mind. Many Bitcoin investors understand that the financial system is unsustainable and heading for collapse, so they want to hold an asset that's censorship-resistant and limited in supply. They don't see Bitcoin as a means to get richer in fiat terms, but as a replacement to the fiat system entirely, and something that will eventually be accepted directly for goods and services.  No-coiners also like to point out how the extreme price volatility proves that Bitcoin could never be used as money. Whenever Bitcoin crashes 20%, 50% or even 80% against the dollar they announce that this signals the end of Bitcoin. They equate it to the Dutch tulip mania of the 1600s in which traders emotionally speculated on the price of tulips until they finally crashed to zero. However, these No-coiners fail to **zoom out** and see that Bitcoin has dropped by similar percentage amounts in previous years (notably in 2011, 2014 and 2018), but always falls to higher lows and reaches higher highs in subsequent years, whereas tulip prices never recovered from their crash. So while Bitcoin tends to be volatile in the short-term, the long-term trend of Bitcoin's growing demand should be obvious.  Let's also consider the trend of corporate and nation-state adoption. Businesses such as Gucci and CheapAir have announced that they accept Bitcoin as payment. Major investment firms such as Fidelity are now allowing their clients to allocate a portion of their portfolios to Bitcoin. Tesla, Square and Microstrategy have added Bitcoin to their corporate treasuries. El Salvador and Central African Republic have now adopted it as legal tender, with more countries contemplating making the same move every day. Goldbug No-coiners also claim that Bitcoin isn't tangible, isn't backed by anything, and has no intrinsic value. What they fail to recognize is the primary trait that makes Bitcoin valuable - **immutability**. This concept of a decentralized, censorship-resistant database had never existed before, and it's what makes Bitcoin the first non-confiscatable asset in history. No government, bank, corporation or individual can stop you from sending a Bitcoin transaction or suspend your Bitcoin wallet. In a world where your bank account can be frozen for attending or donating to a protest, this value proposition of immutability becomes rather appealing. By far, the best No-coiner argument is that Bitcoin is just one cryptocurrency in a sea of thousands of other cryptocurrencies. They ask, "What's preventing another cryptocurrency from taking Bitcoin's place", like how Facebook replaced MySpace? And in a world where anyone can create their own cryptocurrency, this is a real possibility. However, only those cryptocurrencies which are secure, user-friendly, innovative, and can build strong communities will grow in value. So while it may be true that an infinite number of cryptocurrencies can be created, only the best will survive long-term. Over the years, several well-known No-coiners have transitioned from Bitcoin skeptics to Bitcoin advocates. Some examples are author Don Tapscott, financial pundit Kevin O'Leary, and Michael Saylor of MicroStrategy. In fact, it's quite rare to meet proponents of Bitcoin who weren't skeptical of it at first. You probably have even noticed it among your friends and family too, and even within yourself. At first almost everybody dismisses Bitcoin. Then, after it's brought to their attention a few times, they laugh at this ridiculous "magical Internet money". Then it evokes fear and anger as it threatens their foundational beliefs about the financial system. And finally they realize that this new form of money is not only better for humanity, but an unstoppable idea, and they accept its inevitability. The bottom line here is that No-coiners are trending towards accepting Bitcoin and proving the famous quote "first they ignore you, then they laugh at you, then they fight you, then you win." Some people will enter into crypto willingly, while others will be dragged into it kicking and screaming, digging their nails deep into the rotting floorboards of the traditional financial system. https://www.youtube.com/watch?v=lbJxuxIpc_g # Bitcoin Maximalism So far we have established that Bitcoin is a revolutionary new form of money with a transparent supply that facilities censorship-free value transfer at a global scale. We owe Satoshi Nakamoto and the early developers of Bitcoin a token of our appreciation for inventing this new technology that liberates us from the unsustainable debt-based traditional financial system. However, Satoshi and co. could not foresee the invention of smart contracts, stablecoins, non-fungible tokens, DeFi, and decentralized autonomous organizations that emerged from the Ethereum ecosystem. In retrospect, Bitcoin was but the first building block in our new decentralized financial world. While many people have accepted Bitcoin as a new form of money, some have unfortunately succumbed to their emotions, tribal nature, and become what are known as Bitcoin Maximalists (Maxis). In the crypto community, Bitcoin Maxis are the people who believe the only useful cryptocurrency is Bitcoin and that all other blockchain projects are "shitcoins" with a value proposition of zero. Let's take a look at some of the leading causes of Bitcoin Maximalism. ## Tribalism Humans are tribal by nature and tend to stick to their own groups. For example, consider how many different religions there are in the world and how difficult it is to convert someone to a new creed. Do you think it would be possible to convert every single person on the planet to one specific religion? Not likely. This tribalism applies not only to religion, but cryptocurrency too. What are the chances that Bitcoin Maxis will convince all seven billion people on the planet to use only Bitcoin? Tribalism exists not only within the Bitcoin community, but throughout the entire cryptocurrency space. For example, I'm sure you've seen the Ripple XRP army show up in certain Twitter threads to pump their bags. As an investor, all you need to be able to do is recognize this tribalism and not get caught up in it. Rather, take comfort knowing that the projects you are invested in have very dedicated community members! ## Ego A lot of Bitcoin Maxis got into Bitcoin during its early stages of development. As a result, they have made investments which have done very well, and some have even become millionaires or billionaires (in fiat terms). We must consider that this massive transfer of wealth over such a short period of time likely had an impact on their ego, and that their judgement is probably clouded when considering alternative cryptocurrencies. ## Scam Police Some Bitcoin Maxis think that by calling everything other than Bitcoin a shitcoin they are protecting new investors from scams, when in reality what they are doing is discouraging innovation and stifling the free market, which is what we need in order to produce an optimal decentralized financial system. And how does one get better at golf, chess, or tennis? Why, by making a lot of mistakes of course! Investors only become better if they are allowed to make mistakes and learn from them, so that, in the future, their capital is allocated to projects more thoughtfully, and the industry improves as a whole. Appointing regulators who choose which projects are "safe" will only make investors weak, and reduce their personal accountability. While it may be true that the cryptocurrency market is littered with scams, we can use our will power to fight against the natural inclination to generalize, and instead look deeper into a market that is much more complex and nuanced. There are lots of legitimate projects out there - it just takes time, effort, critical thinking, and some experience to find them. ## Fear We must also consider that these competing blockchains pose a threat to Bitcoin's overall market dominance, and therefore the value of a Maxi's portfolio. Bitcoin's overall market share has actually been in decline for over a decade, as it loses new capital to innovative projects such as Ethereum.  Looking into similar market battles of the past, we can make some assumptions about what is going on here. Telecommunications companies didn't like Skype, record labels didn't like YouTube, Bankers don't like Bitcoin, and Bitcoin Maxis don't like altcoins. However, in order to optimally design the most secure, efficient, and robust decentralized financial system, we need this kind of healthy competition. ## Laziness It takes time, effort, and critical thinking to sift through all the blockchain projects out there to determine which have a high chance of surviving long-term and which are more likely to be scams or non-viable ideas. It also requires an open mind and time to understand automated market makers, decentralized autonomous organizations, NFTs, algorithmic stablecoins, and yield farming. Of course, it's much easier to simply label everything other than Bitcoin a scam, and hope that the nations and businesses of the world will only adopt Bitcoin. But in reality this innovative tech is inevitable, and the more negative energy Maxis put into fighting it, the faster it will grow. ## Regulation Some Bitcoin Maxis argue that government agencies like the SEC are going to squash all non-Bitcoin digital assets. But cryptocurrencies, if engineered correctly, are actually impossible to regulate. Crypto is a global, borderless industry, and no single government has jurisdiction over the entire planet. So while some countries may regulate cryptocurrencies or ban them entirely, others will open their borders to crypto projects and entrepreneurs, and attract foreign talent from nations which chose to heavily regulate the industry. So at this point in human history we have a Cambrian explosion of public blockchains, all sprouting up and in their infancy. They are not all going to zero guys, despite what the Bitcoin Maxis are saying. Some of them will continue to grow, innovate and form die-hard communities. Some coins will gain more adoption in certain regions in the world, and others will gain traction in other parts of the world. This is the reality, and why diversification of your portfolio is so important. If we consider the amount of brain power, capital, and consistent dedication being applied to these blockchains, it's quite obvious that the entire crypto industry is going to flourish, not only Bitcoin. # Shitcoiners If you're not already aware, Bitcoin Maxis like to refer to anyone who holds a cryptocurrency in their portfolio other than Bitcoin as a "shitcoiner". Personally, I'd like to break down the definition of a shitcoiner into three different categories - evil shitcoiners, mindless shitcoiners and thoughtful shitcoiners. ## Evil Shitcoiners These are the shitcoiners who prey on the financial dreams of Normie No-coiners. They sit around long tables and plot how they will extract as much wealth as possible from their naive victims. Their intention is never to experiment for the greater good, but rather to deceive and steal from people. They don't accidentally make mistakes which cause losses, but rather premeditate how they will scam people via fancy pyramid schemes, rugpulls and pump and dumps. One of the downsides to a free market is that we must deal with this type of shitcoiner, but it comes with the territory. Evil Shitcoiners would make the world a better place if they became mindless shitcoiners. ## Mindless Shitcoiners These are the shitcoiners who trade cryptos like throwing darts at a wall with a blindfold on. They buy altcoins when they go up, and they sell them when they go down. They speculate on the volatility of the crypto markets in order to accumulate more fiat money. What these traders fail to realize is that the fiat money they are accumulating is being hyperinflated away at an ever increasing rate, and that their goal should actually be the accumulation of solid blockchain projects with long-term roadmaps. Mindless shitcoiners get too emotionally attached to an experimental blockchain project because they think it's going to make them rich in fiat terms. They let their emotions take control over their logical brain and they end up making irrational decisions like putting their entire life savings into a single project. Mindless shitcoiners should strive towards becoming more thoughtful shitcoiners. ## Thoughtful Shitcoiners These are the shitcoiners who see the potential of decentralized, censorship-resistant, blockchain technology and understand that not only will it revolutionize finance, but a variety of other industries as well. They are willing to invest their time and resources to experiment with the technology to find out what works and what doesn't. These shitcoiners know that not all 19000 coins listed on CoinMarketCap are going to survive long-term. They understand that a lot of these coins have been created by malicious actors who simply want to rob people of their fake fiat monopoly money. However, they also know that several of these projects have been founded by very intelligent people with good intentions, who want to open the financial system to a greater percentage of the world population, or simply find the technology fascinating and want to see what kind of innovative and interesting stuff can be done with it. The bottom line is that we need to experiment with this new technology in order to discover what's going to work long-term and what's going to fail. While a lot of these projects will stagnate and fade away, some of them are going to form the backbone of our future financial system. ## How To Become A Better Shitcoiner Practice makes perfect. We need to be willing to experiment and fail. We need to remain cautious, yet open-minded and constantly willing to take in new information. We need to use our resources like LeoFinance, Twitter, Discord, and Reddit to find the information we need and keep ourselves up to date. Above all, we need to set aside our emotions and think rationally. When researching a project we should ask questions like "How anti-fragile, secure, and censorship-resistant is this blockchain?", "How easy is this project for the average person to use?", "Is the team and community behind this project willing to stick it out during the good times, and the bad times too?", "How will their tokenomics model attract new users and retain them long-term?" We also need to take into consideration market cycles and market psychology. We need to develop a "sixth sense" for when a particular coin, or the overall market, is overvalued, and be willing to take action, whether that be buying a new token, trading one for another, or selling it for a stablecoin. Overall though, we need to stop thinking about the crypto market as a casino where we can come out of it with more fiat than what we put in. Rather, we need to think of crypto as a long-term replacement to our broken financial system, that will need to be iterated upon until it is perfected. Then, and only then, will we come out of this shitstorm as seasoned Shitcoiners. # Conclusion In this world there are three types of people - No-coiners, Bitcoin Maxis, and Shitcoiners. The No-coiners are clearly trending towards accepting crypto, and the Bitcoin Maxis continue to lose ground to innovative competitors. It would seem that being a shitcoiner is the best long-term strategy, but we must learn from experience and become more thoughtful shitcoiners. Let me know if you agree or disagree with any of my arguments in the comments below. Be sure to follow me here on HIVE so that you don't miss out on my other articles. # Follow Me Elsewhere [publish0x.com/@brennan](https://www.publish0x.com/@brennan) On Twitter [@brennanhm](https://twitter.com/brennanhm) # Sources https://forums.babypips.com/t/the-history-of-bitcoin-crashes/134173 https://coinmarketcap.com/charts/