Credits - The Blockchain Project U Have to Read Abt

ico·@calagnin·

0.000 HBDCredits - The Blockchain Project U Have to Read Abt

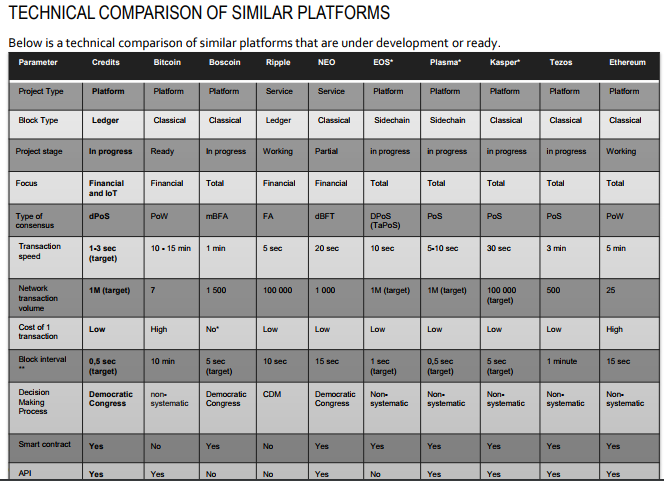

After the recent upheaval in the crypto markets, my personal opinion is that some of the main coins could have lost some steam/momentum, and in comparison, the ICO space likely has a higher growth potential, returns-wise, for say the next 6-12 months. As you can see on my Steemit account, I am an active ICO researcher. Mainly for my own interests and investment purposes. For those ICOs which I find to be interesting, potentially successful and profitable, I would consider joining in on their blog bounty progs. Now that the preamble is done, that brings me to the main topic of the day-> Credits ICO project. I found the ICO several weeks ago, and was fast captivated by the robustness of their whitepaper, and their ultimate vision of creating an ultra-fast, decentralised, blockchain platform where all fin svcs participants could come together to meet mutual needs. Democratised banking v. 2.0, so to speak. The rapid rise in popularity (currently 21k telegram users, doubling in the past 2 weeks alone, and 8k twitter followers) validates my views on the potential reach of the project.  First of all, WHAT is Credits? Credits, is at its core, a BLOCKCHAIN PLATFORM, aiming to intermediate the provision and purchase of financial services btw businesses and individuals. While at first, this seems like a daunting goal, a closer examination of the various types of common financial services (domestic payments, offshore payments, loans and deposits, securities exchange and trading) reveals to us a **KEY TRUTH**, i.e., the value add that intermediaries such as banks provide in ALL these activities is essentially just verification of transactions/ownership and settlement. And as we all know, blockchain tech's ability to execute smart contracts (u know, all those if/else algos) and simultaneously provide a secured record of all transactions on distributed ledgers, powered by cryptocurrency tokens (in this case the Credits token), is essentially a perfect fit for the fin svcs industry. GO fintech GO! WHY Credits? Why then, would credits be superior to other existing blockchain platforms. In fact, observers of the crypto/blockchain space would come to the realisation that the current state of blockchain platforms, even for big names like ethereum, leaves much to be desired. The eth network for instance, is almost always busy (omg, gas fees of 99 GWEI?!?) ever since transaction or smart contract execution volumes shot up in late 2017. If individuals are unwilling to pay the high fees, their transactions could be stuck for hrs, or worse, timed-out. Any ico-participant would definitely agree with me on the common desire among crypto participants of a system where we can enjoy HIGH SPEEDS, LOW COSTS and HAVE TRUST IN THE SMART CONTRACT EXECUTION.  And here comes Credits. Honestly, it was tough to read through and comprehend perfectly the technical aspects of the project, even though I'm a self-professed geek. But simply put, and from what I gather, Credits was a blockchain protocol that was going to be fundamentally different in design from say ethereum, bitcoin or other cryptos out there now, with a structurally different approach with regards to how different node roles were assigned, and in how the transaction ledger was maintained. For the technical details, pls don't feel shy about visiting the following two links listed. whitepaper: https://credits.com/Content/Docs/TechnicalWhitePaperCREDITSEng.pdf technical paper: https://credits.com/Content/Docs/TechnicalPaperENG.pdf The following comparison table also compares the key salient features of Credits vs other potential competitors in this space.  Other Major Plus Points - NON-GREEDINESS OF THE DEVELOPERS. The team could have came out much earlier on and "asked for" money. When interest caught on (like NOW), they could also have increased the hardcap to milk investors. But no, they stuck to their original offer. I would say 20 mn hardcap for 60% of the tokens, would be among the lower end of valuations in terms of what other ICOs are asking for, especially when they have an almost-ready product to introduce to the market. Notably, up to 50% of the funds collected will be locked in escrow until the alpha version and the Full product release, so investors can have an added sense of confidence that technical milestones will be met. - KEEPING TO THEIR PRINCIPLES. They waited till they had a minimum viable product (MVP), available on their site for testing, before launching the project. They even pushed back the ICO to 15th Feb because of some bugs found in their alpha, and they insisted on letting investors test the alpha before the public sale. Should be coming out these two days (9/10 Feb). The roadmap is also one of the clearest among all the ICO projects I've seen, with key technical and operational milestones flagged out over the next several months. - SOLID TEAM. Compared to bare/resource-thin teams of 4-5 members, the Credits project has up to 25 experienced members working on the platform. Notably, 10 of these are developers, again signalling how tech-heavy and robust this project is. Almost half of the advisory board are hardcore blockchain tech experts, while the others are leaders in their respective fields (business development etc.). - OTHER VIABLE MARKETS. The Internet of Things (IoT) market could be one area where Credits could credibly expand to as well, once they have gotten their base set up as a fin svcs platform. Logically, its fast processing speed and low fees would be ideal for micro-transactions in IoT related applications in the fields of logistics, smart homes, infrastructure management, healthcare etc. I've tried to highlight the salient features of the credits project (tech, team, financials) which attracted me to it. If this post caught ur attention and u wish to find out more, pls visit https://credits.com/en/Home. Forum comments and discussions can be found at https://bitcointalk.org/index.php?topic=2401248.0. Excellent presentation deck at https://credits.com/Content/Docs/PresentationENG.pdf. Latest info is that the ICO date is on 15 Feb, open to whitelisted investors only. Join the whitelist after DYOR!

👍 calagnin, rfidsignpost,