TIB - An Investors Journal #753 - Gold Mining, Uranium, Nuclear Technology, Vanadium Dutch Bank, US Real Estate, ASX Stocks + more

hive-167922·@carrinm·

0.000 HBDTIB - An Investors Journal #753 - Gold Mining, Uranium, Nuclear Technology, Vanadium Dutch Bank, US Real Estate, ASX Stocks + more

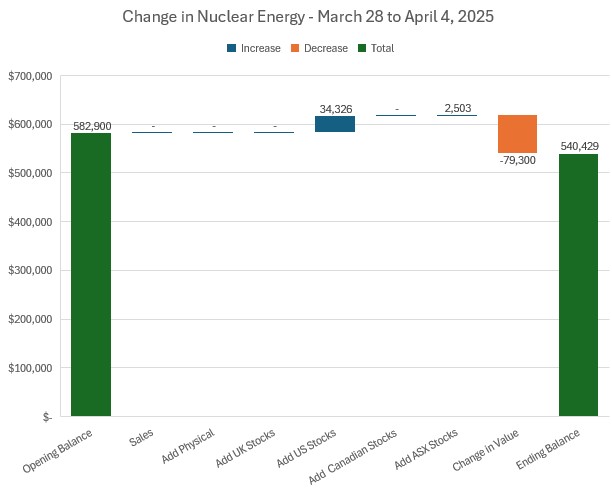

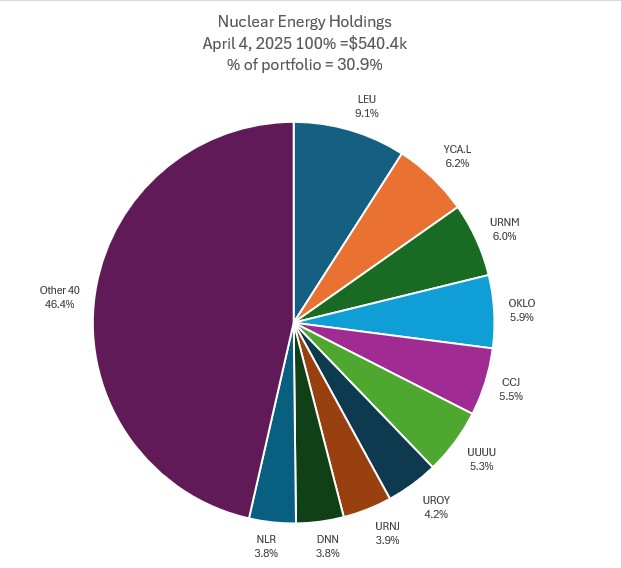

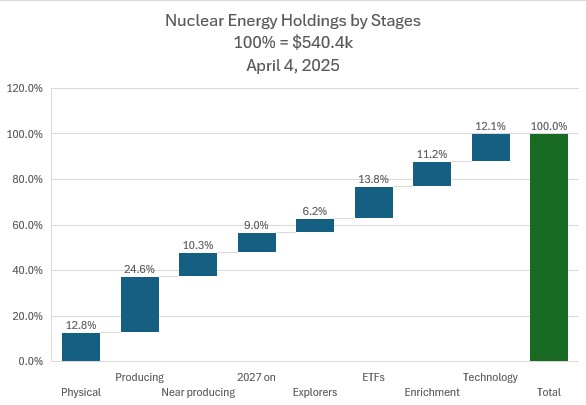

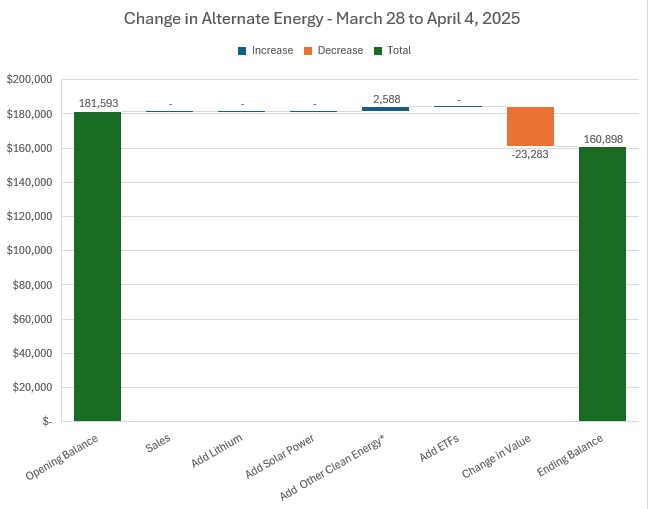

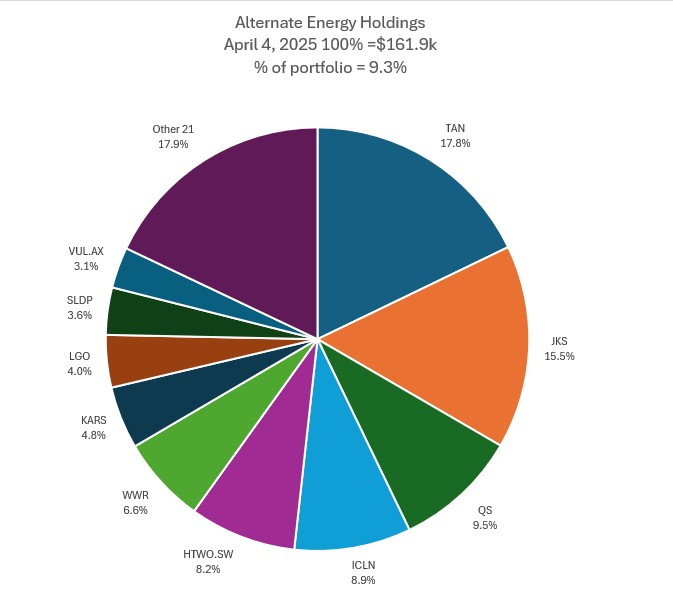

A week best forgotten in markets - time now to hunker down and not do a lot apart from adjusting naked puts and preserving capital <h3>Portfolio News</h3>  In a week where S&P 500 dropped 9.1% and Europe dropped 8.4%, my pension portfolio dropped 6.46% - not as bad. The numbers presented for this change in value is in a constant exchange rate view with rates from ages back  One softening action that helps a portfolio held mostly outside Australia is the fall in the Australian Dollar - down 5.3% in one day. Big movers of the week were WhiteHawk Limited (WHK.AX) (125%),ProShares UltraPro Short QQQ (SQQQ) (31.5%), Koonenberry Gold Limited (KNB.AX) (20%), Earths Energy (EE1.AX) (14.3%), Premier American Uranium Inc. (PUR.V) (13.5%), Cauldron Energy Limited (CXU.AX) (11.1%) Not exactly the week to be talking big themes but there are a few - Gold mining (1 stock), alternate energy (1 stock) and uranium (2 stocks). TSP have cybersecurity in their themes - top stocks comes from that segment but it was a Next Investors idea - won a big contract in US in the week.  News for the became irrelevant when the tariff bombshell was dropped. Now I have lived through a few of these market corrections in my time. I learned from watching my fund manager in 2008 what not to do. He sold a bunch of stocks to keep portfolio balance and what would have taken 6 years to recover without selling took 8 years. The chart below shows what happened for the last tariff cycle in 2018. Markets took 26 weeks to recover the drop. The same story in March 2020 with the Covid collapse - I stopped looking at markets and did nothing - markets took 26 weeks to recover what was a more substantial fall.  Plan for this time is to do nothing (other than deal with the raft of sold puts that are now in-the-money and the margin pressure that is creating) and see how long the recovery time is **Crypto Stumbles** Bitcoin price was tracking somewhat sideways with two spikes higher but got caught up in the down rush late ending the week 5.3% lower with a peak to trough range of 12.8%  Ethereum price started out the same but fell over before the tariffs broke ending the week 14% lower with a peak to trough range of 22.1%. Price is testing levels not seen since Q4 2024.  Going against the flow was EOS - no news - popping 25% and giving half away  **Nuclear Energy Holdings** Two changes in holdings plus the first slice of monthly auto-invest - one of the additions accounts for big part of the 13.6% fall in valuation as it is marked to market on sold put assignment (even after accounting for sold put premium)  Mix of holdings changes with Oklo (OKLO) coming into the Top 10 in slot 4 and Van Eck Nuclear ETF (NLR) dropping a place into slot 10. Falling out was NexGen (NXE). Share of portfolios surprisingly rose a little to 30.9%. Percentage drop over 1 point for Centrus Energy (LEU)  Holdings by stage sees more than 2.5 percentage rise in Technology and 1.4 points drop in Enrichment and 0.7 points drop in producing despite the one addition there.  **Alternate Energy Holdings** One change in holdings with the addition of Largo (LGO) and portfolio drops 12.9%.  Mix of holdings changes with Invesco Solar ETF (TAN) changing places at the top with Jinko Solar (JKS). Largo (LGO) comes into Top 10 in slot 8 on the addition there. SolidPower (SLDP) and Vulcan resources (VUL.AX) swap places. Leo Lithium (LLL.AX) falls out the Top 10 - still not resumed its listing. Share of portfolios remains at 9.3%  <h3>Bought</h3> **Largo Inc** (LGO): Vanadium. Averaged down entry price in pension portfolio. **ING Groep** (INGA.AS): Dutch Bank. Added to pension portfolio on the pullback. **Rolls-Royce Holdings plc** (RR.L): Aerospace/Defense. Replaced stock assigned on covered call at 13.3% premium to assigned price. With the Europeanisation of defense spending and SMR ability, this keeps moving away. Wrote covered call for 0.58% premium with 7.2% price coverage. **enCore Energy Corp** (EU): Uranium. Averaged down entry price in pension portfolio on the pullback **Lotus Resources** (LOT.AX): Uranium. Averaged down entry price in personal portfolio. Market reacted badly to two seemingly innocuous announcements - one about connecting to Malawi electricity grid (transmission lines to be built) and signing of a previously announced offtake sale agreement. The details of that should have been in the price already. Note: These trades were at the start of the week - had no idea what was coming **Oklo Inc** (OKLO): Nuclear Technology. Assigned early on sold put. Breakeven after 3 cycles of sold puts is $37.75 vs $19.80 close (Apr 4).  Chart shows price was at breakeven level a short 26 trading days ago (5 weeks). <h3>Sold</h3> **Direxion Daily MSCI Real Est Bear 3X ETF** (DRV): US Real Estate. Been waiting for a big sell off day to close out this holding - 90% blended loss from November 2018/November 2019. A reminder not to hold short ETF's for anything more than a month or two. <h3>Hedges</h3> **VanEck Vectors Gold Miners ETF** (GDX): Gold Mining. Replaced stock assigned on covered call at 9.5% premium to assigned price. <h3>ASX Portfolio</h3> The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots **Top Ups** **Metcash Limited** (MTS.AX): Food Retail. Dividend yield 5.21% Consumer staples went green after the big sell off. Chart shows breaking a long downtrend and bottoming out - maybe this time.  **AutoInvest** $600 spread across 4 uranium stocks, one gold ETF and two index ETFs - first part of the series done this week. - Silex Systems Limited (SLX.AX): Uranium. - Global X Uranium ETF AUD (ATOM.AX): Uranium. - Deep Yellow Limited: Uranium. - Global Uranium and Enrichment (GUE.AX): Uranium. - Terra Uranium (T92.AX): Uranium. Balance will happen next week (Apr 7) <h3>Income Trades</h3> Five covered calls written in the week across two portfolios (none in the others) (UK 1 Europe 3 US 1) **Naked Puts** Sold puts on stocks happy to hold at lower prices - QuantumScape Corporation (QS): Battery Technology. Return 3.25% Coverage 3.8% - DHL Group (DPWA.DU): Europe Logistics. Return 0.88% Coverage 5.6% - Commerzbank AG (CBK.DE): German Bank. Return 1.1% Coverage 5.1% - Deutsche Bank AG (DBK.DE): German Bank. Return 1.2% Coverage 7.1% - Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 0.8% Coverage 3.8% - Coeur Mining (CDE): Silver Mining. Return 3% Coverage 19.8% - May expiry - Coeur Mining (CDE): Silver Mining. Return 5.8% Coverage 4.4% Too bad that market rolled over - a few had to be kicked down the road inside 3 days Rolled out a few likely to be assigned: - Builders FirstSource (BLDR): Building Products. 97% loss on buyback. 4% cash positive - Honeywell International (HON): US Industrial. 89% loss on buyback. 38% cash positive - Global X Lithium & Battery Tech ETF (LIT): Lithium. 148% loss on buyback. 0.3% cash positive - Commerzbank AG (CBK.DE): German Bank. 636% loss on buyback. 27% cash positive - down in strike - Deutsche Bank AG (DBK.DE): German Bank. 1143% loss on buyback. 8.4% cash positive - DHL Group (DPWA.DU): Europe Logistics. 721% loss on buyback. 3.7% cash positive - down in strike Why do this? Do not have the capital to get assigned at this point - will look to markets stabilizing and then look at buy backs or more rollovers or early assignment. **Credit Spreads** A few new spreads - L'Air Liquide S.A. (AI.PA): Specialty Chemicals. ROI 19.5% Coverage 1.1% - Centrus Energy Corp (LEU): Uranium Enrichment. ROI 62.9% Coverage 7.8% - adjusted - see below - Barrick Gold Corporation (GOLD): Golding Mining. ROI 52.7% Coverage -1% - pending order hit in selloff. **Centrus Energy Corp** (LEU): Uranium Enrichment. Converted a 60/55 credit spread to a 60/50 credit spread by selling the 55 strike bought put and linking the 50 strike naked put. Locks in 312% profit in a few days and increases ROI from 23% to 31% on the spread. Spread is however now 9.3% in-the-money. <h4>Resources</h3> **Cautions**: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas **Images**: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work **Tickers**: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView **Charts**: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices **Investing**: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr **Crypto Trading**: **Binance** offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance **Kucoin** offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15 **Gate.io** offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio **Tracking**: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking **Aus/NZ Investing** Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares March 31 - April 4, 2025

👍 erikah, hive-113748, b00m, spamfarmer, bdmillergallery, mitchelljaworski, alexis555, joeyarnoldvn, letusbuyhive, tresor, bnk, happyphoenix, fortune1m, hive-176147, ekavieka, aqsagu, steemitboard, lydon.sipe, hivebuzz, lizanomadsoul, manncpt, jnmarteau, crypticat, pinmapple, roelandp, princessmewmew, xsasj, itchyfeetdonica, musicandreview, kimzwarch, gabrielatravels, crimsonclad, anarcist69, clayboyn, bigdizzle91, blarchive, anarcist, bilpcoinbpc, vcclothing, lee1938, edkarnie, arcange, achimmertens, laruche, calebmarvel24, walterjay, aidefr, robotics101, twoitguys, wargof, imcore, cocinator,