Advantages of Margin Trading with High Leverage on BitMEX and PrimeXBT?

bitcoin·@catk·

0.000 HBDAdvantages of Margin Trading with High Leverage on BitMEX and PrimeXBT?

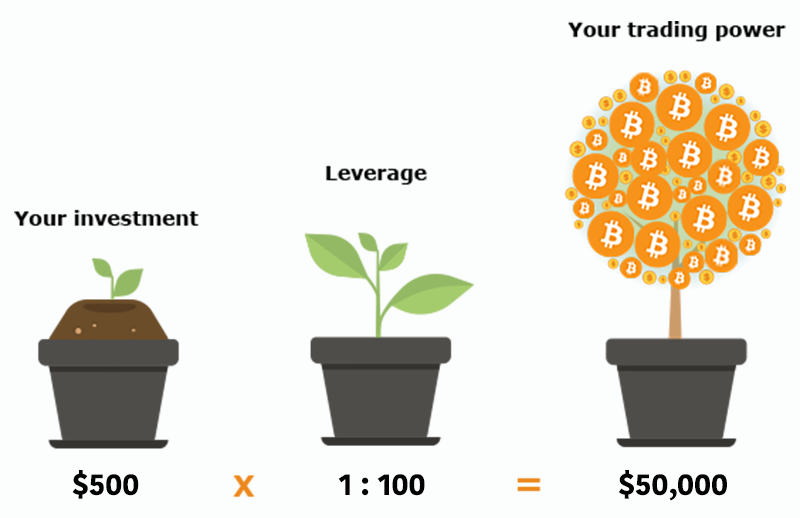

The main advantage of trading with high leverage, as offered on <b>PrimeXBT</b> and <b>Bitmex</b>, is that you are able to put a substantial amount less of your money on the line for the opportunity to trade a far more profitable position than that amount of capital would otherwise allow. This is because the amount you deposit into the trade is multiplied by the leverage you choose to take and seeing both PrimeXBT and Bitmex offer up to <b>100x leverage</b> this is significantly more. <h2>For Example:</h2> When using 100x leverage, a $500 deposit becomes a $50,000 position and the profits you would yield from this trade would likewise refect this increased position size. So if the price moved favorably by 5% and you decided to secure this profit and exited the trade, you would have gained $2,500 as opposed to $25 if no leverage was used.  On the other hand, if the price moved opposingly, the most you stand to lose is the $500 deposit as your account cannot go into a negative balance on either PrimeXBT or Bitmex. However, it’s important to note that the risk of being liquidated is increased, i.e. higher leverage = higher risk. This is because the available margin (room for price movement) is proportional to the original amount deposited <i><b>before</b></i> leverage was applied ($500) which is only 1%. More funds can be added to your trading account to prevent losing your position if you were confident the price would recover. The other major benefit of both platforms is that margin trading allows you to <b>profit in both rising and falling markets</b> by going <b>long or going short</b>. On <a href="https://primexbt.com">PrimeXBT</a>, you can hedge to reduce risk by going long and short on the same asset at the same time. For that matter, there are a number of additional advantages to trading on PrimeXBT over Bitmex, namely: - PrimeXBT offers 100x leverage to all of the 5 top crypto-assets (9 major pairs), whereas Bitmex only offers 100x to BTCUSD. - Access to 30+ traditional financial instruments in <a href="https://primexbt.com/leverage-trading-crypto-indices-forex">FX, commodities, and stock indices with the highest available leverage</a> across all assets (up to 1000x). - The array of varying asset classes allows for thoughtful portfolio diversification by spreading capital across a range of both high, medium, and low volatility markets to balance the wins and losses of opposing markets - for consistent gains over the long term. - Lower fees - PrimeXBT only takes 0.05% on all trades/assets, compared to 0.075% on Bitmex for BTC and ETH markets, increasing up to 0.25% on all other crypto-asset markets. - A highly customizable, modern, and easy-to-use interface - in contrast, Bitmex’s is overstressing and outdated. - Reliable and precise order execution - Bitmex’s connectivity issues are notorious and often occur at the most inconvenient (in peak volatility) times, causing their clients to get ‘bitmex rekt’. - PrimeXBT features a mobile for both <a href="https://apps.apple.com/us/app/primexbt-trade/id1469035685">iOS</a> and <a href="https://play.google.com/store/apps/details?id=com.primexbt.exchange&hl=en">Android</a> devices. <h2>Final Thought</h2> Bitmex is currently under <a href="https://www.bloomberg.com/news/articles/2019-07-19/u-s-regulator-probing-crypto-exchange-bitmex-over-client-trades">investigation</a> by the Commodity Futures and Trade Commission (CFTC), suspected of <a href="https://coinnounce.com/bitmex-trading-against-their-customers-foul-play-bitmex/">trading against its clients</a> and allowing U.S citizens to use the platform. If the inquest confirms the allegations, the CFTC may shut it down and freeze all assets. In only a week, <a href="https://www.minds.com/_Ronnie_/blog/bitmex-afflicted-by-cftc-probe-with-a-steep-outflow-of-136m-1001486602193338368">more than $136M has been withdrawn</a> by traders since the news broke. Yet, the verdict remains to be seen.