Steem Follower - Estimate of annual return on upvotes

steemit·@cryptobols·

0.000 HBDSteem Follower - Estimate of annual return on upvotes

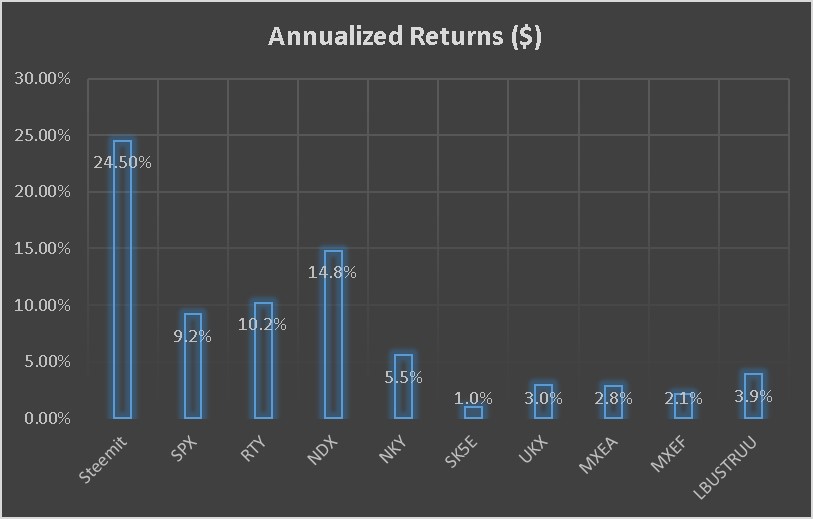

Steemfollower is setup so that you trade upvotes on blog posts with other users. I recently joined and have already seen that I receive more upvotes than I had been otherwise. It got me wondering what the return on account value would be using 10 100% upvotes per day. Assumptions (as of 5/26/2018): - Account value = $1,466.41 - Individual vote value = $0.0883 (I took the value when I have around 90% voting power which I assume with be the average value) - Daily vote value = $0.0883 * 10 = $0.8830/day - 100% of votes are reciprocated on blog posts via steemfollower - No changes in underlying value of steem or sbd during period of analysis - Ratio of daily vote value to total account value is constant Using these assumptions, I determined that my account value would grow to $1,825.65 after 365 days of using Steem Follower - this would mean a 24.5% return over the 1-year period! I compared this to the average annual return over the last 10 years (5/23/2008-5/24/2018) for 8 major equity indices and 1 bond index (returns are USD denominated with no FX hedging assumed):  SPX - S&P 500 RTY - Russell 2000 NDX - NASDAQ 100 NKY - Nikkei 225 SX5E - Euro Stoxx 50 UKX - FTSE 100 MXEA - MSCI EAFE MXEF - MSCI Emerging Markets LBUSTRUU - Bloomberg Barclays US Agg Total Return Source: Bloomberg Of course, this only uses average return and makes no mention of the distribution of returns. Also, the actual payouts will be different due to curation rewards earned and paid out to other upvoters. Regardless, simply maximizing upvotes through a system like Steem Follower stacks up exceptionally well to conventional investments! You could argue that some/all of Steemit's excess return is a liquidity premium due to the process of powering down but most more conventional investments are drawn down over time anyway. Lot's of simplifying assumptions in the analysis but I thought it was interesting nonetheless. Thanks for stopping - let me know your thoughts! Also, if you decide to go check out Steem Follower, please use my referral link below! https://old.steemfollower.com/?r=16440