Goldman Sachs Analyst Predicts Bitcoin at $4000!

bitcoin·@cryptodata·

0.000 HBDGoldman Sachs Analyst Predicts Bitcoin at $4000!

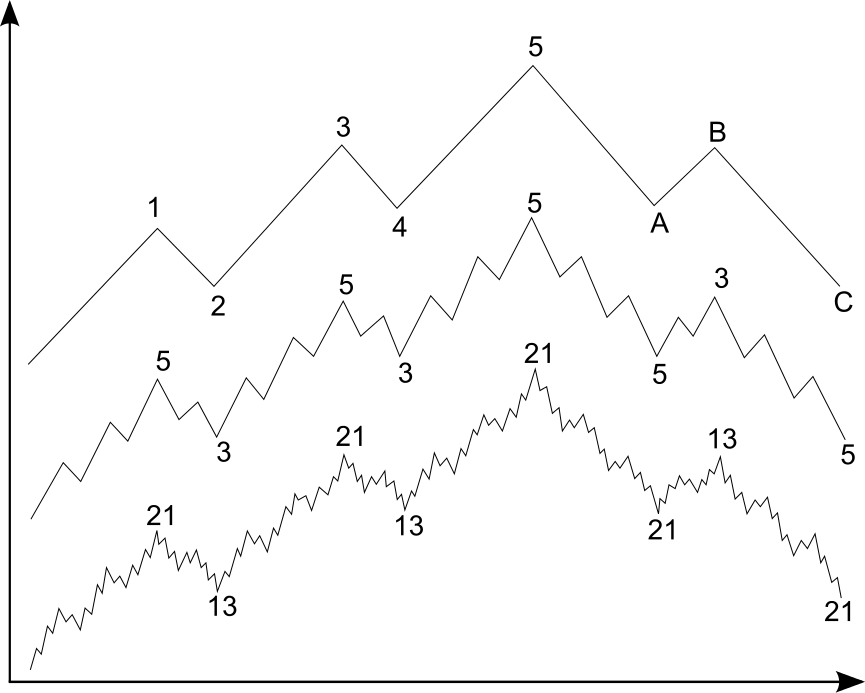

You read that right. One of the leading financial firms has predicted Bitcoin will reach $4,000. Now before you start buying up all of the Bitcoin, read the whole article first.  So as many of you may know, Goldman Sachs is a leading global investment banking, securities, and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments, and high-net-worth individuals. While they mostly dabble in stocks, mutual funds, bonds, and client operations, they've also taken an interest in cryptocurrenices (as of June 12th). Because as you and I know, anything that involves high profits, will eventually interest the eyes of financial institutions. # Introduce Sheba Jafari Sheba Jafari is the bank's leading chief technician, and the same person that predicted the downturn of Bitcoin after it passed $3,000 on June 11th ([see attached article](http://www.coindesk.com/goldman-sachs-bearish-bitcoin-price)). In that article, he stated that if Bitcoin closed below $2,749 (on June 12th), that would be a bearish key. Referencing "both daily/weekly oscillators are diverging negatively. All of this to say that the balance of signals are looking broadly heavy." He then stated that with an eventual "4th wave, the price would fall between $1,915 and $2,330, in which investors could re-establish a bullish exposure." Both of those things happened, and in two days, we saw Bitcoin retrace to a low of $2,012 (June 15th), then bounce back and continue it's current trend upward.  # When Will Bitcoin Hit $4,000? After seeing Sheba's recent prediction, it's safe to say his opinion has some weight. In a recent article, [published today](http://www.coindesk.com/goldman-sachs-eyes-bitcoin-price-near-4000-latest-analysis/), Sheba states that Bitcoin "could consolidate sideways for a while longer", highlighting a possible low of **$1,857** and "eventually targeting" a figure of $3,212.  [Image Source](http://www.coindesk.com/goldman-sachs-eyes-bitcoin-price-near-4000-latest-analysis) He states that bitcoin markets are in the "4th wave" of sequence that dates back to late 2010. His form of analysis is based on The Elliot wave. The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Essentially, prices will alternate between an impulsive, or motive phase, and a corrective phase on all time scales of trend. So you'll have waves 1, 3, and 5 that are impulses, and waves 2 and 4 that are smaller retraces of waves 1 and 3.  [Image Source](https://en.wikipedia.org/wiki/Elliott_wave_principle) He then states that "it could remain sideways/overlapping for a little while longer. At this point, it’s important to look for either an ABC pattern or a more triangular ABCDE. The former would target somewhere close to 1,856; providing a much cleaner setup from which to consider getting back into the uptrend. The latter would hold within a 2,076/3,000 range for an extended period of time.” Regardless of what happens, Sheba still asserts that there will be a 5th wave, and predicts a "minimum of $3,212 to as high as $3,915." # Conclusion With all of this analysis, we need to keep in mind that it is after all, analysis. With that said, I believe Sheba has a point in thinking that the price of Bitcoin will retrace before it rises. He properly predicted the last downturn, and I don't think that was a coincidence. Being the chief technician at Goldman Sachs holds some weight, and I see other investors following his lead. I believe we'll see a retracement for Bitcoin to $1,800, then a huge rally afterwards. So always remember to set your stops in case this happens, in order to protect all of that hard earned profit. Cryptocurrencies are a volatile market, and with the way things have been, it always pays to be one step ahead. Thanks for reading! Sources: -http://www.coindesk.com/goldman-sachs-bearish-bitcoin-price/ -http://www.coindesk.com/goldman-sachs-eyes-bitcoin-price-near-4000-latest-analysis/ -http://www.zerohedge.com/news/2017-06-12/due-popular-demand-goldman-starts-covering-bitcoin -http://www.zerohedge.com/news/2017-07-03/goldman-sees-bitcoin-soaring-high-3915 -https://en.wikipedia.org/wiki/Elliott_wave_principle