Is a new crash in the markets coming?

hive-167922·@cryptomaster5·

0.000 HBDIs a new crash in the markets coming?

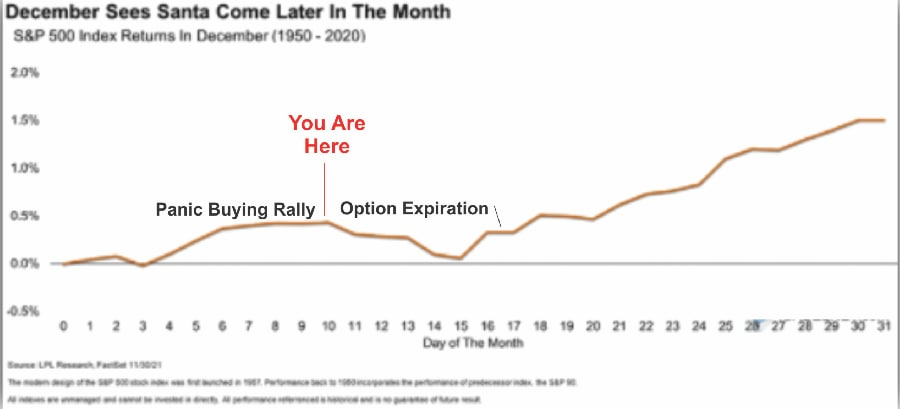

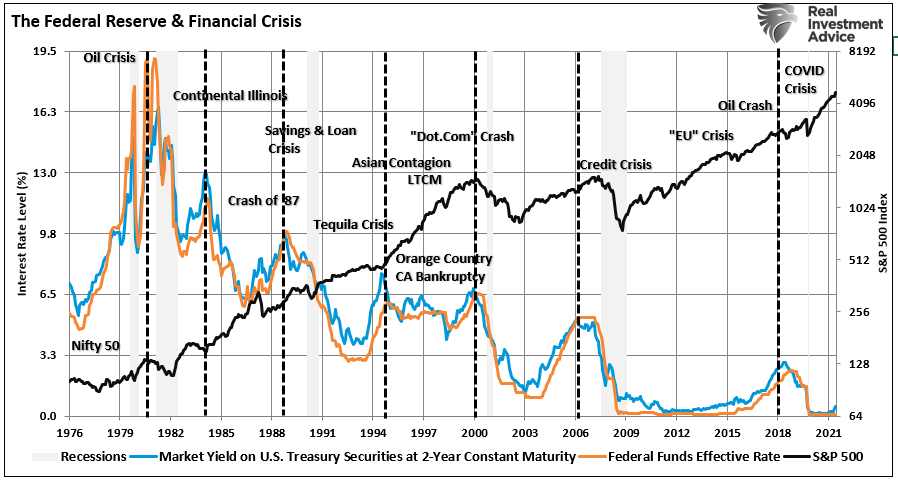

## PREMISE I'm not here as a bird of ill omen but to provide some food for thought on the current situation of traditional markets and cryptocurrencies. As we all know, the economic crisis caused by COVID has been addressed by the major world economies through expansive monetary policies. Without explaining the reasons, which is easy to find online or with a good copy of a book that deals with macroeconomic matters, expansive monetary policies are aimed at giving a new impetus to economic activities, but have the disadvantage of triggering inflation higher than desired, and therefore loss of purchasing power. On the one hand, this could be interpreted as a positive development for BITCOIN and other cryptocurrencies with a defined supply, on the other hand, it could lead to a decline in prices, due to the relationship that exists between cryptocurrencies and the stock market. This could be seen as a dual nature of cryptocurrencies, i.e. anti-inflationary refuge asset and high risk investment asset. In reality, the question, in my opinion, concerns more than the characteristics of crypto those of investors who have been operating in the markets for little more than a year (institutional investors). Let's see together. ## THE LONG-AWAITED RISE IN INTEREST RATES  In this picture we have the daily seasonality, different from the monthly seasonality we have posted other times. Here are the highs and lows for each day of December, averaged from 1950 to 2020. From this perspective, seasonality seems to be respected so far. After last week's brief bullish rally (written: "you are here"), we should expect a further decline this week, due to the usual expiration of derivatives around 15-17 of the month, and then a fairly pronounced rally (Christmas rally). From a medium-term perspective, I found this other chart, where you can see that every time the Fed raises rates (blue and orange curves), a correction in the S&P500 follows (vertical dashed lines).  On the far right is our situation, with rates practically at zero and markets rightly rising. The Fed is in the difficult position of having to decide whether to break this happy situation, causing a new rise in the orange and blue curves, with the almost mathematical certainty of causing another fall in the black curve, to achieve only one objective: to show the media that it takes inflation seriously. This year the planets aligned in an even more curious way: the Fed's decision to start "tapering" (which is not necessarily a rate hike, but probably just a further reduction of government bond repurchases) should happen in the week (this one) before the Christmas rally. I really want to see, in case the Fed announces tapering, whether seasonality (the Christmas rally) or medium-term tension (canceling the Christmas rally, or postponing it to January) will prevail anyway. In the event that the Fed does announce some "tapering," markets could have a bearish reaction in the second half of December, before realizing that tapering and raising rates (the orange and blue curves in the chart above) are NOT the same thing. Therefore, once the irrational tension is discharged and after reading more calmly the news in the newspapers, the rally could still happen, but late. I believe that the same scenario can also come true in the cryptocurrency market. At the same time, if inflation growth rates do not return to normal levels, it is logical to expect even greater growth than equity markets. Thank you for reading. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@cryptomaster5/is-a-new-crash-in-the-markets-coming)

👍 gaottantacinque, cribbio, gasaeightyfive, wilkera, ctime, good-karma, esteemapp, esteem.app, ecency, ecency.stats, valentin86, beemengine, aro.steem, badpupper, atnep111, rmsbodybuilding, gotgame, pedrobrito2004, stefannikolov, dannychain, meins0815, pavelsku, iamjohn, hive-131548, mlrequena78, navre, blockchitchat, milabogomila, elyelma, chaosmagic23, shiftrox, magnacarta, merilin077, weesleytv, bmngn, intellihandling, budmeister33, milly100, learningenglish, fragozar01, pimpstudio, crimo, crimcrim, driptorchpress, itsostylish, imfarhad, steemstreems, waivio.welcome, waivio.com,