December 22, at the end of the day, bitcoin fell by 0.62%

hive-167922·@cryptonotes·

0.000 HBDDecember 22, at the end of the day, bitcoin fell by 0.62%

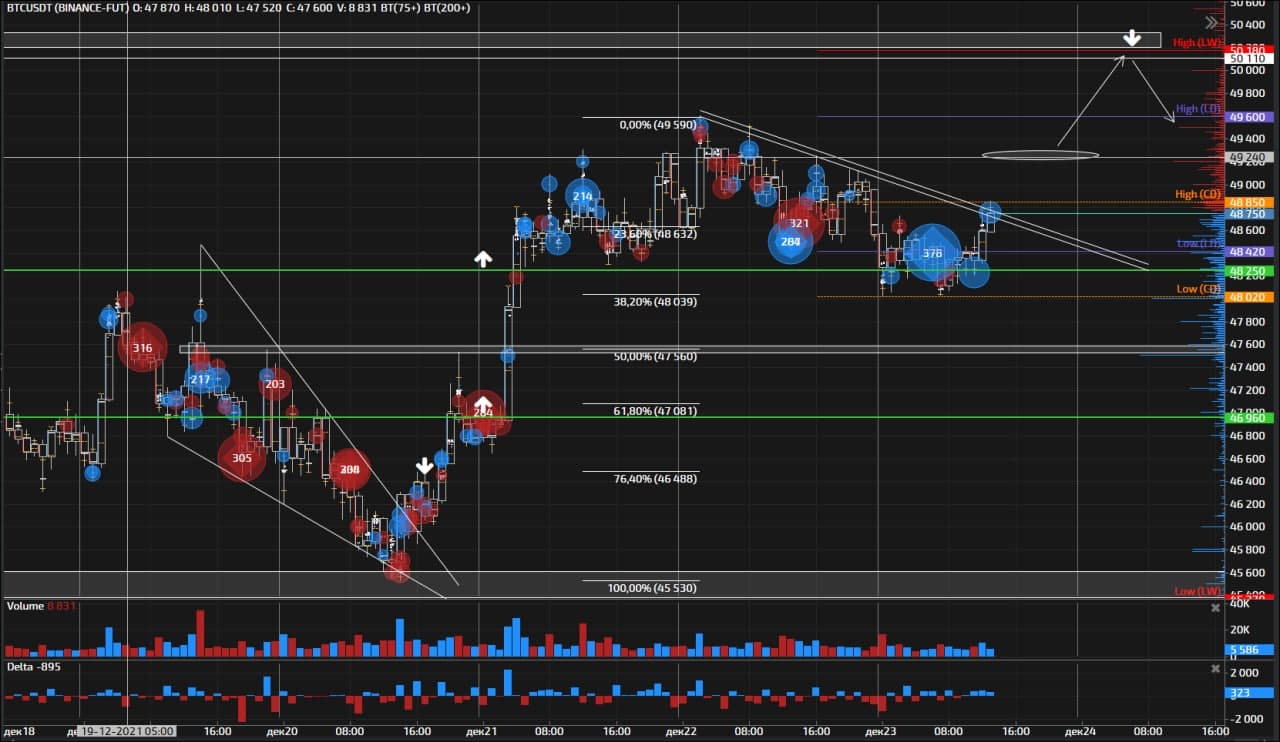

On Wednesday, December 22, at the end of the day, bitcoin fell by 0.62%, to $ 48,588. Buyers were unable to capitalize on a weaker US dollar, higher stocks and gold. The demand for risky assets rose on the news about Omicron. The new strain is less likely to bring patients to the hospital than the Delta strain, according to the latest research and preliminary data from South Africa and the Universities of Edinburgh and Strathclyde. The FDA has approved Pfizer's COVID-19 remedy for home treatment.  Technical analysis On Wednesday, the BTC / USD pair rose to $ 49,576 in the Asian session. After an unsuccessful attempt to break through the trend line, which originates from the top of 69 thousand, a downward correction began in the market. Sales increased on the transition of the day, while the dollar was actively depreciating against its competitors. Someone really does not want bitcoin strengthening. At auction in Asia, the price dropped to $ 47,920. The BTC / USD pair is trading sideways at $ 48,438. The fall stopped at the Fibo level of 38.2% of the rise from $ 45559 to $ 49576. On Thursday, demand for risky assets remains high. Resistance has formed at $ 49,500, although the upper border of the sideways range passes through 51200. If on Thursday the price remains below the 49500 level, sellers will once again try to test the $ 45500 level for strength, and the $ 46540 level will be an intermediate level. On Friday, the US markets and the precious metals market will be closed. The foreign exchange market works on a shorter schedule. We expect high volatility in the cryptocurrency market during the holidays. There are no ideas. I will wait for the opening of the American session and then publish the levels for cluster analysis.  1. Fibo-level 38.2% was a good support for buyers. 2. Pay attention, while the price is trading above $ 48250, buyers are pouring large volumes into the market. 3. 50% - $ 47560. Reference level. Below it is the sellers' area. The closer the price is to $ 46,950, the more active sellers will become. 4. Resistance is at the levels: $ 50100-51200. To accelerate upward, you need to go $ 49300.  The dollar is getting cheaper, the fund rushing up. Finally, the cue ball moved up. Buyers have passed the resistance at 49500. We can move to the level of 51200. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@cryptonotes/december-22-at-the-end-of-the-day-bitcoin-fell-by-0-62)

👍 ctime, notesfortrader, ezrider, bradleyarrow, frankydoodle, greatness96, maaz23, globetrottergcc, mytechtrail, drunksamurai, oredebby, citimillz, cruisin, linco, mk992039, bonnie30, shoaib21, elizabetamt, bizventures, curtawakening, hirohurl, kaseldz, daniky, aslehansen, johnandgrace, hive-112281, twicejoy2, firstborn.pob, kballories011, lostkluster, flaxz, improbableliason, maddogmike, bigtakosensei, guurry123, kingneptune, hodlcommunity, yefet, vlemon, karinxxl, chekohler, mikitaly, culgin, paragism, minimining, merlin7, idiosyncratic1, krunkypuram, enison1, jskitty, nulledgh0st, mynima, f0x-society, hivexperiment, defi.campus, dotnb, spirall, jmsansan.leo, jocieprosza.leo, vietthuy, agathusia, oxoskva, l337m45732, drax, zdigital222,