Banks Are Moving to Ripple as SWIFT Network Recently Lost Transactions

cryptocurrency·@cryptopigmedia·

0.000 HBDBanks Are Moving to Ripple as SWIFT Network Recently Lost Transactions

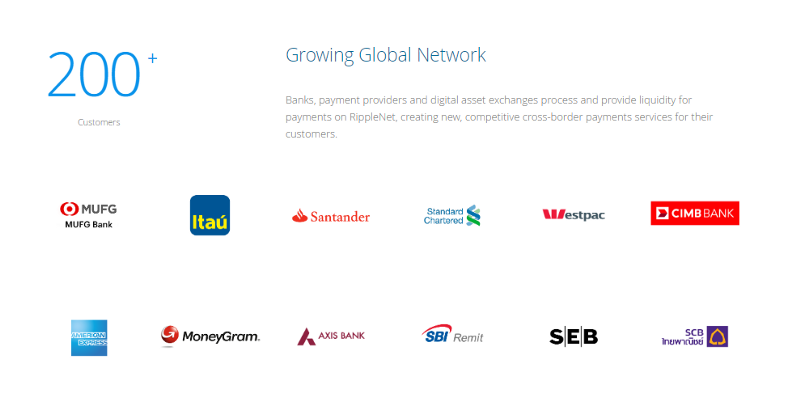

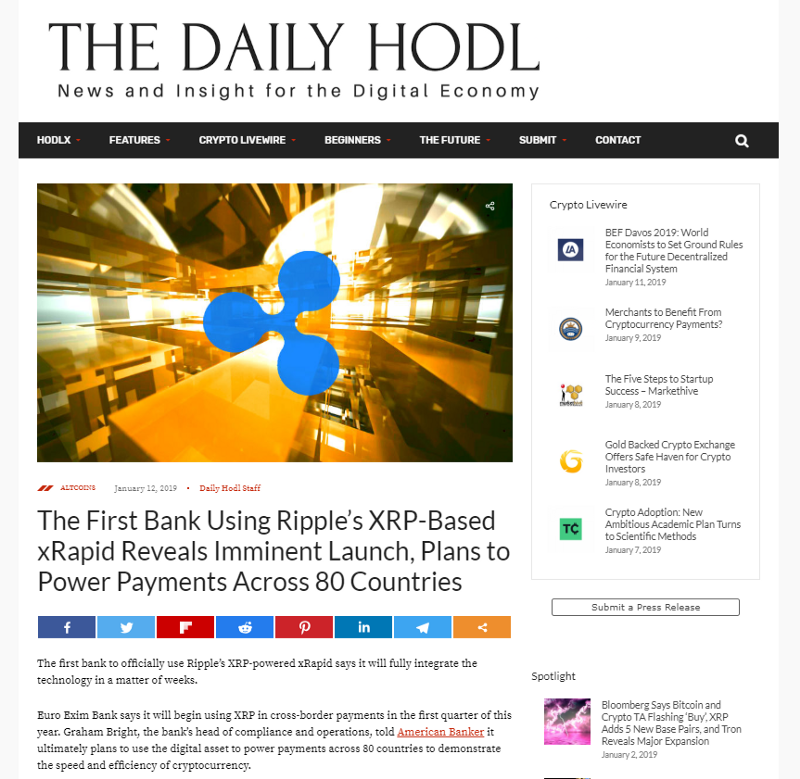

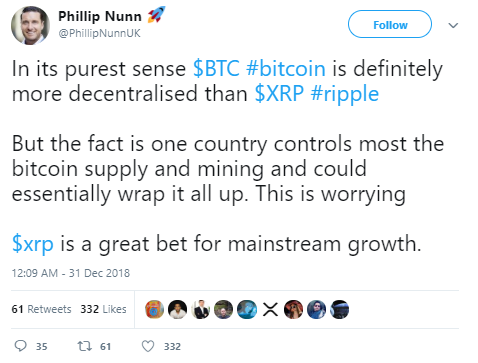

https://www.youtube.com/watch?v=nB7fxz0BpY4 Today we’re going to be looking at whether Ripple can potentially overtake the existing SWIFT network and how why this situation may be better for the banks than for the people. For those who aren’t aware, SWIFT is a system that allows financial institutions to send and receive information about financial transactions. If you’ve sent money overseas, there’s a good chance that your banking provider has used SWIFT, because over 11,000 banks and financial institutions currently use the SWIFT system. While many organizations trust SWIFT, it has failed to keep up with the current demands of life today. SWIFT is dated back to the 1970s and was initially built to replace telex machines with electronic transfers. The legacy system is inefficient, slow, and old. It’s unfortunate that SWIFT, the backbone of the banking industry, is currently a ceiling, preventing the further growth and innovation of the banking sector, especially when it comes to cross-border transfers. Not only is system slow, but it has also failed to track funds in certain situations. A key example is the Euro Exim Bank’s Transaction that recently was lost on the SWIFT network this month.  So it’s clear here that there are a lot of areas to improve when it comes to the SWIFT network. Unlike SWIFT, Ripple is an emerging organization which only came into formation in 2012. Although they’re much younger than SWIFT, they currently have over 200 financial institutions such as banks, and payment providers as partners, including Santander, Standard Chartered, Westpac, and American Express.  While we’re just a fortnight into the New Year, according to the Daily Hodl, Euro Exim Bank will also be the first bank to use Ripple’s xRapid officially and will integrate the technology into their banking system in just a few weeks.  Unlike xCurrent, one of Ripple’s other products, the bank will be using the XRP token during the cross-border payment in the first quarter of 2019. According to Euro Exim Bank’s head of compliance and operations, Graham Bright, the bank plans to use the XRP token to power payments in more than 80 different countries to show the efficiency and speed of XRP. This is fantastic and positive news for holders of the XRP token. While Euro Exim Bank is one fantastic trending case study, Ripple has been hard at work, creating over more than 200 partnerships in the international payment market. THey’re becoming very successful at cornering the remittances and cross-border payments which will soon become one of the most critical use cases for cryptocurrency and blockchain technology. These are all positive signs for the token. So positive that Phillip Nunn, a cryptocurrency and ICO expert even tweeted to his 28.2 thousand Twitter followers on the last day of 2018, that he believes Ripple is a better bet than Bitcoin, even though Ripple is more centralized than Bitcoin. Nunn believes in Ripple more than BItcoin because, in addition to Ripple’s strong growth, he noted that China controls the majority of Bitcoin supply and mining and could, therefore, have the power to destroy Bitcoin. Therefore Ripple is a great bet when it comes to mainstream growth.  Bitcoin’s troubles and demise is a significant factor that could affect Ripple’s growth. According to Coinmarketcap, Ripple is valued at $0.32 per XRP token. It currently has a market capitalization of 13.3 billion dollars. Ripple is currently ranked second on the list. While things appear to be going very well for Ripple, here is an interesting thought for discussion. It’s important to note that Ripple, doesn’t necessarily stand for the same principles that Bitcoin stood for. Ripple is fantastic for banks and intermediaries because it enables them to do their job in a faster, more efficient manner. Don’t get me wrong, Ripple’s technology is excellent. They’re leveraging cryptocurrency and blockchain technology, but it’s being done to help banks and intermediaries improve their existing services and not necessarily for everyday people to obtain monetary sovereignty. Helping middle-men technically places Ripple in a very different category to Bitcoin and other decentralized cryptocurrencies that were initially created to empower the individual. Others online have noted this issue. They’ve also pointed out that one of Ripple’s primary products offered to banks and financial institutions, the xCurrent does not even use the XRP token, It’s only xRapid, a smaller service offered by Ripple that uses the token. Furthermore, the XRP token is not as decentralized as we may believe. Ripple controls RippleNet which owns 62% of the total coins in existence. While they market themselves like a decentralized system, it appears very centralized with investors having to trust Ripple with their word. #### So what are your thoughts on this situation guys? Do you think Ripple can overtake SWIFT? Do you think Ripple can beat Bitcoin and is a great bet when it comes to mainstream adoption? Or do you think there are currently too many flaws with Ripple’s system? Let us know what you guys think in the comments below! #### Please join us at our Telegram Group and follow us. [**CRYPTOPIG.COM**](https://cryptopig.com) [**TELEGRAM GROUP**](https://t.me/cryptopiggroup) [**YOUTUBE CHANNEL**](https://www.youtube.com/cryptopig?sub_confirmation=1) [**TWITTER PROFILE**](https://twitter.com/cryptopigmedia) Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.

👍 greencmetaha, steem-raffle, supu, whitebot, cifer, eforucom, steemchoose, smartmarket, funtraveller, kaylinart, fundsteem, ibc, ourdailyboard, ccoin, mehta, jumaidafajar, sebhofmann, neander-squirrel, foruni73, phusionphil, spirits4you, pi5000, husaini, ustaadonline, dlive24hour, sakhone, shawnvanderveer, harferri, bscrypto, hadean, nuoctuong, quicksnake, banglatech, niallon11, qberry, berthold, calimeatwagon, thatterrioguy, cageysquirrle, yehey, stackenblacken,