**Bitcoin Earned from Mining is Taxable Income - How to Calculate**

money·@cryptotax·

0.000 HBD**Bitcoin Earned from Mining is Taxable Income - How to Calculate**

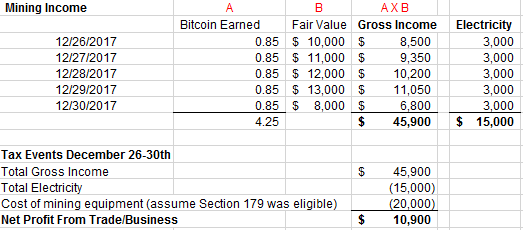

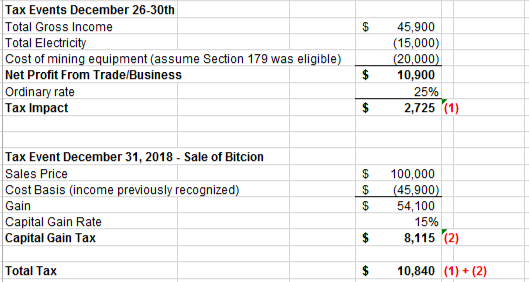

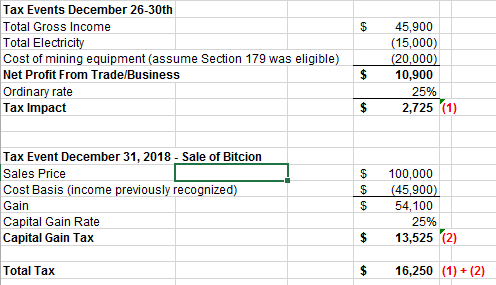

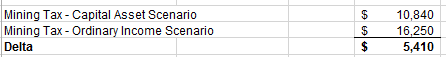

<center></center> In this article, we explore the complex tax issues that cryptocurrency miners will face for this filing season. **Is cryptocurrency earned from mining taxable? Crypto Tax Blog Part III, Section A** **IRS Cryptocurrency Rules** The IRS provides limited guidance on the U.S. income taxation of cryptocurrency in Notice 2014-21. For U.S. income tax purposes, **“convertible virtual currency” (CVC) is treated as property** for tax purposes. Convertible virtual currency means Bitcoin any other virtual currency that can be: (1) Digitally traded between users and (2) Purchased (and sold/exchanged) for U.S. Dollars (or other currencies including virtual currency). More information can be found in the Part I-A blog: https://steemit.com/money/@cryptotax/crypto-tax-blog-investing-in-bitcoin-let-s-learn-u-s-tax-rules-part-i-a **Mining – Tax Event #1** The IRS declared in its crypto notice that mining income is taxable gross receipts for purposes of U.S. income tax. The fair market value of virtual currency is includible in gross income when it is successfully mined (Notice 2014-21, Q&A 8). Fair market value must be calculated in a consistent and reasonable manner (Q&A 5). An example could be the exchange which a miner transacts with if it is liquid. How this calculation would actually work is in an example down below. Furthermore, mining income could be considered to be conducted under a trade or business and thus may be subject to self-employment tax (Q&A 9). All is not lost, because deductions are claimed against the income, otherwise the profitability of mining would be significantly reduced for U.S. tax payers, as applying a tax just to the currency earned without regard to deductions would be devastating. **Deductions** *Deduction vs. Hobby* Generally, in assessing tax consequences of mining, this will require a taxpayer to determine if mining is a trade or business or is a hobby. Generally, if a taxpayers has a profit in 3 out of 5 tax years (ending with the year analyzed), the activity is “for profit” and thus not a hobby. However, it is up to the taxpayer to determine whether mining is a trade/business or a hobby. A tax advisor should be contacted to help assess the trade/business vs. hobby assessment. Why is this important? Under Code Section 162, ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business are deductible. However, under Code Section 183, expenses incurred related to an activity that is **not engaged for profit** (a hobby) are deductible **only** to the extent of the income. This generally results in deductions that are subject to a 2% miscellaneous itemized deduction limit (substantially limited). *Expenses Miners Incur – The Tangled Web of a “Home Office* The examples of expenses miners incur are: 1. Cost of hardware to mine (ASIC miner, GPU rigs, cost of computer) 2. Electricity cost 3. Miner pool fees an exchange fees. For a small-time miner who made a purchase of an ASIC, the problem is the cost of electricity is usually tied to an individual miner’s place of residence. The electricity generated from the activity is with the residential electricity bill. The IRS permits a deduction for expenses related to a living unit, but only if the expenses are connected to a taxpayer’s trade or business. This is known as code section 280A. A taxpayer cannot take a home office deduction with respect to a hobby. For a taxpayer that has a full time job but mines cryptocurrency off to the side, as long the mining activity is a true “trade or business”, the home office deduction is permissible. A tax advisor should be contacted to help assess the home office deduction and ability to take a write-off for electricity. It should also be noted that the cost of mining equipment may be subject to depreciation provisions, although equipment is relatively cheap relative to the Section 179 and bonus depreciation (168(K)) provisions, meaning a significant amount can be written off in the first year. **Disposition of Mined Currency– Tax Event #2** It should be noted that the subsequent sale/exchange of mined cryptocurrency results in a second taxable event (unless like kind exchange applies). The character of this second gain/loss could be ordinary or capital, depending on whether the mined cryptocurrency is a capital asset in the hands of the miner (see Q&A 7 & 7). Inventory is an example of an asset that is **not** a capital asset in the hands of a taxpayer. So that leads us to wonder, is mined cryptocurrency an ordinary income asset, as it related to the miner’s activity of engaging in profit. It might be on the burden of a taxpayer to show their habitual treatment of mined bitcoin (i.e. immediately trading into fiat currency versus holding as an investment). **Example** Crypto Bro purchased an ASIC miner for $20,000 USD, which was delivered to him on December 25, 2017. Crypto Bro used an ASIC miner in order to mine Bitcoin. Crypto bro intends to operate his mining activity as a trade or business. At the current difficulty, the miner generates 0.85 Bitcoin per day. He mined on December 26, 27, 28, 29 and 30th. The fair market value of the mined Bitcoin were $10,000 USD on December 26, $11,000 USD on December 27, $12,000 USD on December 28, $13,000 USD on 29 and $8,000 USD on December 30. He skipped December 31, 2017. Every day, the electricity cost (calculated by his tax advisor) is $3,000 USD. On December 31, 2018, Crypto Bro sold all of his Bitcoin that was mined in 2017 for $100,000, when the holding period was long-term. Crypto Bro is in the 25% marginal bracket (15% long-term capital gain rate). *Below is a general estimate of Crypto Bro’s income from mining* <center></center> *If Crytpo Bro’s Mined Currency is a capital asset, the tax is as follows* <center></center> The first layer of tax is recognized on the **2017** tax return, the year the coins were successfully mined. The second layer of tax applies to the **2018** tax return (year when the Bitcoin is disposed of). Amounts above are totaled but span two tax return years. **NOTE**: Calculation ignores Self-Employment Tax Impact which would also apply to increase the ordinary rate. *If Crytpo Bro’s Mined Currency is an ordinary income asset, the tax is as follows* <center></center> The first layer of tax is recognized on the **2017** tax return, the year the coins were successfully mined. The second layer of tax applies to the **2018** tax return (year when the Bitcoin is disposed of). Amounts above are totaled but span two tax return years. **NOTE**: Calculation ignores Self-Employment Tax Impact which would also apply to increase the ordinary rate. *The difference between the two scenarios* <center> </center> **Takeaway** Cryptocurrency taxation is complex, and there are even more complex considerations for miners. Do you have any questions or thoughts of other challenges that miners may face related to U.S. income taxation? Feel free to post them here, however this is not personal tax advice, so it is also recommended you consult your tax advisor. **Note: Upcoming tax reform could result in changes to tax law as discussed in this article.** *Disclaimer: This series contains general discussion of U.S. taxes in a developing and unclear area of tax law. As always, you should consult your own tax advisor in your jurisdiction to determine your specific situation as this is not personal advice; and consider any future guidance by the Congress/IRS after the date of this article. Under Circular 230 to the extent it applies, this article cannot be used or relied on to avoid any tax or penalties in the U.S., its States or any other jurisdictions. Last, this article does not create a client relationship between author and reader.* *Picture Credit* Cover Picture: https://pixabay.com/en/users/ArtsyBee-462611/ Calculations: Me using Microsoft Excel

👍 cryptotax, abhishek587, steem-marketing, lordoftruth, promoted, originalworks, decayinjack, smithgift, cmtzco, minnowpondblue, minnowpondred, alchemage, mubarak, evananisa, firstamendment, bootycall, cryptohustlin, tokenteller, driva, minnowpond, mrainp420, udemycoupons, zahid0406, landmine, cryptotaxadvisor, fire2025, coreyou, muppetdingdong,