New Year's Day is a great time for data collection for U.S. Steemit Authors!

steemit·@cryptotax·

0.000 HBDNew Year's Day is a great time for data collection for U.S. Steemit Authors!

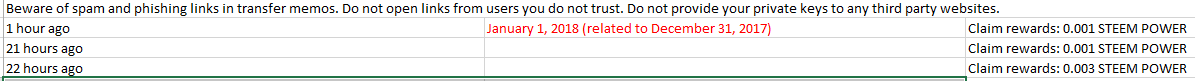

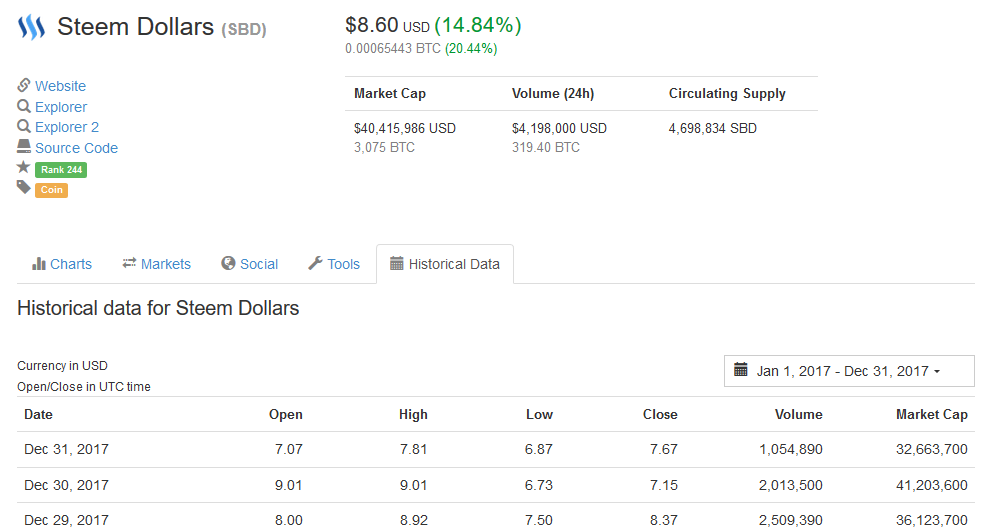

<center></center> I hope everyone had a Happy New Year! Hopefully you were able to enjoy a day off of work. I use this day for typical housecleaning before I return from annual leave. This article includes a few recommendations for U.S. Steem authors for data collection in the 2017 tax filing, as today is a great day to work on this sort of thing before 2018 kicks into gear! **1. Claim Awards that were related to 2017 ASAP** Generally the SBD/SP is taxable when the crypto is made available to an author free of risk of forfeiture (or is transferable to others). This means, if the SBD/SP award that vested on December 31, 2017 is sitting in a wallet *unclaimed* on January 1, 2018, and all the author has to do is *claim rewards*, this is probably taxable in **2017.** The reason for this is, the author has no risk of forfeiture once the award is in his/her wallet. **2. I copied my 2017 wallet transactions into excel** Unfortunately, the copy/paste doesn't put the actual date of the transactions, meaning, unless someone knows another way to access this data in a columnar format, I have to manually mouse over each transaction date and key the date off to the side. <center> </center> *I checked Steemd.com and didn't see a quicker way to extract the data, but perhaps the tech savy folks on this platform could assist?* **3. Find an exchange** U.S. taxes are assessed in U.S. dollars, meaning each crypto transaction needs to be translated to a USD equivalent. For translating crypto into USD, a consistent/rational method is required to be used. There are plenty of websites with historical exchange rate data. Below is a coinmarketcap excerpt (note that coinmarketcap is a weighted average of many exchanges, with higher weighting based on liquidity). I might seek to use coinmarketcap since it has flexibility in going back to specific dates: **** Just a heads up, it is probably no longer reasonable to use a Fair Market value of $1 USD for a Steem Dollar (SBD), since it can be sold on liquid exchanges for approximately $8.6 USD as of today. *If you are using a different exchange rate data tool, please let me know!* **4. Find a Tax Advisor & Relax!** Remember, there is no shame in treating Steem/crypto investing like a real business. In economics, it is typical for a company to *Insource* its core competencies (for Steemit author - blogging etc.) and *outsource* areas where the business is not (and does not need to be) an expert (i.e. although this varies for each company - supply chain, legal, accounting, IT tax). **5. Have a great New Year and Onward to 2018!** Have a great new year, don't let taxes bum you out! Taxes is part of the pathway towards mainstream acceptance & legitimacy of this new technology. *Disclaimer: This series contains general discussion of U.S. taxes in a developing and unclear area of tax law. As always, you should consult your own tax advisor in your jurisdiction to determine your specific situation as this is not personal advice; and consider any future guidance by the Congress/IRS after the date of this article. Under Circular 230 to the extent it applies, this article cannot be used or relied on to avoid any tax or penalties in the U.S., its States or any other jurisdictions. This post/book does not create a client relationship between the author and the reader.* *Picture Credit* *Cover Photo: https://pixabay.com/en/users/mohamed_hassan-5229782/* *Excel: Me, data from Steemit.com* *Exchange Photo: Coinmarketcap.com screenshot*