Anchor To Lower Its APY On UST For 1.5% Each Month?

hive-167922·@dalz·

0.000 HBDAnchor To Lower Its APY On UST For 1.5% Each Month?

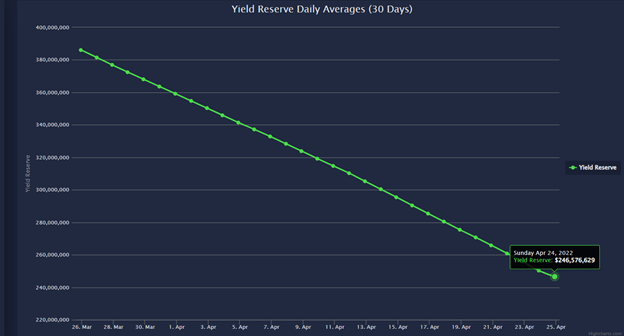

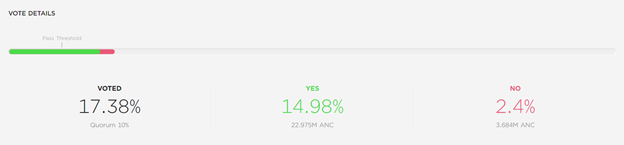

Most of the crypto world is familiar with the UST stablecoin ant its amazing 20% APY on the Anchor protocol. Thanks to this the [UST supply](https://leofinance.io/@dalz/6-billion-more-ust-printed-in-2022-or-a-look-at-terrausd) has expanded to 17B in just over a year, while the LUNA token has also increased in value multiple times. But the thing is we are in some form of mild bear market in 2022 and the Anchor yield reserves are depleting at fast rate. Recently there was a proposal on Anchor to change the way APY is determined, and it passed. Let’s take a look at this and what does it means going forward.  The simplicity of the Anchor protocol and the fixed 20% APY has been one of its key drivers for adoption. The Anchor protocol is paying 20% APY fixed, while in the meanwhile it holds yield reserves that are being used to accumulate any excess funds that the protocol makes, or if the current APY is lower then 20%, then it uses the yield reserves to make up for the difference. ## Where Does Anchor Yield Come Form To better understand the whole picture first let’s take a look how the Anchor protocol is generating yield and where does it comes from. @forexbrokr has an excellent [post](https://leofinance.io/@forexbrokr/where-does-anchor-yield-come-from) on it. The Anchor yield comes from three places: 1. Interest charged to borrowers 2. Staking rewards earned from borrowers’ collateral 3. Liquidation fees The first point is basically the standard way how the financial system works, it transfers the interest that borrowers pay to the one who have deposited funds in form of UST. The second point is something new. The protocol takes the deposited UST and reinvest it into other assets that bring in yield, mainly Luna and Ethereum. The third point are fees from borrowers who don’t have enough collateral for their loan, and are getting liquidated. **Is this enough?** As many things in crypto, when the market is in a general uptrend, then everything seems to work, and all is going fine. The yield reserves seems to be even going up back in November 2021, meaning that the protocol was making even higher APY then the 20% that is has been paying and was able to accumulate those excess funds in the reserve. But 2022 has been challenging for crypto and the yield reserves have been constantly going down. In February 2022 the Luna Guard Foundation LFG, made a top up to the yield reserves with additional **420M** UST. This basically means that the 20% APY is at the moment subsidized. Some of the reasoning behind doing this is that it will drive expansion of the UST that will then leads to its mass adoption. But even with this, the yield reserves are going down fast at a rate of **120M to 140M** per month.  ###### [source](https://mirrortracker.info/anchor) With this pace of depletion of the yield reserves there will be funds to maintain the 20% APY for only about two more months or up until June 2022. Note that not all 20% of the UST APY is coming from the reserves. Some part of it is coming from the protocol earnings. But since the reserves are going down, it means that the protocol is earning less then 20% and it need additional funds from the reserves. I can’t really tell what are the current earnings of the protocol, and those are basically changing by the day, but there are some estimates that they are somewhere around 7%. Again this number is just approximation and is changing every day. As mentioned in the past it was above 20%. ## Introducing Semi Dynamic Earn Rate The proposal for this is described here: - [Dynamic Anchor Earn Rate](https://forum.anchorprotocol.com/t/dynamic-anchor-earn-rate/3042) From the description above we can see that what is proposed is basically to change the APY on a monthly level depending on what is the change in the yield reserves. The formula looks like this. ``` (% Earn Rate Change) = min( abs(1.5%, ((YR % Change) ) ) ``` What this means if the yield reserves are reduced for 20% in a month, the protocol will choose the minimum value between 1.5% and 20%, ergo the 1.5%. The same goes in both directions, meaning if the protocol increases it reserves for more than 1.5%, the change will again be just a 1.5% on the upside. The proposal passed as we can see on the Anchor [governance tab](https://app.anchorprotocol.com/poll/20) with a 15% voter for yes and 2.4% against.  The proposal closed on March 27, 2022. What this means that April should be the first month when this mechanics are put in place, and if everything is according to the statement above from May 1st we should already have a smaller APY for UST, somewhere around 18%. We can see that the yield reserves have went down from 386M to 246M in the last 30 days, a reduction for around 36%. Far below the 1.5% ## What Happens If The Yield Reserves Goes Down To Zero? This was one of the questions asked in the forum link above and probably something that a lot of people are thinking about. The original answer goes as follows: > It goes to a completely dynamic money market until the yield curve starts to build a balance again What this means is that if yield reserves are zero, the APY for UST will be what the protocol earns at the moment. If the protocol earns 5%, then it will be 5%, if the protocol earns 7% then it is and so on. Up until some point when the protocol starts earning more and accumulate funds in the reserves again. ## Final Thoughts Having a buffer that will serve as a stabilizer for a yield is actually a great idea. It should accumulate excess funds in period of a bull and use them when the times are not as great. But this being crypto everything seems to happen at faster rate. Anchor now has 13B deposits in UST. At 20% APY it should pay around 200M per month. At the end of November 2021 when the protocol was making surpluses, Anchor had around 2.5B or five times less. The protocol didn’t had time to accumulate enough reserves for the amounts that it needs to pay now. In the last 30 days 140M were taken out of the reserves or 70% of the yield was subsidies. These are huge numbers and the only thing that can revert them is a nice bull market, lasting for months. If this doesn’t happen the total depletion of the yield reserves is almost inevitable despite the efforts like the above that try to create a sort of soft lending for the APY. It’s just a matter of time, will it be two more months or maybe four months. The other way for the APY to be sustained is more subsides from LFG, but after the 420M round in February I’m not sure how willing they are to repeat this. **Ok, so the APY for UST goes to 7%, not that big of a deal!** I agree with this, but the other far more concerning thing for me personally would be the UST peg. If the APY of UST going down creates a pressure on UST and people start getting rid of it, it will inevitably reduce the UST supply, meaning more conversions to LUNA, putting pressure on the LUNA price, the underlining asset UST is backed on. Now we have heard that they have been buying Bitcoin for condition like this, so if the price of LUNA falls a lot of Bitcoin to be used as a asset to support UST. This gives some confidence in the project, but still if all the crypto market dumps for a long period of time it can be challenging. Terra has been doing some interesting stuff with UST and it seems to continue to do so. However, some form of caution is always welcomed and be sure to not overexpose yourself to a project. I personally have some UST on Anchor, but not all of my stablecoins. All the best @dalz Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@dalz/anchor-to-lower-its-apy-on-ust-for-1-5-each-month)

👍 leovoter, r0nd0n, moeenali, dwayne16, leomaniacsgr, topbooster.leo, freebornsociety, fantasycrypto, revise.leo, unpopular, knowhow92, harkar, bearjohn, vxn666, nikoleondas.leo, officialhisha, dashroom, nervi, abh12345.leo, babytarazkp, joeyarnoldvn, ava77, therealyme, neoxcur, netaterra, not-a-bird, tronsformer, anonsteve, sumatranate.leo, dalz.shorts, meesterleo, zuun.net, kendewitt, citimillz, rollandthomas, flipstar.sports, drricksanchez, drexlord, gualteramarelo, sunshineee, scaredycatguide, scaredycatcurate, swelker101, summertooth, therabbitzone, leoschein, bananass, megaleoschein, dugsix, phul, bhealy, generatornation, darinapogodina, maurofolco, solominer.stake, solominer.leo, pjansen.leo, pjansen.ctp, dalz, gerber, ezzy, exyle, steem.leo, mice-k, dcityrewards, reazuliqbal, kaniz, bestboom, dlike, cakemonster, kggymlife, mfblack, daan, iansart, felander, steem.services, bobby.madagascar, milu-the-dog, triplea.bot, ribary, jelly-cz, dcrops, dine77, not-a-gamer, revisesociology, ninnu, cookaiss, yogacoach, sbi4, holoferncro, sbi-tokens, crokkon, bala41288, erikahfit, bala-leo, alphacore, sneakyninja, mastergerund, xawi, thedailysneak, babysavage, ravensavage, kanibot, kamaleshwar, chandra.shekar, kannannv, nkechi, cryptoknight12, sketching, solarwarrior, victor-alexander, resiliencia.pal, culgin, kgakakillerg, diabonua, vietthuy, city-of-dresden, kgsupport, luminosity, dhimmel, goodcontentbot, bastter, kgswallet, garlet, gerardoguacaran, howiemac, jongolson, pet.society, themightysquid, sharpshot, dosh, asmr.tist, jasonbu, ericburgoyne, improbableliason, cbridges573, shanghaipreneur, znnuksfe, russellstockley, ua-promoter, dfacademy, voter, schubes, kreur, olympicdragon, hiro-hive, rezoanulvibes, annabellenoelle, stemisaria, rezoanulv.leo, erikahskitchen, simplifylife, fullcoverbetting, freddio.sport, pouchon.tribes, zwhammer, lrekt01, libertygame27, borniet, libertyleo27, enm1, leeyh2, netaterra.leo, iproto, perronegro, abdulmath, goldmonsters, noborders, heyitshaas, stayoutoftherz, coyotelation, blainjones, steem-tube, ocupation, elektr1ker, ctpsb, jeanlucsr, elianaicgomes, aslehansen, myupvote2u, bala-ctp, luckyali.ctp, abh12345.ctp, eddie-3speak, johnripper, naty16, ambifokus, meanbees, flaxz, hive-data, leoline, gallatin, cryptoccshow, kiemis, mrsbozz, abcor, abacam, zeeon, bet1x2, drorion, nortjenn, thisisawesome, ambyr00, svirus, penguinpablo, cryptonized, funnyman, merlion, hungrybear, onepercentbetter, discernente, parejan, eirik, costanza, sportfrei, emma-hs, reyvaj, ctrpch, goldbuyer, penyaircyber, bukiland, bearableguy123, kph, xrp.trail, bluerobo, blue-witness, themarkymark, upmyvote, apeminingclub, makerhacks, blockheadgames, punksonhive, hivewp, gogreenbuddy, recoveryinc, samrisso, tyrnis.curation, movement19, xthemarkymark, newsflash, hebrew, luna777, mikezillo, meowcurator, cassillas5553, jmsansan.leo, maonx, baba-kush, soyrosa, nateaguila, helgalubevi, xrp-news, serjoo.yam, steem.cleaners, bricksolution, cooperfelix, steem.powerup, sand.box, davidesimoncini, pladozero, crazydaisy, sand.box.game, somnium.land, uruiamme, n12, haimy, deadswitch, krunkypuram, hislab, abh12345, philnewton, tobias-g, misterengagement, isabel-vihu, mallorcamum, decentraland.vip, tryskele, deep.fucking.art, sorin.cristescu, borislavzlatanov, carlos13, tehox, hamsa.design, daltono, elderson, flowerbaby, yabapmatt, davidtron, preparedwombat, acesontop, tokenizedsociety, pocketrocket, taskmaster4450, unyimeetuk, mightpossibly, rohansuares, susie-saver, readthisplease, director.rar, anhnghn, bippy, cooperclub, deadleaf, snlbaskurt, fijimermaid, ash, techcoderx, xrapid, bonyem, bozz, jfang003, fabiodc, he-index, fw206, trumpikasleo, namelessnameless, johnhtims, gadrian, shortshots, tomhall.leo, santigs, softworld, forexbrokr, crypto-guides, leoalpha, jk6276, manniman, bitcoinflood, nealmcspadden, kittylover, cryptololo, michealb, cornavirus, hive-108278, tsoho, muratkbesiroglu, pablorg94, vimukthi, emeka4, sulemanlodhra, zdigital222, d-zero, riandeuk, listnerds, ctptips, oblivioncubed, lacking,