HBD Savings Balance Reaches Another All Time High! A Look At The Data In HBD Savings

hive-167922·@dalz·

0.000 HBDHBD Savings Balance Reaches Another All Time High! A Look At The Data In HBD Savings

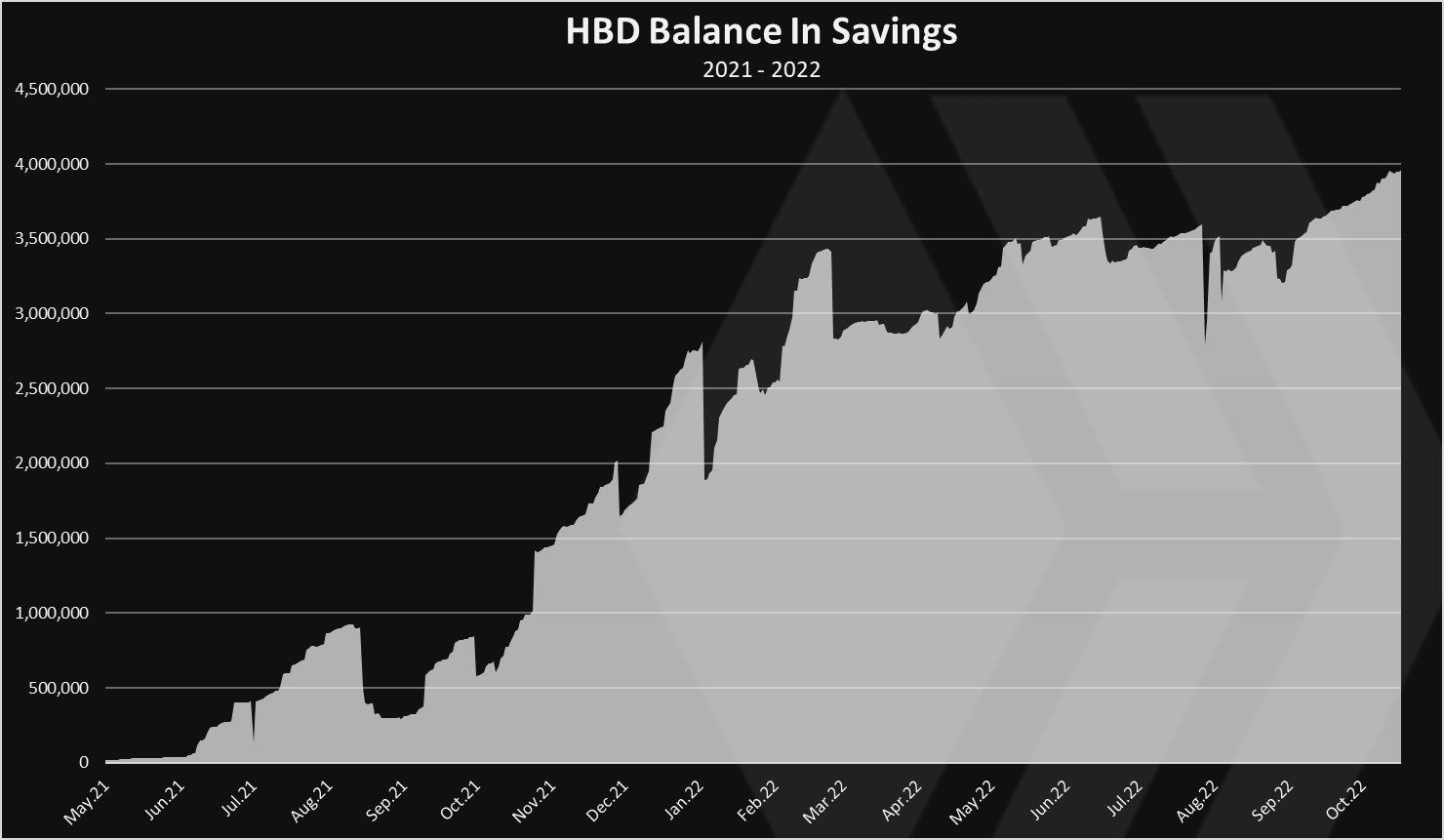

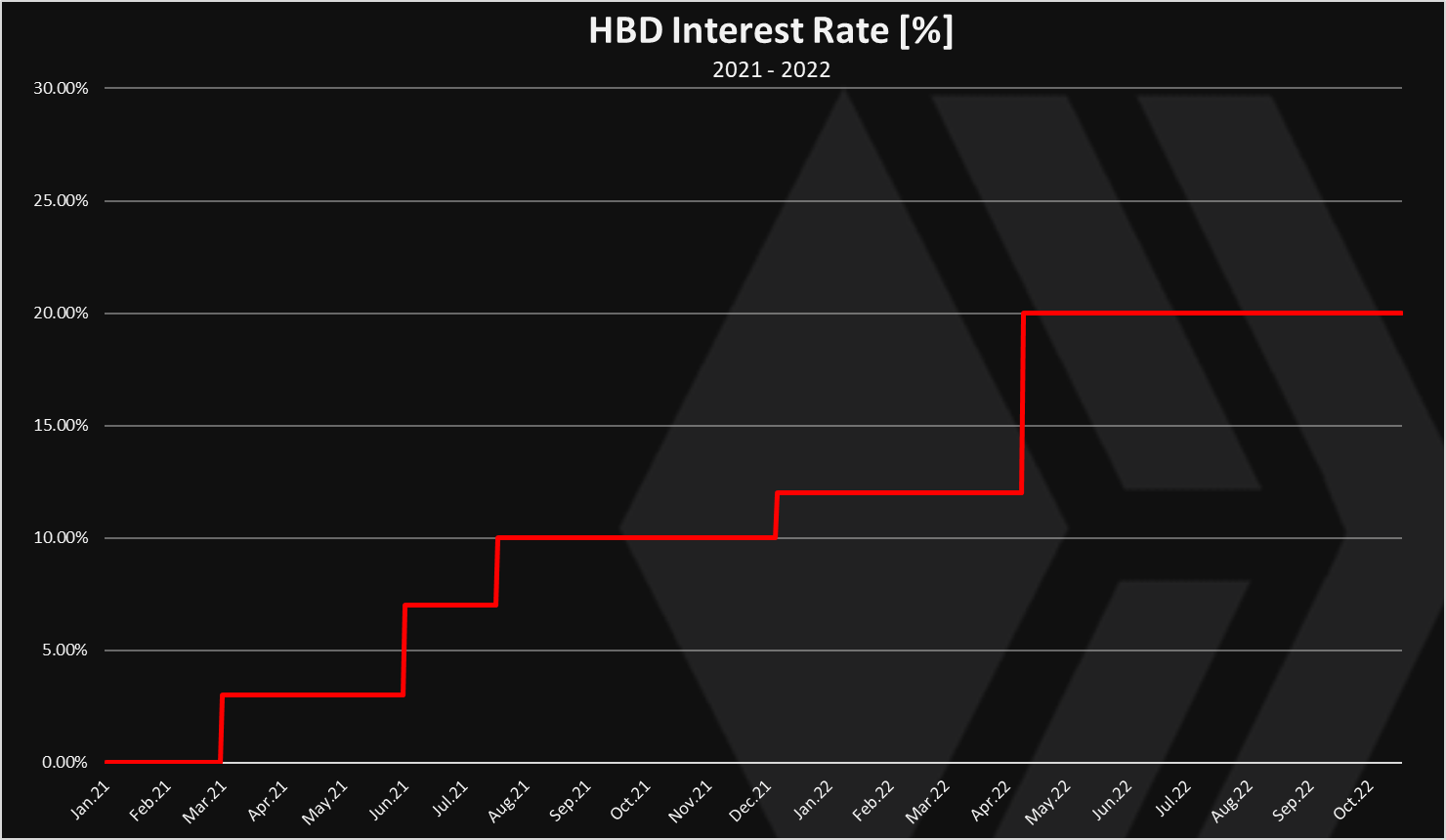

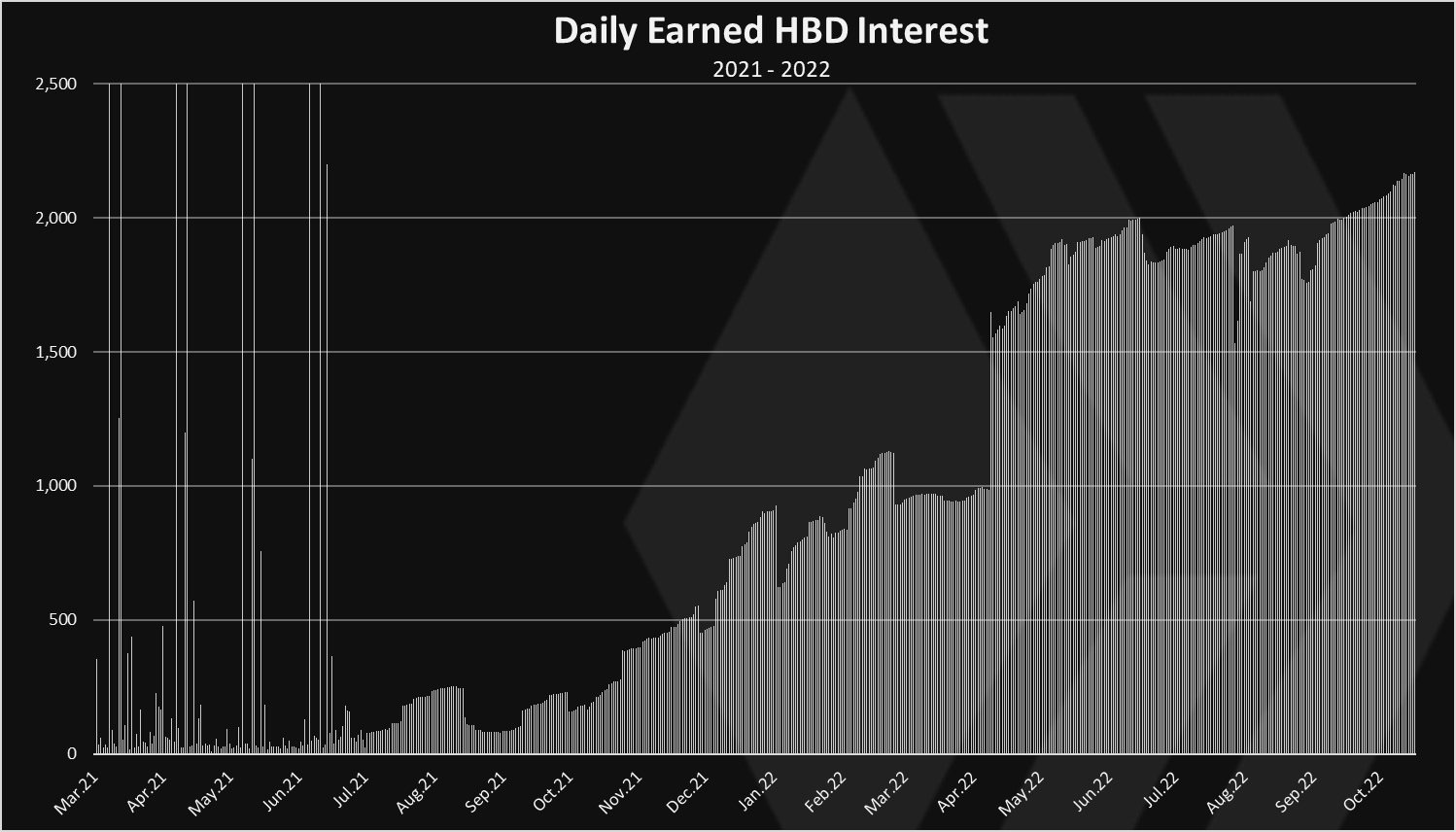

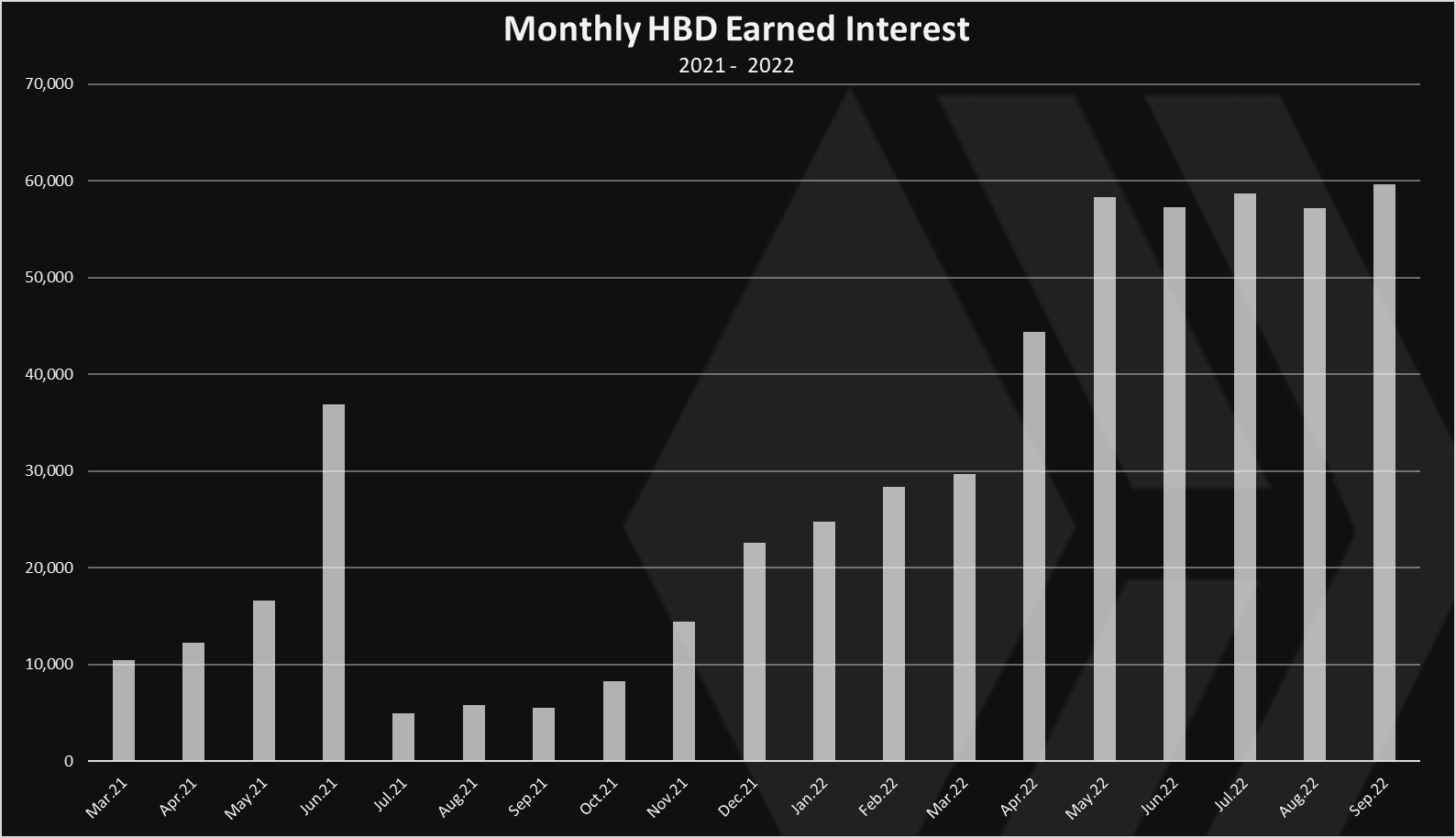

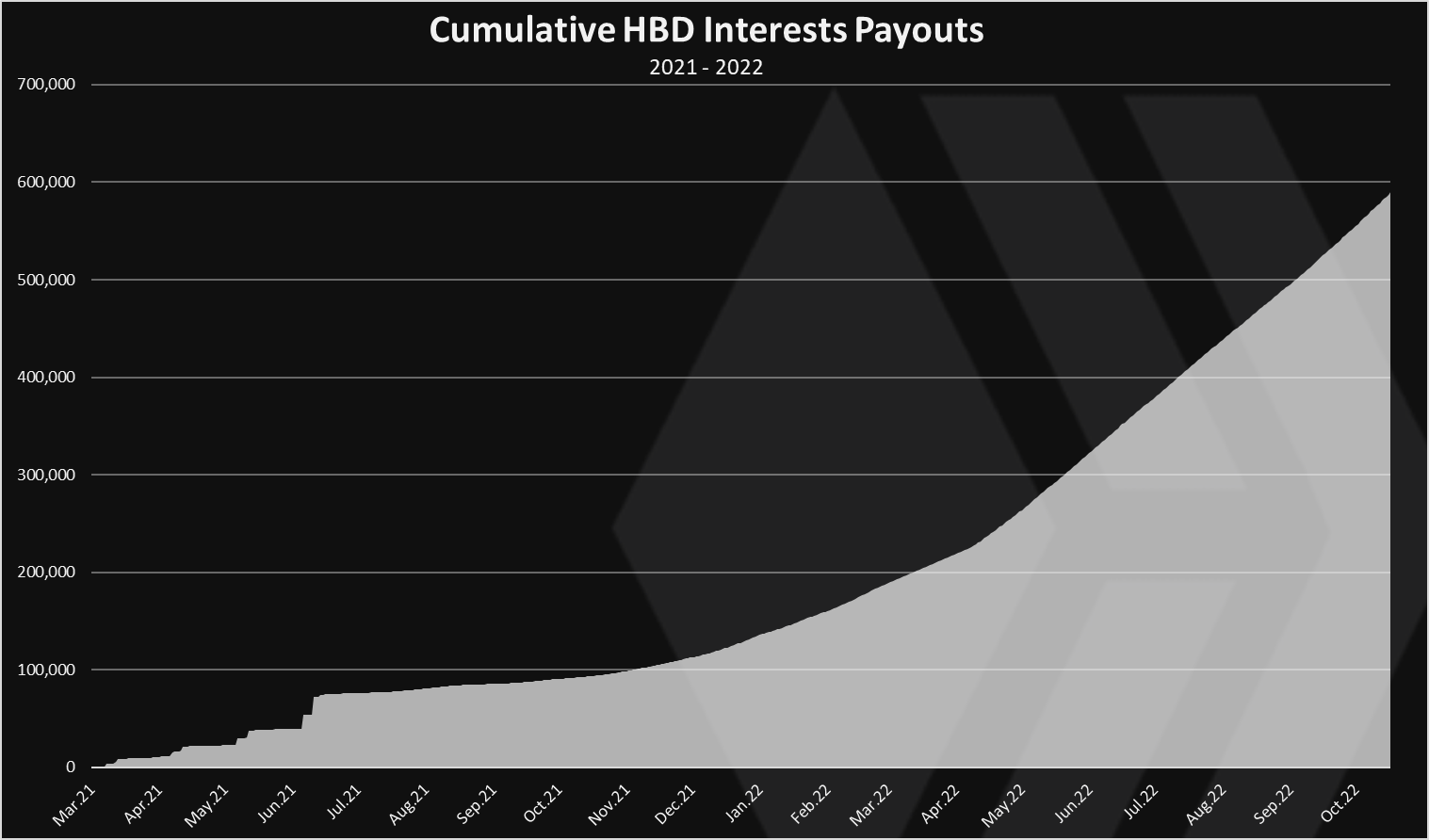

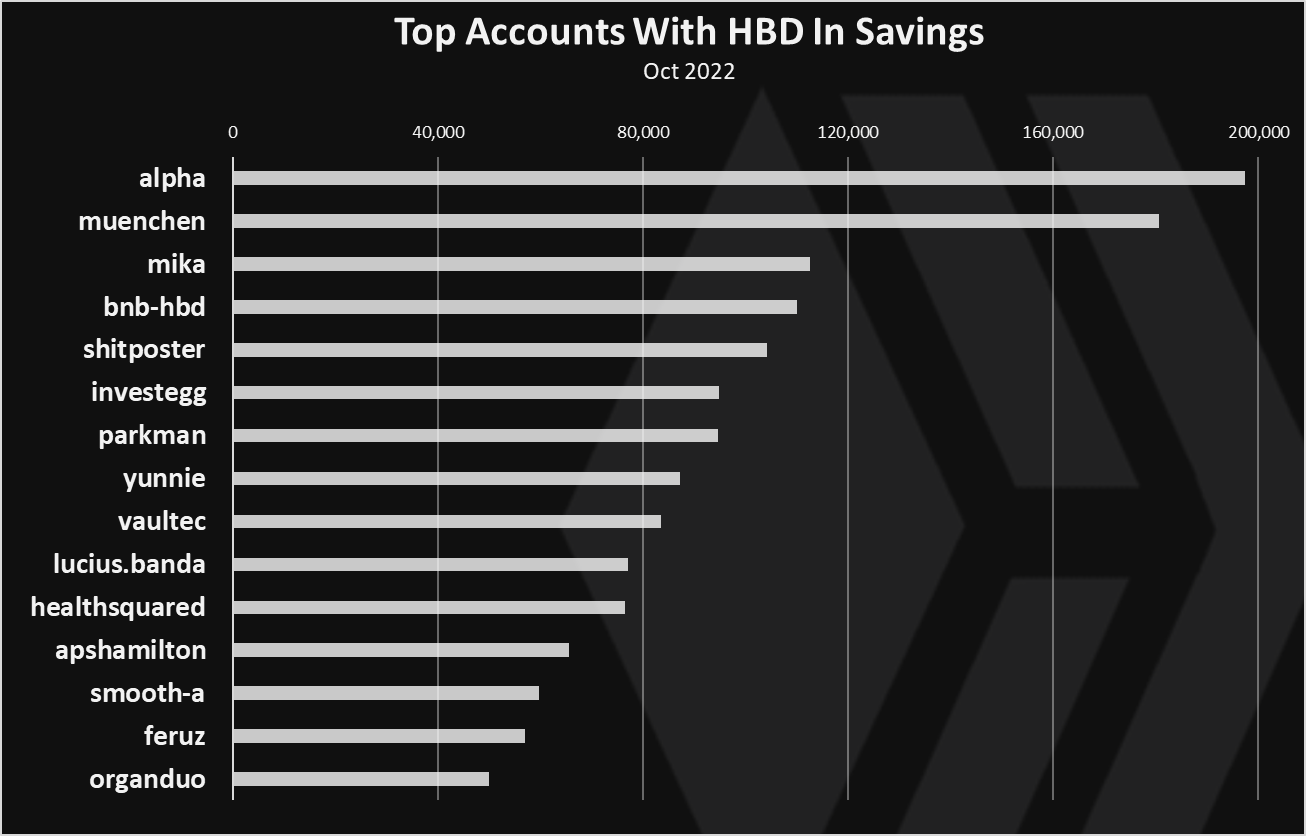

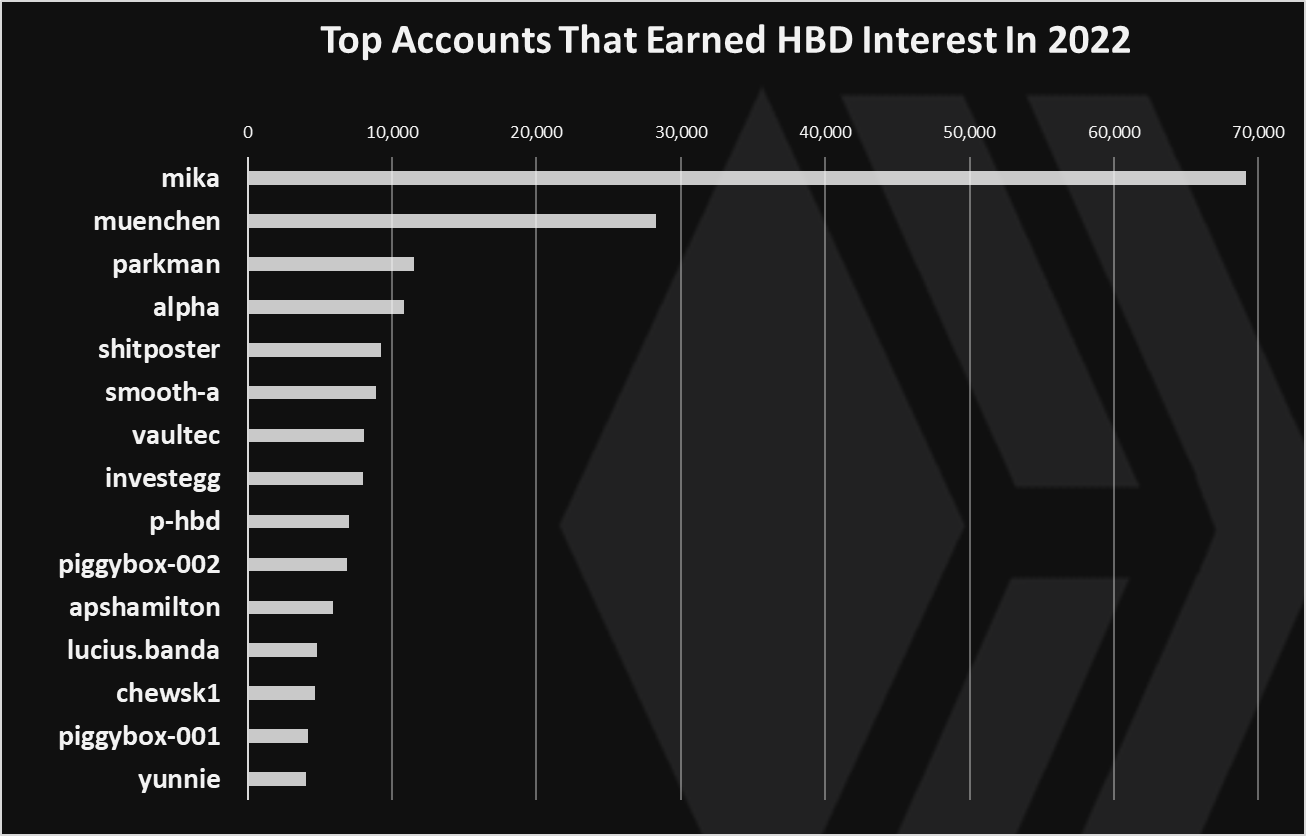

The HBD APR for savings was set to 20% back in April 2022. To get interest users need to transfer HBD into the savings on their Hive wallets. This allows for better tracking on the overall balances in savings that are eligible to earn HBD. The withdrawal from the savings account is three days, that is a reasonable period. It’s like staking with three days unlocking period.  When the interest on HBD was first set by the witnesses somewhere in March 2021 it was only 3%, then they push it to 10%, 12% and now a 20%! You can see what the interest rate is set by the witnesses here https://peakd.com/me/witnesses. With the latest Hardfork the debt limit for HBD was pushed to 30%, allowing more HBD to be printed before the haircut rule is applied and HBD is devaluated. The HIVE price to support the current HBD in circulation now stands at 7 cents, down from the 20 cents prior to the HF. If the HBD supply increases this price can move up. ----- Now let’s take a look at the data and see how much HBD has been transferred to savings and who is taking advantage of the HBD interest rate. **The period that we will be looking at is starting from 2021 to Oct 2022** . We will be looking at the following: - HBD balance in savings - HBD interest in savings - Daily interest rewarded - Monthly interest rewarded - Cumulative interest - Top accounts that hold HBD in savings - Top accounts earning interest # HBD Balance In Savings Here is the chart for the HBD balance in savings in time.  Prior to July 2021 there was insignificant amount of HBD in the savings. Then they stated growing and continue an aggressive expansion up until March 2022, with some bumps in the way. In March 2022 the ATH for HBD in savings was at 3.6M. Then there was a big withdrawal from one account and it dropped to 3M. A steady growth since then and we are now at **4M** HBD in savings. Although these are not such a big amounts, it should be considered that this growth is happening in a full force bear market. If we **zoom in 2022** we get this.  A steady growth with some bumps usually when the price of HBD increases. ## HBD Interest Rate [%] Historically the interest rate for HBD has been as follows:  - Mar 2021 - 3% - Jun 2021 - 7% - Jul 2021 - 10% - Dec 2021 - 12% - Apr 2022 – 20% We are now half a year with the 20% interest rate and it is the longest period in the Hive history to hold this percent. One important question for the HBD interest rate, is what is the proper interest policy to be taken? Should we just keep the interest rate fixed no matter market conditions, or change it depending are we in a bull or bear market? This question deserves a post on its one, and I plan doing one, considering the pro and cons on a different interest policies. ## Daily Interest Rewarded How much interest is paid to the HBD in savings? Here is the chart.  At first in 2021 the interest was paid to all the accounts that hold HBD, without the need to be put in savings. Then after the HF in June 2021, HBD interest is paid only for HBD in savings. We can notice the sharp drop at that time. Since then the daily interest payouts depends on the amount of HBD in savings and the interest rate for HBD APR. The payouts started growing and reached to around 1k HBD daily prior to April 2022. Then the APR increased to 20% and so did the interest to 1.6k and later to almost 2k HBD daily as the HBD balance in savings was growing. In the last months the daily payouts have been around around 2k per day, with a recent increase just above that. **The monthly chart for the HBD interest looks like this:**  We can see here as well that in the last months we have a stableish payouts with just bellow 60k HBD paid in interest per month. ## Cumulative HBD Interest Payouts The chart for the all time cumulative HBD interest earned looks like this.  Almost 600k HBD earned as interest in 1.5 year. In 2022 alone this number is at 420k HBD. At the end of the year it will probably be around 600k HBD paid as interest on a yearly level. For comparison there is around 2M HIVE equivalent minted per month, or somewhere around 24M per year, so this will add around 1M HIVE more on top of the 24M. ## Top Accounts That Hold HBD In Savings Who has the most HBD put in savings? Here is the chart.  @alpha is now on the top with almost 200k HBD in savings, followed by @muenchen. @mika is on the third spot now, after a long period of time when it was dominating the chart. More than 6k accounts have at least 1HBD put in savings. ## Top Accounts That Earned HBD Interest The above was the current situation for accounts that hold HBD in savings. Some might have added and others removed. Who has earned the most in the past? Here is the chart for interest earned in 2022.  @mika comes on top here, followed by @muenchen and @parkman. ---- An overall uptrend for the HBD in savings, with more aggressive increase in the last week! This is most probably because of the new 30% debt limit after the recent Hardfork. I expect for the HBD in savings to continue to grow as long as the 20% APR stands. This said it is worth debating what is the proper long term interest policy for HBD. This steady growth for the HBD in savings is happening in a bear market. Meanwhile the overall HBD supply has decreased from 14M in Jan 2022 to 9M in Sep 2022, with a low of 8M back in July. We have seen a steady increase in the HBD supply in the last two months. HBD has proved to be resilient even under the current conditions and with all the mechanics in place has hold its peg. As time progresses and the concept proves itself more, we might see more and more HBD put in savings, that will on the other hand put pressure on the HIVE price as well. Not to forget that HBD savings are on L1 blockchain, not an anon defi app. Payouts are in the native HBD token, not a secondary yield token. Much better security and stability. Other dapps can build on top of this. All the best @dalz Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@dalz/hbd-savings-balance-reaches-another-all-time-high-a-look-at-the-data-in-hbd-savings)

👍 leovoter, r0nd0n, joeyarnoldvn, invest.country, babytarazkp, meta.condeas, dinvest, topbooster.leo, zuun.net, neal.power, netaterra, freebornsociety, fantasycrypto, moeenali, rollandthomas, nervi, unpopular, leomaniacsgr, smartvote, d-zero, knowhow92, the.nervi, therealyme, sumatranate.leo, drexlord, cst90, citimillz, flipstar.sports, ava77, bearjohn, vxn666, tronsformer, revise.leo, nikoleondas.leo, officialhisha, dalz.shorts, dashroom, harkar, abh12345.leo, not-a-bird, meesterleo, scaredycatguide, scaredycatcurate, swelker101, surya1adiga, leoschein, gualteramarelo, bananass, megaleoschein, dugsix, bhealy, generatornation, darinapogodina, maurofolco, solominer.leo, therabbitzone, phul, maakue, pjansen.leo, pjansen.ctp, kaniz, dine77, revisesociology, not-a-gamer, edb, steembasicincome, ninnu, revise.spk, anikys3reasure, doze, sbi-tokens, qwertm, sneakyninja, thedailysneak, erikahfit, bala41288, marianaemilia, kanibot, kamaleshwar, chandra.shekar, kannannv, shaidon, vrezion, dudeontheweb, fireguardian, viniciotricolor, sanjeev021, carlosro, brando28, vitoragnelli, hkinuvaime, elfino28, bteim, aemaez, genepoolchlrn8r, genepoolcardlord, dosh, brucolac, dragonmk47, culgin, city-of-dresden, shanghaipreneur, victor-alexander, jongolson, diabonua, pet.society, asmr.tist, garlet, dhimmel, howiemac, ericburgoyne, luminosity, cbridges573, sharpshot, resiliencia.pal, gerardoguacaran, cocaaladioxine, znnuksfe, dfacademy, improbableliason, gamer00, voter, russellstockley, coyotelation, libertyleo27, balaz, heyitshaas, fullcoverbetting, kreur, kendewitt, simplifylife, libertygame27, hiro-hive, netaterra.leo, noborders, enm1, leeyh2, goldmonsters, stayoutoftherz, schubes, blainjones, abdulmath, steem-tube, rezoanulv.leo, pouchon.tribes, stemisaria, erikahskitchen, annabellenoelle, naty16, ctpsb, ambifokus, jeanlucsr, thisisawesome, ph1102.ctp, elianaicgomes, aslehansen, myupvote2u, luckyali.ctp, abh12345.ctp, johnripper, gallatin, hive-data, india-leo, cryptoccshow, bhattg, text2speech, photolovers1, flaxz, ambyr00, kiemis, xabi, abcor, abacam, bet1x2, curatorcat.leo, nortjenn, thelogicaldude, anosys, taskmaster4450le, eliel, adambarratt, rodent, oakshieldholding, warmstill, leoline, alokkumar121.leo, robmojo.leo, jocieprosza.leo, foreverhero, kwskicky, coolguy123.leo, kam5iz, hykss.leo, globalcurrencies, ew-and-patterns, lbi-token, leoball, kheldar1982, khan.dayyanz, jacuzzi, mrsbozz, godfather.ftw, kooza, youdontknowme, leomolina, houseoftribes, shebe, penguinpablo, cryptonized, emma-hs, funnyman, alphacore, reyvaj, hungrybear, zealous4ever, costanza, sportfrei, tehox, goldbuyer, ctrpch, alex-rourke, eddie-earner, saboin.ctp, ctp.sub, aljif7, patsitivity, trostparadox, onealfa, mindtrap-leo, star.leo, ykretz.leo, dbooster, pouchon, plusvault, iquestionla, piotrgrafik, hivehustlers, bozz, thatsweeneyguy, mytechtrail, jglake, maddogmike, successchar, thepeakstudio, patronpass, hankanon, muratkbesiroglu, lrekt01, kraken99, hive.friends, cconn, tomwafula, minerspost, darkpylon, alz190, crazydaisy, hivelist, kind.network, groove-logic, trumpikasleo, gradeon, xyba, hebrew, oliverschmid, pocketrocket, gungunkrishu.leo, deadswitch, valor2s, khaleelkazi, vempromundo, supersla, muski, elong, mk2, leverup, findbalance, selectyourself, purefood, leo.voter, eloi, meosleos, kaef, hemerit, twrk, hodol, muskland, finleo, etheru, bitbi, hallogen, frankjr, thatbull, hollywoodz, f82, apeople, gohodl, runify, ledg, mylioness, tolf, shauner, steem.leo, leo.curator, refinement, chloem, cd-leo, leofinance, invest4free, bepresent, jobar, gcomplex, druma, ropehold, tv-d, protoleo, eth2, bynd, logroll, index-a, kropak, feelfor, hodldays, mandawanda, tierbtc, starked, knowhere, dvision, challa, quantumblank, endgames, realleader, buildhedge, seevision, cornerbreak, hodlmi, optionfreedom, bnb-hive, cubdaily, khalil319, organduo, triptolemus, learn.leo, asteroids, arctis, furtherance, leotrail, oelgniksivart, autowin, wrapped-leo, ztfo, integrated, hanez, plasticsoul, scrpt, infihedge, strk, stackfi, midtrain, starle, thorc, basechain, flowc, psgood, alorian, theco, hochismin, givup, outperform, perfi, foreo, capsule, sn8, fundament, mercador, companyx, portfoliomargin, fremo, deliveries, jackedup, compoundin, waiting8, ghostdrive, pitchleo, zbh1, blockhire, natureway, gamor, quantumant, cvlwar, sanctum, justbuild, justcapital, reflecting, yellowstone, floobrecords, cybermusk, saylorfy, lasergang, billionsight, onemission, totalrekall, capitalcost, b-leo, stablefi, ironhot, pubgood, bitjoins, p-leo, xleo.voter, ahmadmanga, dante31, thauerbyi, roleerob, joannewong, warpedpoetic, dlike, thefalcons, krunkypuram, kgswallet, empoderat, poam, coinlogic.online, blocktvnews, invest2learn, syberia, tokenx, slat, bruton, rondonshneezy, heimdalla, darkelon, trasto, brainstommer, zeclipse, saboin.leo, jkeen33, grabapack, khaltok, p-hive, rufans, ireenchew, apokruphos, megavest, janku, onemoretea, repayme4568, steentijd, gehenna08, femcy-willcy, specific-leo, bahagia-arbi, minloulou, obsesija, tsurmb, ross92, zaxan, leo.bank, onestop, zuly63, reonarudo, cielitorojo, elongate, elgatoshawua, blacardi, brume7, bella76, gwajnberg, stefanialexis, bitrocker2020, marketinggeek, thetimetravelerz, mindtrap, strenue, getron, gallerani, raiseup, steemaction, anonsteve, engrsayful, belico, x9ed1732b, w-t-fi, leo.tokens, v10r8, amongus, luckyali.leo, creodas, blockdate, impurgent, banzafahra, kushyzee, njker, killerwot, prosocialise, plicc8, kevinwong, gniksivart, runicar, silwanyx, flyingbolt, steemxp, edian, pardeepkumar, ocupation, enjoyinglife, sacrosanct, davdiprossimo, elektr1ker, minebb, littlebee4, vintherinvest, break-out-trader, torrey.leo, tslap, travelwritemoney, agro-dron, panosdada.leo, gubbatv, toofasteddie, ragnarhewins90, edkarnie, salicj, abh12345, jayna, abitcoinskeptic, philnewton, misterengagement, mattbrown.art, abh12345.cards, isabel-vihu, mallorcamum, tryskele, eforucom.leo, eforucom.ctp, olaf.gui, vcelier, russia-btc, senorcoconut, beehivetrader, konvik, al-leonardo, limka, shmoogleosukami, chisdealhd, waffleuncle, imoogin3v3rm0r3, stream4fun, smjn, director.rar, roniakuko, michupa, eijibr, perfilbrasil, rarereden, preparedwombat, devpress, uwelang, currentxchange, douglasjames, rt395, hivecuba, ricardoeloy, pumarte, chisa.gaka, lioz3018, manuphotos, jomancub, miguelgonzalezms, manuelernestogr, osmy91, janetedita, abelfotografia, ditoferrer, cryptocubangirl, demoad, fabiodc, tecnologyfan1, androliuben, kumagaro, karelnt, trumpman, steemychicken1, ruth-girl, bilpcoin.pay, giotists, jaraumoses, tesaganewton, tapadey, taskmaster4450, unyimeetuk, rpren, racibo, rohansuares, susie-saver, the.rocket.panda, bluerobo, heartofdarkness, a-quarius, duskobgd, madame-cyntaia, crapitskevin, ribalinux, intentionsoflife, arcange, shainemata, achimmertens, laruche, fatman, msp-foundation, walterjay, pboulet, motorseb, kaazoom, hectorsanchez18, sagarkothari88, uruiamme, apshamilton, hamismsf, yaelg, jpbliberty, darrenflinders, ykretz, vikbuddy, fw206, softworld, santigs, bitcoinflood, miosha, cryptokungfu, francescomai, danyst1ne, hjrrodriguez, brianoflondon, hivehydra, podping, mightyrocklee, borran, thrasher666, smooth, xsmooth, petrolinivideo, belug, resonator, ura-soul, informationwar, ausbitbank, ironshield, firstamendment, truthforce, dmwh, aagabriel, haccolong, shanhenry, delver, investinfreedom, risemultiversity, empress-eremmy, deepdives, riskneutral, oratione, hoaithu, v4vapid, reversehitler88, solaiman, wakeupnd, atma.love, commonlaw, aconsciousness, jimbobbill, jdike, maxsieg, mcoinz79, forexbrokr, crypto-guides, stefano.massari, cyboule, whatsup, bigmoneyman, ga38jem, fermionico, davidesimoncini, ammonite.leo, karmaa13, paasz, papilloncharity, iykewatch12, pexpresiones, ernick, karlin, hojaraskita, leninbracho50, petronila, rodyservi, yolmare, nacarid, ninachejov, jadams2k18, karolines, axeltheartist, junior182, marinmex, celi130, nildasalazar, obandoduarte, sevalo13, josemoises, yosmandiaz, isabelpena, boxcarblue, lalupita, yiobri, acidyo, adamada, mister-meeseeks, ghaazi, rendrianarma, zhoten, leveluplifestyle, jazzhero, sgbonus, scoutroc, elyelma, pastzam, danielsaori, leoalpha, jk6276, yusma21, irenicus30, jphamer1, sharkthelion, behiver, ericvancewalton, matheusggr.leo, xplosive, megamariano, sodomlv, vxc.leo, tamaralovelace, manniman, superxsymbiote, jhoanbolivar19, nangel01, trafalgar, raindrop, traf, julesquirin, xtrafalgar, zdigital222, nineclaws, arabisouri, el-dee-are-es, jordand89, milaan, pnc, generosesity, olaunlimited, theb0red1, amitsharma, ikrahch, daveks, artonmysleeve, kolus290, tobywalter, workaholic666, agog, alex2alex, treasuree, banat, dejan.vuckovic, daniiela, nelu-rusu, suzana72, daniel-vs, tina-vs, sanjatea, viki76, sportal, grad.best, ujka-vs, filip-psiho, milan-petrovic, lov.plus, viktoria-erina, vragolana, djuramrdja, prudens, bojan-bee, dorika-bee, photographercr, jonela, vid.observer, captainquack22, politicalhive, reetuahlawat, drax.leo, violator101, galenkp, hive-168869, slobberchops, andrastia, zahara22, dstampede, luciannagy, thetroublenotes, theviralamazon, ak08, melcaya, bosveld1, successforall, tzae, marcocasario, gabrielatravels, social, kerwinjz, celestegray, jschindler, xclie, listnerds, ctptips, tomhall.leo, cinqowy, rocinanteprimo, sunitahive, borislavzlatanov, ssekulji, cryptothesis, themonetaryfew, ace108, meowcurator, cassillas5553, jmsansan.leo, steemik, sd974201, sofs-su, arman.ithm, robertmendontza, marymi, filotasriza3, newsflash, michealb, cflclosers, stevelivingston, verbalshadow, ajanaku, forsakensushi, bank-of-hive, phoenixwren, tuxtify, thomashnblum, riansilva, vyb.curation, dwinblood, richardcrill, nonsowrites, funshee, khoola, crazygirl777, flamistan, trostparadox.vyb, leprechaun, vyb.pob, topbooster, proofofbrainio, smokingfit, vyb.fund, rahim.art72, anomadsoul, adaezeinchrist, merry01, freddio.sport, nathen007, katerinaramm, epsilon27, thecuriousfool, urun, nuagnorab, ronbong, everrich, catanknight, moneyheist-sl, krischy, nicolemoker, steemseph, vimukthi, leo-curator, uyobong.venture, haastrecht, pob-curator, kellyane, schindmaehre, carcio84, industriouslv2, ctp-curator, vyb-curator, elys,