Ethereum surpasses the Marketcap of Deutsche Bank while Bitcoin is within reach of Morgan Stanley and Goldman Sachs

ethereum·@daudimitch·

0.000 HBDEthereum surpasses the Marketcap of Deutsche Bank while Bitcoin is within reach of Morgan Stanley and Goldman Sachs

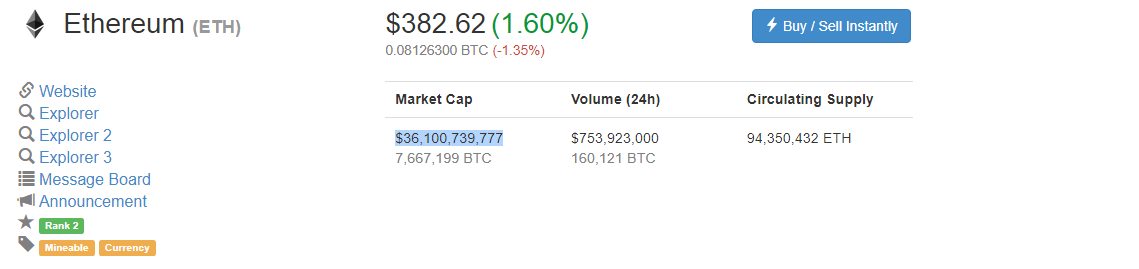

Ethereum is a cryptocurrency based on blockchain technology that was launch in 2015 as a platform that would go beyond the financial use cases allowed by bitcoin. Many view Ethereum as a hybrid offering all the financial tools of Bitcoin but makes it easy to create smart contracts and build a wide range of application. This digital currency has gained popularity in the financial markets due to its decentralized status. Some folks also refer to Ethereum as the Bitcoin killer until it suffered a flash crash that saw prices drop to a low of 13.00 USD. Nevertheless, Ethereum faithful and enthusiast continue to support the project with a surged in demand following the announcement of Metropolis Hard Fork that is reflected in its current price and market capitalization. At the time of writing this blog Ethereum current marketcap stands at $36,100,739,777. .png) What is even more eye catching, the technical outlook shows it trending higher and as we approach the Metropolis Hard Fork date we can possibly see Ethereum making record highs. .png) Lets turn our attention to Deutsche Bank, one of the largest German Bank.  Deutsche Bank is publicly traded on the Frankfurt Stock Exchange under the ticker symbol DBK, and on the New York Stock Exchanges under the ticker symbol DB. It was founded in 1870, making it one of the oldest financial institution in Europe and in the world. Deutsche Bank offers many types of financial services such as Private Banking, Commercial Banking, Corporate Finance, Private Wealth Management, Cross-Border Payment, Market Research, and Securities trading. It is one of the Bank's that has seen its fortune decline in the last couple years, facing scandals after scandals with a record 7.2 Billion charge from the US government all reflecting on its balance sheet and stock price. At the time of writing this blog, Deutsche Bank current market capitalization stands at 33.23 billion USD with a technical outlook that is trending downwards. .png) It is important to note that Deutsche Bank can still boast of assets of 1.7 trillion euros however, the continuous scandal haven't help lift it off the downward trends. Customers are also facing an interesting dilemma as Europe is also in a decade of "ultra low interest rate" and increasing rate of inflation. To break this down simply, if you deposit 1000 euro into Deutsche Bank last year, it would still be 1000 euro this year but the amount you can buy with 1000 euro is significantly less compared to last year. To give "Euro" some credit over "USD", the euro has appreciated significantly over USD since the election of President Macron but that still hasn't impacted the rate of inflation. .png) We can compare their against the winner Ethereum, which has seen a +376.65 (USD) increase in price and +3213.31% increase since last year. Astonishing growth, depending on your investment in Ethereum, it has seen an +3213.31% increase in value compared to 0.5% in interest you would have received from your bank deposit and taking account banking fees you may actually end up on the losing side. While current performances isn't indicative of future performance it shows the impressive growth of digital currencies and assets. Current performances definitely makes a case for individuals to diversified their wealth, as cryptocurrencies continue to provide opportunities to everyone not just select few. I am currently monitoring Bitcoin performances as approaches the likes of Morgan Stanley and Goldman Sachs, you can also check out my previous post where I highlight the growth of Bitcoin against these premiere financial institution. https://steemit.com/bitcoin/@daudimitch/bitcoin-is-less-than-10-billion-dollars-away-from-surpassing-the-marketcap-of-goldman-sachs-one-of-the-biggest-banks-in-the I am also keeping my radar on this coins EOS, Bitcoin Cash, Zcash, Ripple, Monero, OmiseGo, Litecoin, Iota, Ethereum Classic, Dash, Aragon and Steem. Particularly EOS and Steem, at its current price with what it intends to do, it is certainly setting up juicy returns if the project unfolds as plan. If you haven't read the updated Steemit Whitepaper you should, exciting times ahead. _Remember to hit the upvote and resteem, thank you for the support_ ==