Let's talk about Bots, Trading Bots and their use case in Arbitrage

bots·@daudimitch·

0.000 HBDLet's talk about Bots, Trading Bots and their use case in Arbitrage

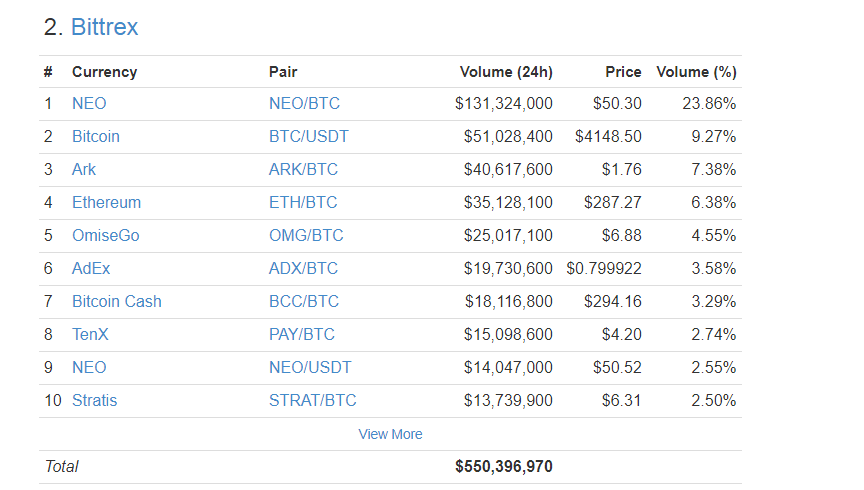

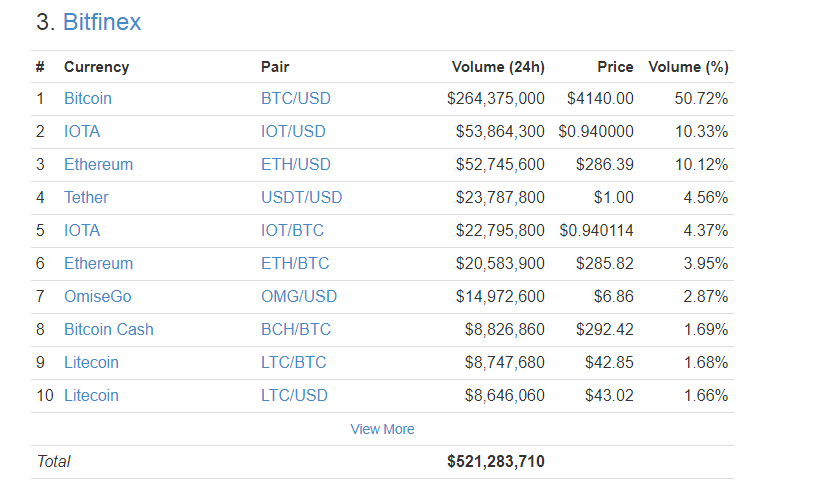

As the cryptocurrency space develops, many opportunities continue to arise. Both Bull and Bear market becomes profitable if you have the correct setup. At the time of writing this blog, the total market capitalization of cryptocurrency stands at $137,027,176,156 with a 24 hr trading volume of $6,376,635,269. Volatility and cryptocurrency go hand in hand and it is the economic model that traders love as it provides countless opportunities. Today I want to zero in on the opportunities that exist but very few people participate because _it's just to fast_. Let's break it down Most of you by now are familiar with Bots, but those who aren't, Bot's are basically coded software application that runs automated task on the internet. Chances are you may have interacted with one Bot or two on a daily basis. Bots have some unique characteristics that make them irresistible for those looking at speed, efficiency, accuracy, and cost effective.  Now that you understand what are Bots, let's talk about Arbitrage. So what is Arbitrage, Arbitrage is basically the simultaneous purchase and sale of an asset or commodity to profit from difference in prices among different market or exchanges. These prices differences exist because of inefficiencies. So let's break this down further, let's say Bitcoin is trading at Bittrex for 4000.00 per coin while trading at Poloniex for 4050 per coin. A trader can buy Bitcoin on Bittrex and then sell it on Poloniex making a cool 50 dollars profit. Now you may say that's impossible, there would never be enough time or it take so much time to put in a buy or sell order or probably who gonna be watching all these exchanges for these difference. That's where our friendly Bots come in, you see, what takes minutes for us are only fraction of second for them. Programmers have studied markets and their inefficiencies and has created unique algorithm that make some of these Bots unbeatable. The game has certainly evolved, its more than just recognizing big buy orders or sell orders, and positioning trades accordingly, market inefficiencies can be exploited and become quite profitable. I have tried simplify the terms and association but I want you to know that there are many layers, and difficulties to it. Now you may ask, are there any examples of these, _Yes, yes, yes_. Let discuss a few of them. There are Crypto arbitrage trader, Tapibot, Bitcoin dealer, Bitcoin arbitrage, Gekko and Blackbird. Let discuss them _1. The Crypto arbitrage trader which provides support Coins-E, BTC-E, and Vircurex and its source code could be found in Github_. _2.The Tapibot which provides support for BTC-E among other things...it's one of those that has evolved and its support code could be found in Github_. _3. The Bitcoin dealer provides support for Bitstamp and it support code can be found in Github_ _4. The Bitcoin arbitrage provides support for Bitstamp, Paymium and Coinbase_ _5. Gekko provides support for Kraken, BTC-E, CEX, and Bitstamp and its source code could be found on Github_ _6. Blackbird provides support for Bitfinex, OKCoin, Kraken, and Gemini, it is the easiest among the arbitrage bots and once set up properly, you can make thousands in passive income without actually active trading_. There are many more to the never ending list of arbitrage bots, some are top secret as these programmers remain anonymous only showing results of their work and receiving thousands of dollars if their bots are successful. The market has also move on from focusing on Bitcoin and includes the likes of Ethereum, Litecoin among others. Coins appearing in the TOP20 to TOP30 are often targeted. I believe these Bots are here to stay as these market inefficiencies would always be present. A Bot does not even have to actively trade to make a profit, _as long as market arbitrages exist and the correct setup is executed, Bots would be making money_. _Their unique characteristics afford them that opportunity_. To give your a perspective of the trading opportunities, here is a snapshot of the some of the major exchanges .png) .png) .png) Each of these exchanges, offered over half billion dollars worth of volume each over the last 24hr. There are lots more of these exchanges all providing opportunities for Bots coded to find arbitrage opportunities and we haven't even mention those coded to perform active trades using unique algorithm. You can also participate in arbitrage although beating Bots are out of the game but you can still win. Poloniex often shows some erroneous high prices depending on the coin compared to other exchanges. At times I have seen Steem going for $1.15 on the Internal Steem market while on Poloniex its trading at $1.45 or in some cases $1.70, providing that the wallets are operational on Poloniex, that's an opportunity to buy some on the internal Steem market and sell it on Poloniex, ensure that you buy enough Steem to cover fee and get a good profit. You should also take going market rate and avoid asking to high or you may end up stick in a trade for days...Once again, this is just an observation, _let the Bots do their thing, an rake in that passive income_. _Please remember to Upvote and Resteem_ == If you feel that this post is undervalued, I welcome a tip in the cryptocurrency Jars at below BTC: 1Cau9AhRnfeVjr8cuJzdMEtAiJUP1JNdmK LTC: LV4iqkB59mKfZ6M7LT8xfstkixyMNCqJQX ETH: 0xfe15B672805875454fC113B564F32ccD8A17c94A EOS: 0xfe15B672805875454fC113B564F32ccD8A17c94A