ETHLend & Salt Explained | Cryptocurrencies that could replace the banks?

crypto·@davidhay·

0.000 HBDETHLend & Salt Explained | Cryptocurrencies that could replace the banks?

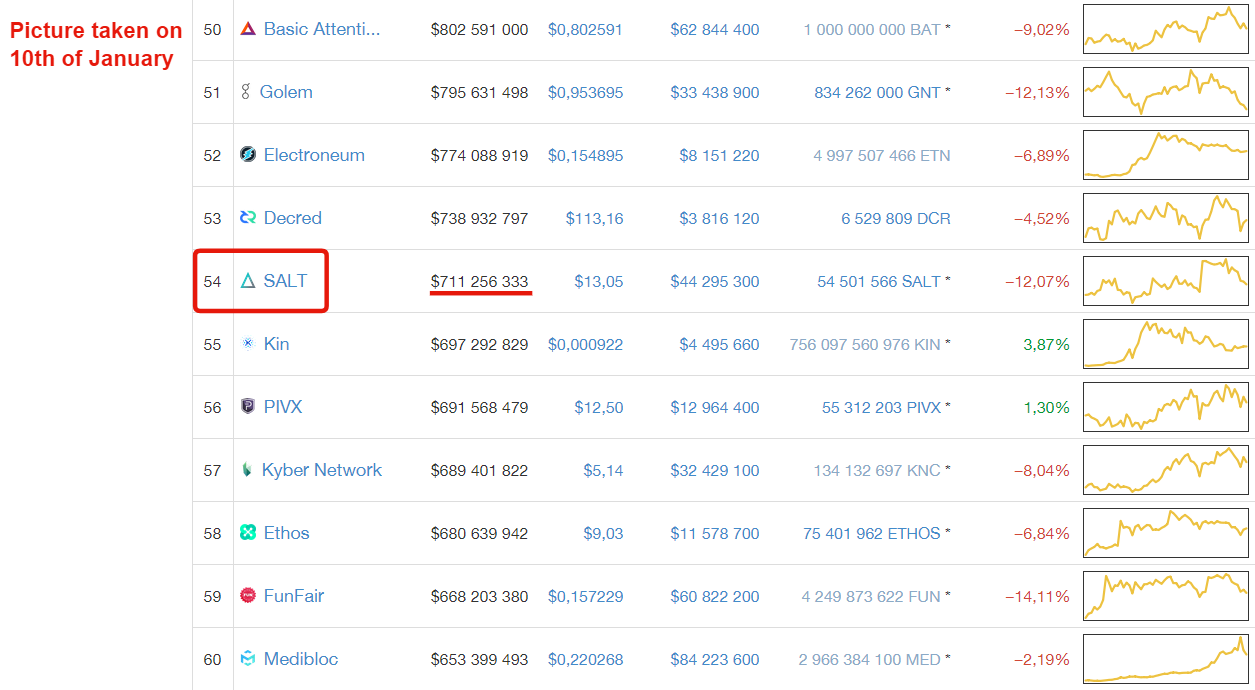

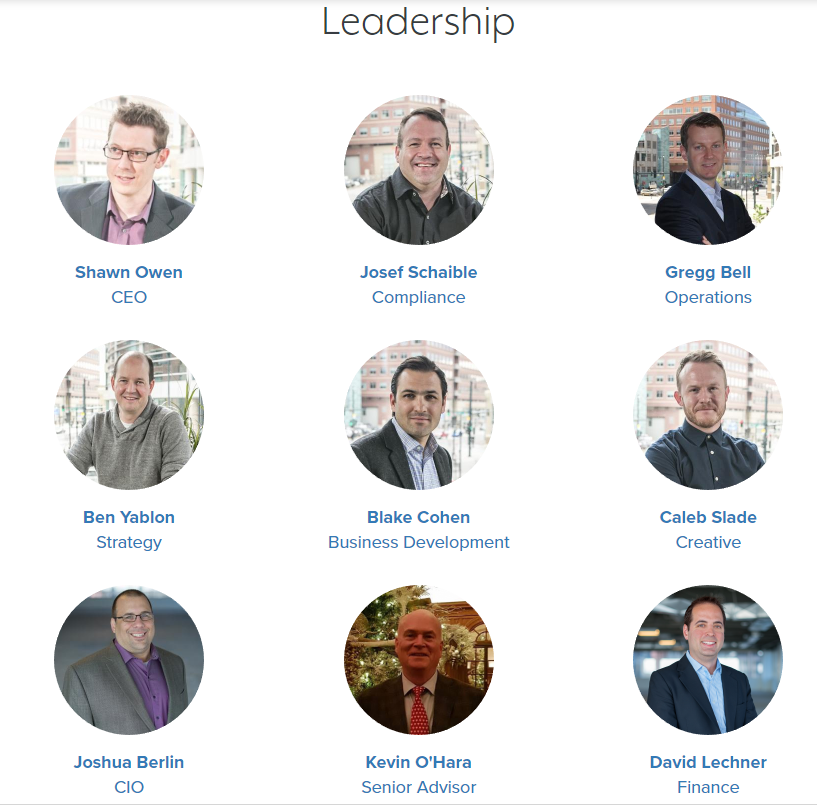

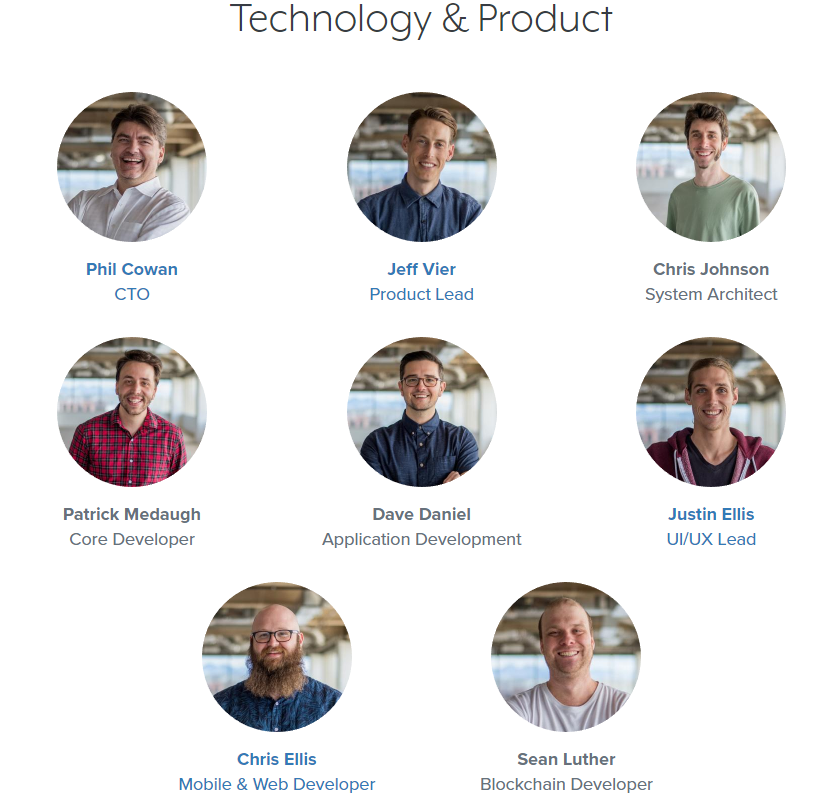

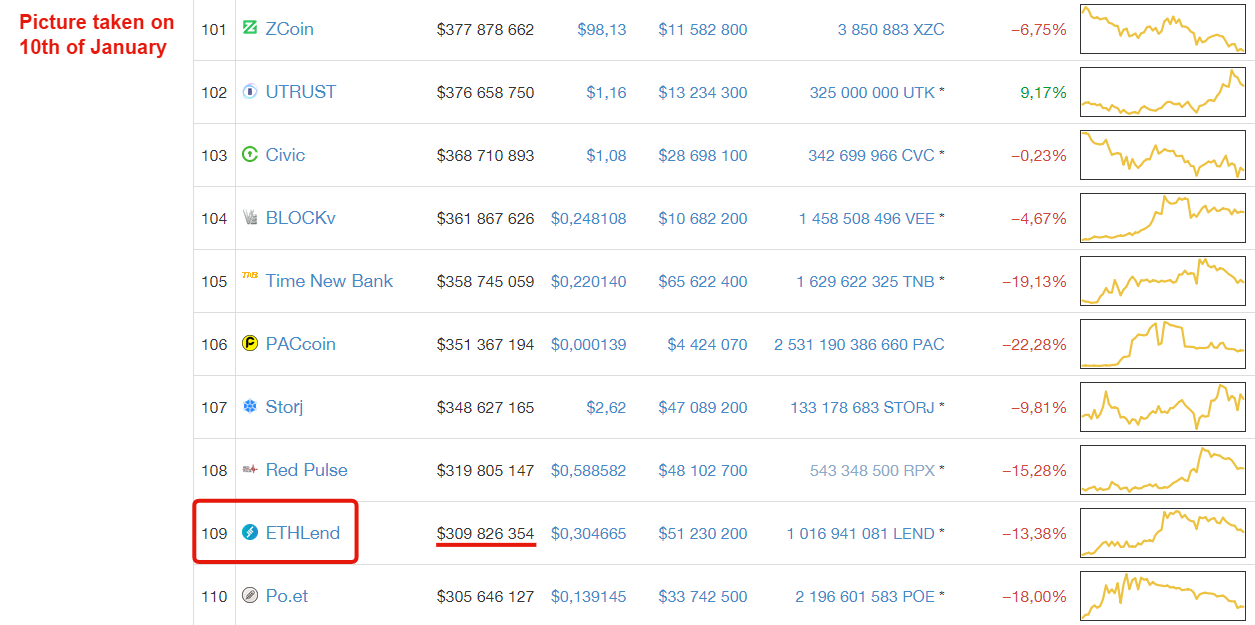

Have you ever had a situation where you've needed to sell some of your cryptos, because you needed fiat currency? *It sucks...* *Let's imagine a situation like this; you are an average person who has invested some of his money into cryptocurrencies. You have a decent job and you get a pay check every month from it.* Sounds nice? *But let’s say that, for some reason, you've already used all of your pay check this month and you don't have a lot of money saved.* What happens if you get an unexpected bill, or something unpleasant happens which makes you need money urgently? What if your car breaks and you need to repair it right now, but you don't have any fiat money. You would be in a very annoying situation, where you'd have to sell some of your cryptocurrencies to get some fiat money. __In the future, you might have an another option,__ *blockchain lending*. In this post, we are looking at two lending platforms on the blockchain, [ETHLend](https://ethlend.io/en/) and [Salt](https://www.saltlending.com/). At first, we'll look at the problem these two are trying to solve. Then we are going to dive in deeper to these cryptos and talk about the differences of them. https://www.youtube.com/watch?v=oVdn-aPhmmc # What are ETHLend and Salt? The explanation is pretty simple and straightforward, they are *lending platforms* working on the blockchain. So basically, they allow you to borrow fiat money (USD, CAD, EUR, etc.) with your cryptos. Salt even allows you to use your Bitcoin as collaterals for the loan. For example, if you have 20 000$ worth of Bitcoin, on Salt you could use that as collateral and get a loan of 10 000$ at 5-10% interest rate. Once you have finished paying back the loan, the Bitcoins are released back to you. This means that you have the advantage of being able to use fiat currency, and at the same time you have the advantage of holding onto your cryptocurrency assets. Also, the person lending the fiat money to you will profit from this because he will be receiving 5-10% interest for his/hers money. This is why ETHLend, and especially Salt are going to be such a big deal in the near future. One thing you should remember is that even though Salt and ETHLend are working on similar things, they are both quite different. *Well, what are the differences of these two?* ## Salt Salt is more straightforward and a lot easier to understand then ETHLend. It also currently has a lot less risk involved, which is probably why it has a bigger market cap than ETHLend.  ### The problem Salt is trying to solve? Salt is trying to solve a problem that’s probably going to become a lot more frequent in 2018. *People having to sell their cryptos to pay their daily expenses.* If your car breaks and you need money to repair it, with Salt you can easily use your cryptocurrencies as collateral and borrow some fiat money against it. Then you pay the loan back, and you'll get your cryptos released back to you. Salt is great for two types of people. 1. **Someone who has cryptocurrencies and needs fiat money.** As David said in his video, if you have cryptocurrencies, you most likely want to **hodl** them. Salt will allow you to borrow fiat money easily with your cryptos, so you don't need to sell them. 2. **Someone who has extra money and doesn't necessarily want to get into cryptocurrencies.** Even if you don't know anything about cryptocurrencies you can make some money with them. If you are a wealthy person, instead of keeping your money in your bank account where you'd get ~2% interest, you could put your money into the salt platform and get 10% interest on your money. *The best part about this? You don't have to know about the crypto-markets or anything like that.* The concept of Salt is great. It's a great deal for both, the borrower and the lender. Now the person borrowing money doesn't have to sell his cryptos to pay for his daily expenses. The person lending the money will get a ~10% interest for their money. Also, the lender is protected, because if you want to borrow 10 000$ in fiat money you'd probably have to deposit close to 20 000$ worth of Bitcoin to borrow that money. The lender doesn't have to worry about anything, if the person borrowing money can't pay it back, the platform will just liquidate the Bitcoins and pay the lender his money back in his local currency. *Well, what if Bitcoin price crashes? How am I going to get the money that I lent back?* Even if the price of Bitcoin falls rapidly the lender would be safe, because then salt would tell you (the borrower) that you either need to terminate the loan, so they can liquidate the Bitcoins and give the money to the lender, or you need to put more Bitcoin in as equity so they can still rest assure that you're going to be able to pay this loan back. ### Salt as a project Salt is an interesting project with a lot of potential. They're still pretty far away from their goals, but they've already issued initial loans to small group of their members. They expect to have between $50m and $75m in active loans by the end of January 2018. So, they have a somewhat working platform, which is something that many cryptos don't have yet. They also have a strong team and a decent sized community behind them. Salt has showed some great potential and it could be a really good investment for 2018. I'm most likely going to add some Salt into my portfolio soon.   ## ETHLend ETHLend has a lot more ambitious goal. They're promising financial services to people that are otherwise unable to get financial services.  Basically, they're trying to establish a credit protocol, which is going to allow peer to peer lending. This is probably not going to be compliant in the US. Which means that this is something US citizens most likely won't be able to enjoy in the future. Still, this could be useful in the rest of the world, especially providing banking services to the unbanked. I think that their short introduction video does a great job explaining the concept of ETHLend. https://www.youtube.com/watch?v=FeXqGq-at28 ## The problems of ETHLend? ETHLend sounds awesome **in theory** but there are few major problems to it. #### The first is that ETHLend runs on an [ERC20](https://en.wikipedia.org/wiki/ERC20) token, which means that it's running of the price of Ethereum and it's using the Ethereum backbone to run its whole network. *Why is this a bad thing?* If you know what happened to [Cryptokitties](https://www.bitsonline.com/cryptokitties-wrecking-ethereum/), you probably understand why this is a bad thing. (They basically launched a decentralized app/game that was supposed to be funny, but it overloaded the network and almost tripled the price of Ethereum transactions). This really showcased how weak this whole infrastructure is, and how important it's that we scale up. #### The second thing is that there are still too many pieces that need to be put together before this is going to work. The problem with lending money to people that don't have money is that you need a way to make sure that the lender feels safe. If you don't have any collateral backing the loan up, or if the collateral can't easily be exchanged to cash, it's going to be hard. If somebody wants to borrow money against a cow, how are you going to turn that cow into money? #### The third thing is that it'll be a difficult process getting your money back if someone doesn't pay you. If you are using Salt and you don't pay your loan, the process is quick and easy. Salt will just liquidate the Bitcoin, and pay the lender in few minutes. On ETHLend it's going to be much more difficult. ETHLend says that their loans are legally binding, which means that you must go through a court system to get your money back. ## Does this mean that ETHLend is a bad project? Absolutely no! They still have a great team and a nice community behind them. Their goal is ambitious, but if they manage to achieve it... They could replace the banks. If you would invest in ETHLend now, you'd never know where they'd be in 5, or 10 years. They could be a multi-billion-dollar company, or they could be completely gone. I'm going to stay away from ETHLend for now, but if they manage to start putting these pieces together, and they're able to form a working system, I can guarantee that I'll be one of the first persons to invest in them. # Your opinion? I hope this helped you understand little bit more about Salt, ETHLend and lending platforms working on the blockchain. If you still have questions, be sure to comment them down below! Also, we would love to hear your opinion on the future of these two! Comment it down below too! **Social Media** YouTube: https://www.youtube.com/user/DavidHaydotOrg/ Facebook: https://www.facebook.com/davidhay.org/ Reddit: https://www.reddit.com/r/DavidHay Steemit: https://steemit.com/@davidhay/ DTube: https://d.tube/#!/c/davidhay Website: http://www.davidhay.org/