BRICKBLOCK: BUILDING A BLOCKCHAIN-BASED SOLUTION FOR REAL ESTATE INVESTMENT

realestate·@empress01·

0.000 HBDBRICKBLOCK: BUILDING A BLOCKCHAIN-BASED SOLUTION FOR REAL ESTATE INVESTMENT

From time past, there has been discrimination and unfair participation in cryptocurrency trading. Money as we have known is a medium of exchange, a unit of account and a store of value but cryptocurrencies has only been used for the latter. People of lower class find it difficult to trade these currencies because of the exorbitant transaction fees that will be charged the same as someone participating with lager funds. Also the complexity of this operation discourages them. In buying real estate assets, foreign investors often find it difficult to invest in non- resident countries due to the tax structure and extortion by middlemen. Middlemen / fund managers tend to charge investors at every point leaving them with little or no profit; also they do not manage the funds and property effectively. The reason behind this is because there is no legal backing to this cause. These assets are not available to people of lower class because of the traditional method of acquiring them and because of their income. Brickblock has come to put things right and eliminate the challenges encountered in existing platforms.

ABOUT BRICKBLOCK

Brickblock is a decentralized platform based on ethereum network where users can invest and easily trade in funds , such as real estate funds (REFs), exchange traded funds (ETFs), passive coin-traded funds (CTF)and active coin managed funds (CMFs). Depending on asset class, there are 3 types of funds:

Real Estate Funds (REFs)- Brickblock focuses on REFs because it serves as a means of preserving wealth and a source of income. Frome anywhere across the globe starting with Europe(more locations will be added),investors can choose from the list of gathered real opportunities and review every details. Transaction will be verified and audited in a more convenient and trusted way. There is a legal contract signed by fund managers which will ensure they deliver.

Exchange-traded Funds (ETFs)- This passively track rule-based indices liked the S & P 500 and commodities like silver and gold. What is significant about ETFs is that it has no minimum purchase amount hence, it cut across all income levels and the return in investment (ROI) is also high.

Coin Managed Funds (CMF)- is a type of actively managed funds based on choice. Investors can select which fund managers and strategies to use and likewise fund managers can choose what cryptocurrency to add to port folio. CMF provide projects such as Taas.

Coin–traded Funds (CTF)- This has not been implemented but will involve the blockchain being implemented into ETF. CTF will passively track top cryptocurrency based on their market cap and investors can buy the token either through exchange or creation mechanism

SOLUTION OFFERED BY BRICKBLOCK

* This project is for small and large income investors, it has been simplified to the level that even people with little capital can diversify their portfolio and have many funds to choose from which also reduces the risk involved.

* By blockchain and smart contracts it will eliminate third party and reduce the number of middlemen involved thereby lowering the cost of investing.

* Legal backing that will involve every fund manager and broker-dealer. Secured transactions will be performed through legal binding contract.

* With brickblock, hiked clarify fees, transaction fees, account maintenance fees and the likes is considerably lowered thereby reducing the fees involved in buying and selling real-world assets.

* All trading restriction are removed- opening of bank account is not needed, tax structures are reviewed. This allows everyone regardless of where investors live, to invest directly in any real-estate opportunity of their choice in any part of the world.

* Escrow duty is implemented for security reasons whereby funds will be deposited into brickblock escrow as collateral and it is until after the broker-dealer transfer the assets that the investor's funds will be released.

Brickbblock deals with private investors, institutional investors, fund managers both coin manager and real estate fund manager, broker dealers and commercial paper issuers to ensure a smooth and secured transaction through blockchain technology.

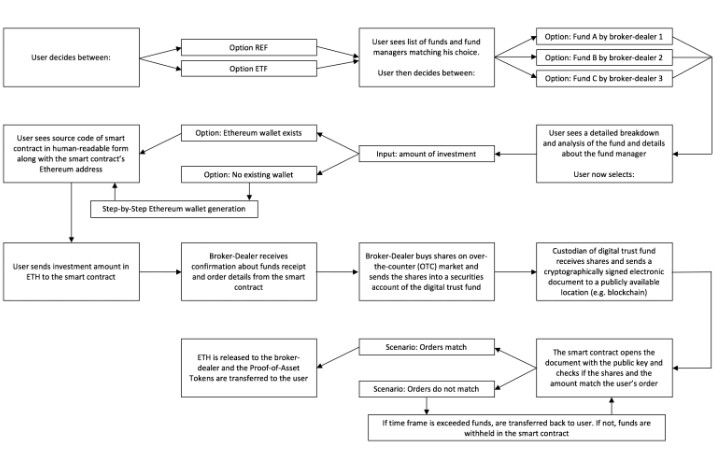

The trading process is detailed in the image below:

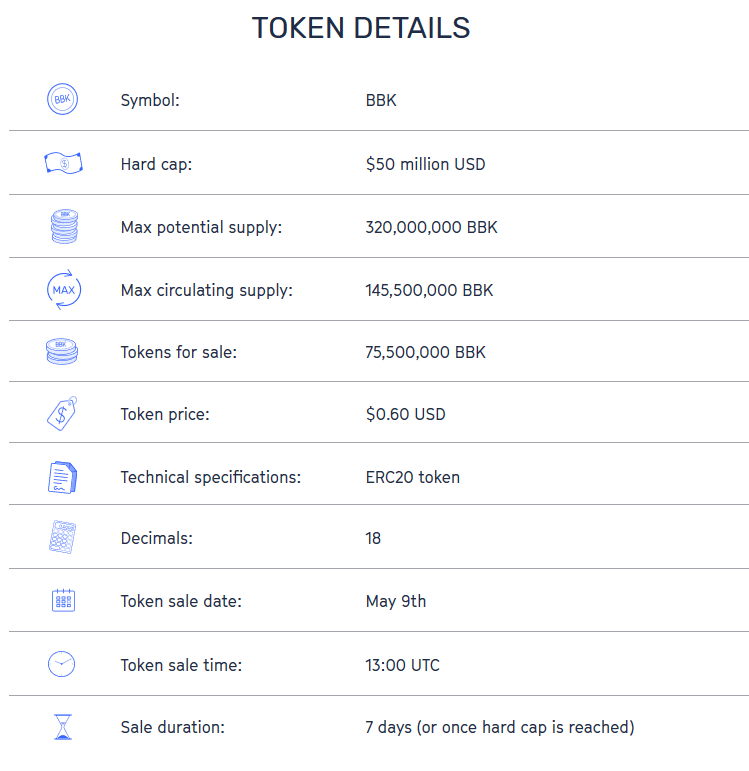

TOKENS

The tokens are ERC 20-compliant and are of 3 types

Brickblock tokens

Acess tokens and

Proof-of-Asset (PoA tokens)

Detailed information about the volume, distribution mechanism and price will be released separately prior to contribution period.

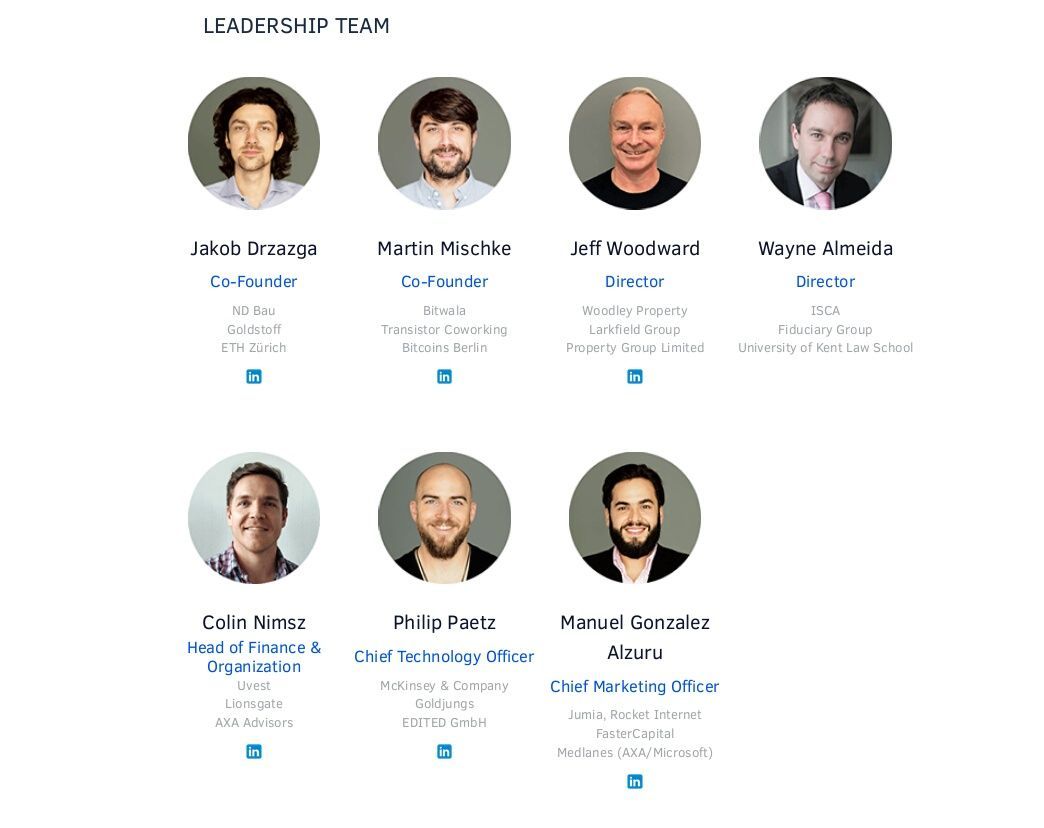

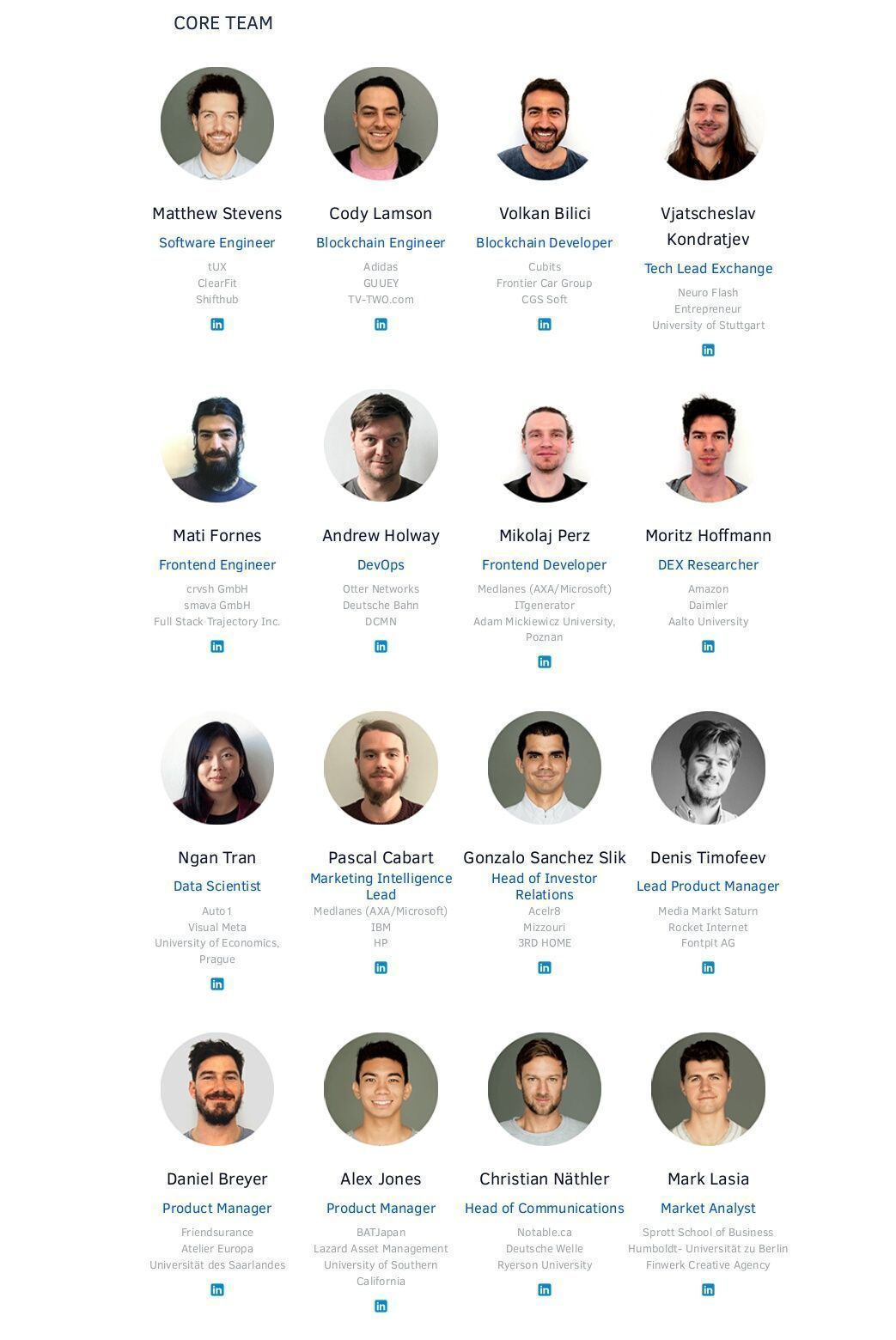

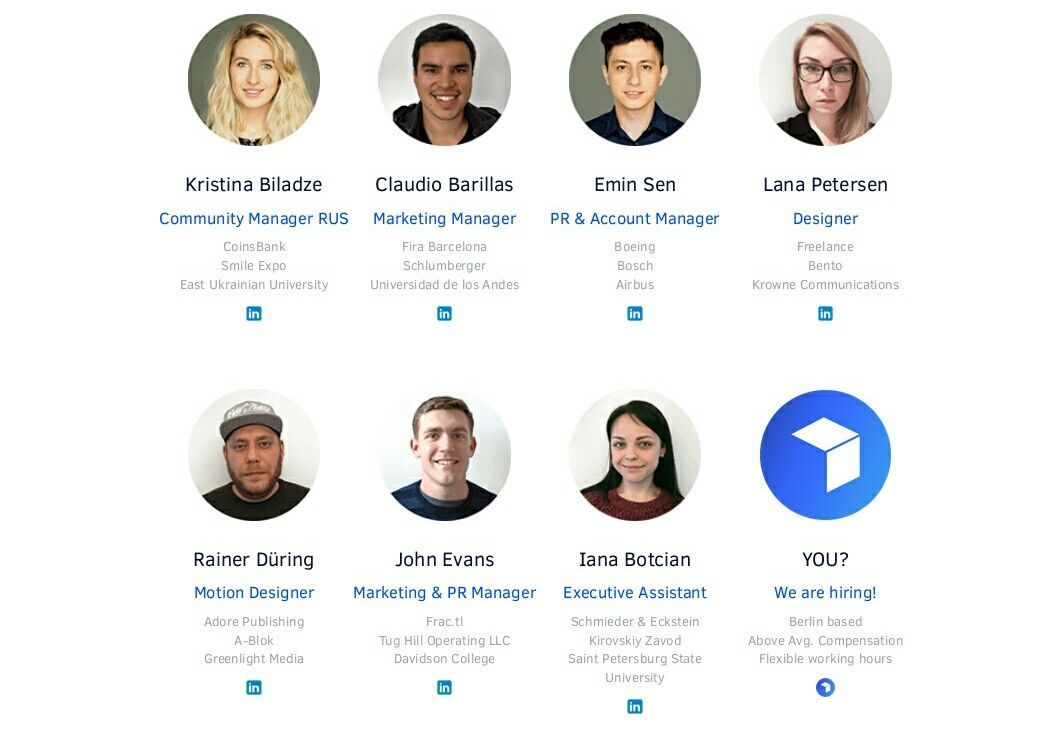

TEAM

In conclusion, brickblock is a go-to platform that transition from the old investment world into new/digital one for a more advance and faster transaction. This project will enable people of difficult classes to invest their money in any way they want in a diversified, simple, secured, faster, and cost effective way.

By implementing this, there will be fair access and participation in acquiring real world assets where everyone wins and store same value.

The crypto-community via blockchain technology will disrupt the old and traditional financial institutions like banks that have sluggish delivery system with unfair local jurisdiction.

PARTNERS WITH BRICKBLOCK

For more information:

Join the Telegram Group: https://t.me/joinchat/AAAAAERj-_1p8AktrkESlQ

Follow on Twitter: https://twitter.com/brickblock_io

Follow on Facebook: https://www.facebook.com/brickblock.io/

GitHub: https://github.com/brickblock-io

Website: https://www.brickblock.io/index.html

Whitepaper: https://www.brickblock.io/Brickblock_General_Whitepaper.pdf

Author- empress01👍 coltpython, empress01,