$HIVE & $BTC Technical Analysis - 22.06.2025

hive-167922·@erikah·

0.000 HBD$HIVE & $BTC Technical Analysis - 22.06.2025

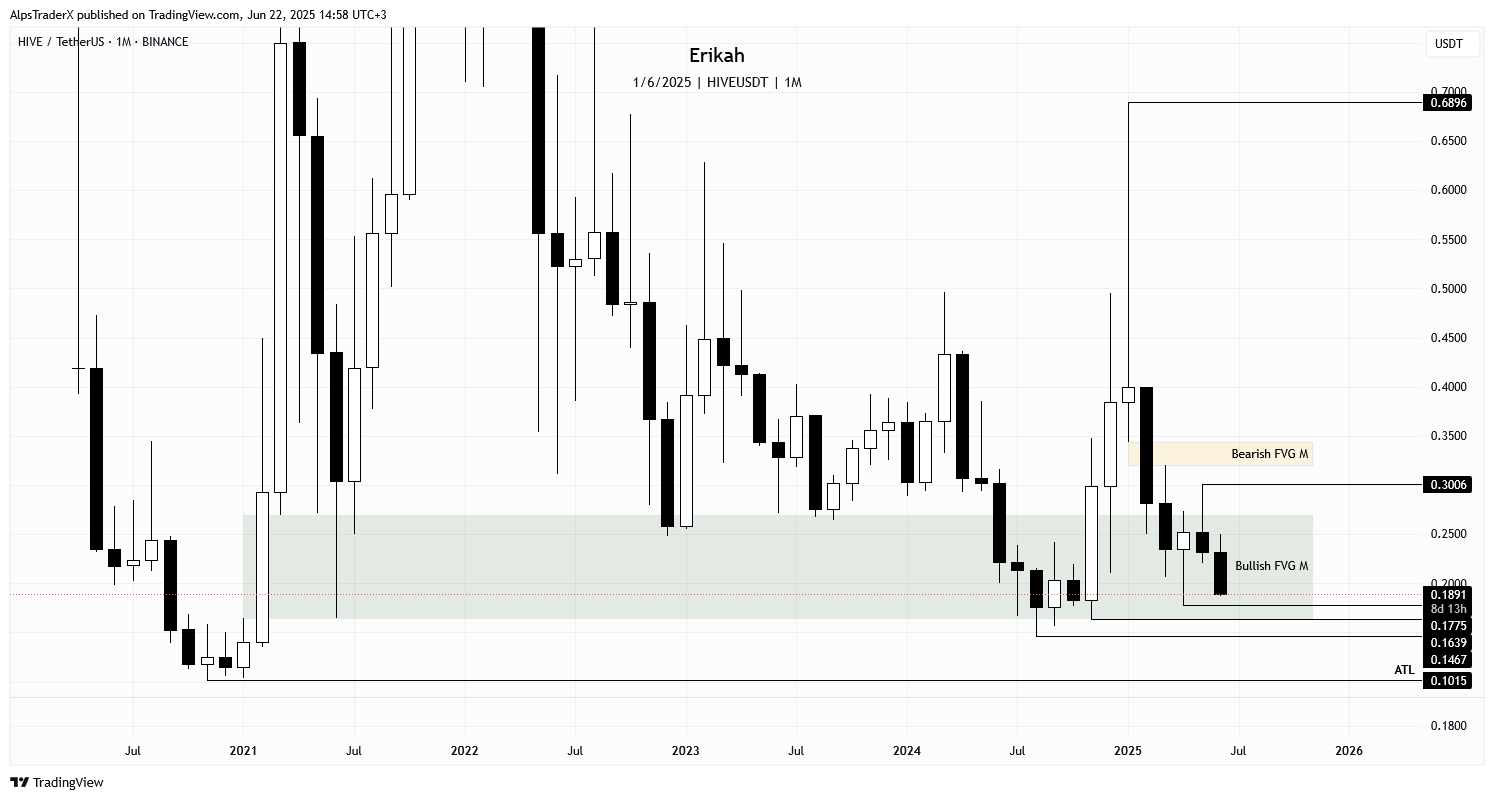

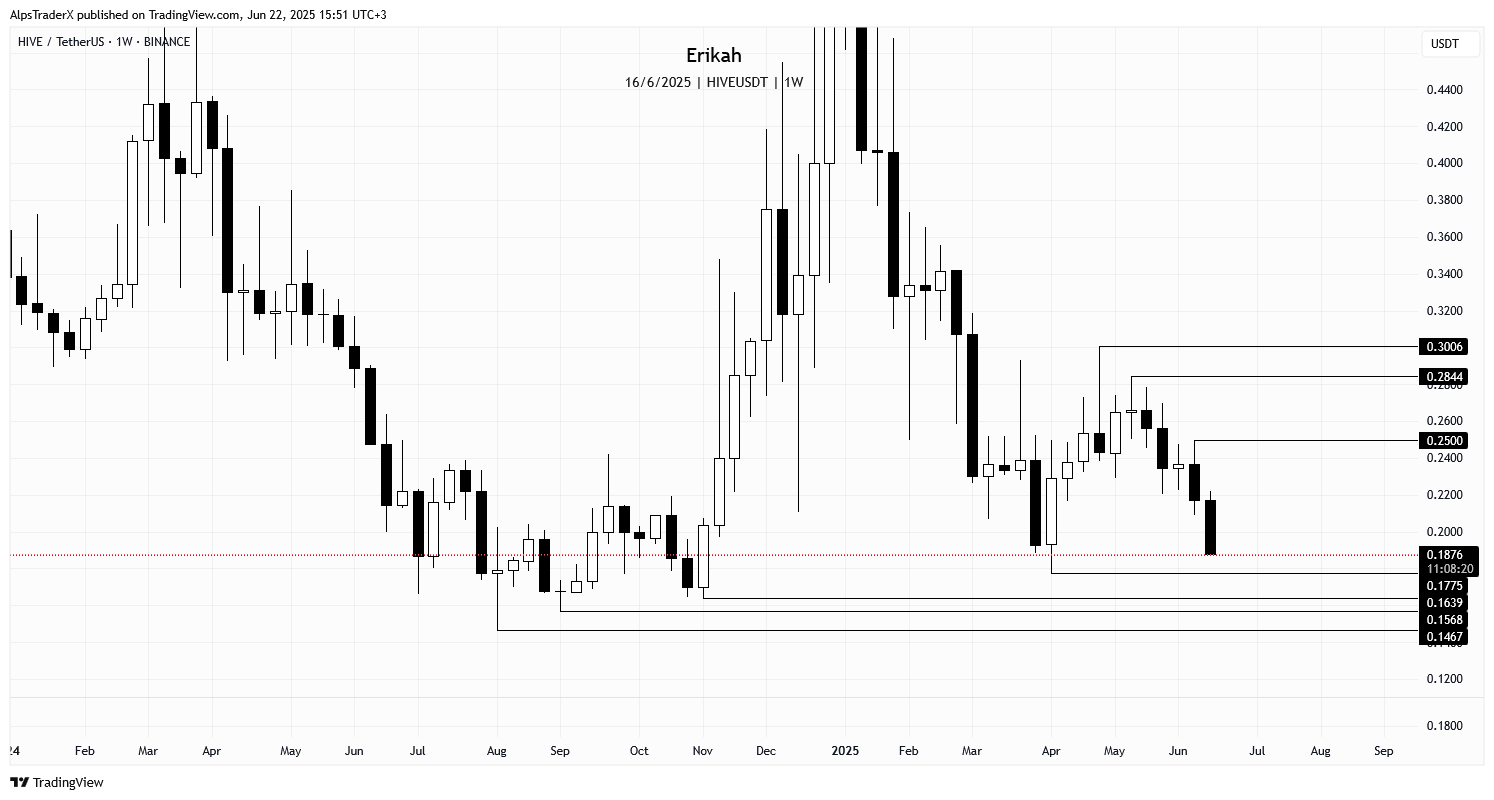

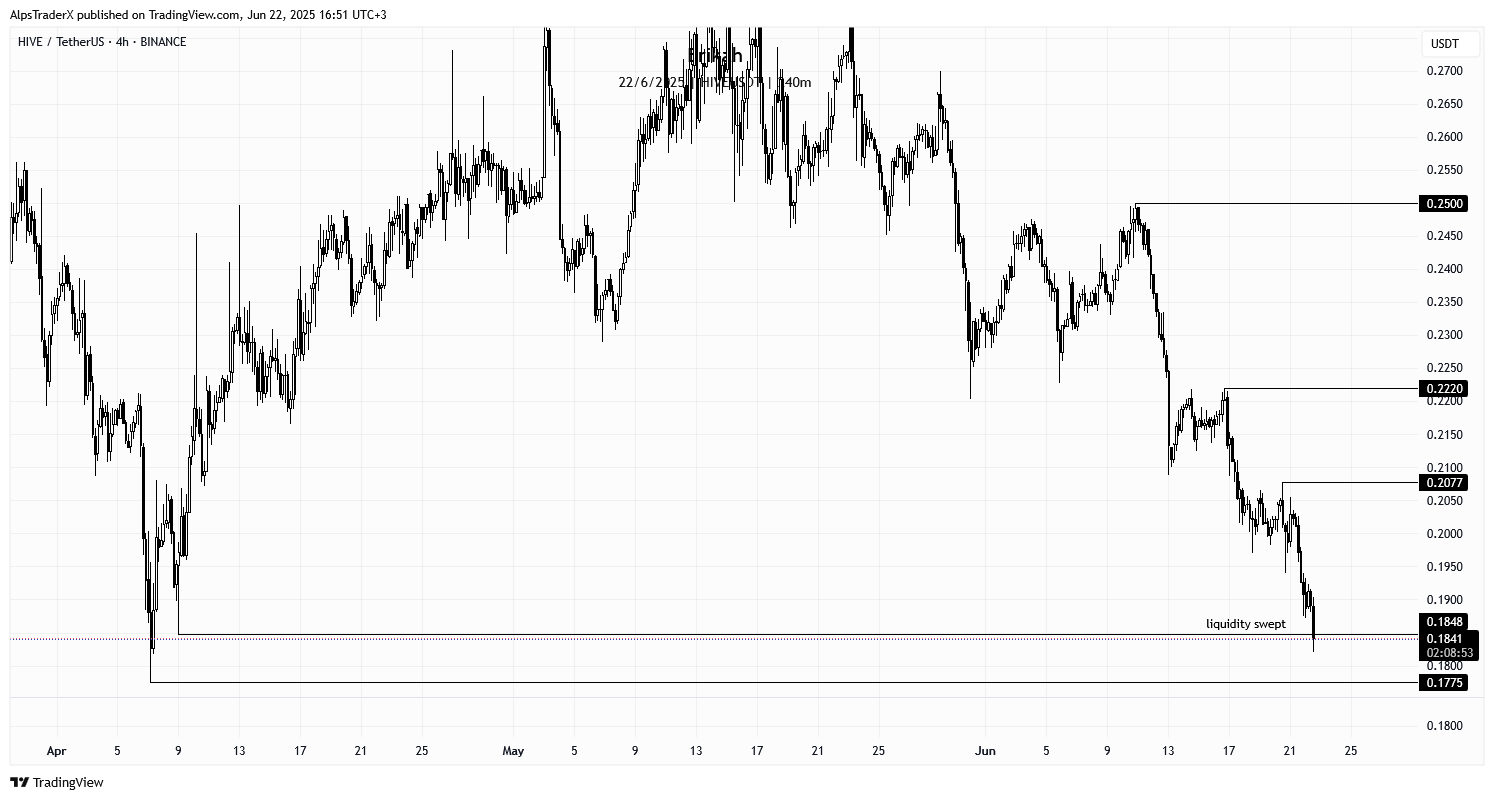

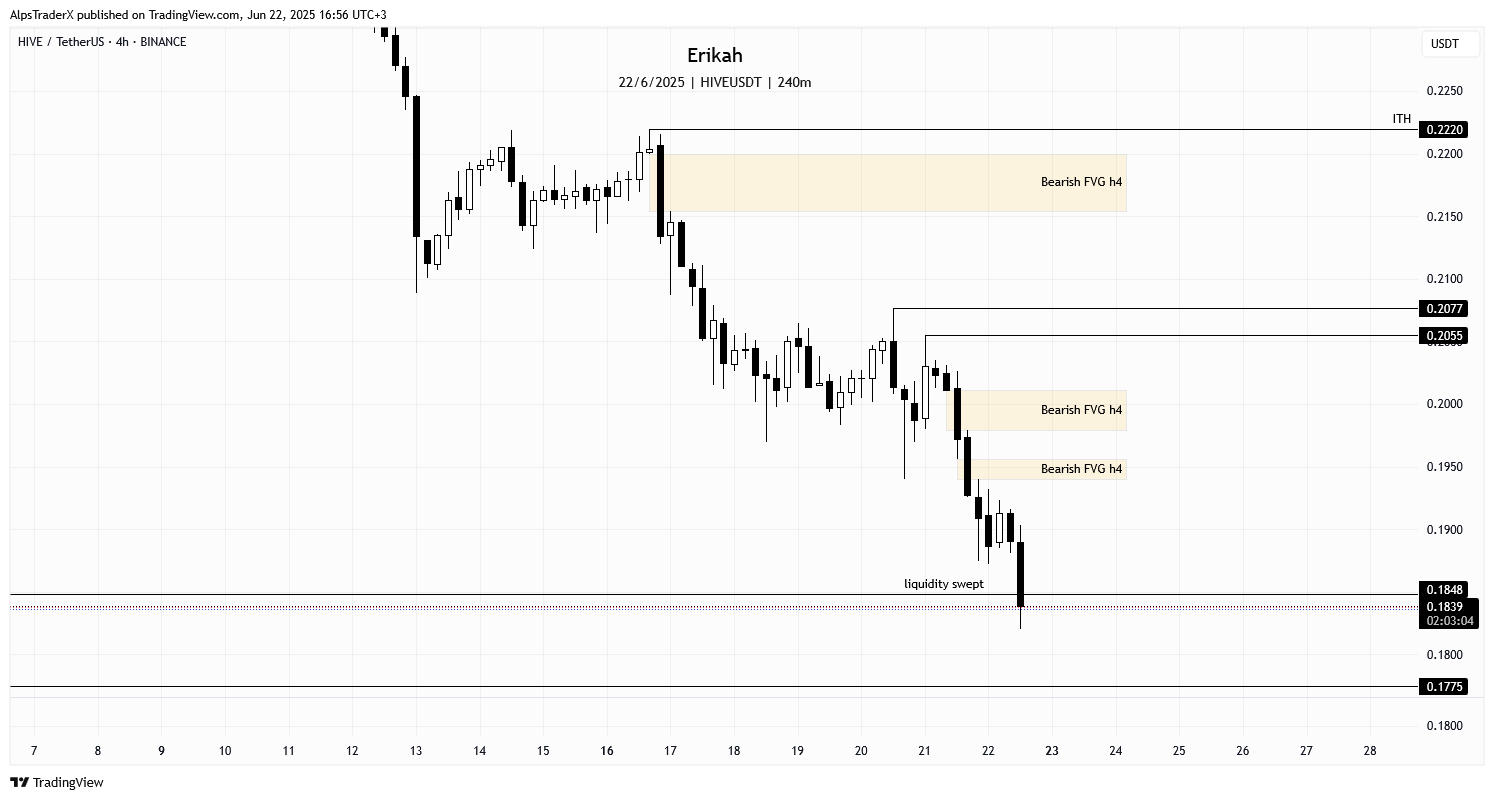

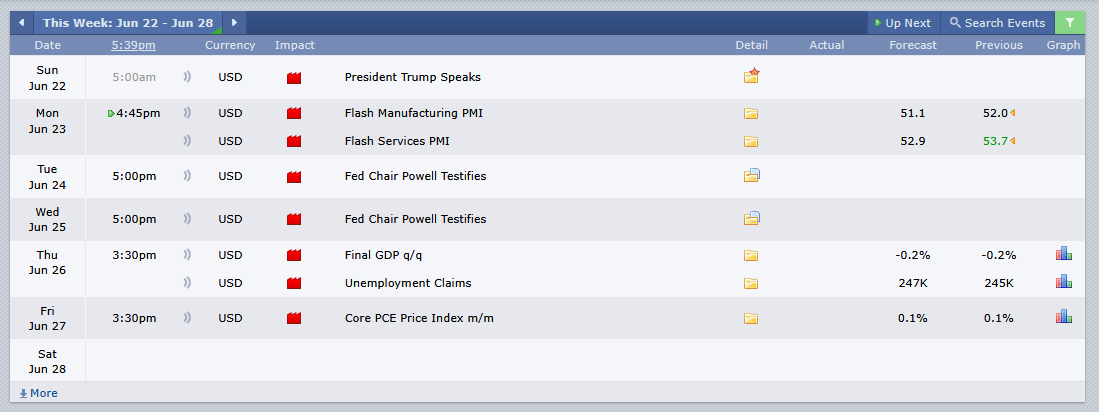

Today's edition of my technical analysis is something I've been looking forward to as we're at a crucial level and it's good to make a plan for next week. I've been using this analysis to know which level to watch when swapping HBD to $HIVE and if you're interested in making some profit when swapping our two tokens, you should too. $BTC has also made some progress in one direction, so let's see where these tokens are now and what we can expect. As you know, this morning the US bombed Iran. I'm not going to comment the event, but it's important to make a note about it as it had some effect on the markets too. Whenever Geo-political events take place, people rush to get out of risk markets and secure their capital. This means crypto usually takes a hit. The extent of the hit is different each time, some assets are more sensible, others with strong fundamentals resist better.  There's one whole week and a day till the ***monthly*** candle closes, so nothing is set in stone at this point, but for those of you who are not familiar with reading the charts, so far we have a bearish candle with a substantial body and price is closer to sweeping $0.1175 than ever. I've been mentioning this level in my previous posts and here we are, nearing towards it. With the current Geo-political situation, I'd be cautious and would watch the next two levels marked on my chart, $0.1639 and $0.1467. There's no guarantee price is going to sweep those levels, but we have to know where and how to react if those levels are hit.  On the ***weekly*** time frame price also looks heavy and close to sweeping the swing low at $0.1775. If we don't get a bounce and a reversal at that level and there will be more weakness, the next levels on the downside I'd keep an eye on are $0.1639, $0.1568 and ultimately $0.1467. I don't want to mention all time low (ATL) at this point, which is at $0.1015. Let's not go there yet as the situation is not so dramatic. The sell side of the curve (or the leg down) is pretty balanced, there's no not much to stop price. In case of a bounce at any of the levels mentioned and some strength, the first swing high, that is not yet confirmed, is at $0.25. This level will be confirmed as swing high, once this current candle closes, which will happen in around 11 hours. Above $0.25, the next possible level I'd watch are $0.2844 and $0.3006.  The ***daily*** chart shows price is heavy, has just swept liquidity flow below the swing low at $0.1848 and possibly heading towards $0.1775. Here the price action (PA) is not as balanced as on the weekly chart, the leg down, or the sell side has two major bearish gaps, that could reject price easily once it get s there, but let's take it step by step. On the way down, you have the levels I'd be watching on the chart. Would be nice to see price bouncing after sweeping $0.1775, but as there's never guarantee for anything in this game, keep an eye on $0.1639, $0.1568 and ultimately $0.1467. If we get a reversal at some point, for bullish continuation price needs to close above the bearish fair value gap (FVG) marked with yellow, and hold $0.2134. If these conditions are met, the nest swing high is at $0.222, after which comes the other bearish fair value gap (FVG), which price needs to invert and hold above $0.237, then $0.25 is next.  On a more granular scale, the ***h4*** chart shows price at a very important level. Has just swept $0.1848, which was the next swing low on the left. You can see the $0.1775 level next, and I'd like to zoom in now, to show you what you can expect.  At the time of writing, there are another two hours till the current candle close and price is slightly below the swing low price has just swept. You know the levels in case of more weakness, so let's see what can we expect if we get a bounce here. Yesterday's price action (PA) was a bit violent and price created two bearish gaps on the way down. These gaps mean internal liquidity and can reject price. I'd be cautious longing into them, but once price manages to invert them (close above them and hold), $0.2055 and $0.2077 are the next two liquidity pools. In case we see the necessary strength for price to sweep $0.2077 and hold, I'd be cautious the the nest bearish gap, which can also reject price.  ... and this happens while I'm trying to finish my post. Just a matter of time till $0.1775 is swept. Ok, let's see what $BTC has been doing this week. >The bearish gap marked with yellow on the chart is capping the market at the moment and sweeping $102,626 is a question of WHEN, not IF, if you ask me. In case that happens, I'm expecting a bounce from that level, but if there's more weakness in the market, price can sweep $100,350 as well. [source](https://peakd.com/hive-167922/@erikah/dollarhive-and-dollarbtc-technical-analysis-15062025) This is what I wrote last week.  Here we are today. $102,626 swept. $100,350 swept. Price is inside the bullish gap that has been holding price since for the past 43 days. It has not been fully rebalanced yet either. As long as this gap manages manages to do its job, which is to defend price, we can expect a bullish continuation to the upside. In case the daily candle closes below the gap, there's another bullish gap between $95,149 and $95,724, a slim one, but we can't dismiss it. If that gap is lost, then the swing low at $93,333 could be next. I'm not going to lie, I don't like the current price action and the uncertainty we're going through complicates things further. Let's see what Monday brings.  [source](https://www.forexfactory.com/calendar) Next week's economic calendar is full, we have 5 red folder days, plus the Geo-political situation in hand, so if you're a newbie, I'd stay away from gambling with leverage. These are not times to gamble with your hard earned money. *Remember, technical analysis is not about forecasting price, but about reacting to what price does.* As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market. All charts posted here are screenshots from Tradinview. Come trade with me on [Bybit](https://www.bybit.com/invite?ref=M3YJA). <center><img src="https://images.hive.blog/DQmfDaSmTz3y8oavngRrr5mmVhrTXheYoEU4qhGUS7pq3xh/HiveDivider.png"></center> If you're a newbie, you may want to check out these guides: - [Communities Explained - Newbie Guide](https://peakd.com/hive-174578/@erikah/communities-explained-newbie-guide) - [Cross Posting And Reposting Explained, Using PeakD](https://peakd.com/hive-174578/@erikah/cross-posting-and-reposting-explained-using-peakd) - [Hive Is Not For Me](https://peakd.com/hive-150329/@erikah/hive-is-not-for-me) - [How To Pump Your Reputation Fast - Newbie Guide](https://peakd.com/hive-150329/@erikah/how-to-pump-your-reputation-fast-newbie-guide) - [Tips And Tricks & Useful Hive Tools For Newbies](https://peakd.com/hive-150329/@erikah/tips-and-tricks-and-useful-hive-tools-for-newbies) - [More Useful Tools On Hive - Newbie Guide](https://peakd.com/hive-150329/@erikah/more-useful-tools-on-hive-newbie-guide) - [Community List And Why It Is Important To Post In The Right Community](https://peakd.com/hive-174578/@erikah/community-list-and-why-it-is-important-to-post-in-the-right-community) - [Witnesses And Proposals Explained - Newbie Guide](https://peakd.com/hive-150329/@erikah/wintesses-and-proposals-explained-newbie-guide) - [To Stake, Or Not To Stake - Newbie Guide](https://peakd.com/hive-150329/@erikah/to-stake-or-not-to-stake-newbie-guide) - [Tags And Tagging - Newbie Guide](https://peakd.com/hive-150329/@erikah/tags-and-tagging-newbie-guide) - [Newbie Expectations And Reality](https://peakd.com/hive-166408/@erikah/newbie-expectations-and-reality) - [About Dust Vote And Hive Reward Pool](https://peakd.com/hive-153850/@libertycrypto27/discover-hive-focus-on-dust-vote-hive-reward-pool-advices-for-new-users-cosa-sono-i-dust-vote-consigli-per-nuovi-utenti-engita), by libertycrypto27 <center><a href="https://www.presearch.org/signup?rid=2058286" target="_blank"> <img src="https://presearch.org/images/rf/ban-4.jpg" title="Presearch" alt="presearch" /> </a></center>

👍 isnochys, akipponn, therealyme, mipiano, surrealis, coolmidwestguy, netaterra, dimascastillo90, glimpsytips.dex, joeyarnoldvn, silversaver888, bilpcoinbot, aiuna, steem4all, warmstill, ezgicop, yale95reyra, ovlagik, dswigle, bluemoon, ctime, sparker005, drricksanchez, xerox94, hive-180658, gbuchynska, zeltra, mk-photo-token, bpcvoter3, netaterra.leo, islandboi, neythan, hive-187379, bluesniper, keithtaylor, vyb.curation, healthymary, legionsupport, mariuszkarowski, tmw, mmmmkkkk311, gaskets, dwinblood, richardcrill, primeradue, dalz.shorts, funshee, khoola, trostparadox.vyb, wearelegion, michael561, crazygirl777, tenpik, labutamol, ksmith7, sonntags, leprechaun, steemexperience, emsenn0, hiveborgminer, shanibeer, zirochka, ersusoficial, vyb.pob, coffeebuds, proofofbrainio, saboin.pob, anacristinasilva, shanhenry, cryptoandcoffee, philnewton, iamfarhad, mineopoly, bozz, fitcoin, vonaurolacu, mcsagel, chinito, funshel, sportfrei, mdrguez, noborders, artjohn, bozz.sports, kimzwarch, iikrypticsii, davidke20, islanderman, molometer, good-karma, esteemapp, esteem.app, ecency, ecency.stats, ecency.waves, engrsayful, vamos-amigo, ryenneleow, archisteem, cocaaladioxine, namchau, halleyleow, joeliew, bichen, steemegg, fintian, bhattg, sorin.cristescu, sayee, blumela, arka1, steveconnor, im-ridd, traciyork, hanzappedfirst, lizelle, mayramalu, spaminator, alchemystones, vindiesel1980, argo8, denmarkguy, reddragonfly, whitelightxpress, clifth, janetedita, eddyss, cur8, hanshotfirst, bossingclint, steemcleaners, barbara-orenya, cmplxty, csport, abelfotografia, tomiscurious, votehero, thefoundation, voter002, ashokcan143, fatman, halukshananah, helcim, meppij, llunasoul, josart, techslut, ssiena, stickupcurator, tresor, raj808, robvector, hmvf, bnk, randomvoter, jimah1k, mnurhiver, rumors, pobscholarship, jfuji, malos10, cmmndrbawang, menny.trx, lindoro, incinboost, blocktunes, lfu-radio, steemflow, strega.azure, vyb.fund, travoved, tonyz, amy-goodrich, livinguktaiwan, nolasco, martibis, sinochip, helgalubevi, lut-studio, whangster79, kathrynkw, c0ff33a, hive-195880, whiterosecoffee, the.lazy.panda, teamuksupport, cryptosneeze, russia-btc, sasaadrian, hebrew, ernestopg, schiba, ardina, jlinaresp, discovery-it, travelnepal, gianluccio, carolineschell, alequandro, piumadoro, idayrus, adinapoli, juanbg, titti, stregamorgana, yanezdegomera, victoriaxl, damaskinus, marcellasunset, hjmarseille, jrjaime, tonmarinduque, cryptogillone, joyyusuf, marcelloracconti, pab.ink, mad-runner, sbarandelli, spaghettiscience, phage93, coccodema, jessica.steem, middleearth, maruskina, capitanonema, discovery-blog, peterpanpan, matteus57, bindalove, maridmc, arc7icwolf, r4f4, yzamazing, sassy.cebuana, blip-blop, iamscinttwister, spiceboyz, ciuoto, marcolino76, vittoriozuccala, cooltivar, nattybongo, mfarinato, lallo, meeplecomposer, tinyhousecryptos, omodei, repayme4568, farmingtales, crimsonowl-art, digy, ghilvar, armandosodano, dannewton, jlsplatts, kharrazi, franvenezuela, ibarra95, earthsea, emma-h, simgirl, quiubi, flewsplash, andre.btc, cthings, carrinm, nonsowrites, likedeeler, hodlcommunity, joele, vlemon, thetimetravelerz, karinxxl, chekohler, mikitaly, culgin, mistakili, oredebby, uyobong, paragism, minimining, merlin7, idiosyncratic1, enison1, bilpcoin.pay, monica-ene, jskitty, f0x-society, hivexperiment, defi.campus, uyobong.venture, belemo.leo, jocieprosza.leo, hazmat, jude9, attentionneeded, sam9999, beauty197, mhizsmiler.leo, the-lead, vixmemon, rafalski, evernoticethat, bilpcoinbpc, agathusia, oxoskva, hugo4u, gloriaolar, tattoodjay, l337m45732, forykw, joetunex, forkyishere, tanveer11, gadrian, tiptop97, blind-spot, hive-lu, meyateingi, steemtelly, logen9f, nanixxx, slobberchops, chops.support, wanker, bingbabe, dismayedworld, bings-cards, fabulousfurlough, ninjakitten, grindle, plonketypiano, meesterboom, revisesociology, mightyrocklee, becca-mac, celestegray, chisomdamian, heruvim78, heruvim1978, vmihalache, joseluis91, wisbeech, b00m, citizensmith, ezrider, virgilio07, tradinggg, sazbird, steevc, build-it, letalis-laetitia, anonymousman1, cryptothesis, fieryfootprints, galenkp, galenkp.aus, hive-168869, bagpuss, talesfrmthecrypt, wahacoce, chanych85, gollumkp, allover, anadolu, ozeryilmaz, coinmeria, davideownzall, leighscotford, steemychicken1, copychicken1, leadericarus, sylmarill, porqpin, bil.prag, emma-h2, phortun, petrvl, hairyfairy, onlavu, zirky, jelly13, bluepluto, belahejna, maajaanaa, jelly-cz, pokerarema, rostik924, strawberrry, builderofcastles, spectrumecons, vegoutt-travel, captainhive, incublus, aleister, trincowski, tryskele, steven-patrick, nvstly, drax.leo, drax, ganya.grak,