What is my most Heavily Weighted Investment Sector and Why?

hive-167922·@felander·

0.000 HBDWhat is my most Heavily Weighted Investment Sector and Why?

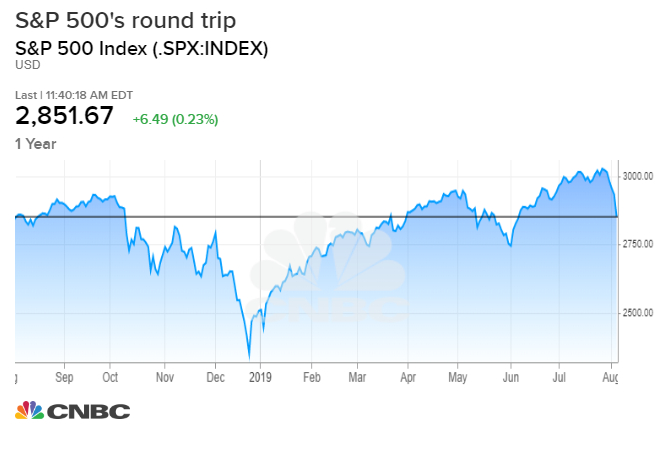

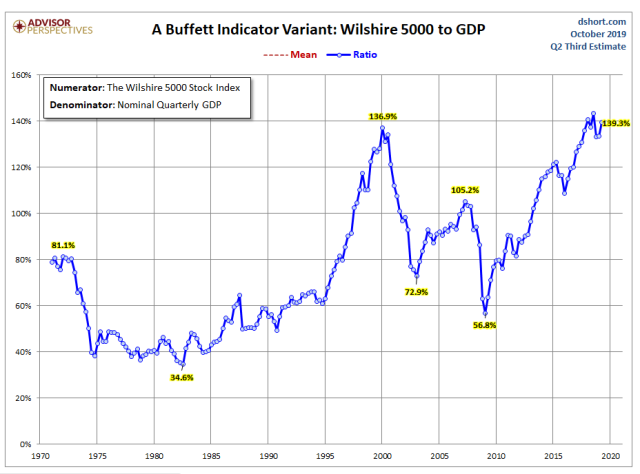

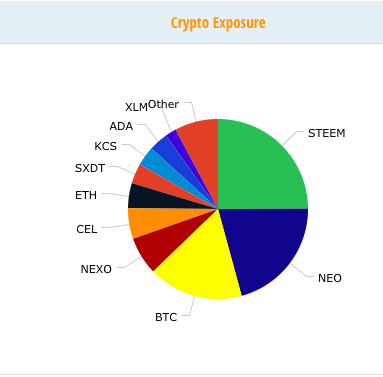

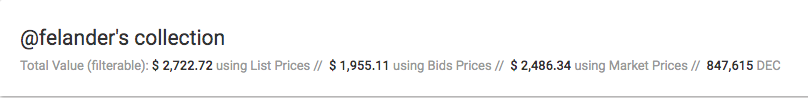

This post is part of the leowritingcontest hoster by the Steemleo team. https://steemleo.com/leowritingcontest/@steem.leo/the-steemleo-weekly-writing-contest-week-3-or-earn-upvotes-from-leo-voter-730k-steem-power I was born in 1976 and if you want to put me into a box that makes me a late GenX or early Millennial Gen Z, iGen, or Centennials: Born 1996 – TBD Millennials or Gen Y: Born 1977 – 1995 Generation X: Born 1965 – 1976 Baby Boomers: Born 1946 – 1964 Traditionalists or Silent Generation: Born 1945 and before  Now if I look at the patterns I would say I am more of a Millenial because of my mindset and investment strategy. Up until 2018 I owned some stocks through investments in funds and those did quite well but then in early October 2018 I sold them all expecting a market crash. This better financial knowledge came from reading blogs on steem and listening to blogs made by https://www.realvision.com/ This crash came but turned out to be a dip in the road before going on to break new highs in 2019. All in all I do think that I made a wise decision. For me the world economy is doing a very fine balancing act between funding from Central Banks to keep everything going and pump the markets higher and falling off a very steep cliff into recession.  So here the risk to reward is really high risk with low reward. The market may go up a bit but I cannot see it going up forever, especially as artificially propped up as it is with the stock buybacks and government money flowing in. Basically the economy is a series of ups and downs and we are really overdue for a drop so just ask yourself if its worth investing right now. Even one of the biggest and most successful investors of all time is not buying. Warren Buffet is sitting on 128 Billion dollars of cash and is not investing. He is as it looks from the chart waiting for the same crash as I am (just with a bit more money to buy)  That was why I am not buying any stocks and do not own any any more either... So what am I buying? ## Real Estate I got lucky that my Parents are good baby boomers and invested in Real estate. I myself owned an apartment in my twenties which I lived in a while but when it became clear that most of my time would be spent abroad I sold it after a few years of renting it out. The profit was put into another apartment together with my Parents and I am getting part of the rent but do not have to manage anything that is rent/tenant related. So as it stands right now this is the biggest investment for me but is not growing and I am not adding anything or buying more. We might be thinking about a house here in Switzerland but this is still only in the early dreaming/planning stage. ## Gold and Crypto I am putting my money into Crypto and my wife is putting hers into Gold which are the hedges in this current world. Most of the money is still in saving accounts but that amount is not growing. I am only adding BTC for now with FIAT and other Crypto through Staking (Celsius and NEXO) or Blogging and gaming on Steem/Steemleo. In the pie chart below there is no account of all the coins on Steem-engine/Steemleo dex and those as well hold a decent value and Splinterlands also holds an ever increasing amount as well Screenshot 2020-01-05 14.03.34 Screenshot 2020-01-05 14.27.41  Screenshot 2020-01-05 14.05.49 There are a couple more accounts that hold some of my cards but this is my main and the cool service of @otterworks is also providing the extra passive income of DEC through 4 accounts being played ### In conclusion: - For the moment (2020) I am not investing any money into stocks unless we get a decent big crash. - For me the future is in crypto either through investing or through staking and earning - The gold hedge still holds value as well. I guess most people are investing on the basis of their upbringing and their generation. Most of us grow up in a belief system and in order to see past that you have to be willing to accept that the new generations might be right. So get over your generational bias and learn from others, both younger and older!! Do not be a creature of habit but be willing to explore new things and be open to new possibilities. ### But I guess if you are reading this on a Steem account you are already a few steps ahead of the heard <hr><center>Posted via <a href="https://steemleo.com/">Steemleo</a> | A Decentralized Community for Investors </center>

👍 stmdev, haxxdump, khalpoint, exe8422, steemslotgames, cryptoandcoffee, mistakili, revisesociology, heidimarie, abh12345.spt, marlians.spt, gerber, accelerator, cadawg, daan, exyle, techken, bozz, bestboom, dlike, triptolemus, bobby.madagascar, steem.leo, abh12345.leo, project.hope, blockbrothers, fsm-liquid, maxuvc, maxuvd, maxuve, earlmonk, triplea.bot, smartbee, upvoteshares, wherein, brucutu, brucutu1, brucutu2, tubiska, pocoto, kitty-kitty, jussara, cyrillo, carioca, qustodian, arcange, dachcolony, eikejanssen, matschi, dreimaldad, richie.rich, sparschwein, jean-luc.picard, ripperone, helpyou, voter001, monster.oo7, alexis555, leo.voter, sbi3, oakshieldholding, pearltwin, zaku-leo, stevelivingston, yogacoach, backinblackdevil, swisswitness, milu-the-dog, felander.leo, ew-and-patterns, tengri, raphaelle, map10k, jesus.christ, swiftcash, spinvest-leo, jk6276.leo, onealfa.leo, vxc.leo, roar2vote, goldneon, axeminni, cn-leo, firefuture, primeradue, leotrail, nickyhavey, goinvesting, jk6276, chesatochi, ssekulji, revise.leo, flyinghigher, estefania3, minersean, l00k13, tonalddrump, organduo.leo, cervisia, kissi, captain.kirk, lizanomadsoul, manncpt, jnmarteau, sblue, thehealthylife, payger, crazydaisy, sunit, chrono.leo, cannonwar, homestead-guru, airmatti, newslady, dima772089, wolfje, lion200, damla.leo, soccermom, felander, msp-lovebot, dtrade, ecoinstant, laissez-faire, bilpcoinpower, yangyanje, skylinebuds, budwizard, ecoinstar, swissbot, life.syndication, ecosaint, jeffjagoe, morph, sportschain, jagoe, kicchudop1434, wishmaiden, thebilpcointrain, bilpcoin.pay, wacol413, sbi-tokens, brendanweinhold, deathcross.leo,