MILLENIAL'S ARE LEADING THE WAY IN ADOPTING CRYPTOCURRENCY AND DECENTRALIZATION

bitcoin·@fieldsofgold·

0.000 HBDMILLENIAL'S ARE LEADING THE WAY IN ADOPTING CRYPTOCURRENCY AND DECENTRALIZATION

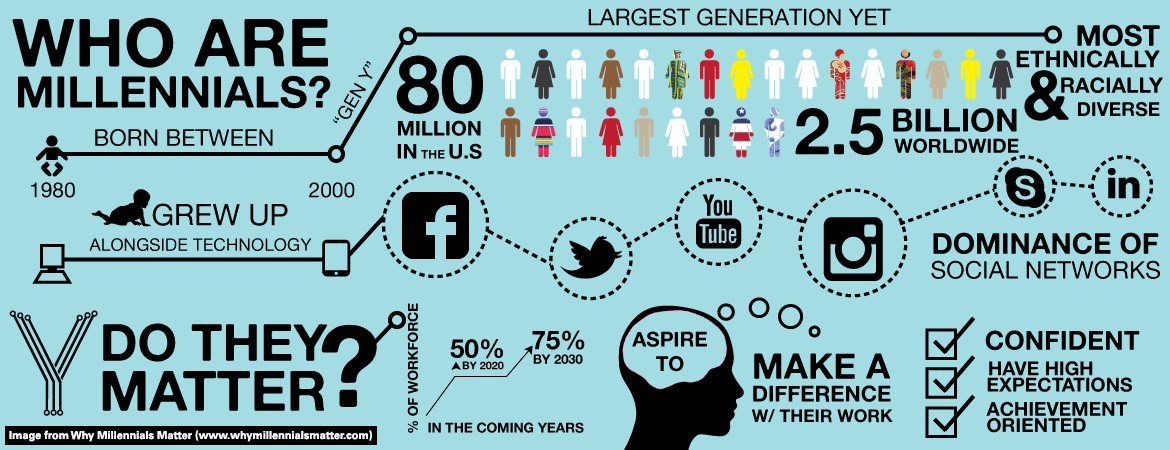

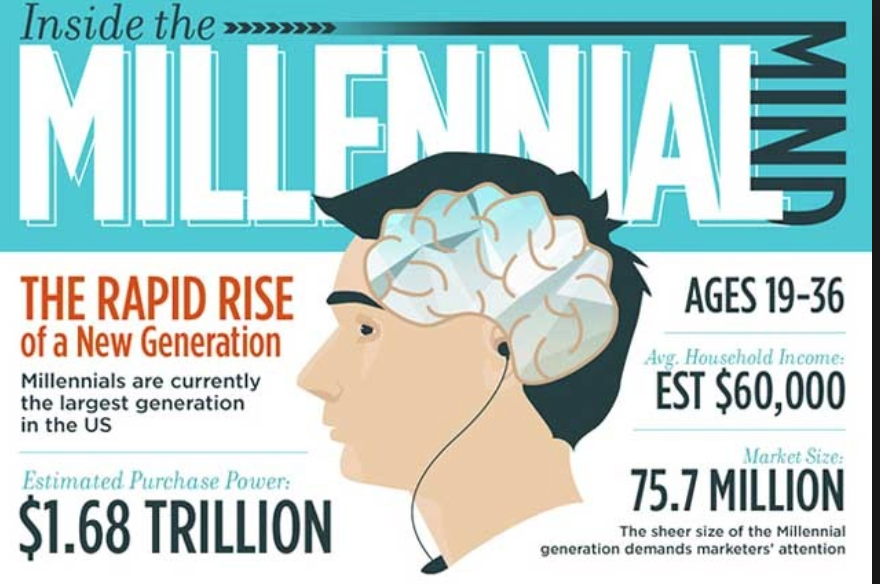

OLDER AMERICANS ARE SLOWEST TO ADOPT CRYPTOCURRENCY  Millennials, or America's youth born between 1982 and 2000, now number 83.1 million and represent more than one quarter of the nation's population. Their size exceeds that of the 75.4 million baby boomers, according to new U.S. Census Bureau estimates released today. (June 15, 2015 US Census).  Graphic: whymillenialsmatter.com ACCORDING TO RECENT ARTICLE IN FINDER.COM: Most people haven’t bought into virtual currencies because of a lack of interest or practical need. Cryptocurrencies continue to push their way into mainstream society, serving up attention-grabbing news headlines and stirring regulatory controversy at the highest levels of government and consumer protection. Despite their sudden rise in popularity and constant discourse on social media channels and online forums, the overwhelming majority (92.05%) of Americans do not actually own any digital currencies, according to a recent survey of 2,001 American adults commissioned by finder.com and carried out by Pureprofile in February. Of those respondents who haven’t purchased crypto, less than one in 10 (8%) have plans to do so in the future. Two-fifths (40%) of those who haven’t bought virtual currencies revealed that they chose not to because they were disinterested in them or felt that there was no practical need to hold these types of assets. A similar proportion (35%) claimed that the risks were too high, while a little over a quarter (27%) suggested that the industry and cryptocurrencies themselves were too difficult to understand. Almost one in five (18%) respondents were hesitant to buy into the current craze because they believed it was a scam or fraud. Some Americans (16%) are waiting for what they believe is a bubble to burst. A number of economists have suggested that this theory will come to fruition at some point in the near future. Around one in 10 (11%) respondents said crypto was too complicated and fewer still (6%) think that there are too many fees involved. However, the median transaction fee for bitcoin trades fell to a 10-month low of $0.52 towards the end of February, after peaking at an all-time high of $34.09 in late December last year. In response, a raft of popular exchanges trimmed their fees for bitcoin withdrawals, while blockchain congestion has also lessened. Crypto is very much a millennial’s game, with almost one in five (17%) owning digital currencies. In contrast, only half as many (9%) Gen X respondents and a very small proportion (2%) of baby boomers can say the same.  Graphic: Single Grain Marketing The most popular cryptocurrencies among Americans The leading cryptocurrency is the most well-known – bitcoin – with 5% surveyed owning an average $3,453.89. The runner-up was Ethereum, with 2% of those surveyed owning an average $1,243.42 worth of the coin. Of those respondents who do own cryptocurrency, more than half (54%) chose their particular coin or token because they did their own research. These same crypto owners are twice as likely to have completed their own research than rely on the coin’s social media sentiment or presence (27%). Two in five (40%) holders appear to have factored in their coin’s presence among news reports when making their decision on whether or not to buy, and a similar proportion (42%) simply followed the crowd and bought what was popular. BITCOIN IS A MILLENIAL STORY Tom Lee, the co-founder and strategist of the Fundstrat market research company, claimed that the value of the leading cryptocurrency Bitcoin will continue to rise. The cryptocurrency will achieve substantial gains because the millennial generation is interested in it, according to Lee. He added that the way millennials will power Bitcoin today is similar to how the baby boomers bolstered the stock market in the 1980s. In an interview with CNBC’s “Squawk Box” on Dec. 12, 2017, Lee claimed that the millennials are very interested in digital businesses, social media and Bitcoin. He further stated that the population group still has over 20 years to go before its numbers peak. "I think what viewers have to appreciate is, this is a millennial story. The average millennial is 25 today. The boomers were 25 in 1982, so what did the boomers drive from 1982 to the peak population of the boomers, which was '99? The S&P 500…Millennials have great interest in digital businesses, social media and Bitcoin and the millennial population is not going to peak until 2040." Previous predictions from Lee During an interview in October 2017, Lee has predicted that Bitcoin price will continue to rise to reach $25,000 by 2022. During 2017, Bitcoin has posted eye-popping 1,700 percent of growth to hit more than $17,000 per token in December, and if this dynamic continues into 2018, Lee’s prediction might end up not too far off. The launch of Bitcoin futures by the CME Group and the Chicago Board Options Exchange (CBOE) is expected to drive Bitcoin price further and pave the way for the introduction of a Bitcoin exchange-traded fund (ETF), which might further impact the price. This is a compilation from several sources. SOURCES USED Cointelegraph Fundstrat Market Research US Census: - https://www.census.gov/newsroom/press-releases/2015/cb15-113.html This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.