Update on my cryptocurrency portfolio, part 2

cryptocurrency·@gargunzola·

0.000 HBDUpdate on my cryptocurrency portfolio, part 2

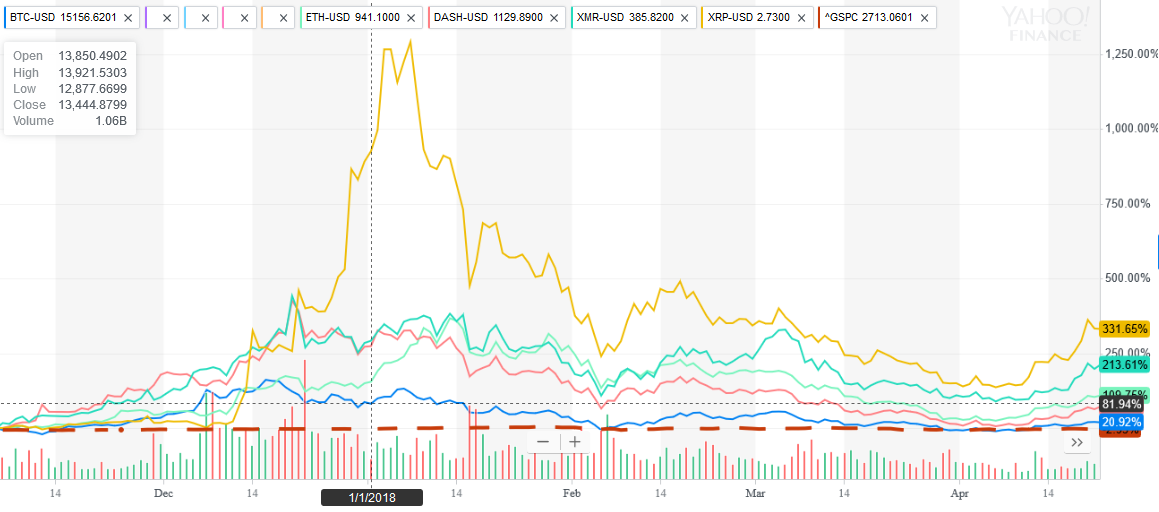

It's been about 4 months since the last [update on my cryptocurrency portfolio](https://steemit.com/cryptocurrency/@gargunzola/update-on-my-cryptocurrency-portfolio). Much has happened in the crypto world, so we should all have a fire-sale and get back into more legitimate investments, right? Well, not really. For this post, I'm only going to chart the cryptocurrencies that I chose for my portfolio. In reality, I only bought Bitcoin and Ethereum, so you can consider only those two if you like. This is the chart for all five cryptocurrencies over the past 6 months:  Here is the chart for only Bitcoin and Ethereum over the past 6 months:  In those charts, I included the S&P 500 as a benchmark. It's the red dash at the bottom that looks like a flat line. I inserted a line at 1 January 2018 since this is around the time that I last gave an update on my portfolio. Things don't look so great for Bitcoin from that date, but Ethereum is still looking good. ## What can we learn from these mystical charts? * Compared to the S&P 500, which for lack of a better term represents Mr Market, **my selected cryptocurrencies have all done remarkably well during** the past 6 months. They're all in the green! * For the sake of full disclosure (or fool disclosure, perhaps), **reckon only Bitcoin and Ethereum**. Despite the volatility, you would have still made ridiculous amounts of gains during the past 6 months. * If this kind of volatility makes you nervous, you're not alone. **Volatility should make you nervous, so diversify**. That's why I advise to [protect the principle](https://steemit.com/cryptocurrency/@gargunzola/protecting-your-money-how-to-protect-the-principal). In my overall portfolio, I have an index tracker that constitutes the biggest slice of the pie. Cryptocurrencies constitute only 10% of the overall portfolio, and 90% of my portfolio is far less volatile and risky. * I don't know about you, but I'm still going to **HODL**!