Build A Crypto Portfolio That Will Stand The Test Of Time

cryptocurrency·@getonthetrain·

0.000 HBDBuild A Crypto Portfolio That Will Stand The Test Of Time

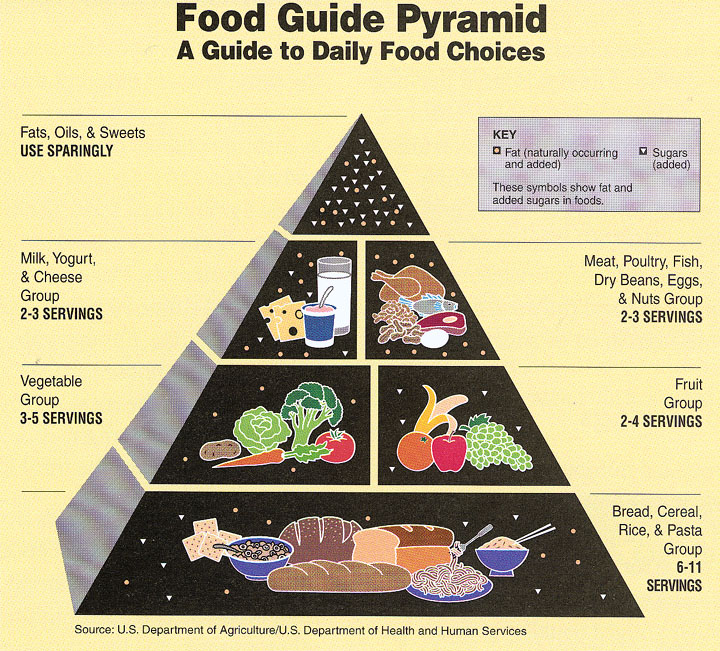

<center></center> <h1>How Do You Build A Crypto Portfolio Pyramid?</h1> I find wealth building and investing to be fascinating for many reasons. Firstly, you begin to see the world differently. You notice opportunities and trends that float right on by those that don’t invest. Secondly, you get to see how powerful investing can be. You can <a href="https://steemit.com/money/@getonthetrain/2017-net-worth-increase-72-103">earn more in one year</a> by investing that you can by work. The increases to your net worth can be substantial and allow you to retire early, should you choose to do so. Third, there are just so many ways to build wealth that no one way is correct. It is this last bit that I want to expand on today. One way that you can build up a crypto portfolio to stand the test of time – a pyramid! No, not a <a href="https://steemit.com/cryptocurrency/@getonthetrain/scam-alert-profitable-morrows-ponzi-scheme-another-bitconnect-like-scam-do-not-invest">pyramid *scheme*</a> (que BITCONNNNEEEEEECCTT!). But to use the powerful strength of a pyramid to create lasting crypto wealth. <hr> <center></center> <h2>THE FOOD PYRAMID</h2> Back in my school days we all learned about the food pyramid. It went something like this; The base of the pyramid is your healthy carbohydrates – grains like rice, bread, or pasta. Because your body burns this for energy they make up the bottom of the pyramid and are the largest portion of your diet. Next tier up are your fruits and veg. Important for the vitamins they provide, they should be eaten every day but in a slightly smaller amount than the grains. The third tier is your dairy and protein consumption. Important nutrients, but you don’t need as much of them. Lastly is the very top, your fats, sugars, and oils. To be eaten rarely. You can build your crypto holdings the same way and enjoy the strength that a balanced investment portfolio achieves. <hr> <center></center> <h2>Crypto "Grains" – 40%</h2> These coins will form the base of the pyramid and so we are looking for long-term strength. We are not expecting them to double overnight, but neither will they crash to zero. Just like how a marathon runner might eat a plate of pasta the night before the race, we are loading up on coins that will remain a key part of the market well into the future. However, nobody knows exactly what the future holds so we have to have a few stipulations on what we include here. <h4>1: The coin must have been around for at least two years</h4> The crypto market is very young, all things considered, with much of the latest coins being created within the last year or so. This means most are untested. I’m not saying that any coin under two years old is bad, just that it doesn’t belong in the base of the pyramid – yet. <h4>2: The coin must be globally used</h4> Sorry, that coin that is really popular in Korea but nowhere else in the world won’t make the cut here. We are looking for worldwide popularity as it shows diversity. Diversity helps to mitigate risk. For example, say that Korea decides to clamp down on crypto then that one coin popular there will be hurt greatly. A globally used coin might take a small hit, but it will keep on going. <h4>3: The coin must serve a key societal need and have made large progress towards that goal</h4> Words can get a coin moving in the short-term, but action always wins out in the long-term. This is the base of the pyramid, the long-term is all we have room for here. We are looking for a moat, and you cannot just talk a moat into existence. Only <b>action</b> *(not words)* will provide the security that the coin will not lose market share. In short, we are looking for the coins that might not grow so fast but will surely be used by a large portion of the crypto market in the years to come. If you think in stock market terms, these are your "blue chip" coins. <hr> <center></center> <h2>Crypto "Fruits and Veg" – 30%</h2> This category is crucial for your crypto portfolio to run properly and grow but don’t meet all the criteria to be in the base of your pyramid. These coins are your “up and comers.” Maybe they haven’t been around long enough, or they are not widely adopted yet but you believe that the team behind the coin can solve the problem the coin is aiming to fix. So these coins have great long-term prospects that haven’t been proven – but your research shows that the chances of success are high enough to buy in. These coins should grow at a more aggressive pace than the “grains” giving your portfolio a great return, but with increased risk. Ok, so these two categories of crypto should take up 70% of our pyramid. Much like the food pyramid, we can do quite well with just those two coin groups. This is because those tiers are the most important. Next up we add a little bit of flexibility to our crypto diets. <hr> <center></center> <h2>Crypto "Protein and Dairy" – 20-25%</h2> This level of the pyramid are your short-term holdings. Coins that have a short-term catalyst or momentum. Coins to buy, ride the wave, and then sell. Trading coins. While this tier is not required, it can add a large amount of profit should you know how to handle trading them. I don’t mind if you prefer to avoid this tier, you can just as easily “buy and hold” more of the coins you identified as strong long-term contenders. Many people in the crypto market of today like to trade, and this is the tier to do so. The most important thing to understand is that you need to have the first two tiers in place! Your base and your growth prospects need to be solid before you start trading in this tier. Otherwise one bad trade can wipe out a large chunk of your money. <hr> <center></center> <h2>Crypto “Sweets” – 5-10%</h2> The very top of the food pyramid is your fats and sugars – basically your candy and junk food. You don’t need any of this to live, but it sure is fun to eat. In the crypto field, these are your pure speculation coins. Maybe you just have a hunch that this obscure and lightly traded coin is going to gain 10,000% in a week and you want to take advantage of that. It’s fun to think about, right? However, these are just treats that should not make up a large percentage of your holdings. While a few coins might see huge gains, many are destined to remain in the dregs. So just like it might be fun to have an ice cream cone or a candy bar every once in a while, you don’t want to base your whole diet on it. So for a healthy crypto portfolio, keep this amount under 10% at most. Before any investment in this category, you should ask yourself *“Am I OK if I lose everything here?”* <h2>Conclusion</h2> - Base coins – 40% - Growth coins – 30% - Trading coins – 25% - Speculative coins – 5% Using the crypto pyramid is just one method you could use to blueprint your crypto investments, but is far from the only way. I wanted to show people one more option that they have and if you think this is a valid structure please let me know in a comment below. My hope is that this example will help you align your portfolio is with your crypto investment goals. By defining your goal, and following through with an appropriate plan – whatever you decide - you will maximize your success as an investor. Food for thought.

👍 getonthetrain, tpvoter1, taukproung85, mitchelljaworski, sclazy, stokjockey, lesliestarrohara, sulev, roxane, jimitations, nepalipahad, revisesociology, sebastianjago, oleg326756, abh12345, fitinfun, builderofcastles, juanmiguelsalas, logic, brianphobos, bmwrider, startdominating, theroadtoriches, hartfloe, crypto-trail, carrinm, hanamana, vieira, musamalijames, stripnus, dedicatedguy, robertandrew, blog-beginner, moon32walker, wandereronwheels, aburmeseabroad, cathynsons, jona12, thedawn, ace108, rea, clivingston005, scaredycatguide, ezzy, nafazul, walterjay, mindfulthoughts, acehdalam,