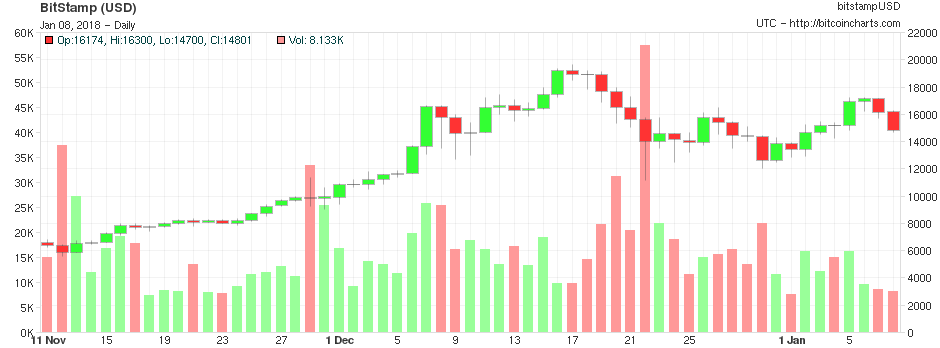

Bitcoin Faces Bearish Move as Prices Drop Towards $15K 8/1/2018

cryptocurrency·@goharmughal·

0.000 HBDBitcoin Faces Bearish Move as Prices Drop Towards $15K 8/1/2018

Bitcoin is looking powerless today after costs neglected to hold above $17,000 levels at the end of the week. Coindesk's Bitcoin Price Index (BPI) tumbled to a low of $15,253 prior today and was most recently seen exchanging at $15,345 levels. As indicated by information source OnChainFX, bitcoin (BTC) has devalued by 8.86 percent over the most recent 24 hours. Prominently, fears of a China crackdown on bitcoin mining may have debilitated the offered tone the world over biggest digital currency by advertise capitalization. Caixin Global revealed a week ago that nearby controllers in China may not longer offer marked down power and expense reasonings to mining organizations. Further, a spilled archive now proposes that China's best web back controller is asking for that neighborhood governments push bitcoin-mining operations towards an "efficient exit" from the business. Given that China is the world's capital of bitcoin mining, and records for more than 66% of the world's preparing power dedicated to the way toward securing the system, such moves – if turned out to be bona fide – could convey more strain to costs of the cryptographic money. The specialized diagram additionally demonstrates an expanded danger of a bearish breakdown. bitcoin chart The above outline (costs according to Coinbase) appears: Bear hail – a bearish continuation design. A drawback break – i.e. a nearby underneath $14,460 (signal help) – would show the remedial rally from the low of $10,400 (Dec. 22 low) has finished and the auction from the record high of $19,891 has continued. The relative quality file (RSI) is back beneath 50.00 (bearish domain). Since Dec. 21, exchanging volumes have stayed well underneath the 30-day moving normal. A sharp ascent in volume on negative value activity (today) would help chances of a bearish breakdown in costs. View A high volume bearish banner breakdown (close underneath $14,460) would open entryways for a drop to $10,400 (Dec. 22 low). An infringement there would uncover the following help arranged at $9,965 (100-day MA). Bullish situation: Only an upside break of the banner would resuscitate the bull run and move chance for rally to crisp record highs above $20,000.