The Cryptocurrency Mining Craze That Has Boosted AMD and Nvidia May Be Weakening

bitcoin·@hamzayousaf·

0.000 HBDThe Cryptocurrency Mining Craze That Has Boosted AMD and Nvidia May Be Weakening

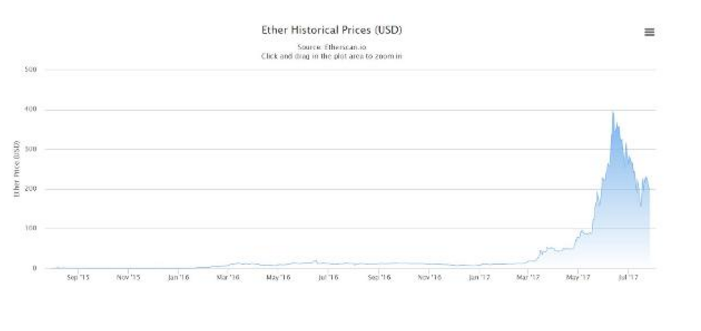

AMD Inc.'s (AMD) strong second-quarter earnings report provided additional evidence that Ethereum mining activity has provided a major boost to global GPU sales. But there are already signs that the craze is waning, and that AMD was quite justified in taking a cautious approach to forecasting its mining-related sales for the coming months. Unlike Bitcoin, which is now mostly mined using specialized chips (ASICs), Ethereum -- the blockchain technology underpinning the Ether cryptocurrency -- was built from the ground up to be friendly to GPU mining. That led mining-related sales of graphics cards running AMD's mid-range Radeon RX desktop GPUs to soar in recent months as Ether prices took off. Some miners are relying on cards optimized for mining, such as Asus' Mining Series cards, but many are using general-purpose hardware. Sales of certain mid-range Nvidia Corp. (NVDA) GPUs, such as the GeForce GTX 1060 and 1070, have also gotten a boost. But overall, AMD's cards are more popular with miners. And from a financial standpoint, the fact that AMD's quarterly sales are over 30% lower than Nvidia's means that its top line receives a greater benefit (on a percentage basis) from a given amount of mining-related sales. Demand among certain large-scale miners still appears to be pretty strong -- especially in places like Russia and China, where lower electricity costs improve mining's economics. A recent Quartz column noted that some large-scale miners are even resorting to leasing Boeing 747s to procure graphics cards. But it looks as if enthusiasm among small-scale miners has begun declining. Last week, Vice's Jason Cross observed there has been a major uptick in recent weeks in the number of Ethereum mining PC rigs being listed in eBay, as well as in the number of AMD graphics cards being unloaded by miners. "I was going to build a mining rig but realized it was not going to be profitable." one eBay seller offering an AMD RX 580 card told Cross. One sign that the craze still has some legs: RX 580 cards still sell for major premiums to the $229 MSRP they were given in April. New non-auction eBay listings still generally feature $325-plus prices, with some cards listed for over $400. But compared with three weeks ago, when cards were typically selling for over $400, things have cooled off a bit. Why is interest cooling off? Slumping Ether prices are one obvious factor. After soaring from less than $10 in early January to nearly $400 in mid-June, Ether is now trading near $200. Bitcoin has also cooled off a bit since mid-June, but not as dramatically.  Ether's price is well off its June highs. It also hasn't helped that Ethereum transaction activity, after skyrocketing from early March to late June, has been declining lately. Etherscan reports seeing 225,435 Ethereum transactions on July 27th, well below a June 26th peak of 316,788. Miners get paid for the work they jointly do to validate and secure Ethereum transactions -- many involve buying/selling Ether, while others involve Ethereum smart contracts -- by means of small transaction fees (usually much less than $1 per transaction) and a tiny fraction of the roughly new 36,000 Ether units (current value of over $7 million) that are created each day. Meanwhile, due to the nature of blockchain-based cryptocurrencies, Ethereum mining has become much harder computationally as more transactions have been processed and more miners have arrived to compete to process new transactions. Etherscan's data indicates the difficulty of mining a given amount of Ether has grown by a factor of 16 since the start of 2017, and by more than a factor of four over the last three months.  It's a lot harder to mine Ether than it used to be. Greater mining difficulty and declining prices make for a bad mix, even if transaction activity was to remain healthy. Cross, doing some back-of-the-envelope math, estimates that a $300 RX 580 card that may have paid for itself in 2-to-3 months after factoring electricity costs when Ether prices were near their peak "will now take over 6 months, at best." And that doesn't account for whatever value small-scale miners assign to the time they have to spend setting up and operating their mining rigs. After briefly causing shortages, graphics card demand from Bitcoin miners plummeted in 2014 as Bitcoin prices fell sharply and mining continues getting computationally harder. AMD seems well-aware that history could repeat. On the Q2 earnings call, CEO Lisa Su insisted the gaming market remains the main priority for AMD's GPU business, and that it isn't "looking at it as a long-term growth driver." She added AMD is "being conservative in [its] estimates" for what mining-related demand will be like in Q4. AMD and Nvidia both, of course, have plenty of avenues for growth besides cryptocurrency mining, in their GPU businesses and elsewhere. Investors just shouldn't be shocked if sales for this particular part of their GPU businesses take a tumble.