Bitcoin's Steep Drop: Analyzing Key Indicators Behind the Decline

teammalaysia·@hooiyewlim·

0.000 HBDBitcoin's Steep Drop: Analyzing Key Indicators Behind the Decline

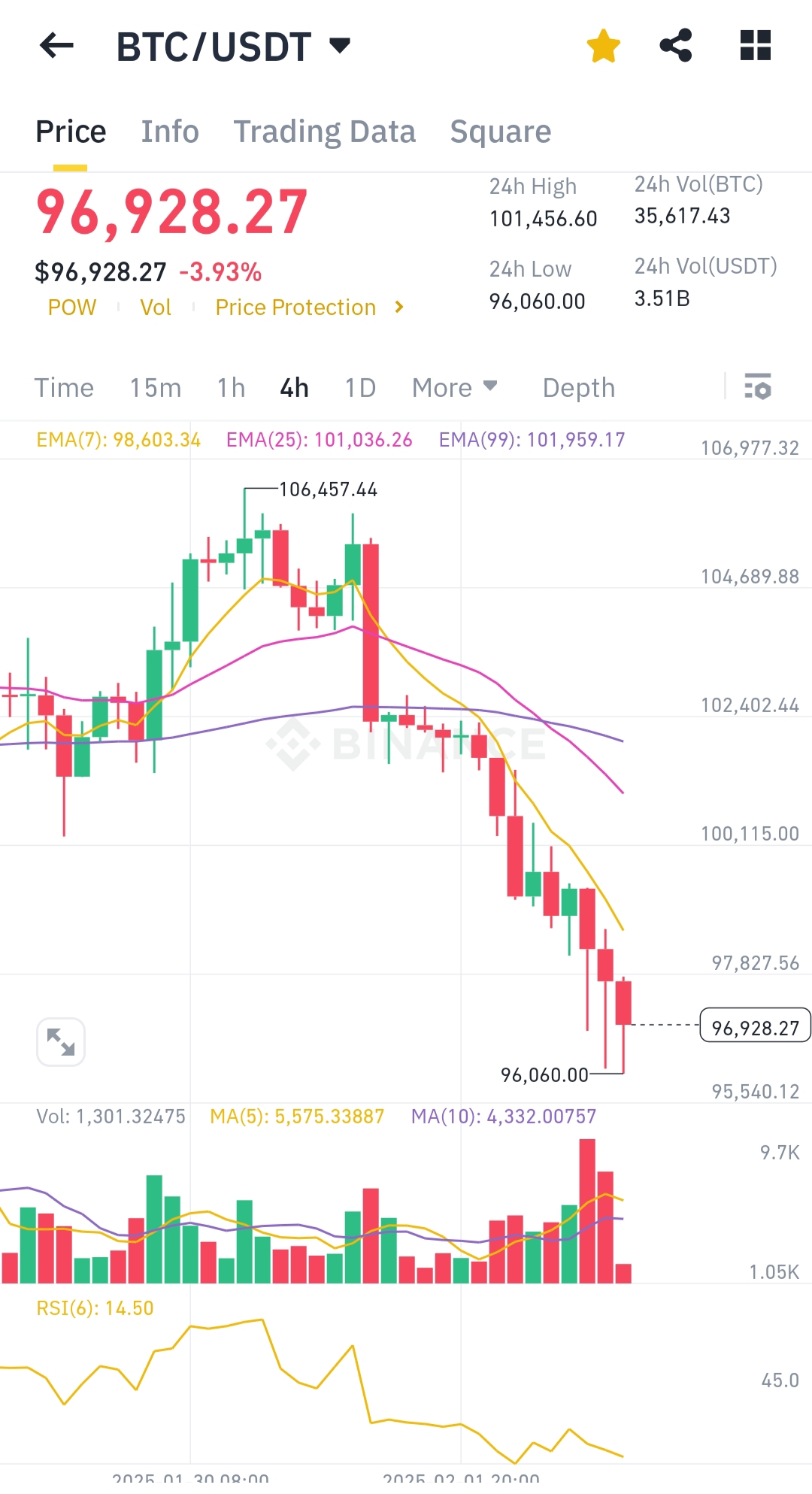

**Technical Analysis:** 1. **Trend and Price Movement**: - Bitcoin (BTC) has fallen sharply to $96,928.27, registering a **-3.93% decline in 24 hours**. - The price broke below the **7 EMA ($98,603.34)**, **25 EMA ($101,036.26)**, and **99 EMA ($101,959.17)**, signaling a **strong bearish trend**. 2. **Support and Resistance**: - The **24-hour low** is $96,060, indicating potential near-term support. - The **24-hour high** of $101,456 shows strong resistance above. 3. **Volume Analysis**: - High sell volume is evident, particularly in the last few 4-hour candles, reinforcing bearish momentum. 4. **RSI (Relative Strength Index)**: - RSI at **14.50** is in the oversold region, suggesting the market is heavily dominated by sellers. A potential rebound may occur if buyers step in. 5. **Key Catalysts for the Decline**: - Breaking below **psychological levels ($100,000)** triggered panic selling. - Broader market sentiment or external macroeconomic factors could be driving selling pressure. - High leverage liquidations may have accelerated the fall. **Conclusion**: Bitcoin's rapid decline is driven by strong bearish momentum, breaking below critical support levels, with oversold RSI signaling possible near-term recovery. Tight risk management is crucial for traders in this volatile environment.

👍 endhivewatchers, poeticammo, curie, waivio.curator, amphlux, clpacksperiment, arunava, coindevil, yoghurt, jennyferandtony, palimanali, mejustandrew, straykat, marc-allaria, outtheshellvlog, minerthreat, dawnoner, yadamaniart, stayoutoftherz, leomarylm, qberry, robmolecule, aicoding, machan, azj26, balabambuz, humbe, kaylinart, dhimmel, aboutyourbiz, jayna, sunisa, dynamicrypto, edithbdraw, cosplay.hadr, tawadak24, albuslucimus, ghostlybg, thewobs94, jacor, michelle.gent, amberyooper, stickchumpion, adelepazani, bil.prag, multifacetas, dcrops, aries90, diabolika, double-negative, hairgistix, baltai, trippymane, blingit, whitneyalexx, justyy, ohamdache, sustainablyyours, improv, dandesign86, empath, mhel, meno, myach, steveconnor, sco, fineartnow, didic, koenau, therising, me2selah, tfeldman, zerotoone, melvin7, vcclothing, vittoriozuccala, cheese4ead, tggr, atexoras.pub, newilluminati, netvalar, baboz, samminator, pepskaram, torico, kenadis, gordon92, steem.services, kylealex, the.success.club, proxy-pal, monica-ene, altleft, meritocracy, zanoz, whywhy, cryptosneeze, elgatoshawua, limn, rhemagames, boynashruddin, minnowbooster, minnowpowerup, bigdizzle91, carn, superlotto, steemegg, bluemaskman, noalys, hadrgames, traderhive, mugueto2022, steemiteducation, greddyforce, talentclub, ilovecryptopl, anafae, evagavilan2, the-burn, bennettitalia, jigstrike, musicvoter2, bflanagin, samsemilia7, historiasamorlez, quinnertronics, mayorkeys, noctury, jhymi, modernzorker, investingpennies, cryptononymous, sunsea, jjerryhan, zipporah, dailyspam, cliffagreen, witkowskipawel, epicdice, jessicaossom, yixn, metroair, rt395, zyx066, zmx, irgendwo, putu300, c0wtschpotato, armandosodano, yaelg, steemcryptosicko, steemean, mmckinneyphoto13, prosocialise, cloh76, lemouth, boxcarblue, federacion45, bitrocker2020, gunthertopp, battebilly, bscrypto, frissonsteemit, flyerchen, palasatenea, iamsaray, aicu, hiveonboard, failingforwards, kryptof, finkistinger, neumannsalva, rocky1, stahlberg, videosteemit, cryptocoinkb, nateaguila, endersong, rencongland, h3m4n7, belug, growandbow, hd-treasury, michelmake, trautenberk, chipdip, driptorchpress, russellstockley, doctor-cog-diss, steemed-proxy, torkot, juancar347, schoolforsdg4, decomoescribir, broncofan99, qwerrie, dresden.theone, sportscontest, detlev, enjar, therealwolf, tazbaz, dejan.vuckovic, gabrielatravels, positiveninja, movingman, acgalarza, jijisaurart, janwrites, llunasoul, isaaclim, sahil07, joeyarnoldvn, tobias-g, smartsteem, ausbit.dev, tinyhousecryptos, chasmic-cosm, gloriaolar, travelgirl, kiemurainen, kimzwarch, danielwong, littledrummerboy, ssg-community, goblinknackers, acantoni, psychkrhoz, senstless, bdmillergallery, thisismylife, cornerstone, ibt-survival, forykw, mproxima, sanderjansenart, robibasa, reggaesteem, hivecoffee, holovision.cash, shawnnft, scooter77, pladozero, jerrybanfield, bigtakosensei, inthenow, uche-nna, sevenoh-fiveoh, wasined, peaceandwar, hooiyewlim, drifter1, buttcoins, iptrucs, aiziqi, mariusfebruary, lettinggotech, danaedwards, shinedojo, vegan.niinja, portugalcoin, marcoriccardi, kieranstone, nfttunz, afifa, eric-boucher, nicole-st, eternalsuccess, chrisdavidphoto, nwjordan, holoferncro, kalivankush, bluefinstudios, m1alsan, gamersclassified, willielow,