The Year of 3 Yellow Assets: Bitcoin, Gold & PolyCUB

hive-167922·@idiosyncratic1·

0.000 HBDThe Year of 3 Yellow Assets: Bitcoin, Gold & PolyCUB

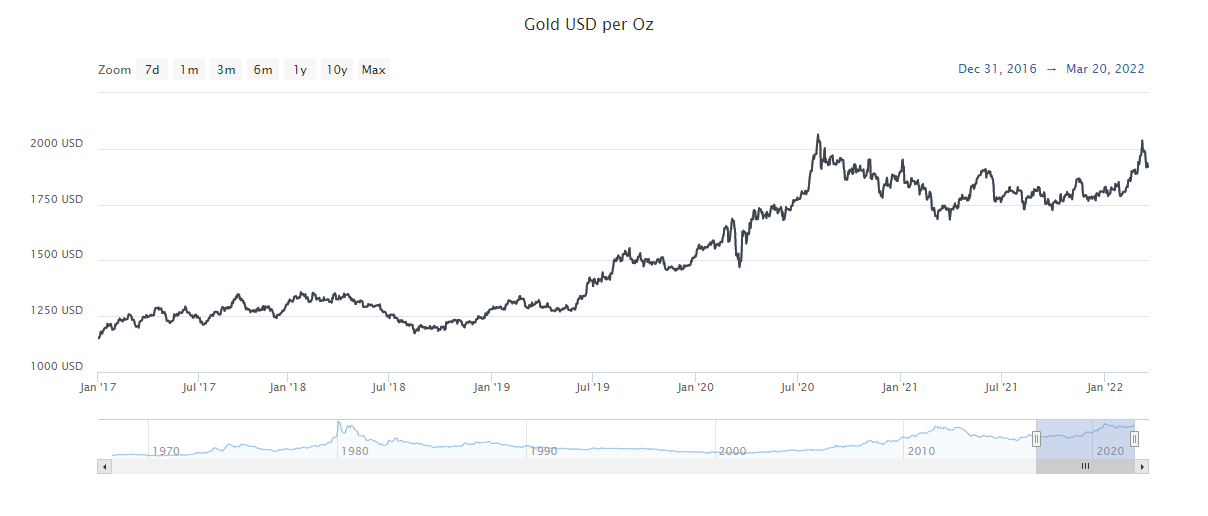

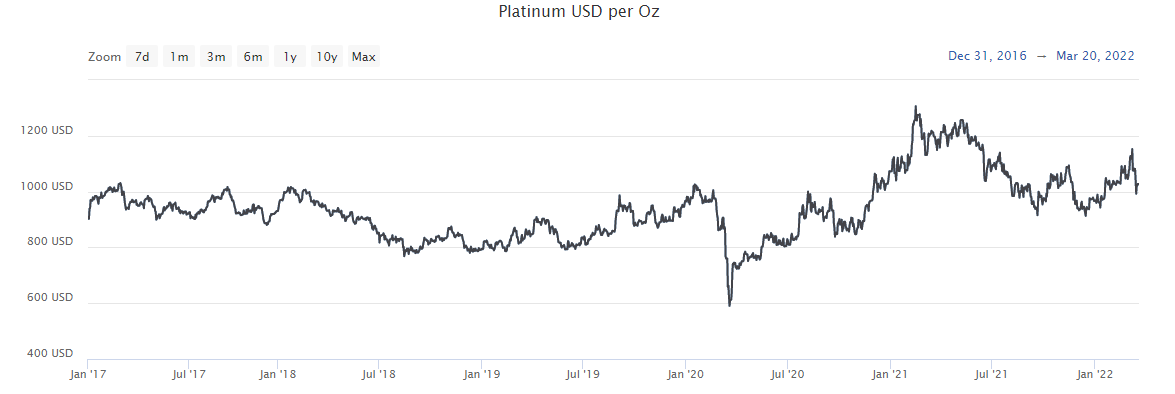

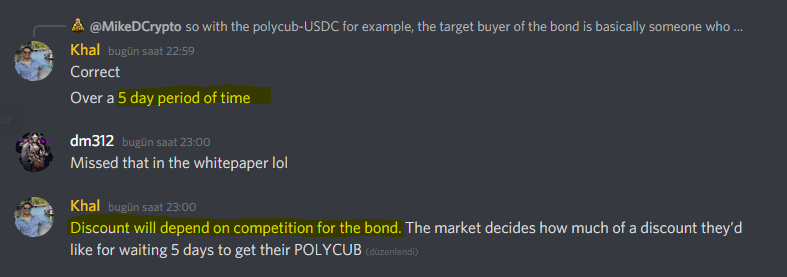

The whole world is dealing with the growing threat of inflation on the fragile economies. Even though slightly increasing prices may not look scary at the first stage, it drains up your budged in a sneaky way.  Now that the inflation is going to be in the top 3 problems of the world along with war and pandemic (!), we may need to take some more cautious to sustain our life quality. Meanwhile, the limited cap & deflationary assets become more valuable as they are exactly opposite to the monetary experiment that the world economies are in. My individual plan is basically on preserving my purchasing power and saving assets that have intrinsic value. Let's discuss why these **3 Yellow Assets** may help me achieve my goal. ### Bitcoin - a.k.a. Digital Gold The price of Bitcoin has become less volatile as the players in the crypto ecosystem and the liquidity that they bring increase gradually. Even though the **market cycle** of cryptocurrencies may be one of the fundamental reasons of the valuation of the cryptocurrencies, they are like hyperactive child with high IQ. Since the crypto ecosystem brings brand new products that had never existed before, they are always likely to be popular and hyped anytime. Consider the rise of DEXs, NFTs, De-Fi, GameFi, Social-Fi and Metaverse concepts, how often can other stocks bring brand new things to fix a problem? Leading the crypto pack, Bitcoin has been accumulating power and waiting for the right time to show up once again. The right time? Yeah, [Before and After March](https://leofinance.io/@idiosyncratic1/fud-fed-and-crypto-before-and-after-march-2022) would never be the same considering FED, War, Inflation in the world. As of writing, I'm proud of ourselves by spotting the time in the light of the things happening in the world. Even if we may not see another ATH with this or that reason in 2022, crypto itself became an inseparable part of our lives thanks to the fancy words "Metaverse" and "Web 3.0" ✌ ✔ Accumulation ✔ Inflation ✔ Mass-adoption = 🐂 in crypto ecosystem. ### GOLD - Global Risk Lover I believe Gold should represent the precious metals just like saying Bitcoin to mean the rise of crypto with another bull-run. Gold, Silver, Platinum and their brother will be **"more precious"** metals than before 🤏 Let's see the charts by using [Denvergold](https://www.denvergold.org/precious-metal-prices-charts/) #### Gold since 2017  #### Silver since 2017  #### Platinum since 2017  Do you see the drop in 3 of the charts in the mid of March 2020? It was the day when the market crashed due to the pandemic. Yet, you can clearly see what took place within 2 years. I believe it is the tip of an iceberg. ### PolyCUB - Deflationary Asset of CUB family CUB Finance on BSC, PolyCUB on Polygon and CUB Life in Hive ecosystem. These are the native tokens that work like a piece of puzzle in inter-blockchain CUB projects. In addition to [CUB on BSC](https://cubdefi.com/) that brings auto-compounding, high APR, LeoBridge and Kingdoms, PolyCUB has an amazing feature that is getting scarce every single day. If you are in xPolyCUB staking, you may feel fascinated with PC / xPC ratio. (*as of writing: 1 xPCub = 15.11 PCub*) Beyond the deflationary nature, PolyCUB comes up with Bonding & Collateralized Lending according to [the latest roadmap post](https://leofinance.io/@leofinance/introducing-the-polycub-roadmap-or-xpolycub-bonding-and-collateralized-lending) ### What will these features bring to PolyCUB? > Bonding is an absolute game changer. We're going to see permanent liquidity added to the protocol via POLYCUB-USDC and POLYCUB-WETH bonds. In 5 days period, people will be able to get PolyCUB at discounted prices. The discount rate will be determined by the market as far as @khaleelkazi stated in Discord.  So, you can either buy / swap PolyCUB or buy the bonds with stablecoins and enjoy the discount. Up to you 🦁 Also the xPolyCUB stakes will be collateralized and you will be able to get a loan with your staked asset 🤤 > When it's released, users will be able to stake their xPOLYCUB tokens into the collateralized loan contract and take out a loan from the Protocol Liquidity in exchange. Great products to have a real usecase for PolyCUB! Imagine it through the end of this year when the emmision rate of PolyCUB will be extremely low and the token gets scarce each month 😅 ### TL;DR Gold, Bitcoin and PolyCUB; three yellow assets of my 2022 porfolio. Each of these assets have different narrative and usecase behind to have position in my portfolio to preserve my purchasing power and sustain my life quality. **Bitcoin**, in nature, is against the inflation and the accumulation phase in crypto ecosystem points an upcoming bull-run for the investors. As mentioned earlier, [March](https://leofinance.io/@idiosyncratic1/fud-fed-and-crypto-before-and-after-march-2022) is a critical period for crypto ecosystem considering FED, War, Inflation and many other things. **Gold** and *precious metals* likely to be more precious more or less the same reasons for the rise of Bitcoin. Since March 2020, when the market crashed, the uptrend looks quite promising in the realm of inflation. **PolyCUB**, the youngest of the gang, is the deflationary token that acts like Bitcoin. The token is the part of Polygon Network in cross-chain CUB project. With the recent announcement, there are new usecases established for PolyCUB and xPolyCUb. 1- **Bonding**-> You may buy PolyCUB bond with your stablecoins in a discounted price according the market dynamics 2- **Collaterals** -> Your xPolyCUB can be collateralized for crypto loan while it is still accumulating 🔥 Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@idiosyncratic1/the-year-of-3-yellow-assets-bitcoin-gold-and-polycub)

👍 mariuszkarowski, solairitas, solairibot, gerber, ezzy, exyle, steem.leo, mice-k, dcityrewards, ripperone, reazuliqbal, iansart, felander, unconditionalove, bestboom, steem.services, linco, bobby.madagascar, mfblack, milu-the-dog, triplea.bot, therealyme, ribary, bilpcoinbpc, steem-holder, myupvote2u, pokerarema, pixelfan, fatman, voter003, netaterra, agathusia, oxoskva, hivexperiment, sbi6, yogacoach, holoferncro, forykw, meanbees, onealfa.leo, onealfa, webdeals, summertooth, marketinggeek, dwayne16, oakshieldholding, jacuzzi, senstlessmonster, contrabourdon, leovoter, moonappics, uyobong.venture, hykss.leo, luckyali.leo, onealfa.pob, gimme-your-coinz, take-my-coinz, trasto, onealfa.vyb, bigbraincurator, leprechaun, hitmeasap, rxhector, velourex, r0nd0n, rival, allcapsonezero, nikoleondas, erectus, thisismylife, corporateay, kooza, joseph23, readthisplease, dibblers.dabs, chincoculbert, lordemmy, doziekash, bitsofwisdom, investegg, scooter77, shebe, whiskeyjack1231, topbooster.leo, memeisfun, saboin.pob, l337m45732, hykss, pouchon, lordneroo, ahmadfaraz, meowcurator, meesterbrain, elector, botito, tobor, hadaly, dotmatrix, curabot, stoudi, chomps, freysa, lunapark, weebo, otomo, swissbot, swissapps, quicktrade, buffybot, hypnobot, psybot, bilpcoin.pay, chatbot, psychobot, misery, freebot, cresus, honeybot, quicktrades, droida, hodlcommunity, yefet, vlemon, karinxxl, chekohler, mikitaly, mistakili, aotearoa, uyobong, paragism, minimining, krunkypuram, enison1, jskitty, nulledgh0st, mynima, f0x-society, defi.campus, spirall, jocieprosza.leo, icon-bassey, culgin, vietthuy, liotes.voter, seckorama, achim03, pixiepost, emsenn0, liotes, liotes.fund, horstman5, kemonine, good-karma, esteemapp, esteem.app, ecency, ecency.stats, drax, paulmoon410, listnerds, liotes.ctp, achim03.ctp, ph1102.ctptrail, ctpsb.ctp, globetrottergcc, cruisin, mk992039, curtawakening, hiveghost, rezoanulvctp, lukeisalive, kaseldz, improbableliason, luckyali.ctp, samseny, bradleyarrow, frankydoodle, noloafing, mytechtrail, ericburgoyne, opeyemioguns, citimillz, hive-112281, happyvoter, mybiel, ph1102.ctp, flaxz, danewilliams, liotes.leo, maddogmike, uwelang, edprivat, iamraincrystal, rubido, djsl82, evegrace, gurseerat, guurry123, solymi, ph1102, prideofleo, leoalpha, jk6276, ga38jem, hamza-sheikh, mister-eagle, brofund-leo, limka, opinizeunltd, paasz, steem-key, whatsup, mikedcrypto, hivebuzz, lizanomadsoul, manncpt, globalschool, mammasitta, leo.voter, dante31, thauerbyi, gallerani, megavest, leo.bank, rmsadkri, netaterra.leo, leo.tokens, elongate, brainstommer, leofinance, ykretz, amongus, creodas, broadhive-org, khaltok, ahmadmanga, khalil319, hibbi, coinlogic.online, filip-psiho, flyingbolt, bahagia-arbi, ross92, cielitorojo, elgatoshawua, ew-and-patterns, shortsegments, xleo.voter, saboin.leo, babytarazkp, travelwritemoney, cryptololo, rainingfall, beehivetrader, funt33, zdigital222, ergheiz4853, finguru, muratkbesiroglu, trans-juanmi, poorchard01, gungunkrishu.leo, automaton, bagofincome, lamprini, steliosfan, williamtboy, vxc.leo, engioi, magnacarta,