The Volatility Daily - 01/19/20: Buy Pick - Ethereum Classic!

cryptocurrency·@joshdrummer15·

0.000 HBDThe Volatility Daily - 01/19/20: Buy Pick - Ethereum Classic!

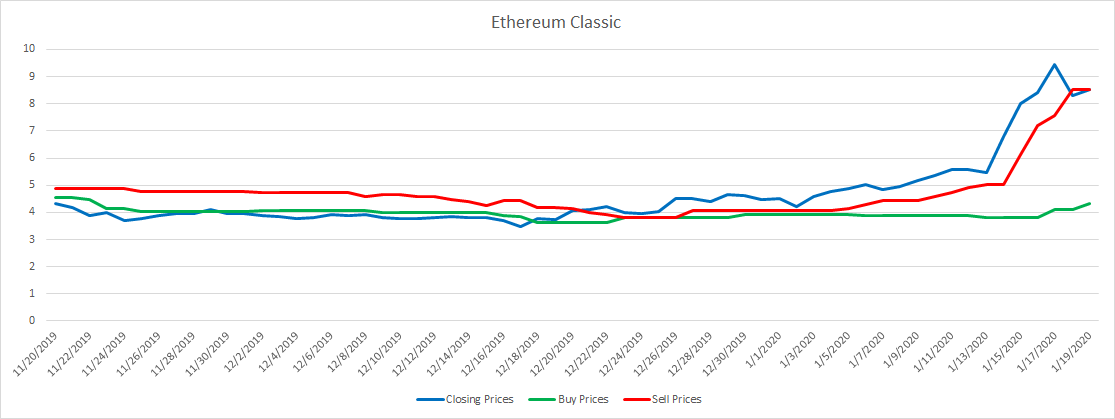

.png) Hey, what's up guys? Sorry I'm late on this one again. Here is today's buy pick and our sell signals! Note About These Charts: Straight Green Line = Buy Line Straight Red Line = Sell Line Buy Signal = When price line crosses above both the Buy Line and Sell Line Sell Signal = When price line crosses below the Sell line Signals are generated at midnight UTC Time *Today's Buy Pick:* **Ethereum Classic**  Today, Ethereum Classic once again closed just above the sell line as of midnight UTC time after being below it for a day. We already had a previous position in this, but let's buy this again at the current price of $8.35. *Today's Sell Signals:* Today we have no sell signals since all our picks are above the sell lines! *Current Returns* EOS (Bought at $2.54 on 12/23) - 142% Bitcoin Position 1 (Bought at $7,296.42 on 12/27) - 119% Basic Attention Token (Bought at $0.192247 on 12/29) - 112% Neo (Bought at $8.84 on 01/01) - 126% Ren (Bought at $0.035216 on 01/02) - 120% Bitcoin Position 2 (Bought at $7,317.36 on 01/03) - 119% Ethereum (Bought at $144.20 on 01/06) - 115% Chainlink (Bought at $2.14 on 01/07) - 122% 0x (Bought at $0.208368 on 01/11) - 113% XRP (Bought at $0.214603 on 01/12) - 108% BitKan (Bought at $0.001918 on 01/13) - 115% Decentraland (Bought at $0.033249 on 01/14) - 107% Verge (Bought at $0.003925 on 01/15) - 96% Raiden Network Token (Bought at $0.121064 on 01/16) - 103% XYO (Bought at $0.000265 on 01/18) - 94% *Average of Current Returns* 114.07% *Locked in Returns (Last 50 Positions)* Decred - 131% NEO - 97% Emercoin Position 1 - 82% Pillar - 80% SingularityNET - 89% Stratis - 92% Horizen Position 2 - 93% Enigma - 92% iExec RLC - 91% NavCoin - 85% Burst - 98% Loopring - 88% Augur - 97% Cardano Position 1 - 94% Maker Position 7 - 96% Horizen Position 3 - 89% Cardano Position 2 - 100% Ripio Credit Network Position 2 - 82% TomoChain - 95% Steem Position 2 - 101% GameCredits - 59% Electroneum Position 1 - 98% Kyber Network Position 1 - 89% Loom Network - 97% ZCash Position 1 - 90% Verge Position 1 - 82% Tezos Position 1 - 170% Electroneum Position 2 - 95% Kyber Network Position 2 - 89% Emercoin Position 2 - 120% Syscoin - 97% Tezos Position 2 - 94% Enjin Coin - 127% PIVX - 96% DigixDAO - 98% Horizen Position 4 - 112% Horizen Position 5 - 116% Kin - 100% SALT - 89% TomoChain - 132% Lisk - 97% Aave - 109% Horizen Position 6 - 112% Zcash Position 2 - 100% Telcoin - 93% XRP Position 1 - 101% Ethereum Classic - 209% Dash - 215% Zcash Position 3 - 166% Polymath - 98% *Average of Locked-In Returns* 104.44% *Average of all Return Types* 109.26% Thanks for reading this edition of The Volatility Daily and stay tuned for more picks, more return data and more great gains!