Introduction to Crypto - Online Free Course by BitDegree [My Review + Checklist for Analyzing Cryptos]

cryptocurrency·@katerinaramm·

0.000 HBDIntroduction to Crypto - Online Free Course by BitDegree [My Review + Checklist for Analyzing Cryptos]

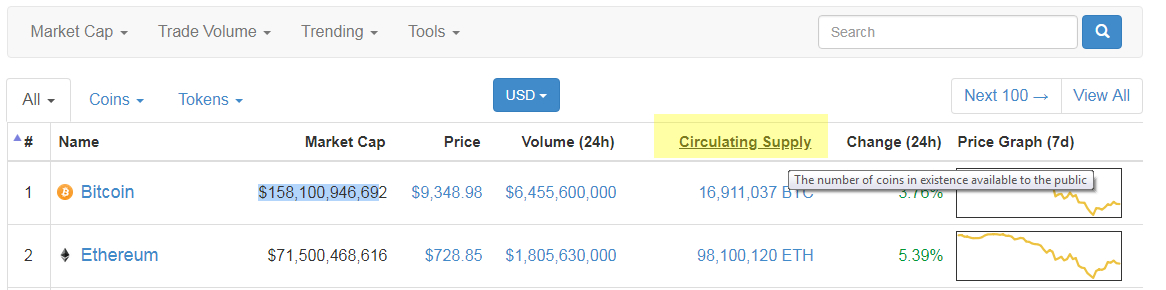

In my [last post about BitDegree]( https://steemit.com/education/@katerinaramm/first-mvp-courses-by-bitdegree-gamified-course-about-solidity-introduction-to-cryptocurrencies-and-more-education-in-the) I informed you about new, online courses that are being published by the [first educational platform]( https://www.bitdegree.org/) built on the blockchain. One of the courses offered is the 8-lecture Introduction to Crypto & Cryptocurrencies, which you can find [here](https://www.bitdegree.org/en/course/cryptocurrencies-intro) I took the time to attend it a few days back and I can recommend it for beginners as it does offer a lot information, easily explained and in a short amount of time. Let’s take the time to review it in more detail: <div class="pull-left">https://steemitimages.com/DQmU2MghrNoeeGiiw89akH23jFoimeWmFfojzWsu6qBCXdX/review.jpg</div> # Is this Course FREE? Yes, you can enter the [link](https://www.bitdegree.org/en/course/cryptocurrencies-intro/lesson/intro) and immediately start learning. You do not need to register, you do not have to pay, you just literally **click and learn** # Is this Course Short? Yes, in total you will need a total of an hour (approximately) to listen to all the lectures. # What if I am more of a ‘visual’ learner? Then you should have no problem, for every lecture you can download the Lecture Slides (in pdf form) and also the Lecture Transcript. # What is this Course about? This course presents the cryptocurrency world using simple language and covers a variety of topics. - In the first lecture you will learn what crypto currencies are and why they differ from traditional currencies - Then you will be informed of the reasons cryptos have become so popular and you will learn how you can start with buying some and about creating a secure wallet for storing them. - You continue by examining the Bitcoin as well as the Ethereum and at the end you learn about Ethos.io (the sponsor of this lecture) proposal and checklist of how to analyze any crypto. # What if I just want the check list? If you are an intermediate or expert crypto-player, skip everything and visit [this link]( https://www.bitdegree.org/en/course/cryptocurrencies-intro/lesson/checklist-for-analysing-crypto-btc-vs-eth). You can listen to the lecture or simply download the checklist. (Attention: The file will probably come without extension – you just need to rename it to ``pdf`` in order for you to be able to open it) You will be able to see the checklist applied to Bitcoin (BTC) and Ethereum (ETH)  ## Suggested Check List Includes but is not limited to.. ## 1. Token Supply A Tokens Supply is the number of coins circulating in the Market. You can read [this article]( https://www.coinist.io/understanding-token-supply/) for more information and you can see the current numbers by visiting the coinmarketcap website (or similar ones) <center> (Screenshot of CoinMarketCap 10 March 2018)</center> This will be a public element always and the price of a token will depend on its supply. But be extra careful because you should also take under consideration the token’s maximum supply as well as the fair distribution of its tokens. These should be included in any token’s white paper and is public information. > Satoshi Nakamoto is estimated to hold nearly 1 million bitcoins [source]( https://mashable.com/2017/12/12/bitcoin-satoshi-trillionaire/#Pexd48v.5Zq0) ## 2. Market Cap, Trading Volume, Liquidity These objectives provide information about valuation, popularity and easiness of trading. - [Market Cap](https://www.coinist.io/cryptocurrency-market-cap/) is the product of the token’s circulating supply with its current price and is a vital metric for a coin’s value. For instance by calculating the Market Cap of Bitcoin (10 of March 2018) we see that the total amount is $157,676,671,621 - With [Trading Volume](https://www.coinist.io/cryptocurrency-trading-volume/) we see how many people actually buy and sell the specific token. For instance in the last 24hours the trading volume of Bitcoin was approximately 39.1% which puts it the first in line. - [Liquidity](https://www.investopedia.com/articles/investing/112914/liquidity-bitcoins.asp) is usually defined by the ability of a token to be converted into cash easily. It is not easy to determine the liquidity of a coin, as this depends on factors such as in how many exchanges it is present, its acceptance as a trading coin, its trading volume and more. According to the lecture, in order to find if it is easy / hard to buy and sell a coin, you have to check the order books on exchanges. ## 3. Mining Algorithm Now this is going technical so I will not say much about it. However you should know some basic information about Mining Algorithms. You should be able to identify how new tokens are being produced. Is it via [Proof of Work]( https://en.wikipedia.org/wiki/Proof-of-work_system), is it via [Proof of Stake]( https://en.wikipedia.org/wiki/Proof-of-stake)? Or is it ‘Proof of Brain’ as it is described in the [BluePaper of steem.io?](https://steem.io/steem-bluepaper.pdf) After you determine the above values which will surely give you an idea of the token you are examining, you can go through the (a)Technology behind the coin, the (b)*raison d'être* and of course take a good look at the (c) people behind the project. Check the Development Team, the Community and the Governance of the Project. # The Takeaway Of course everyone is responsible of their own research. I do not invest but I am very curious about discovering new coins due to the various ways that blockchain technology is being used. I always check their whitepaper and tone they use in their social media presence. Also if it is an older token, you can read many reviews about it if you simply google them. Performing your own analysis is very important and the final decision is your own. Crypto currencies are really too many to know them all, there has been scam before and I am sure that there are the ones who will succeed and the ones who will eventually fail. This does not change the fact that the block chain is here to stay and it will change the way we perceive the world. <sub>Please note: Bitcoin is used merely as an example. It is the most promiment coin among the circulating tokens, and it is known to everyone (even my grandma knows about it!)</sub>  # Bonus Info! BitDegree has also announced [Tutorials](https://www.bitdegree.org/tutorials/) and I admit the ones I read are very well written. So feel free to visit them and read about what interests you Thank you very much for reading! I hope you found this info useful, please feel free to comment below and if you would like to stay in touch – click the links to follow me! <center>[](https://steemit.com/@katerinaramm) [](https://twitter.com/katerinaramm1) [](https://www.facebook.com/KaterinaRamm-876468415833984/) [](https://www.instagram.com/katerinaramm1/)</center>