This Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods

cryptocurrencies·@kenraphael·

0.000 HBDThis Single Metric Seems to Correlate More with CryptoAsset Values The Past Two Weeks Than Most Predictive Methods

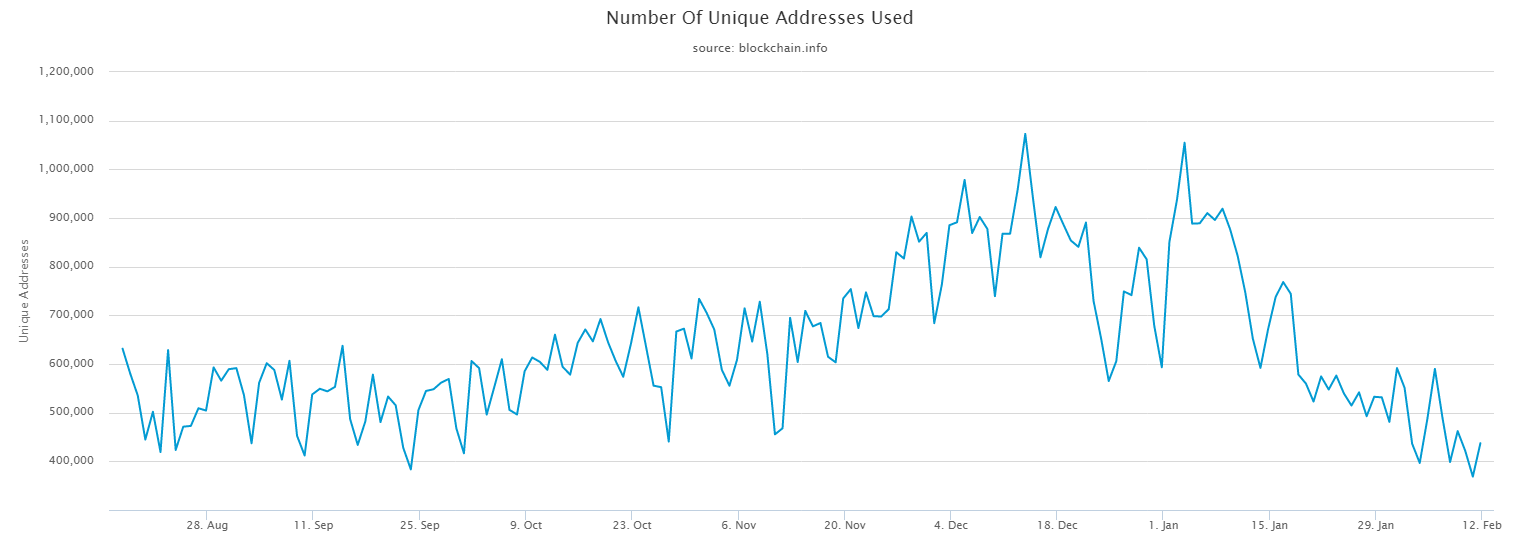

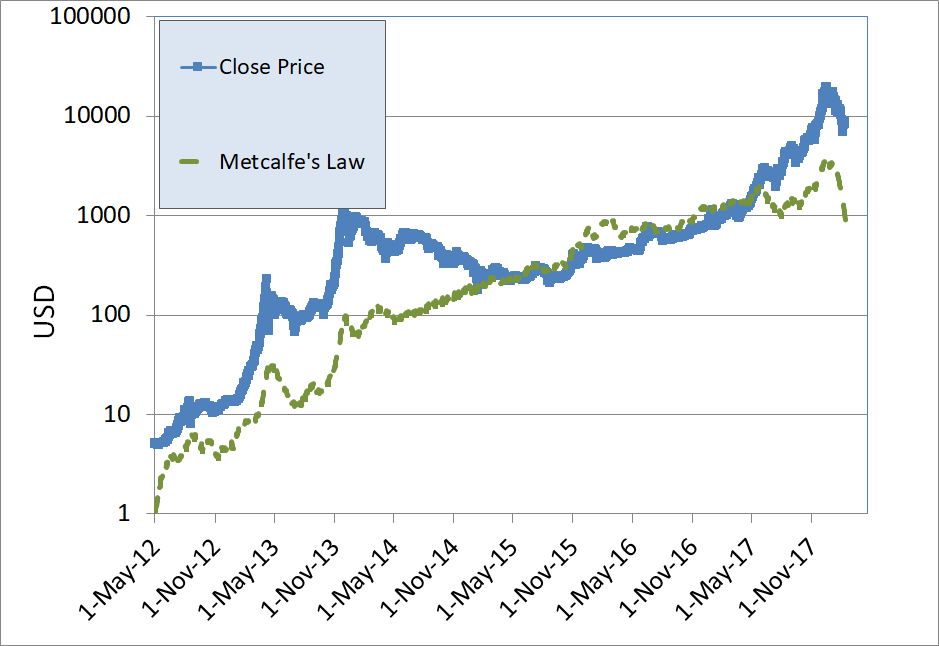

The past three to four weeks have been extremely volatile as far as cryptoasset prices. And candidly many predictive methods over the same period has been about as uncertain in many cases. It turns out that <a href="https://blockchain.info/charts/n-unique-addresses?timespan=60days" target=_new>this daily chart</a> that tells how many unique new accounts were opened on the bitcoin blockchain per day has been much more correlated with its price going back several years. And even more so the past month as many TAs flailed away. The chart is shown below and right after the daily price.  _feb_13_2018_6.png) (Source: blockchain.info) <b>Uncanny right?</b> The rationale behind this metric is that ultimately the value behind the coin, which is 9 years old, should be correlated with how many actual people are finding use for it; since ultimately that is its purpose. And if it is growing it will be more useful and its value will be bid up; and vice versa. And if it is growing, those who have adopted and acquired it have even more people to trade it with. (Unlike daily transactions, the unique address is likely a better measure of adoption because it strips out dice game sites and bots that daily transactions include.) Ultimately, this relationship can be recast in the form of the Metcalfe law with correlations going back to 2010 that looks as shown below. (A second experimental model was also presented in the reference and could potentially even offer a better fit.)  (Source: Current Author) We saw in 2014 after its price had significantly outstripped its network effect value that it snapped back to that value in a major correction. And we saw its value depart significantly by the end of last year. <b>The Model Adds More Information</b> So the daily unique address chart is quite informative. But it does not tell for instance how far the asset is outstripping its network effect value. The model does that. For instance, in 2014 we saw the price grow to about 8x that value followed by a snap back to that value. Similarly, we see it go up to nearly 5x by the end of Dec 2017. Its like watching a kid blow a balloon. As it keeps growing, a point comes when you can tell that a mere tap from an fairly sharp object (which could be like what cryptos call FUD) will cause it to burst simply because it had become excessively inflated; or it could even just eventually implode simply from being over inflated. Meanwhile, that same object may not cause the same impact if it had not yet been inflated by that much. <b>The Published DUA is Lagging</b> Turns out that the daily unique addresses published at bitcoin.info lagging by nearly two days. So it is difficult to know if the daily rate has picked up until nearly 2 days later. If this post gets up to 400 upvotes/resteems, then on this space, using a small program written to extract this info, I will publish the daily adoption rate as measured by unique address. And if you would like to receive the spreadsheet behind this article, simply follow, resteem and upvote. Then place a comment under this post and shoot an email to kenraphael7 requesting the spreadsheet. Thanks for reading. <b>Question of the day:</b> Has adoption rate truly recovered and gone back to its growing ways? <b>References:</b> https://www.sciencedirect.com/science/article/pii/S1567422317300480 <b>Legal Disclaimer:</b> I am not a financial advisor and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs. This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

👍 kenraphael, friends-bot, talaxy, mackcom, isi3, hottopic, salahuddin2004, petervroom, trmnl-cmdr, raise-me-up, dolles7, demonsthenes, cryptoslicex, bitcoin.news, haikal077, byresteem, emmanuelae, evan-koser, genvking27, mercedesgarage, emretozlu, jatinder, gmzct, nizam166, lochsteemit, barakar, najib12, masha2525, mohhusrilmubariq, thancan, davedickeyyall, enriqueherrera, steverainer, saysteem, xpnexindia, soubhagya, sushnanda, samarbbsr, sweetbbsr, ranjangjang, sanmi, somadeb, thehumanbot, sanjeevm, gregorykelly, humair273, rokysteem, tayfunc1, longming, aellly, resteem.bot, nurmidirman, qiyi, philstein, humzaimran, nyakyusra, corporategifts, boomerang, boomerang-test, postpromoter, thehappytank, daviellaymp14, spykakos, ifriyami-hamam, minnowpondblue, minnowpondred, garage22, cmtzco, bitkmbr, mrcheezle, po27, harmonicliving, minnowpond, reported, minnowpond1, jasen.g1311, cnmtz, ering, desmonid, phreakerx, bofadeez, driva, tugboatjoe89, shamrock017, thewindowflower, bitcoindon23, mrainp, royrodgers, medha, mrainp420, blockchaindaily, schulbz, steemitla, thevark, thedrayness, drguy, sammyb, colleenc, eileenbeach, woodrow, unholyleaf, magikos, rngdz, steemvote, umpe, nuoviso, ophelion, querdenken, matzep, neuehorizonte, news24, infokrieg, wissenschaft, steemwin, politik, kittentown, minnowsteemwin, blockbooster, votebuster, randofish, randofish1, pingpong, freeupvote, whalewatch, myup, steembeamer, votex, postpromo, appreciato, coinbooster, thisismein360vr, pushup, upme, adriatik, therising, dannynvrr, mid.life.hustle,