Avalanche's Trader Joe (Joe) White Paper Seeks to Mitigate Impermanent Loss

hive-167922·@kevinnag58·

0.000 HBDAvalanche's Trader Joe (Joe) White Paper Seeks to Mitigate Impermanent Loss

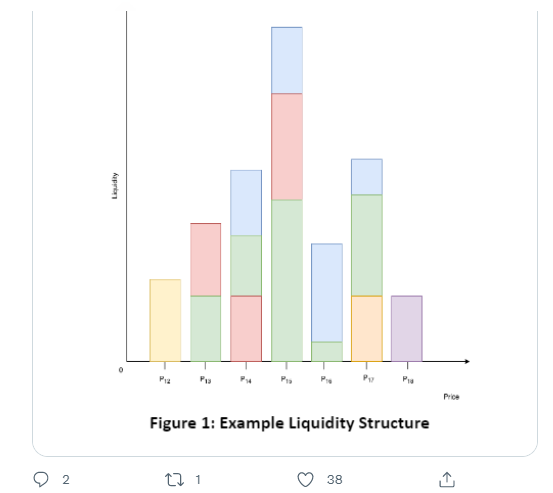

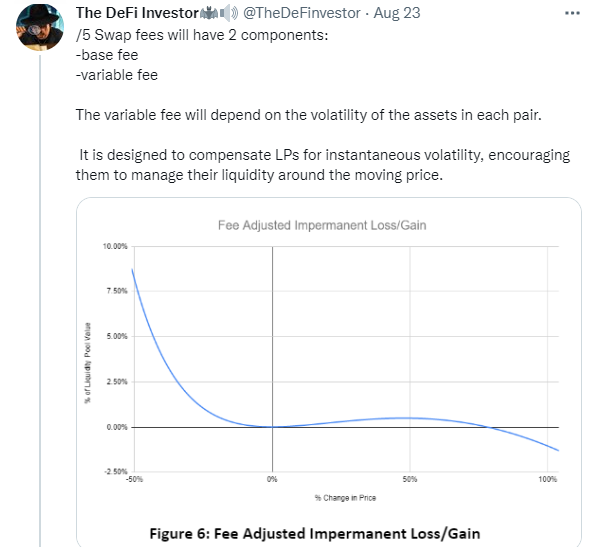

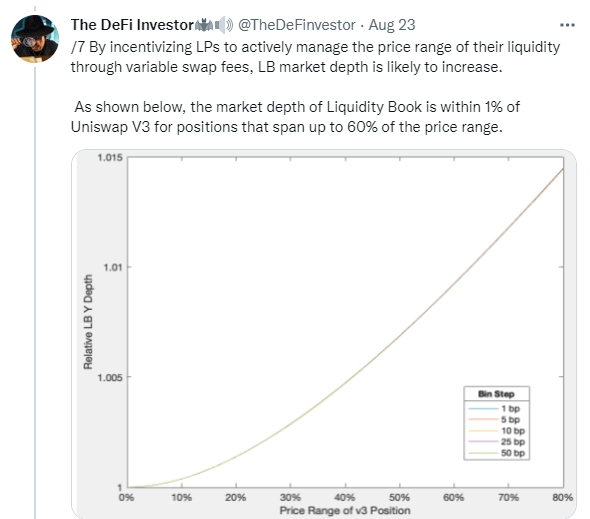

[Photo Source](https://pbs.twimg.com/card_img/1561804714815242241/bZP6Oy1_?format=jpg&name=small) Trader Joe on Avalanche has proposed a method whereby the dreaded curse of 'impermanent loss' may be mitigated especially in the times of extreme market turbulence. Could prove to be a cure for one of DeFi's major weaknesses. By way of reminder, impermanent loss "happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes compared to when you deposited them. The bigger this change is, the more you are exposed to impermanent loss. In this case, the loss means less dollar value at the time of withdrawal than at the time of deposit" [Binance Academy. [Impermanent Loss Explained](https://academy.binance.com/en/articles/impermanent-loss-explained). (Accessed August 24, 2022). The 'loss' is said to be impermanent because it is not realized until the underlying assets are liquidated. In a newly released white paper on Tuesday called the JOE v2 Liquidity Book, authored by Quant developers and researchers Adam Sturges, TraderWaWa, Hanzo and software engineer Louis MeMyself, the developers outlined the use of Liquidity Book (LB) with an additional variable fee swap feature to 'provide traders with zero or low slippage trades' [Lindrea, B. [New fix for curse of impermanent loss proposed on Avalanche](https://cointelegraph.com/news/new-fix-for-curse-of-impermanent-loss-proposed-on-avalanche). (Accessed August 24, 2022)]. Should you wish to read the highly technical white paper above referred you may access it by clicking [here](https://github.com/traderjoe-xyz/LB-Whitepaper/blob/main/Joe%20v2%20Liquidity%20Book%20Whitepaper.pdf). However, Twitter user The DeFi Investor (@TheDeFinvestor) posted a relatively short thread greatly simplifying the white paper which follows in its entirety: .png) .png) .png) .png) .png) .png) .png) .png) .png) [Photo Source](https://twitter.com/TheDeFinvestor/status/1562009791848796161) To summarize, Trader Joe's Liquidity Book (LB) model arranges the liquidity of an asset pair into separated price bins, which bins are then exchanged at a constant price. A new variable swap fee is introduced which provides the protection from impermanent loss through compensation to LP's when volatility in the market is high. This permits the liquidity to be managed in a more efficient manner when responding to unforeseen or immediate price changes. By offering zero to low slippage trades the LB further offers better buying rates for traders. Trader Joe's system relies on the general notion that "[i]mpermanent loss can still be counteracted by trading fees. In fact, even pools with volatile assets — that expose a liquidity provider to heavy amounts of impermanent loss — can be profitable thanks to the trading fees. THORChain, for instance, charges fees on every trade and about 50% of those fees go to liquidity providers (the other 50% goes to node operators). If there’s a significant amount of trading volume in a given pool, it can be profitable to provide liquidity even if the pool is heavily exposed to impermanent loss. This, however, depends on many factors: the protocol, the specific pool, the deposited assets, and even wider market conditions" [LP University. [Impermanent Loss and Impermanent Loss Protection](https://crypto-university.medium.com/impermanent-loss-and-impermanent-loss-protection-a4a0f78d1701). (Accessed August 24, 2022)]. Should the Trader Joe Liquidity Book model be properly executed it will be a major improvement to the DeFi sector as a whole. .png) [Photo Source](https://twitter.com/traderjoe_xyz/status/1561804731412013056) According to the digital-asset management firm IDEG’s chief investment officer Markus Thielen, impermanent loss is one of the reasons why institutional investors have shown caution in the area of DeFi. While speaking with Cointelegraph, Thielen maintained that "his firm and other institutional investors “have been less engaged with automated market makers (AMMs) as the risk of impermanent loss is too high” [Lindrea, supra]. He then added: "I must admit that Trader Joe’s v2 whitepaper offers a novel idea and liquidity providers have generated 30bps for facilitating trades, which is an attractive return when future growth is uncertain for the industry. We want to see how much liquidity v2 is now attracting and how Trader Joe's TVL will improve" [Id]. Thielen posits that to gain a competitive edge in crypto, investors can not solely rely upon the blue-chip investments. Rather the investors should search out alternatives displaying good fundamentals. He stated: > As a crypto fund, we can’t just rely on ETH and BTC, we want other layer ones and alt coins to thrive, so we applaud the Trader Joe team for keeping developing and other AMM on their toes. [Id]. About Trader Joe: > The Trader Joe protocol dubs itself as a “one-stop decentralized trading platform” that is built on smart contract platform Avalanche. The protocol is currently the largest decentralized exchange (DEX) on Avalanche, with $191 million in total value locked (TVL) on the protocol. The DeFi protocol allows users to trade, farm, lend and stake among other things. Trader Joe’s token, JOE, saw its price briefly spike following the white paper release and is trading at $0.28 at the time of writing, though it’s still down 94.5% from its all-time-high, according to CoinMarketCap. [Id]. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@kevinnag58/avalanche-s-trader-joe-joe-white-paper-seeks-to-mitigate-impermanent-loss)

👍 tyrnis.curation, m00m, da-dawn, workaholic666, khaleelkazi, jeanlucsr, purefood, asteroids, p-hive, organduo, shauner, leo.voter, b-leo, p-leo, dlike, megavest, leofinance, w-t-fi, broadhive-org, jkeen33, rufans, thauerbyi, getron, gallerani, ireenchew, rmsadkri, cryptosimplify, leo.tokens, rondonshneezy, steentijd, steemaction, reonarudo, elgatoshawua, cugel, grabapack, khaltok, bahagia-arbi, zaxan, flyingbolt, edian, onestop, ew-and-patterns, saboin.leo, break-out-trader, babytarazkp, agro-dron, pouchon.tribes, uwelang, beemd, life-shturm, beco132, trostparadox, xyba,