Ceyron Project

cryptocurrency·@larrybsbs·

0.000 HBDCeyron Project

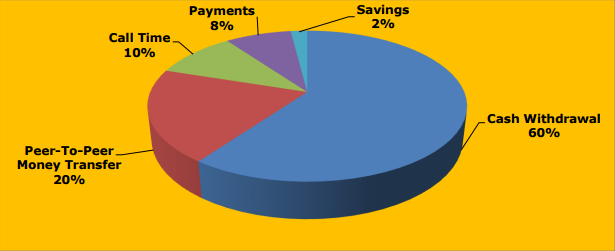

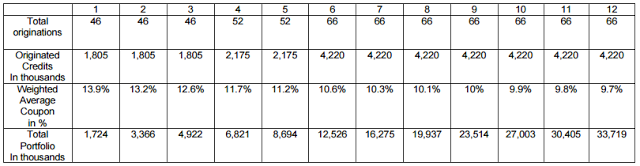

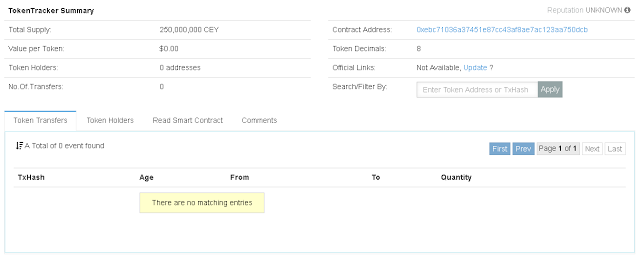

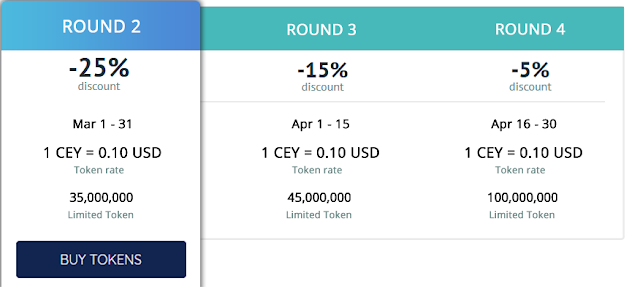

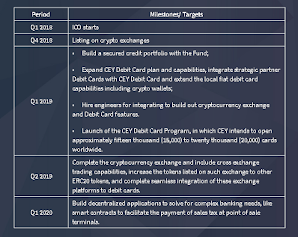

Ceyron is a cryptocurrency-based investment platform with cryptocurrency trading terminal, debit card capability and offer token backed by secure credit assets. The CEY Token is a token that will be issued to investors (investors) and that represents a lucrative interest in a separate class of non-voting shares from Ceyron. The CEY Token is a smart contract of functional utility within the Fund. The CEY Token is non-refundable. This is not for speculative investment. Ceyron Finance Sarl (CFS), is a limited liability company incorporated under the Company Law (“Dana”) and is wholly owned by Ceyron Finance Ltd. The CFL and IMF have signed an operation agreement governing their rights. and obligations of each party. Sub-Funds will be managed and advised by Colombus Investment Management Ltd (“Investment Manager”). Colombus Investment Management Ltd, is one of the British Virgin Islands listed as an independent alternative investment management company specializing in alternative assets and global asset allocations. The Fund Manager will be responsible for the Fund business and will perform all services and activities related to the management of IMF assets, liabilities and operations. Objective strategy and investment The Fund’s investment objective is to provide an attractive return on invested capital through an exclusive quantitative approach to the assurance of credit assets, provided by Colombus Investment Management Ltd. The fund will adhere to the investment strategy based on data science. Nonparametric statistical models are applied to expected profit issues in financial investments. The net income earned by the Fund in a given month is generally reinvested, but a portion of the potential periodic profit may be used to distribute the annual dividend to the holders of the CEY tokens, whereby the dividends are approved by the board of directors. and shareholders of CFL voting. Token is protected by loan portfolio for less volatility and more cash flow A portfolio of credit assets will also be secured by bonds to improve stability and returns. Fund managers will use artificial intelligence and machine learning to build a secured credit asset portfolio. Blockchain technology delivers effective liquidity for investors Blockchain technology has the potential to provide greater integrity, security, security, and transparency. Thus, CFLs will use blockchain to ensure the immediate auction of low-cost transactions in the hope of providing investors with greater liquidity. Prepaid debit cards are effective The account holder will be able to choose from multiple cryptocurrencies to use as bids, and when initiating a transaction (for example, dinner at a cost of $ 83.65), prepaid debit will be used, or Holder may choose a supported cryptocurrency, which will then be sold at a spot price to complete the transaction. Competitive cost Since CFLs hold money and various cryptomonnaies at any time, it will be able to facilitate crypto-eye exchange transfers to facilitate transactions and enable CFL Coinbase to compete on services and costs. CFLs enter a growing market The cryptocurrency market grew more than $ 160 billion ($ 160 billion) last year. Financial giants and central banks have invested in blockchain technology. Big and small investors are looking for more regulated markets that can take advantage of the safety net and insurance coverage offered in the registered security market. The problem is stated for the developing world The world’s growing population (Southeast Asia, Latin America and Africa) represents more than 2 billion people. Africa alone accounts for 1.2 billion people. It’s young and dynamic: 60% are under 50. Banks are gradually adopting mobile banking to: develop online banking services; provide digital benefits to parties to integrate millions of people into the formal financial sector; develop merchant payment services. Bank rates are low According to experts, more than 2.5 billion low-income and / or intermediate people are not tied to the bank. Traditional agency models easily meet the needs of the poorest but no longer fully meet the bank’s requirements. The reasons for low banking penetration are at two levels. 1. At the client level: most people have only low or very low incomes, and therefore low savings capacity. While economic monetization has grown considerably since the 2000s, bank use has not been part of spontaneous practices. The rapid emergence and growth of enormous microfinance companies radically changed the situation. 2. At the bank level: excessive relative liquidity from banks is not an incentive for customers to grow. Low population density adds to the average cost for the implementing agency. A very competitive market Over 75% of countries have most of the services in which cellular money services are available. Increased competition means consumers have more choices. Some subscribe to two or three services simultaneously. Usage levels are very low Africa is the world leader in mobile money account 2% of adults have mobile money accounts in the world, 12% holders are in Africa. Each year, the number of open mobile money accounts has increased by more than 40% on average. By 2020, the number of Africans with additional income — nearly 450 million people — will be comparable, if not higher than Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. The result: nearly 10 billion transactions per day, worth nearly $ 135 billion by 2020. An average user behavior behavior analysis seems to be a general trend: withdrawals represent at least 60% of the transaction volume; peer-to-peer transfer operation 20%; purchase of 10% call time, 8% payment, and 2% savings.  Today, sixty percent (60%) of US mortgages are held by non-banks, up from thirty percent (30%) in 2013. More than four trillion dollars (US $ 4T) in US mortgages are available to pick hundreds bank credit platform. Fund managers are responsible for approving platform-based solvency and risks and identifying credit profiles of published assets, compliance with original rules, volumes, warranties, duration and levels, quality of management and services. The fund manager will be responsible for selecting the best performing assets available on this platform for the CFL portfolio, as well as to purge the most risky assets in the CFL portfolio. Roadmap Investment  CEY card The CEY card will become a physical, virtual and debit MasterCard with a mobile app that will allow the use of twenty (20) foreign currency from one card. CFLs can save up to seventy percent (70%) of these costs. Currencies can be traded at both points of sale (the industry average is 3.75% versus 3% for CFLs), and also through applications. In addition, unlike standard one-half percent (1.5%) fees for ATM withdrawals, CFLs will not charge for ABM withdrawals. The CFL mobile app will contain additional features to transfer funds in any currency between merchants, as well as friends and family accounts, The CFL card plans to have partners for cost management. This will allow integration of mobile apps to facilitate travel travel management and links to many travel partners for the management of electronic receipts. In summary, CFLs will be developed to provide increased liquidity in one of the world’s twenty (20) currencies as well as in the main crypto currency. LCF and Blockchain Cryptocurrency (or cryptocurrency) is a digital asset designed to serve as an exchange tool that uses cryptography to secure its transactions, to control the creation of additional units and to verify asset transfers. Cryptocurrency has been designed as a method for decentralized transactions with values held in rare digital assets. This is most striking in societies where governments lose their money due to hyperinflation. Today, fifty percent (50%) of people in the world have bank accounts. By 2014, it’s 62%, and cryptocurrency takes up more space among people who do not have bank accounts. Cryptocurrency has been designed as a method for decentralized transactions with values held in rare digital assets. This is most striking in societies where governments lose their money due to hyperinflation. Today, fifty percent (50%) of people in the world have bank accounts. In 2014, The new cryptocurrency currency market operates for several years. The relatively large difference between the price of Bitcoin paper money in different major markets illustrates the current level of industrial maturity. Blockchain technology is still young, but has proven itself as an irreversible registry. Bitcoin is a purely speculative token, and its value, like diamond or gold, the use of an outside industry, is entirely motivated by scarcity and a guarantee to holders that this property is unique and ready to trade. Sales and distribution of Ceyron tokens (Cey) The CEY symbol is the functional intellectual contract in the fund. The CEY symbol is not returned. The CEY symbol is not intended for speculative investment. Future performance or value will not be promised or provided in conjunction with CEY documents, including the promise of the value of the goods, no current payment obligations, and there is no guarantee that the CEI document is essential. CEY’s right is not an effect and does not bear any cost to the Company. The CEY symbol does not qualify for the company.  The CEI Stock Exchange is a digital marker provided to investors and represents ownership of ownership in a separate class of shares that Ceyron does not choose. The official name of the Representative provided by the Loyal Agency & Trust Corp (“LATK” or “Candidate”) is deemed secret for the icon owner, and the marketer will have a useful interest in Ceyron Finance Ltd. not included in the administration or activities of the fund or fund manager described below. The CEY icon is the intellectual digital sign of the contract representing the extraordinarily profitable holdings of CEY funds held by the Loyal Agency & Trust Corp., which is trusted by the presence of the CEY marker. CEYRON (CEY) TOKEN SALE The CEY Token is a smart functional utility contract within the Fund. The CEY Token is non-refundable. The CEY Token is not for speculative investment. No promise of future performance or value will be or will be made in relation to the CEY Token, including no pledge of inherent value, no promise to proceed with payment, and there is no guarantee that the CEY Token will have any particular value. The CEY Token is not an effect and is not a participation in the Company. The CEY Token has no rights in the Company. The CEY Token is a digital token to be issued to the investor (s) and represents the interests of profitable ownership in a separate class of non-voting equity shares in Ceyron. The legal title of the token will be kept in credence by the Loyal Agency & Trust Corp. (“LATC” or “Candidate”) for the token holder, and the token holder will have a lucrative interest in Ceyron Finance Ltd. Candidates are not independent and are not involved in the management or operations of the Fund or Fund Manager described below. Quotes: CEY Token — A digital token of intelligent contract based on Ethereum representing profitable ownership in non-voting shares in CEY, to be held by Loyal Agency & Trust Corp. in trust for holders of CEY Token. Token Name: Ceyron Token Symbol: CEY . Decimal: 8 . Price Per Token: $ 0.10 USD per CEY Token . Number of Tokens Sold: 250,000,000 . Starting from Pre-Sale Token: 2/16/18 . End of Pre-Sale Token: 3/15/18 . Pre-Sales Discount: 25%, 15%, 5% . Start Sales Token: 3/16/18 . Soft Cap: 2 Million USD . Hard Cap: 45 Million USD Starting from Bounty Registration: 02/15/2018 End of Sale Token: When Hard cover is reached Accepted Currency: BTC, ETH, LTC, PayPal and Credit / Debit card PS: Any time and date in the above schedule may change according to the absolute discretion of the CFL. CEYRON TOKEN VALUE  Ceyron Street Map  For more information, visit the link below: Website: https://ceyron.io/ Telegram: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA Facebook: https://www.facebook.com/Ceyron/ Linkedin: https://www.linkedin.com/in/haythem96/ Twitter: https://twitter.com/cryronico Instegram: https://www.instagram.com/cryronico/ By: larrybabs https://bitcointalk.org/index.php?action=profile;u=1249538