Bitcoin Trend Series / EP. 602 / Bearish With Bullish Divergence

bitcoin·@lordoftruth·

0.000 HBDBitcoin Trend Series / EP. 602 / Bearish With Bullish Divergence

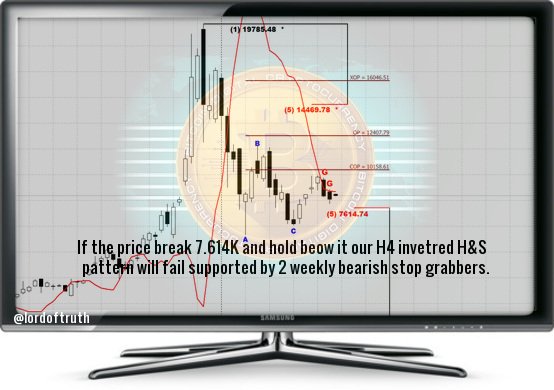

Time: 8.32 A.M. / GM+2 / 24th May 2018 – Thurs. <center>**Recapitulation**</center> - Bitcoin price shows more bearish move to touch 7.402K, the reason why our Inverse H&S pattern become invalid, the downward move was supported by 2 weekly ( G seen on chart ) bearish stop grabbers. But due to **A Bullish Divergence** that can be seen on stochastic, the price start to move up supported by RSI that already indicating oversold conditions and most likely a retreat to 38.2% Fib around 7.900K will take place. <center>**Market Factors**</center> - **The Slowdown** came following concerns over increased regulation in China, and profit-taking and the lack of positive industry updates. Even though the dollar lost some ground to its peers after the release of the FOMC meeting minutes for May, Bitcoin price has carried on with the drop, presumably from negative remarks by Fed official Kashkari earlier on. <center>**Technical**</center> - In our previous post <a href="https://steemit.com/bitcoin/@lordoftruth/bitcoin-trend-series-ep-601-keep-an-watching-eye-on-7-614k-7-770k-area">/ 601 /</a> we had forecast the trading range will be between 7.770K and 8.643K. The intraday high was **7.967K** and the low was **7.402K.** - **EMA50** keeps supporting the bearish wave, as long as the price hold below 8.643K. - **Daily Ichimoku Cloud** may have opened doors to further drops towards key levels around 6.600K. - The 2 weekly ( G seen on chart ) **Bearish Stop Grabbers** try to lead the price for a decline below 6.519K lows but the situation stands a bit tricky ( **Bearish With Bullish Divergence** ). <center></center> <center>**Sentiment**</center> <center>Based on the above, we will suggest **/ Neutral Trend /** for today. Waiting for a clear Bullish Reversal Pattern! </center> Support 1: 7614.000 level. Resistance1 : 8175.00 level. Support 2: 7402.000 level. Resistance2 : 8400.000 level. Expected trading for today: is between 7402.00 and 8175.00. Expected trend for today : Neutral / Bearish With Bullish Divergence Medium Term: Neutral. Long Term: Bullish. The low of 2018: 5947.00. The high of 2018 (BitcoinTrader's Year): 16046.00 / Expected. The low of 2019: ??? The high of 2019 (Bitcoin Holder's Year): 36000.00 level / Expected. <center>YOU SHOULD NOT TAKE ANY MATERIAL POSTED ON THIS BLOG AS RECOMMENDATIONS. TO BUY OR SELL BITCOIN OR ANY OTHER INVESTMENT VEHICLE LISTED. </center> <center></center> <center>Writing a series means playing a long game, investing considerable time and effort up front in hopes of considerable returns down the road. I'm so proud of my little blog, and so grateful to all of you for support to keep it going. </center> <center><a href="https://steemit.com/bitcoin/@lordoftruth/forex-education-center-volume-i"><strong>**If You are New in Trading --> Read Trading Education Center / Volume I.**</strong></a> </center> <center><a href="https://steemit.com/bitcoin/@lordoftruth/fibonacci-retracement-in-trending-market"><strong> **What You Know About --> Fibonacci Retracement in Trending Market.**</strong></a> </center> <center><a href="https://steemit.com/politics/@lordoftruth/what-you-know-about-syrian-civil-war-last-part">**If You Like To Read About Syrian War --> Click Here!**</a></center> <center></center>

👍 lordoftruth, jwolf, nenya, marius19, robmolecule, mycat, funkit, jacobts, janusface, cryptobeans, eco-alex, stevejhuggett, mamata, dorthmaen, fantomcee, pickled, ianfreeman, fiveboringgames, nauman944, brains1ck, showtime, jonasthomas, stephanieangel, drakmin, mustafa4101996, deemarshall, vizualsamuri, maxbullion, upvoted, olgavdovskikh, proctologic, kyawsantun, jimmyjemsx, photobomber, amlehtnewo, onza, tonimarco, eosint, pllo3llo, chucknasty, qxl, aylan, eloniy, enkel, ravenrillay, jgr33nwood, kurtringimages, nicnicy, youngfuego, trendings.online, vivianka, oregonpop, bitcoinmarketss, manfaluthi, gellany, belgarath, natra, treebuilder, zentat, sqube, jimjam1210, thelifestyler, amanda46536, gnoori, epikcoin, reborn99, philip.willemse, graytor, outerground, taisa.gallery, frankydoodle, ocxie, mrslauren, satfit, arunavabiswas, genya.kharitonov, osere, da-primate, ketikasharma, sempurna, spurious-claims, serfis, crypt0boy, ganandoenbtc, ceyksparrow, iliketoast, abenike, mirabdullah, kishan, cryptoclick, ronnybat, merleeyq, zulbahri, hillstech, jfkenndy, frontrunner, alidervash, stonechaisson, ryanarcher, omrii, wishmaiden, tim-rumford, charles1, co-op.blogs, nuad01, pentjosh, vannfrik, rexusmo, helmirenggrik, zulama28, joklahoma, finesse203, andysmancave, crypto2day, benniebanana, mrright, s10, mickeyvera, zappl-lottery, videogeek, kingyus, tastytrade, georgeargyrousis, cryptojake, sahertanveer, abdulrehman, memeology, liberta, jim-borasso-band, steemdrivingman, talesfrmthecrypt, kenhudoy, biglipsmama, joulia, lawyerup, phuresh, treasuregnome, aek081969, jasmadiyunus, halfshinigami, battlemountain2k, sabarniati.aceh, hellmerlin, eddy4king, andrekweku, zaiyn, zuhrareza, hausbau, benjy87, travelingdiva, bjjworldtraveler, eaposztrof, btcbaby, futuredigicoin, tujan, billibong, realcodysimon, historyfromworld, grey580, ladyrednails, voltsrage, agoric.systems, mikegun, transhuman, animapaddy, curiositybot, ragnartheking, rikip94, happyclappy, cldgrf, brunoaco91, marcosespes1, ant884, abso, tomtom87, dashdipak, forever-gala, senor, rest100, emas-jiujitsu, pjcswart, vlasmp, ahmad.rezk, framelalife, mmagreat, kralizec, nicholasjohn, derkon, mustafeez, steem-press, belladonna, steemitwrite, rocky1, michelle.gent, therising, famunger, samvan, freiheit50, jerhole, moon32walker, booster, arcange, raphaelle, flipstar, claudiurbc, stackin, dumar022, mtndmr, afrog, cogitoergosum1, crypto-psy, technicalanthony, hugejan, klarenbach, lazarescu.irinel, tovalenzuela, mednifico, etka, blazing, spx464, d0zer, sn1p3r, passion-ground, scorer, ajaub1962, oldschoolrepair, williamsq,