Daily Crypto Analysis - 28th Jan - Technical Analysis

cryptocurrency·@matthew-analysis·

0.000 HBDDaily Crypto Analysis - 28th Jan - Technical Analysis

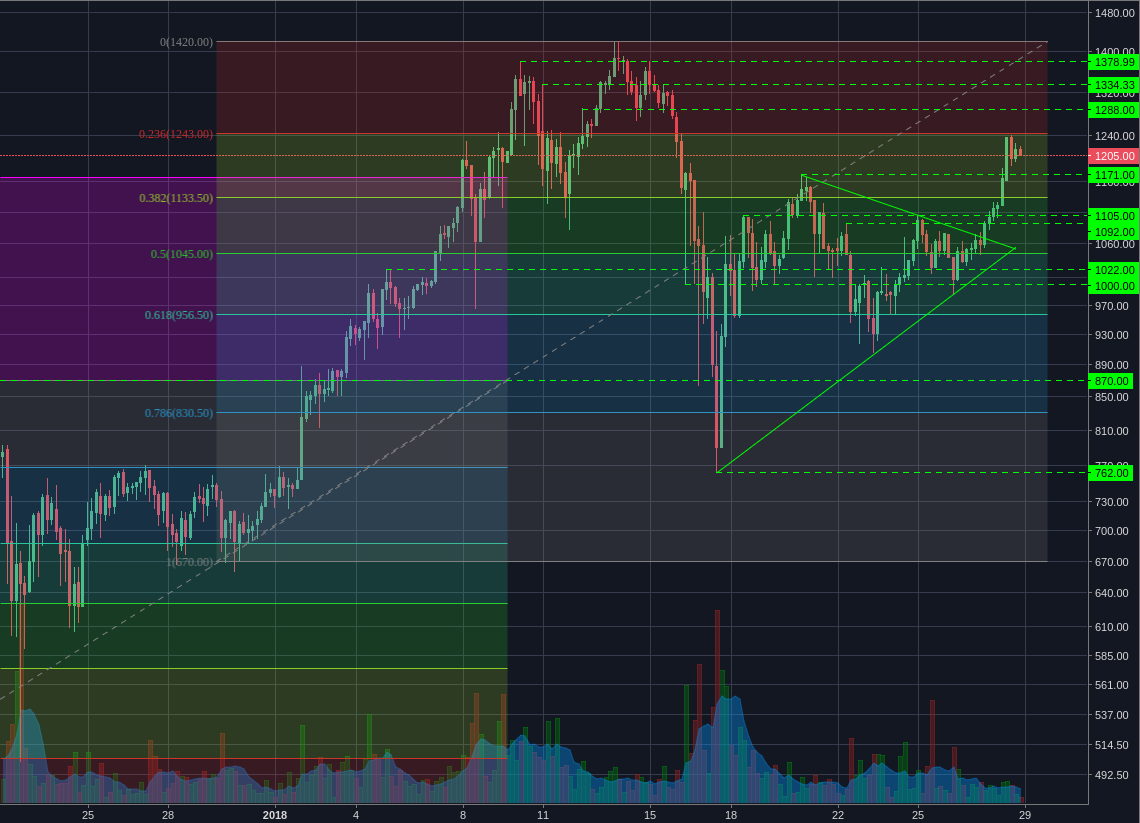

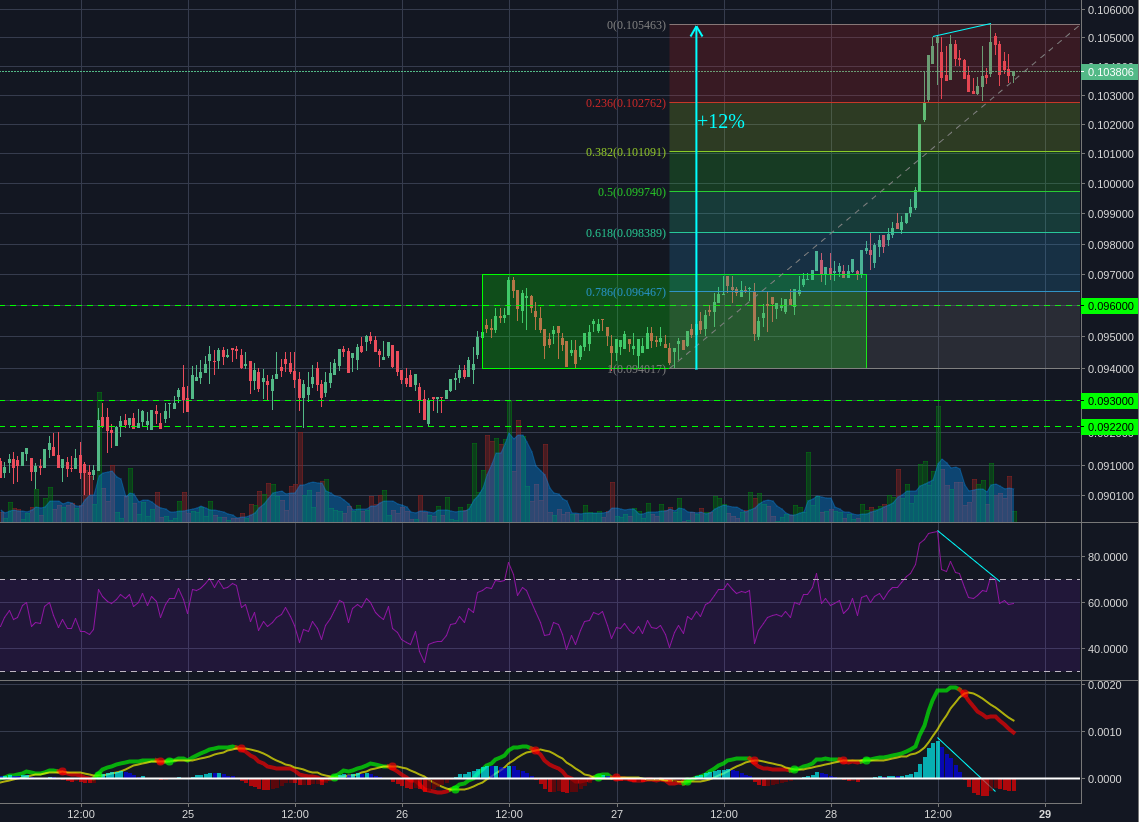

# Bitcoin  (Bitstamp:BTCUSD 1h) Bitcoin made another leg up, this time briefly pushing through the $11910 resistance. This could be the start of a new bull run for Bitcoin if this trend holds. There is no sign of divergence on the RSI nor the MACD, suggesting no weakness yet. I would suggest keeping an eye on the $12146 and $13052 resistance levels and watch out for signs of weakness, but otherwise this looks bullish. # Ethereum  (Bitstamp:ETHUSD 4h) We've seen a good break upwards here for Ethereum. Currently it sits under the 23.6% resistance but has seen no sharp pullbacks, which is a strong sign for this move. However, volume still remains low on this breakout rather than the expected spike for the start of a new trend. This could cause issues around the resistance levels as we retest highs, so I would suggest keeping an eye out for sharp rejections of resistance and other signs of weakness.  (Bitstamp:ETHBTC 30m) On the shorter time frame, ETHBTC has made a very healthy push of 12% after its secondary consolidation zone. So far there has been a small pull back to the 23.6% support followed by an unsuccessful second test of highs with strong bearish divergence. Historically a 38.2% - 50% pullback is the expected retrace for a movement, so I would be surprised if the next leg starts without consolidating a tad lower first. A good 50% retracement would make a very attractive place to be opening positions here, as ETHBTC still has a lot of room to grow in the medium term. # Bitcoin Cash (Poloniex:BCHBTC 4h) Bitcoin Cash looks like it might've finally found a bottom around 0.1420. I would still wait for further confirmation before entering any positions, with a break of at least the 61.8% resistance level. A failed retest of the 0.1420 support would also make a good reversal signal for a longs, but a break even lower is very possible too, so wait for the confirmation. # NEO  (Bitfinex:NEOBTC 1h) Neo remains within its consolidation around the 23.6% retracement. This is a similar situation to the larger ETHBTC consolidation, which held steady within a tight range after its pullback. It's hard to predict how long this pattern will hold for, but unless we see a strong drop below the 0.01207 support level, this zone looks like a pretty good level for longs. # Cardano  (Bittrex:ADABTC 4h) Similarly, ADA is holding within its consolidation between the 50% and 61.8% retracements. A retest of highs seems likely in the next few weeks, so a long looks like a good proposition. With the 4730 support making a good level for a hard stop loss, this setup gives a strong profit/loss ratio. ### Disclaimer I will do my best to give unbiased, objective analysis, but **I can make no promises about my accuracy.** **All posts are based on my personal opinions and ideas** and **do not constitute professional financial investment advice.**