BTC: Distant and Distinct Possibility!

hive-167922·@milaan·

0.000 HBDBTC: Distant and Distinct Possibility!

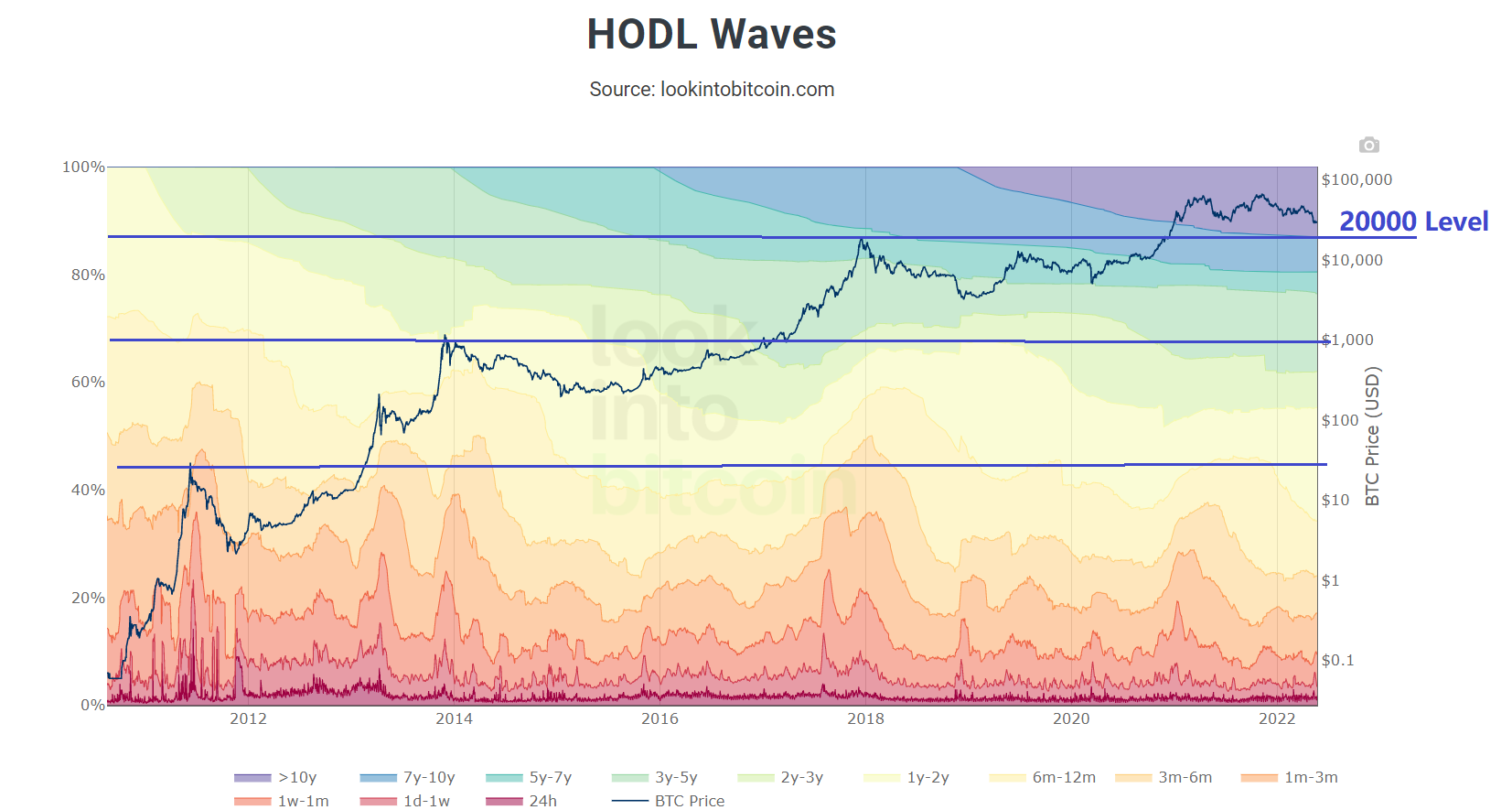

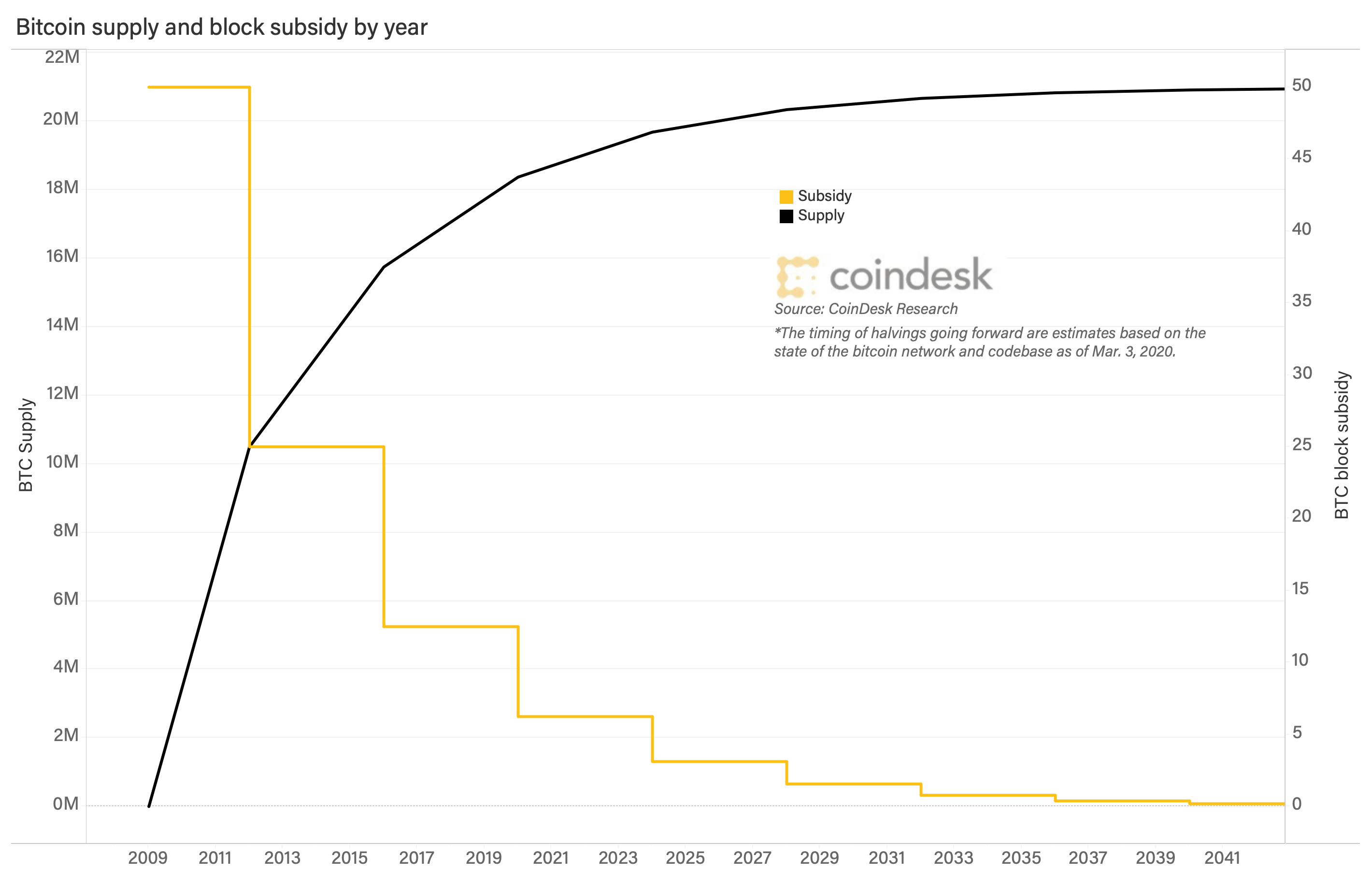

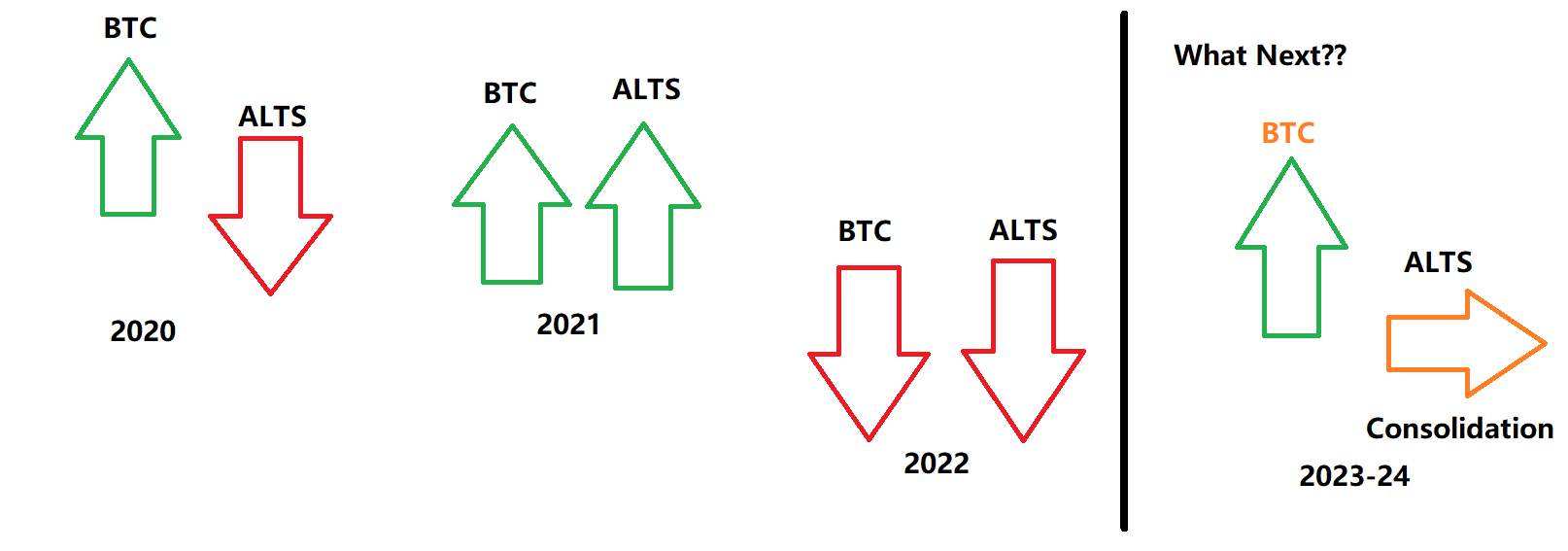

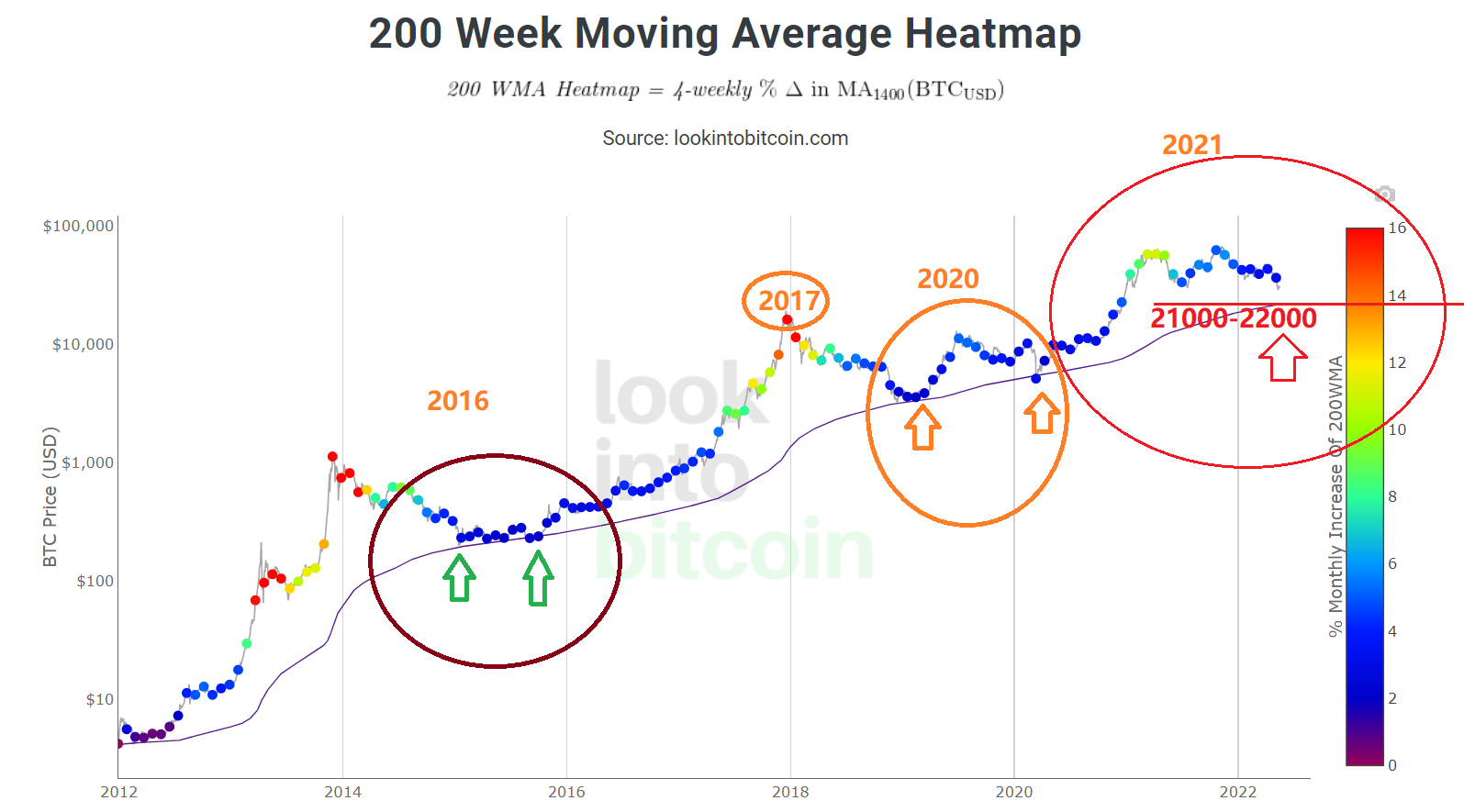

<div class="text-justify"> > In 2021 we didn't have any blow-off top for BTC and the top looks kind of strange if you ask me... Everyone was expecting a blow-off top in 2022, but the market did not produce it. In 2017 every one was anticipating 10k as the top and the market exploded like anything to print an ATH at 20k, followed by a long stretch of bear cycle 2018-19. Every single thesis of BTC maximalists in 2022 has gone wrong including Michael Saylor. Now the point is whether it would visit 20k or not(as it is consolidating on the lower band of the chart). May be may not be, we dont really know. But we can argue and lend perspective based on charts, historical pattern supports, etc. ### (1) BTC has historically preserved the previous ATH in each successive cycle What I see is that every time BTC scales the previous ATH, it tends to preserve that level, so if this theory holds good, then, in any case, it should not plunge below 20k.(20k was the previous ATH in 2018)  <sub>Source: lookintobitcoin.com</sub> ### (2) BTC will become the safe heaven in crypto as it's going to saturate It would be childish to think that every bull cycle (around the Halving event) BTC would rally like 10x, 20x, 30x, and so on. I think that's certainly not gonna happen. As BTC matures more and more the curve is more likely to saturate, just like its mining reward hardens after a period. So we can expect a perfect store of value with minimum fluctuation in BTC in the next decade. That will also be a signal that other young fundamentally strong coins would produce better results.  <sub>Source: Coindesk</sub> The price of BTC may not exactly be saturated like the mining reward. But it is more likely to trade in a narrow range with each successive halving event/bull cycle. This theory does not challenge the proposition of BTC scaling 0.1 Million or 1 Million in a future time, that may come with mass adoption, but from here on taking 20k as the bottom for the next bull cycle will not produce a rally like 20x or 30x within a cycle, that level will be conquered by BTC in a future time, maybe with 2/3 bull cycles and the price action will be somewhat better in the context of the store of value. Store of value diminishes with fluctuation. BTC has got every single box ticked except this. So in the future, it is very likely to inculcate this characteristic. ### (3) The peculiar trends In the second half of 2020- BTC went up alone, and ALTS remained under pressure. In the early 2021- BTC consolidated at the upper range, and ALTS produced a massive rally, this time the rally across ALTS did not happen in one go, the rally was produced in batches.  The current rally or the consolidation is still following the trail of BTC, so BTC to produce the next rally has to be on its own and for that to happen, the ALTS value should flow to BTC, so that BTC can produce a one-sided rally without taking ALTS along in the first run, but for that to happen, BTC should take the entire ALTS for a route(preferably to the downside). That is why I strongly feel that BTC to plunge to the 20k level to mark a bear season in the ALTS segment, and then BTC will start consolidating and constructing the footing for the next bull cycle. So again the ALTS will remain in the cooling phase in the bear cycle. ### (4) Crests and troughs are historical and fundamental to the market Not just the crypto market, the entire market historically is a combination of crests and troughs, crests and troughs produce a cycle and many such cycles constitute the chart/plot of an asset.  <sub>Source: Wikipedia</sub> But in crypto, it is a little bit more prominent, and strong fundamental coins are used to preserve a certain level in every cycle. That level may be considered a parity level and may also be considered as an opportunity for the fresh batch of investors to make an entry and for the existing, an opportunity to re-enter the market. So it's quite fair to have such a phenomenon cycle-wise. Remember not to jump by assuming this is the bottom or that is the bottom every now and then. Wait. The market is more wise and patient than you, so wait for that event to happen, you will get enough time to ascertain a bottom, if you really have doubt and go and check the last 10 years chart of BTC and see how BTC consolidated around the zone 250-300 USD for over a year in 2015-16, how BTC consolidated around 2700-3200 level for more than 6 months in 2018.  <sub>Source: LookintoBitcoin</sub> Now see this one, this is the 200 MA heat map, every time BTC has touched the 200 WMA, it has constructed it as the footing for the next bull run. One more interesting observation is that before a significant bull rally it has formed a double bottom in the two previous cycles. 200 WMA is also considered the parity level. If BTC touches the 200 WMA from hereon, then ideally 20-21k zone should be that level. But let me add a caveat, if BTC delays to touch the 200 WMA, then it will be somewhere in the zone of 22-24k because the WMA is also dynamically being plotted wrt the price of BTC. Whatever.... just keep a close eye on the 200 WMA, you will be psychologically comfortable to make a re-entry in BTC, and perhaps you will get at a discounted rate. --- **Disclaimer:- This article is intended for educational and analytical purposes only. It should not be construed as financial advice. Thank you.** </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@milaan/btc-distant-and-distinct-possibility)

👍 gangstalking, evgen-xx, seckorama, good-karma, esteemapp, esteem.app, ecency, ecency.stats, drwom, xecency, scaredycatguide, swelker101, surya1adiga, officialhisha, leoschein, gualteramarelo, megaleoschein, dugsix, bhealy, generatornation, darinapogodina, maurofolco, dwayne16, msp-curation, ausbitbank, krystle, r0nd0n, ma1neevent, amberyooper, isaria, juliakponsford, auditoryorgasms, digitalpnut, run-the-bits, ayushthedreamer, rootdraws, darkcore29, clayboyn, astil.codex, peachymod, limn, bushradio, franz54, vachemorte, nftshowroom, julesquirin, crimsonclad, anarcist69, blarchive, anarcist, koh, mitchelljaworski, bex-dk, minnowsupport, followbtcnews, punkblogs, angelica7, fragozar01, st3llar, melooo182, coininstant, drax.leo,