Internet vs. Crypto: Lesson To Be Learned

hive-150329·@muratkbesiroglu·

0.000 HBDInternet vs. Crypto: Lesson To Be Learned

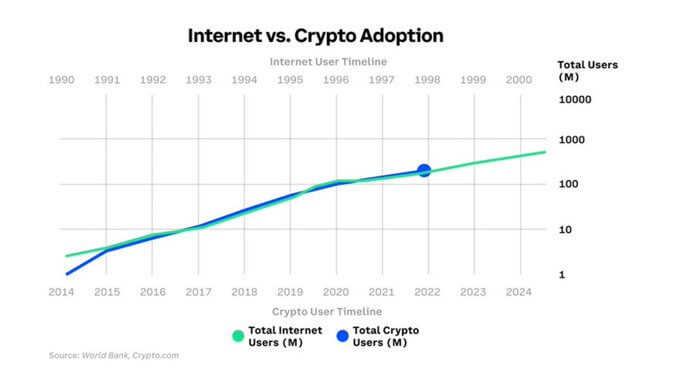

This morning, a question popped into my mind: What can the internet's impact on tech stocks tell us about crypto? I thought the answer to this question might be in the Nasdaq 100 index. The chart below shows the exponential evolution of the Nasdaq 100 index since 1986. I added the orange trendline.  First of all, the price bubble formed between 1995-2000 is seen in the chart. This process, also called the dot.com bubble, reflects the great excitement about the internet. Today, it has been confirmed that the internet is a revolutionary technology. There were only 15 years of early pricing 😀 (The index was able to reach the peak of 2000 again in 2015.) The part of the chart where the trend deteriorates downwards is pointing out the 2008 mortgage crisis. Afterward, prices gradually recovered, even exceeding the trend line in 2020 with the effect of Covid19. The chart shows that the Nasdaq 100 index is growing at an average of 14.4% per year. During the dot.com bubble, this rate was 60%. These growth rates are rather modest compared to the average annual growth of the crypto market of 140%. On the other hand, Nasdaq data can be interpreted positively as it shows that the exponential growth trend is sustainable for 36 years. Recently, the chart below from Coinbase was published on Lark Davis' Twitter account.  [Source](https://twitter.com/TheCryptoLark/status/1471730881337323522) The graph points out that the number of crypto users will increase to 1 billion in 5 years, as internet adoption and crypto adoption progress at a similar pace. According to the chart, the crypto world is currently experiencing the maturity stage of the internet in 1998. There was a price bubble in technology stocks between 1995 and 2000. Could the same price bubble apply to the crypto market? We can answer this question with "no", as crypto prices are following the historical price trend after the rapid rise and in 2017 and 2018. # **Conclusion** A few years ago, comparing blockchain technology to the internet seemed to me to overstate the importance of crypto. Now I think that's a pretty fair comparison. Revolutionary technologies such as electricity and the internet have led to great social changes. Nowadays, blockchain technology is reshaping many industries, from art to media, from finance to entertainment. With Web 1.0, we started to be able to get information easily over the internet. In the Web 2.0 era, online shopping became widespread and consumers began to participate in content production. Blockchain-based Web 3.0, on the other hand, enables much broader participation, such as ownership of digital assets and participation in decision processes. It is enough to observe the dynamism in the crypto world for a while to predict that crypto will become an essential part of our lives in the near future. I'm not sure if today's prices reflect the true value of the crypto industry. There are many arguments to rationalize upward or downward price movements. I believe that with a balanced portfolio, one can benefit from any market conditions in the long run. So it's best to finish this post and take a walk. Thank you for reading.

👍 jumbot, joeyarnoldvn, agememnon, ahmetchef, bluedwains, brofund-leo, brofund, francis.melville, roleerob, yazabilsem, thales7, borbolet, ctime, maonx, sbi3, eturnerx, votehero, steem-holder, fatman, investegg, voter003, chorock, sudefteri, akifane, kahvesizlik, fengchao, brofi, discohedge, behiver, jmsansan.leo, anadolu, bukiland, steemtelly, onealfa.leo, onealfa, webdeals, summertooth, oakshieldholding, senstlessmonster, contrabourdon, leovoter, empoderat, hykss.leo, luckyali.leo, onealfa.pob, seed-treasury, trasto, rollingbones, leprechaun, velourex, r0nd0n, successforall, bilpcoinbpc, meta.condeas, saboin.pob, scooter77, shebe, whiskeyjack1231, l337m45732, jacuzzi, kooza, semihbalkanli, deathwing, mrtats, emrebeyler, ausbit.dev, bigmoneyman, dpoll.witness, meowcurator, maskuncoro, onealfa.vyb, rxhector, axeman, thisismylife, readthisplease, damla, meesterbrain, crazydaisy, emotionalsea, chesatochi, snlbaskurt, uwelang, currentxchange, infinitytcg, centtoken, white-star, steem82868, akkann, funt33, razackpulo.pob, necho41, oldtimer, smartvote, stortebeker, vikbuddy, automaton, myfreebtc, pboulet, keepcalmandread, arcange, shainemata, raphaelle, steemitboard, laruche, walterjay, msp-makeaminnow, twoitguys, jaster, tariksaran, chronogn, marcusantoniu26, vempromundo, californiacrypto, turkiye, ahmetay, kirazay, unlikelysurvivor, lebah, canser,