Why Blockchain Is the Key to Servicing Borrowers with Lower Credit Scores

blockchain·@olacrypto·

0.000 HBDWhy Blockchain Is the Key to Servicing Borrowers with Lower Credit Scores

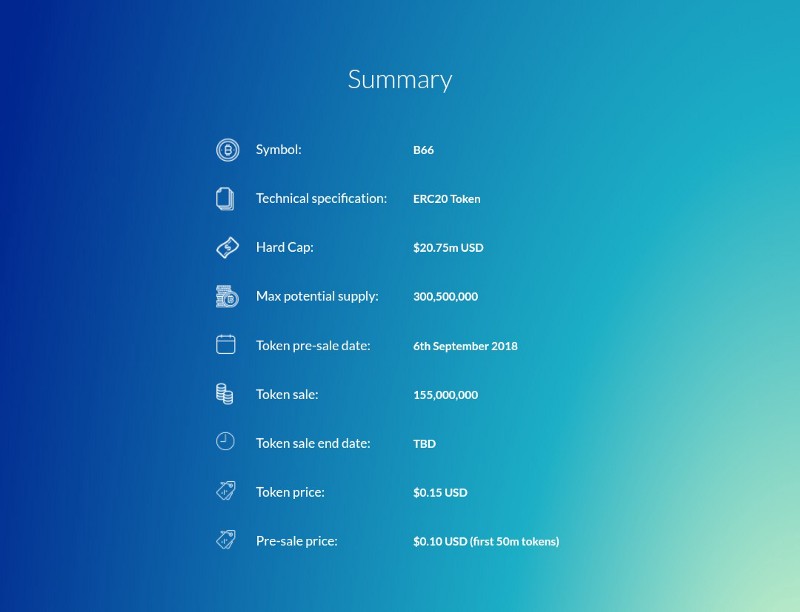

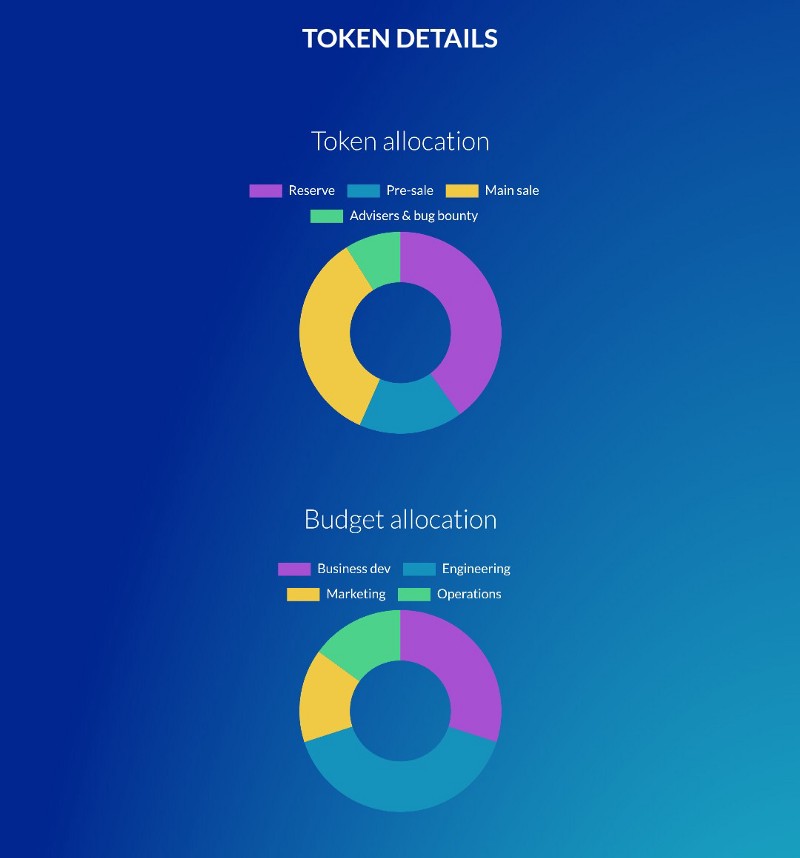

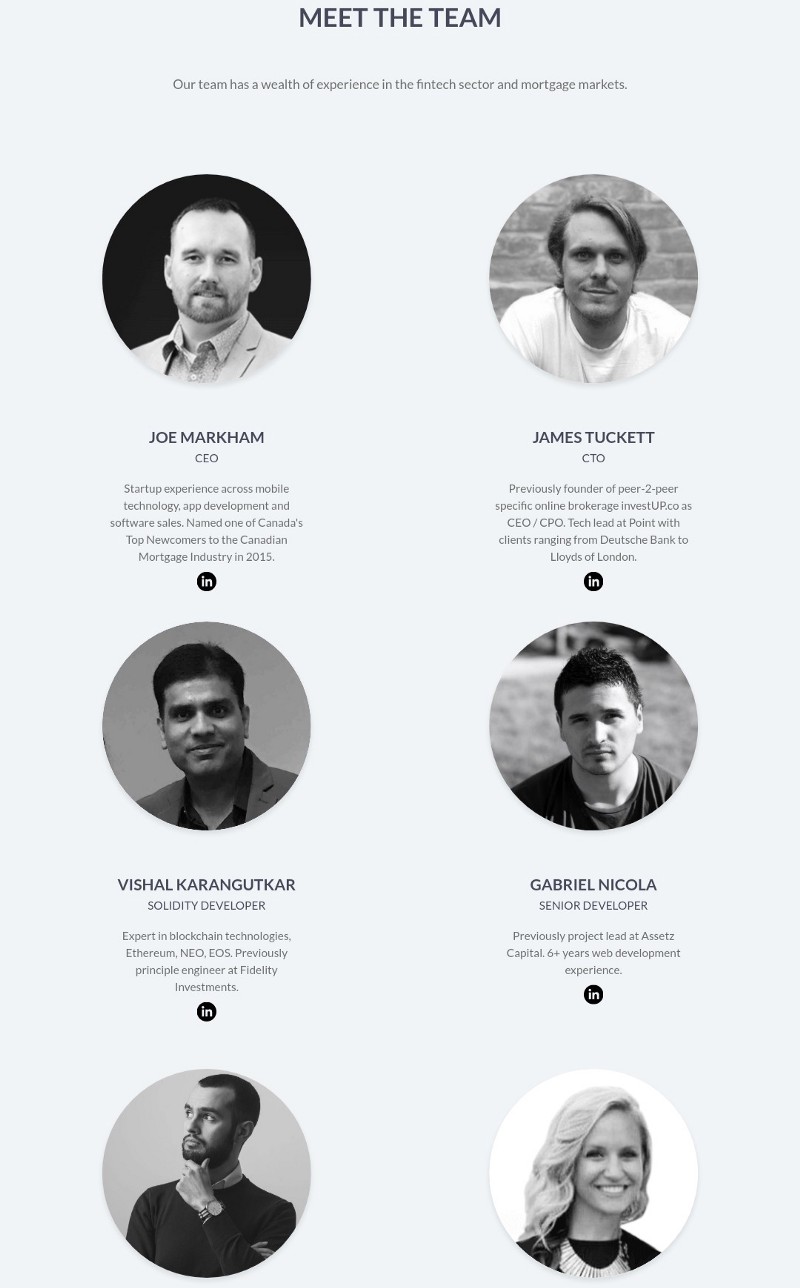

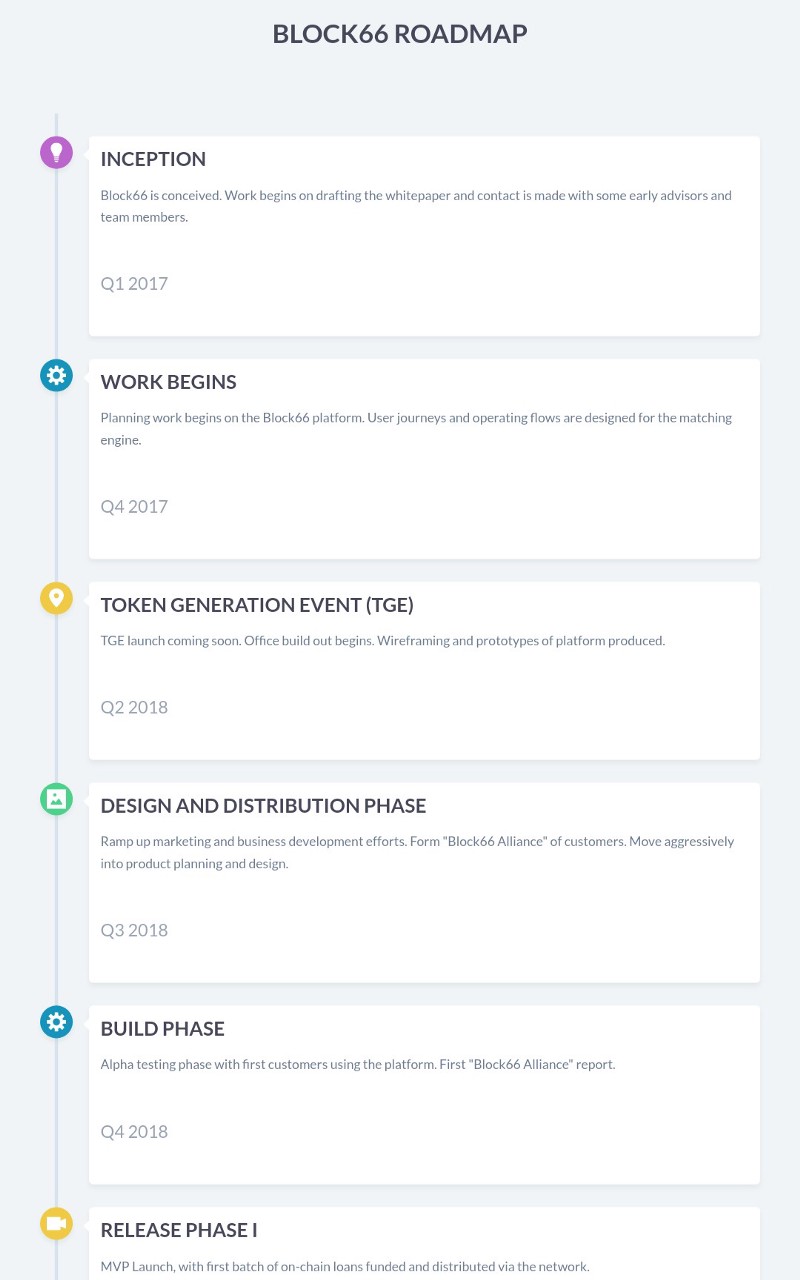

At the present time, loan fees on contracts are a portion of the most minimal they've at any point been. Candidates are scrambling to exploit those rates, yet some of them — even with great credit scores — are being dismissed. Indeed, even individuals with upfront payment and great credit can just purchase homes if the bank's consent to furnish them with advances. In 2015, just 36.7 percent of property holders were sans contract, and the majority of those were more seasoned individuals who had satisfied their home loans in 15– 30 years. Individuals don't have six-figure totals lying around to put toward homes; they require some assistance. Home loan merchants are the guards of that help. In any case, except if representatives discover approaches to get sensible credits in the hands of mindful borrowers, moneylenders will keep on missing out on income. Where Lending Criteria Goes Wrong Because of the budgetary emergency of the late 2000s, loan specialists are substantially more wary today about which individuals they trust with their cash. As a rule, regardless of whether loan specialists wanted to relax the reins, government controls don't give them a decision. This makes it troublesome for borrowers with bring down FICO assessments to anchor contracts. Industry confinements have for the most part done great things on a macroeconomic scale. Banks would prefer not to offer advances to individuals who won't pay them back, and candidates would prefer not to end up in the abandonment procedure. Be that as it may, this home loan development permitted an extensive gathering of individuals with great (yet not awesome) credit to get lost in an outright flood, denying commendable would-be mortgage holders of the opportunity to possess a house. In Canada, for instance, representatives as of late detailed a 20 percent expansion in borrower dismissals from substantial, customary home loan banks because of stricter controls. The expanded prime enthusiasm loaning rate in the U.S. additionally influences the capacity of this disregarded gathering to purchase homes. As the rate goes up (which it has completed five times since the monetary emergency), contract rates in the long run take after. Borrowers with weaker credit and borrowers who marked manages flexible rates get pounded by these vacillations, broadening the hole between those with incredible acknowledge and those for tolerable credit. What's more, despite the fact that financing costs are low, contract obligation benefit ratios — which measure the measure of gross salary devoted to paying the mortgage — don't support individuals with non-prime credit. High home costs shroud the earnestness of potential rate builds, catching property holders into paying more for their home loans (and for longer timeframes) than they proposed. Regardless of the elements neutralizing the normal credit borrower, the fight isn't lost. Home loan agents have a secret weapon to give sensible advances to meriting individuals: blockchain innovation. How Brokers Can Use Blockchain to Serve Mortgages Blockchain permits specialists three unmistakable favorable circumstances in the home loan adjusting process: 1. Changeless Audit Trail Blockchain innovation makes a changeless review trail for merchants to take after as they confirm candidate data and reports. Facilitates never again need to trust that a candidate submitted genuine data: blockchain makes a trustless procedure, following records to guarantee that nobody changes them after accommodation. This urges dealers to benefit individuals with bring down FICO assessments. At this moment, the home loan process powers records through a long chain of guardianship that opens a few open doors for extortion. With blockchain, notwithstanding, dealers can breathe a sigh of relief realizing that all submitted data stays precise. Shady borrowers are effectively gotten, while fair ones at last find the opportunity to demonstrate their value. 2. Less demanding Cross-Border Lending A few borrowers outside the nation who wish to purchase a home battle to discover intermediaries who will work with them. On the blockchain, however, global outskirts display far less difficulties. On account of the predominance of online frameworks, 40 percent of worldwide installments (more than $135 trillion out of 2016) move crosswise over outskirts. And keeping in mind that national frameworks make it troublesome for merchants and other budgetary middle people to track and deal with that cash, blockchain couldn't care less about those hindrances. Because of its all inclusive nature, blockchain enables merchants to serve anybody, anyplace, opening the entryway for global financial specialists and migrating families to purchase homes. 3. Enhanced Payment Tracking In the time of cell phones, contract installment following emerges as an obsolete relic. The installment processor may know when installments are late, however distinguishing constantly late payers and making activity intends to forestall sunk costs remains a tall undertaking. Once more, blockchain gives a simple answer. On account of its starting points as a stage for advanced money, blockchain is the ideal device for moneylenders to acknowledge and track installments specifically from borrower to lender — or loan specialists, all things considered. Expanded straightforwardness and enhanced installment preparing on the blockchain make contracts an engaging venture vehicle. Greater venture bunches giving money to advances implies a larger number of advances accessible for borrowers with not as much as prime credit. Blockchain innovation is taking whatever is left of the world by tempest, and it's chance the home loan industry made up for lost time. Borrowers with great credit and money to spend are sitting tight for banks to acknowledge their support. Also, blockchain gives the apparatuses dealers need to cross over any barrier between would-be borrowers and the general population who support their credits. TOKEN DETAIL  Symbol: B66 Token Type: ERC20 Token Hard-Cap: $20.75m Max potential supply: 300,500,000Token Pre-sale date: 6th September 2018 Token sale:155,000,000Token Token price:$0.15 USD Pre-sale price:$0.10 USD (first 50m tokens) TOKEN & FUND DISTRIBUTION BELOW  PARTNERS  TEAM   ROAD MAP  USEFUL LINKS Website => https://block66.io Whitepaper => https://drive.google.com/file/d/11ZevZaCwYSG_0iv8On810w3Sjj2E5FLq/view?usp=sharing Facebook => https://www.facebook.com/Block66Official Twitter => https://twitter.com/Block66_io Linkedln => https://www.linkedin.com/company/block66/ Reddit => https://www.reddit.com/r/Block66/ Youtube => https://www.youtube.com/channel/UCHBDzsJ5aKcYr02lrDVxoag?view_as=subscriber Medium => https://medium.com/@block66 Telegram => https://t.me/block66_Official Bounty0x Username => sherifcrypto

👍 fastresteem,