Bitcoin Resistance ,Probable Fall

bitcoin·@orphism·

0.000 HBDBitcoin Resistance ,Probable Fall

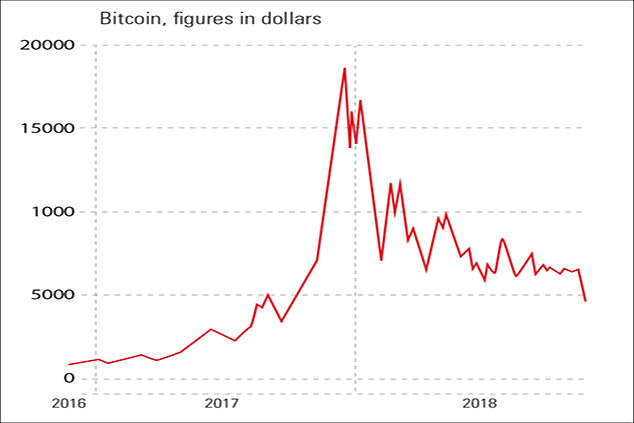

"Bitcoin is a short,! It goes back to 3500! Go to Bitmex and exploit everything you have now!" Sounds familiar? If you have been online since Bitcoin's first attempt to get back above 5400, this should sound very familiar. This is the general consensus among the herd. In fact, I have seen this feeling regularly in my comment panels. Do you want more statistical evidence? Take a look at Bitcoins' short interest. And with the recent double-summit training, I would not be surprised if this feeling becomes even stronger. I will be the first to say that I do not buy in areas of resistance, I prefer to buy in support areas. Since the beginning of April, Bitcoin's low pressure has pushed the price to a zone of great resistance that I have informed our supporters on innumerable occasions. Zone 5200 to 5800 is a zone of resistance proportional to the 6K level. From my point of view, the current resistance increases the probability of returning to lower levels, BUT that does not mean that I go there. Even with the current dual training that is trying to establish itself. This is what you need to achieve: The price is in resistance. Weak markets, even temporarily weak. DO NOT ALIGN TO resistance levels, they sell fast. The time that Bitcoin has fluctuated above 5K is about two weeks, while the short term interest is high. It is not a good recipe to abbreviate in my opinion. All these leverage courts are training, but you do not need a lot of support. Area 4930 to 5K remains intact. Clearly, the purchasing pressure continues to absorb the aggressive supply. It was a situation very similar to the one we found in Resistance Zone 4130. If another short compression occurs (which can happen nowhere), the price can easily see 6K, which is the next obstacle. for this market. The fact that the general consensus is extremely bearish adds to the argument in favor of higher prices rather than a deep decline. The crowd is usually suffering (which is the basis of the business models of most currency brokers). In summary, there are no absolutes in the timing of the market. A good technical analysis presents possibilities and probabilities, not precision. And a good perspective comes from taking into account the variables that are not visible in a graph. Without this basic understanding of market mechanics, it is very easy to get carried away by the irrational feeling of the herd. Our objective is to detect structural changes around possible turning points in order to better understand the probability that the flow of forced orders is imminent (short- or long-term liquidation). And for the time being, as long as the price can stay above the 4930 level, the chances of reaching $ 6,000 remain a reasonable possibility, even in the face of an area of greater resistance (yes, it is confusing and confrontational, but it's the market). And with that, I always stick to my plan to wait for eligible structural support. Would I like to see 4500? Of course, but the market does not care what I like. The area of 4930 to 5K is the active support area where we expect a long commercial exchange, but it all depends on the type of order flow that Bitcoin presents in a subsequent visit.