XVG VERGE - Feb 2 Technical Analysis - Bullish Long Term Up to 680% Gains

verge·@philakonecrypto·

0.000 HBDXVG VERGE - Feb 2 Technical Analysis - Bullish Long Term Up to 680% Gains

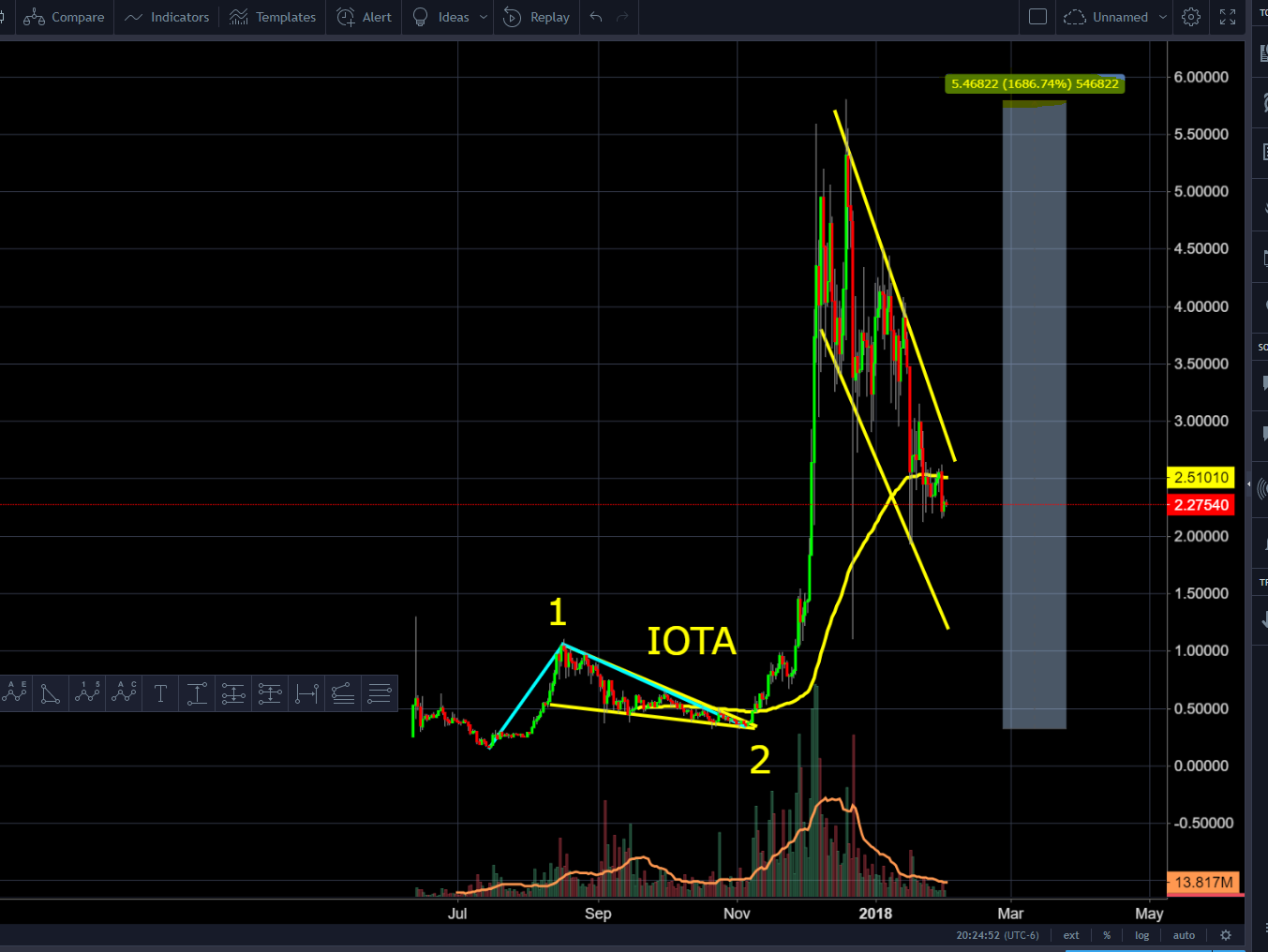

<center></center> <center><h2> WEDGE HOLDS - SUPPORT TREND LINE ESTABLISHED Long Term Bias (6+ months) - Bullish Medium Term Bias (4-14 Days) - Neutral to Bearish Short Term Bias (2-3) - Neutral to Bearish Long Term Target Prediction By 2019 - $0.30 / 0.00003500 Satoshi, Up to 600% </h2></center> https://youtu.be/2-zDbnJQbQc Firstly to correlate similarities to OmiseGo, we can see OMG form the same type of pattern, where it broke out to fairly exact 1:1 extension target 1, and 1:161.8 extension target 2.  We also see similarities in other coins like IOTA. Here is IOTA during its wave 2 consolidation under $0.40 range before the massive breakout.  Then we know the rest with IOTA after breaking out.  <h3>We ask ourselves, can another chart that looks similar do the same? </h3> Since BTC corrected to the $7,900 yesterday, we saw XVG form a bottom right along the trend line support, which now forms a beautiful falling wedge pattern.  Using a fib extension target of 1:1.618, there is a potential 600% play long term.  https://steemitimages.com/DQmRhDtjokAZnGKi4QwheqksKTFo6m4fsjMYsNNrsitC1xk/DQmRhDtjokAZnGKi4QwheqksKTFo6m4fsjMYsNNrsitC1xk.gif <center><h2>Always be cautious, take high probability trades, plan entries and exits, stick to high reward low risk R:R setups. Good luck traders</h2></center> <h2>Tutorial Series</h2> [Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex](https://steemit.com/bitfinex/@philakonecrypto/bitfinex-how-to-customer-and-set-up-bitfinex) [Lesson 2 - How to Analyze Candlesticks Charts with Strategy](https://steemit.com/reading/@philakonecrypto/tutorial-part-2-how-to-analyze-candlesticks-charts-with-strategy) [Lesson 3 - Moving Averages](https://steemit.com/trading/@philakonecrypto/video-tutorial-series-to-help-beginners-let-s-learn-moving-averages-like-a-boss) [Lesson 4 - Relative Strength Index RSI with Advanced Strategy](https://steemit.com/bitcoin/@philakonecrypto/tutorial-series-video-4-let-s-learn-relative-strength-index-rsi-with-advanced-strategy) [Lesson 5 - MACD and Histogram](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-5-let-s-learn-macd-and-historgram) [Lesson 6 - Margin Trading Long, Short, Leveraging](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-6-let-s-learn-margin-trading-long-short-leveraging) [Lesson 7 - Basic Risk Management](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-7-let-s-learn-basic-risk-management) [Lesson 8 - Fibonacci Retracement Part 1](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-8-let-s-learn-fibonacci-retracement-part-1) [Lesson 9 - Fibonacci Extension Part 2](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-9-let-s-learn-fibonacci-extension-part-2) [Lesson 10 - Laddering](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-10-introduction-to-laddering) [Lesson 11 - How To Interpret Time Frames](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-11-let-s-learn-time-frames) [Lesson 12 - Swing Trading Advanced 55 EMA Strategy](https://steemit.com/bitcoin/@philakonecrypto/lesson-12-let-s-learn-advanced-55-ema-strategy) [Lesson 13 - Introduction To Elliot Wave Theory](https://steemit.com/bitcoin/@philakonecrypto/lesson-12-let-s-learn-advanced-55-ema-strategy) [Lesson 14 - Using a Basic Excel Tracker for Risk Management](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-14-using-a-basic-excel-tracker-for-risk-management) [Lesson 15 - Tutorial Part 15 Automatic Stop Sell/Buy Executions](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-14-automatic-stop-sell-buy-executions) [Lesson 16 - Tutorial Part 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2](https://steemit.com/bitcoin/@philakonecrypto/tutorial-part-14-automatic-stop-sell-buy-executions) Twitter - https://twitter.com/PhilakoneCrypto Youtube - https://www.youtube.com/user/philakone1 <h3>If I've helped you, consider buying Luna and myself a beer</h3> BTC address: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9 Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850 LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization. DISCLAIMER: Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

👍 kernobee, llmadrid, seagrass, pcapanna, ohusain611, dengiz, yarostan, chocolatebear, yayaroost, guhn3r, ikeenan, fathye, eugeniuz, aschiedermeier, teamaltcoin, al-bassmalah, modernpicasso, steembasicincome, faedicus, kdinh529, weirdistheway, alextruong54, mindblown, onlineprofits, whaaatoh, fattcontroller, disazajr, fhzm2018, spx464, lionhead2028, qunobis, cliffy32, titan870, texassized104, holidayseasonnnn, derekcharlebois, jb258crypto, onnop, rasheedyassin, sbi2, gunshowmo, dalanfsu, veruda, dbush75, workin2005, rogerheaton, jmosby, cryptojack44, barmoley, winghong, ryancoon, humblestudent, captainofcrypto, kinngme, henk4hire, elnoelio, thecryptofiend, cryptoanalyze, itshodltime, cryptofig, hellandback, asafa, orotund, iamdrock, blessed4789, luc-lucens, charlie-jay, t3d, greenfrog1004, tipitip, ghostfamcab, lachlanh, synco, hefziba, independentricky, naomi88, noxfp, philakonecrypto, michvdamme, cryptocultivator, taylan79, fatetrader, anonimohse, orion61, bembo2, eatan2, greatwan, gsandford, jvik, darksinister, thetheresag, locotoki, swagtoshi, joeal, dustinwang, ouali, lpol, smurfcoin, m1nd777, finkgraphics, leo-87, cryptotrekce, idolbass, pionic, cryptominer1968, newtrix, ewmism, toowoomba, johnnypez, superlative, xtrabytes, jernejsorn, medicinaenvideo, luckymehla, cyrptobelfort, gacs, shouldahodled, ceo2222, jasonclements, crypto-sid, cryptonick87, shakalakaboom, allanbrito8, dariom, boozerock, laijhong, patcic, emphase, adri1202, ausbeimit, cryptozed, ragzzster, darrelh, sumei, hesate, nanthinip, waynemo, wongyal, d0nmani, smita0807, akamachine, stefenchoy, cryptoaholic, jluong, elguap00, adnan.younus, cwazuidema, vchai23, ehsanjamali, shlomoovadya, scoobsyo, sage32, nothingtolose, fhalan969, jecazhao, tweakyneek, caesarkat, acerie, damss83, bjrnlcznk, hernant, denizfi, jpretorius54, rise4dizzzy, keithscan, rbuckleyjr1, autyiuo, tr3nt, tenshi-san, jameswee, alexcara, sn1p3r, kaif, lukas374, razvanski, gummedshoes, karimcompadre, tedmosbey, sanjukk, pti86, menes, baudi, steviesteem, cryptonam, szonjasofia, tofina, aequitas2889, richard9349, theywenttojareds, morph97, weetamoo, thomaschoi, kdibb, lysergicpixel, phatkiller, trader0101-019, augustpaulphoto, shanghaicrunk, sabaidee01, medicwillcrypto, dorvald, edwardin1972, danpaulson, iliya.iliev, davidkortrijk, wazzact25, aaraza, drjain, cryptophile1, sponge123, watchout2017, fazzaa, caliterpz420, jaideepmahajan66, mybeah, vaanon, acorwin, mrjarritos, backnasli, pbees, moddedpegasus, rgbatista, gclancoin, bendiciontrade, bigdigi, stevegrant, resley, edngo, cryptopian68, cryptoforfuture, theryanbanks, luckysatya, cryptocoq, tomtang, labmike, discus420, yewcandoit, igamepad, nonick, viktorcrypt, aaryn, jolhnmarlk, illray, zackofalltrades, brianparisien, delta618, younestft, tdizzle, johnluhno, samlach, michelrhl, flourishes, j00ston, orionmodern, fieldsofgold, linli, ehmsii, svgspnr, jaywalk3r, freakmaster, vixie, cryptodrew, acutedev, sebasmnz, thubbie, husam2018, meatsteemit, simplyhepia, zingarden, ekanika, pinay1002017, spirin, kueikueikueikuei, tysonwd, grumpyoldman, renemegs12, katetozlatkova, kristerkb, nadecrypto, schimelfarb, alexanddurrr, arinsh, jujuzeking, brettlb, kbucher, reynai, wazowski, gqwvw, cptsenseless, amirza, um-siddiqui, gariep, kkastanakis, boydy42, whats-coin-on, crypto-zombie, wytenow, cbarrage, lagrunge, danquc, ckeller17, matthews41, danicool, truchan, deipwang, dgman234, commanderwiggin, thegoodlife, dfellas, jrrrrd, wimopeanon, slamurai, nolimi7s, ceelokstah, clublights, mfmooney, mkoin, cat-in-space, bubbabue, kryp2n1te, akxel, megadarv, mlewk, nunopalha, shannonb, kuroicrypto, kirschner, cryptobar, hodltrader2000x, hukkaboy, fortesquieu, vazulu, markusloo, waddz, scaevolat, rubencone, wf30900, monstersauce, y0ggsarr0n, philpanossian, tradeitforward, papacoins, atmozfear, icky, stu0112358, rjagcr, binim, hypercrypto, abtcd, niogales, additio, kittengray, grasshopper4life, toddrabies, duggaboy,