Crypto is Forcing Us to Rethink Money

crypto·@pietromoran·

0.000 HBDCrypto is Forcing Us to Rethink Money

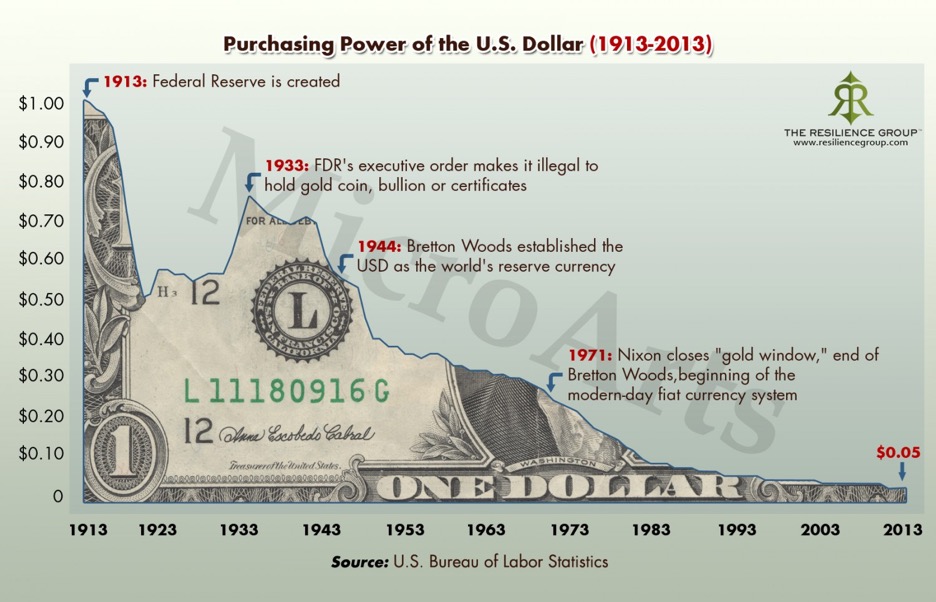

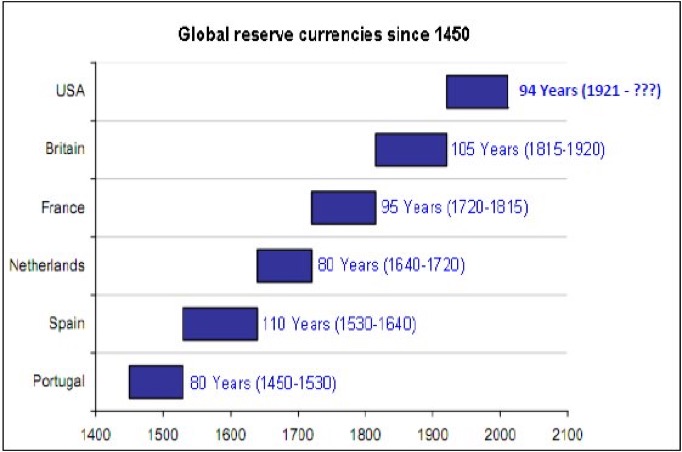

What is money, and why do we use it? A concept as old as trade itself, money is the medium with which we exchange and transfer value from one economic agent to another. Whether it be coins, shells, rocks, or paper, money can take on any form that transacting parties agree on. In the United States, we accept paper currency in the form of dollars to facilitate our economic activity, but we rarely give thought to how this system works, and how it can materially affect our economic well-being if mismanaged. Money was first created as an emergent system by and for market participants to facilitate commerce and storage of wealth. Today it resembles more of a permissioned medium that facilitates government fiscal and monetary policy objectives. Such a shift ultimately leaves the consumer with less agency in the marketplace, exposing him to the effects of inflation and policy experimentation. The emergence of Bitcoin and other cryptocurrencies provides us with legitimate competition to the nation-state monopoly on the issuance of currency potentially facilitating the necessary separation of state and money. Currencies as we know them suffer from the long-term effects of inflation, defined as “the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.” Illustrated below is the erosion of value over a 100-year span of one dollar, which if held over that time period would only carry five cents of equivalent value from start to finish.  Inflation is a targeted metric at roughly 2% per year, meaning that any cash position held is being intentionally devalued on a yearly basis. This tax on savings dramatically affects the composition of our economy, encouraging consumption in the short term to outpace value erosion. Maintain that trend over a long enough time horizon, and the value of a singular dollar drops to near zero due to exponential decay. As consumers we see this viscerally manifested in the amount of goods and services each of our hard-earned dollars can buy us in the marketplace. This is possible due to the purely fiat nature of currencies. Prior to 1971, dollars were pegged to the value of gold under the Bretton Woods agreement. This allowed for a physical commodity with relatively fixed supply to govern the value of paper notes that could otherwise be printed ad infinitum. Remove the peg and the restrictions on printing are no longer an impediment. Though imperfect, this system has served us relatively well, but it is important to understand that 50 years of fiat experimentation is a mere blip in the historical timeline of currency. We have yet to fully understand the consequences of this system in the long term, and should be wary as to whether past results will represent future outcomes. Another conflict with centrally managed money lies in its incentives. Politicians and central bankers keen on garnering favor in the short term are incentivized to debase the value of currency to achieve the ends that benefit their constituents. Once it’s realized that monetary debasement can finance government fiscal irresponsibility through deficit spending, it becomes the de-facto modus operandi; voters to tend to vote for politicians that support social programs that benefit them. A recent example is the 2008 financial crisis, where systemic failure in the banking sector prompted quantitative easing to avoid a deflationary cycle that would spell disaster for over leveraged sectors and the government. This transitional gain trap created by the intermingling of money and the political system, coupled with the inflationary nature of currency is one that will ultimately spell ruin for government fiat currency over time. The resulting effect of this phenomenon is the overuse of leverage and debt, creating massive liabilities like the 21 trillion dollar debt our nation currently faces. In “kicking the can” down the road by concentrating benefits in the short term while dispersing costs into the future, our political system has effectively stripped the equal use of our currency system from future generations. The amount of unfunded liabilities we will eventually need to address, which include such election-issue programs as Social Security and Medicaid are also a major problem for future generations. We are stealing the future prosperity of our children. Those future liabilities amount to over 112 trillion dollars. In a purely fiat system where the only value of currency is in the faith and credit of the government, the ability to repay these debts is directly correlated with the strength of the currency. At some point said debts and liabilities must be funded, or the value of the faith in our currency will diminish further. Separation of government and money is important for many reasons but specifically because governments are cyclical, but the need to transact and exchange always remains. Consumers should realize that the security of value we have enjoyed over the past 100 years will not necessarily persist into the future. In the United States we are extremely lucky because the dollar is the de facto world currency, but reserve currencies have a historic shelf-life, and are cyclical in nature as seen on the chart below. We are already within the historical range to shift to another reserve unit of account, and it is possible that we see a continued and more rapid shift in global reserve currency from the dollar to something else.  So how do Bitcoin and other crypto-currencies provide a solution? Sovereign currencies operate as a cartel that allows for a limited few to manipulate a system designed to include all market participants. Until 2009, there existed no effective competitive mechanism to allow consumers an alternative to the few mediums of exchange permissioned by nation states. But do currencies regulated by physical jurisdictions make sense in the future? In an increasingly digital world, commerce and the majority of economic activities are shifting online. The internet unlike a country has no local jurisdiction, rather it operates freely and openly for all participants. Value transfer should operate under similar principles, allowing for universal exchange that transcend localized barriers like language and geography. Such a system cannot exist under the control of one localized entity but must be agnostic to the machinations of those who would want to manipulate it for selfish and political ends. What cryptocurrency provides is a universal medium of exchange where trust is no longer centralized in a government institution. As a result, the ability of these tokens to store value is independent of a government’s ability to manipulate it. Even if digital currencies do not become widespread, they still move us toward a more efficient equilibrium. The new contestability of the currency market should move us toward more efficient outcomes, as the market demand for sound money will always exist. Crypto currencies will also allow a higher degree of economic agency at the individual level. Encoded inflation schedules, diversity of assets, and the efficiency of transacting in a purely digital medium will enable more economic activity than currently possible in today’s financial system and create transparency as to the rules governing each asset. Crypto-currencies utilize incredibly empowering technology applied at a focal point in the history of currency. These currencies reduce the counterparty risk associated with having a central issuer, while empowering the end user with an un-censorable network of value transmission. The experiment of untethered fiat currencies is a didactic one; we can no longer depend on government altruism and good behavior to maintain the system that facilitates all of our economic activity. We stand at the inflection point where purely fiat systems are struggling to maintain the trust necessary for economic activity, and where digital solutions are emerging to recreate that trust and confidence. Can we honestly tell ourselves that we trust the politicians of today with this responsibility? Crypto-currencies will materially affect the way we and future generations commercially interact with each other. Let us not be complacent with the status quo, but rather make strides to adopt a more meritocratic system that will facilitate economic activity for the long term.