My work in the field of Artificial Intelligence - Episode 4 (2015-2017)

ai·@prameshtyagi·

0.000 HBDMy work in the field of Artificial Intelligence - Episode 4 (2015-2017)

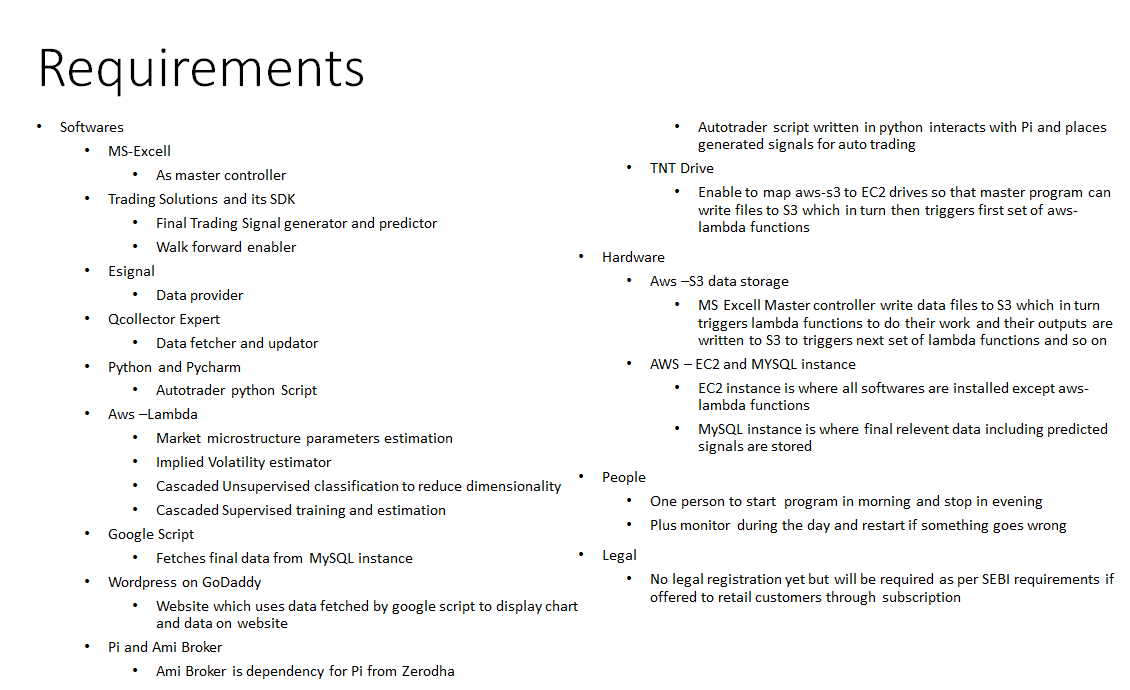

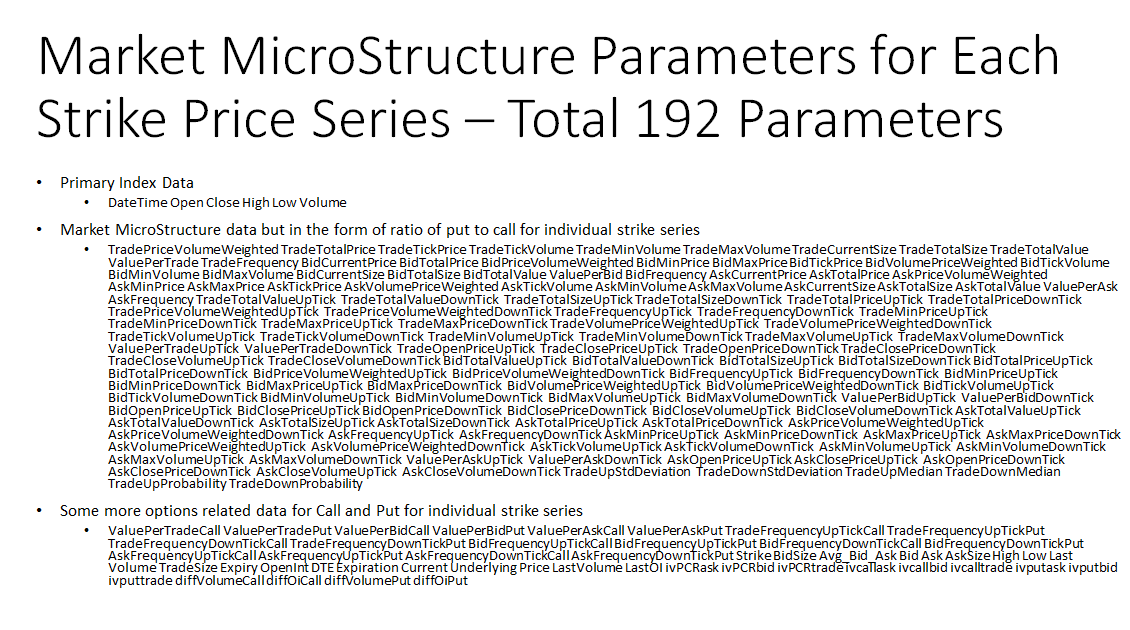

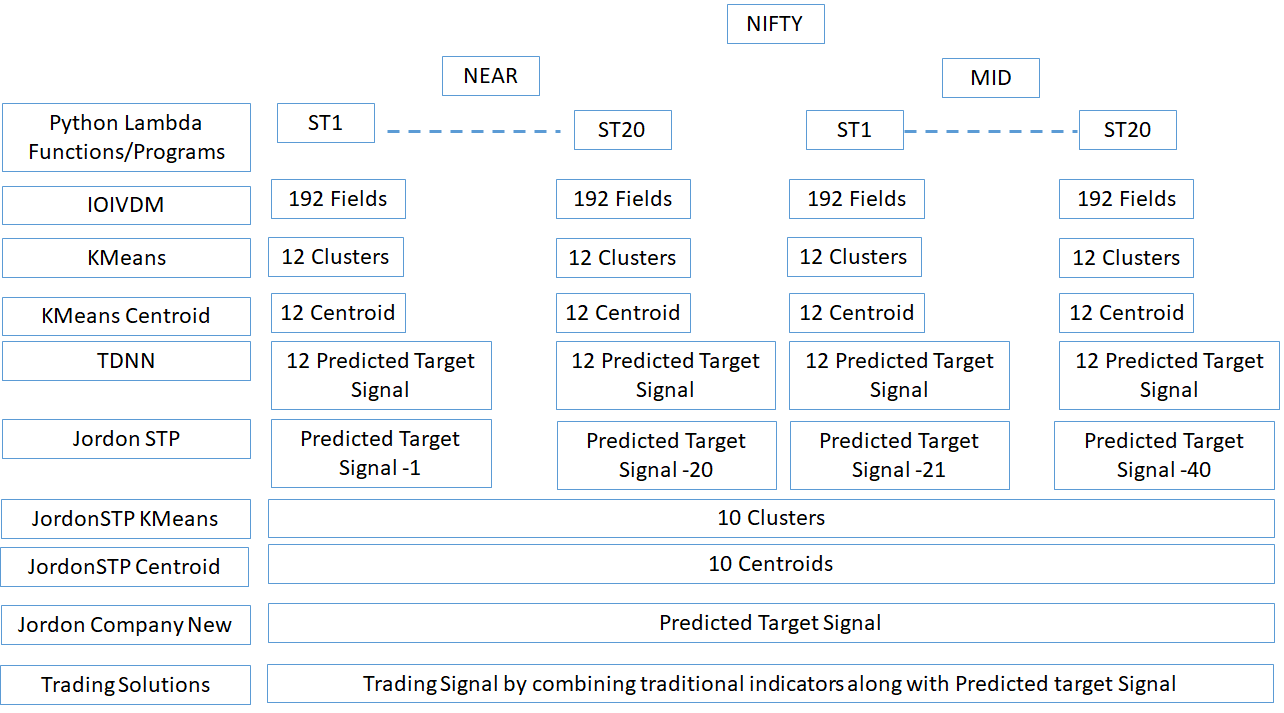

I have had long passion to use AI for stock trading and investments. So as the opening sentence suggests I devised two different methodologies - one for short term trading and another for long term investment. In this post I will discuss about my research and findings about short term trading. I started doing my research since 1994 on and off around this subject. But since 2006 I seriously started coding around my ideas to test the accuracy. I kept doing it along with my job till 2015. And then in 2015 I decided to leave the job and implement my idea. Below are the details of the methodology that were implemented. # Description of the Technology # Predicting stock direction for reduced risk in trading of stock market is of extreme importance in the field of trading and investing. Having worked in this field, as part of my hobby, and reading relevant literature over last 20+ yrs– I have hypothesized that market players with sufficient liquidity, if have some market moving information, then they will discount that information in options and may further fudge it by spreading their activity over different strike prices-in turn affecting implied volatilities and microstructure dynamics of options market. If that is true then one can do real time calculations for implied volatilities (bid, ask, call, put) across all strike prices along with corresponding market microstructure dynamics (bid-ask spread, bid-ask-trade frequency, sizes etc) again across all strike prices and use that to predict entry and exit points through use of artificial intelligence. This would have higher probability of predicting correct entry/exit points that would provide better return with reduced return volatility against say just buy-and-hold. Having made that hypothesis – I subscribed to [E-Signal](https://www.esignal.com/index) Stock Market Data Service, wrote code in dot net and python, used AWS lambda functions and S3 service for parallel computation across all strike prices. Below picture lists out all the technologies/resources that were used  Below picture shows the data fields generated and used  Below picture shows the data representation and flow through various data analysis and AI programs  Development took me nearly 18 months and then I ran this service for one full year June’16 – May’17 for NIFTY and BankNIFTY indexes of NSE, India. I selected these two as liquidity for options of these two instruments is good enabling me to execute signals as market order through automated trading service of say e.g. [Zerodha](https://zerodha.com/).  Based on one year analysis - The profitability for BankNIFTY was better than NIFTY and together was better than buy and hold with reduced return volatility.  All the signals were relayed to [twitter](https://twitter.com/VulturesPick) and [Facebook](https://www.facebook.com/vulturespick/?ref=bookmarks) for validation by third party. # Key Observation # 1. Overnight adverse movements could not be predicted and caused reduced return 2. Higher the volatility of the underlying -better are results Both the above observations suggests that if we use the methodology for a market that runs 24/7 and has higher volatility then that would help us generate higher returns. Therefore, crypto markets could be right place to deploy it. However, the options market in crypto world are in nascent stage, currently offered by [Deribit](https://www.deribit.com), and have very low liquidity. # References # [THE INFORMATION CONTENT OF OPTION PRICES DURING THE FINANCIAL CRISIS](https://www.ecb.europa.eu/pub/pdf/other/art2_mb201102en_pp87-99en.pdf?295908aa3bf14f87232d38c273002e01) [PRICE, TRADE SIZE, AND INFORMATION IN SECURITIES MARKETS* ](http://www.fsa.ulaval.ca/personnel/PHGRE5/files/Easley_OHara_1987.pdf) [How do Informed Investors Trade in the Options Market?✩](http://people.stern.nyu.edu/msubrahm/papers/Informed.pdf) [The Information Content of Implied Skewness and Kurtosis Changes Prior to Earnings Announcements for Stock and Option Returns ](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1309613) [Trade-Size and Price Clustering: The Case of Short Sales ](https://www.researchgate.net/publication/228260690_Trade-Size_and_Price_Clustering_The_Case_of_Short_Sales) [My work in the field of Artificial Intelligence - Episode 3 (2004-2009)](https://steemit.com/ai/@prameshtyagi/my-work-in-the-field-of-artificial-intelligence-episode-3-2004-2009) and many on Artificial Intelligence during my last 20+ years research in this field. # Future Plans # I am currently looking for investors and collaborators to commercialize it and to deploy it to newer markets like Crypto. Please get in touch if it interests you. Codes for AWS functions used in the project are shared in the [github](https://github.com/ShilazTech/VulturesPick)

👍 warchild, share4every1, warrior-sage, changjia, kehuanmi, abcor, stmpay, bluesniper, accelerator, effofex, khairulmuammar, pagliozzo, terminator01, abysoyjoy, ijark, forgetsharif, sunnydream, bitok.xyz, janny, dine77, ctime, steemtruth, hasitpbhatt, erikaa, brokentrust02, enaksis, shilpavarma, hemantrg, followv, rengganis, zackyy, rekibaho, denidrako, arizalfratama, dfruit, prameshtyagi, cifer, magpielover, filipino, utkarshvarma, vishalhkothari, alfanso, wonsangpil, ajaykumar4, anantaguglani,