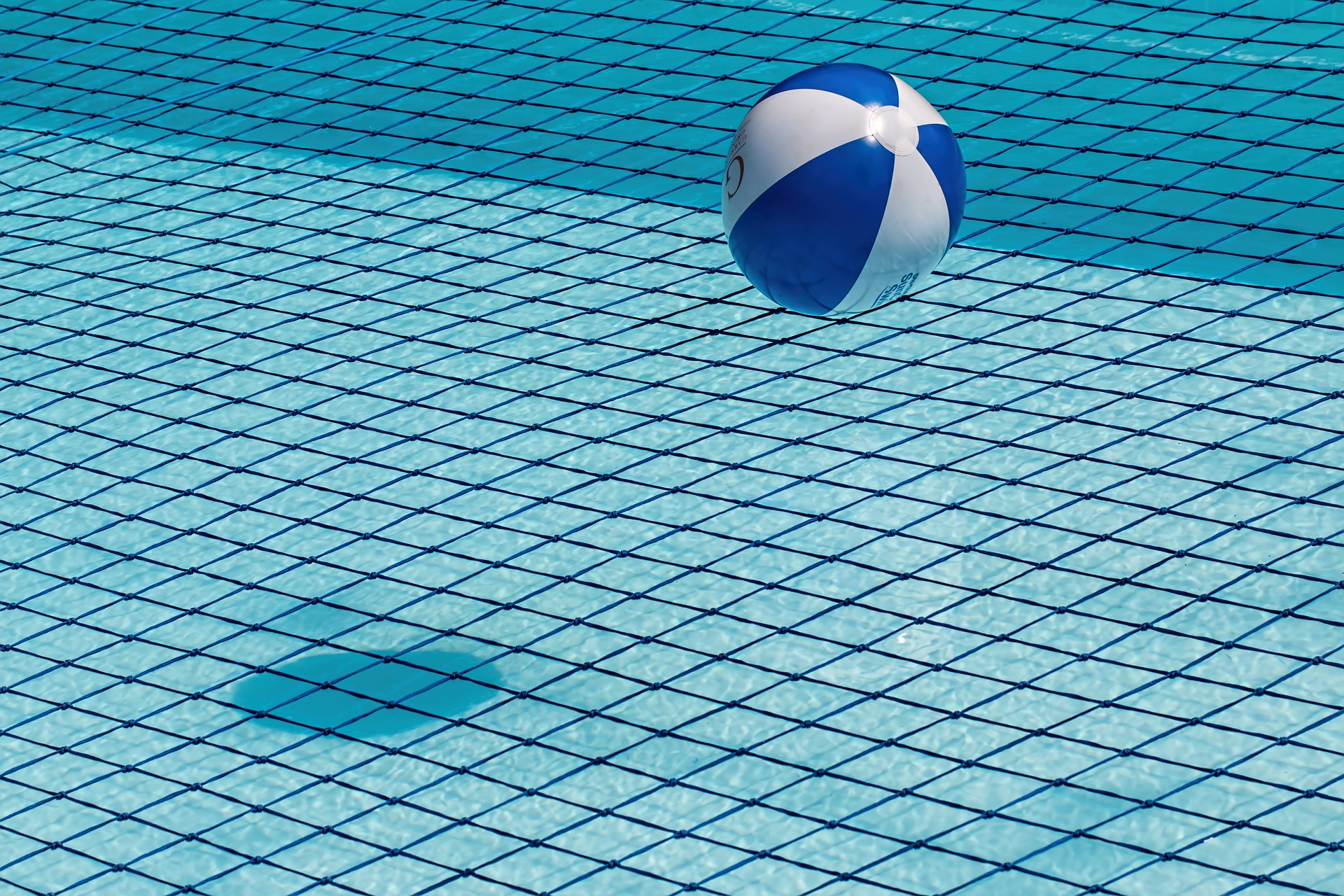

Wisdom in a Safety Net

finance·@psitorn·

0.000 HBDWisdom in a Safety Net

You know the saying that you never need an umbrella until it rains. That would be the time when you don't have one. ( Murphys law.) Too many people have that attitude about money matters or being prepared. " If you are prepared you shall not fear". Words spoken by many wise men and I'm sure it rings true in all our lives. Planning now can bring the reward of financial security when disaster comes your way. So my suggestion is start weaving that safety net. In my family's life Steemit and the crypto currencies are being weaved into that net. Many people, because they are young, healthy and visit the gym 3 times a week, think they're immortal. As a result they don't protect themselves by taking adequate risk coverage in the event of death or disability. The question we have to ask ourselves is : do I have sufficient assets for my family to maintain their quality of living if I die or are disabled?  How will they or you cope financially ( if you're single) for the rest of your life if you're hit by the proverbial bus and permanent injuries prevent you from earning a living? The unexpected does happen quite often. The way to ensure that you and your family are not left impoverished is to take out risk, life assurance against disability or death.If trauma strikes, the lack of financial security will leave a family in crisis. So everybody, except maybe the super wealthy, need to have appropriate safety nets in place. My mother a qualified teacher, degreed and experienced, suffered a mild stroke at a youngish age. She was unable to teach again, but she had a safety net of a good, life-long pension which she paid into religiously for many years. Lionel Karp, the Financial Planning Institute, winner in 2005, warns that you should not mix investment and risk assurance in one policy. If you want both take it out in separate policies. If you want to make an investment, look at all the opportunities available. Do not limit yourself to something packaged with risk insurance. There are reasons for this. Lack of transparency: You can never be sure of how much is going to your investment account and how much is deducted from your premium for risk assurance.  Lack of flexibility : You should be able to reduce premiums as your circumstances change. This should be a option in your premium as you could pay high penalties to the assurance company. If you no longer require a life assurance or want a cheaper option, you can cancel a risk policy at any time without penalties. Costs: The best option is to buy what is called "term" assurance, which you take out for fixed periods. To establish the period of term assurance, the first thing is to assess how much you need. This will differ for different families, taking children's schooling etc. into account. making use of a financial advisor, you will: Have help to clarify your financial objectives. Will be told what you need to do to meet those objectives. Clarify what risks you need covered by assurance. Determine how much you need to invest It's a bit like going for a check up at your doctor. I have a highly qualified friend who has been retrenched and has to travel up into Africa to fulfill contracts. He, being the sole provider for his rather big family, has cashed in a few policies to keep the standard of their living up to scratch. Without his policies, who knows where they might be now.?  Sources : Wikipedia, Excerpts from B. Cameron's advice. Excerpts from Lionel Karps counsel. Pixabay.