Why Silver Is A Good Investment For Your Portfolio

money·@realcodysimon·

0.000 HBDWhy Silver Is A Good Investment For Your Portfolio

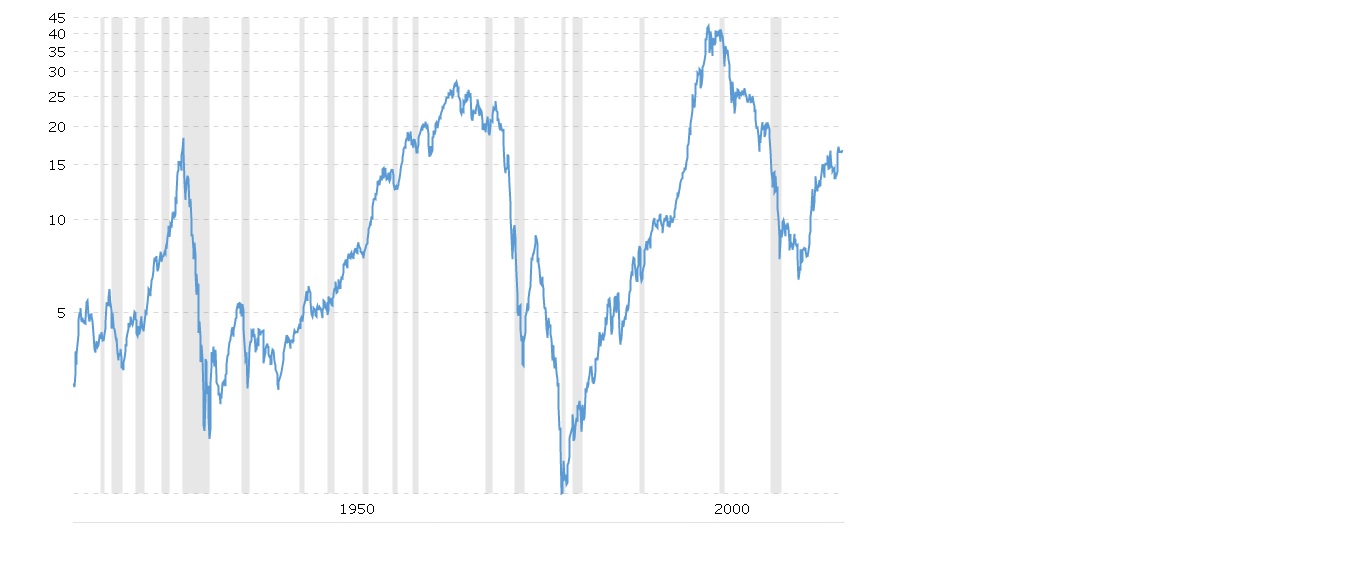

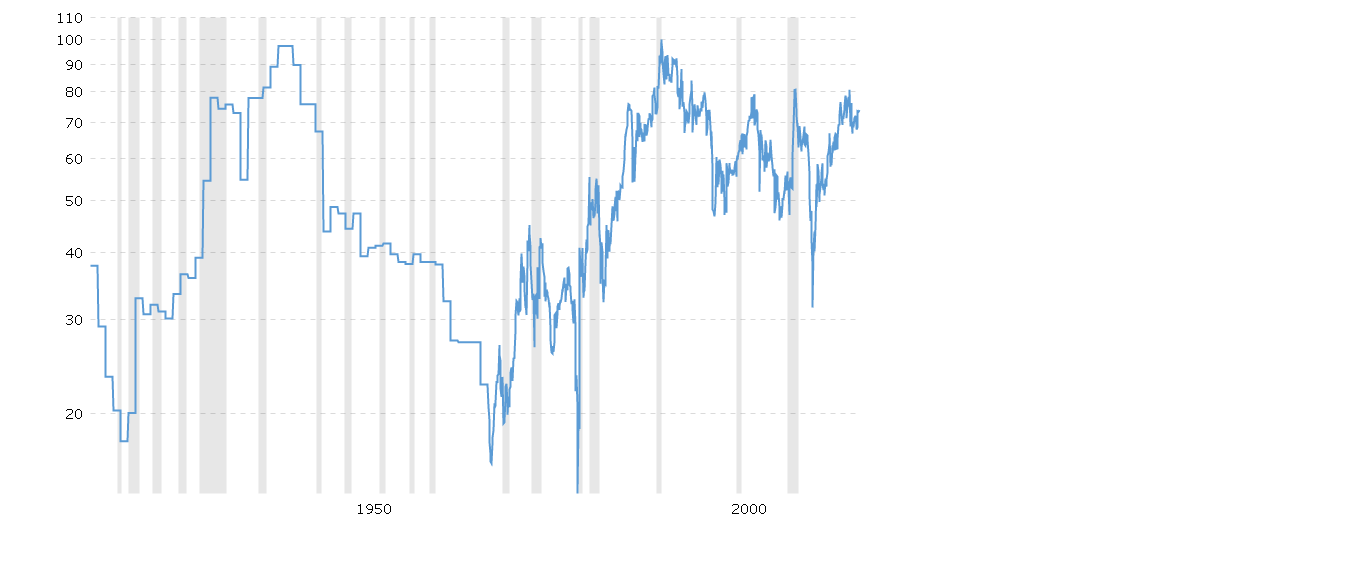

I know many of us here like to wax poetically about how great crypto is, and it really is, but to be a truly diversified investor one cannot discount the importance of having precious metals in one's portfolio.  Usually the best time to buy precious metals is when a stock market crash is imminent. The problem is, how can we know when the market is going to crash. Well for this, we look at a few indicatorssuch as rising real rates. I personally like to use the dow to gold ratio when looking at historical data. Now, I am not truly a fan of technical analysis but with 100 years of hard data there is some truth behind this analysis.  This graph shows the ratio between the Dow Jones and gold. It shows how many ounces of gold it would take to buy the Dow at any time using 100 years of historical data. As we can see, a high Dow/Gold ratio shows that it is time to get out of stocks and into metals. 1929, 1966, and 200 the ratio was very high and as we know they were also the beginnings of long bear markets for stocks. 1980 it was very low signaling a bull market. But this graph just shows us when it is opportune to buy precious metals. Now the question is which one. There are four main metals that we should be looking at. They are: GOLD, SILVER, PLATINUM, PALLADIUM. Most people will just buy gold and sit on it, after all it is the most popular. But a true investor will not just try to make an investment that gets returns, but one that gets the most returns for the investment. The same reason a crypto investor may pick Ethereum over Bitcoin, just because all cryptos are going up, does not mean there are not some better coins to pick than others. So to find out what precious metal to get lets now compare historical gold to historical silver.  Looking at this graph (Gold/Silver Ratio) we can see that silver is nearing its lowest point, in that it costs quite a bit of silver to buy one ounce of gold. If the stock market signals we should buy gold, and the gold silver ratio signals that silver is cheap, it seems to me we should buy some silver. Now I know this is not a lot of data to go on, and it is a fairly simple analysis, but at it's roots, commodities investments are simple. As Yoda would say, buy or buy not. In my advisory opinion I would say an account should have no more than 20% in commodities because they are not the largest gainers in value historically, but they are safer than many other investments. I think if you want to be considered a serious investor you have to think of diversifying out out crypto (at least a little) and into other things. I am personally a lot into crypto, probably an unhealthy amount. But I can afford to lose all my crypto because the rest of my portfolio includes real estate, commodities, stocks, bonds. You may not get rich holding silver, but hopefully you'll never be broke either. Best of luck to all my followers. If you have any questions please feel free to ask. Also, Please like and follow because as a Jew I love to guilt trip!

👍 realcodysimon, preparedwombat, amranamrozi, dylanhobalart, hgmsilvergold, beachgirl, satoshiengaged, solarguy, skririm, soundlegion, runridefly, builderofcastles, indmissbl, michaellamden68, robert-call, thelightreports, ginafraser, emilhoch, andrwooi, shanzashan, crowe, billys, silvernova, pawos, ponnibong, spluff, rocking-dave, badger55, yuslindwi, queenpine, raybrockman, elevator09, spicyer, johngault, truthreport, genics, theswede, steambun, mikenevitt, bullionaire, newprepper, ctrl-alt-nwo, frankietee, samjf87, emilniz, cloratc, lamyh111, xtuffguy,