Currency Analysis Report 12/4/19 – Is The USD/JPY Reversal Short Term???

steemleo·@rollandthomas·

0.000 HBDCurrency Analysis Report 12/4/19 – Is The USD/JPY Reversal Short Term???

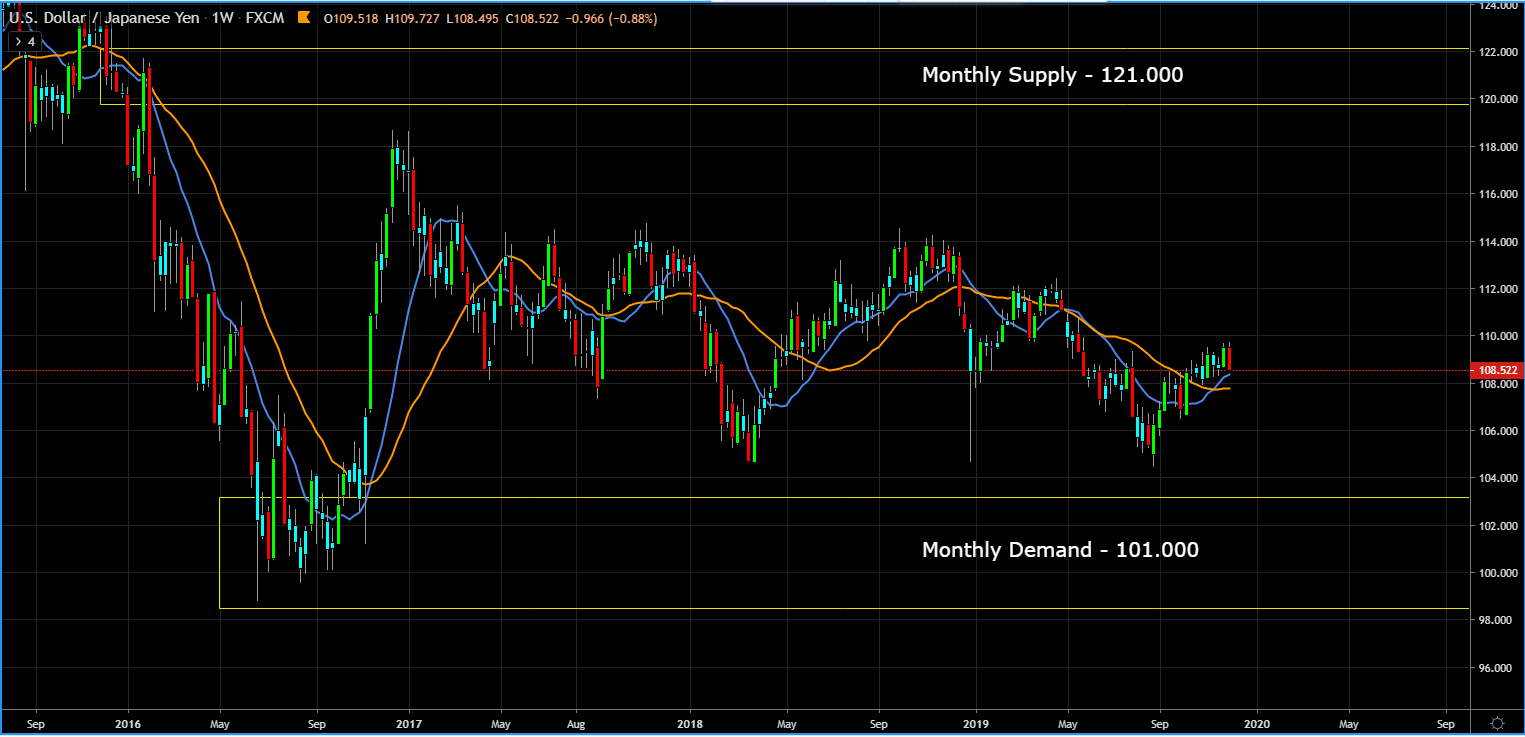

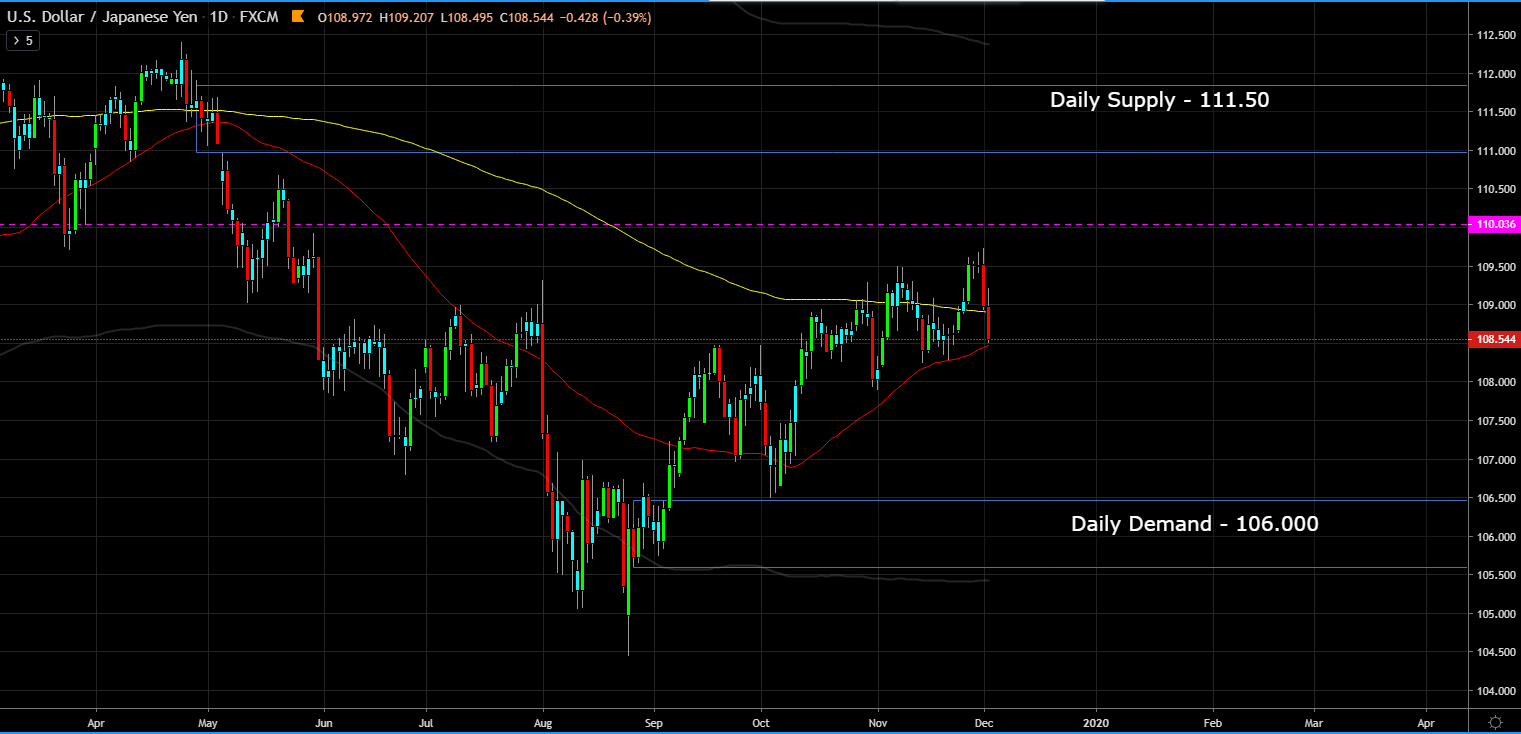

<center></center> Last week, the USD/JPY closed higher along with treasury yields and a rising stock market. The catalyst was the continued optimism surrounding a US and China trade deal despite the December 15th deadline which would implement a fresh round of U.S. tariffs on Chinese goods. Simultaneously, news from Japan continued to point toward a weakening economy and the possibility of further easing from the Bank of Japan. But then Hong Kong got a great Thanksgiving gift when President Trump on Wednesday signed a law supporting Hong Kong's months-long protest movement. The new law will require the US to annually confirm that Hong Kong's special freedoms are being maintained by Beijing. The immediate cause of the protest was the proposed legislation of the 2019 Hong Kong extradition bill. However, the proposed change is the latest in a series of moves by China under President Xi Jinping that are viewed as chipping away at Hong Kong’s autonomy, including barring some activists from seeking elected office, prosecuting protest leaders and banning a pro-independence political party. Then yesterday, the Institute for Supply Management (ISM) said its manufacturing index sank to 48.1% in November from 48.3% in October. This is the fourth straight sub-50 reading. The ISM index is a good leading indicator of the economy and is useful in gauging turning points in the business cycle because the difference between new orders and inventories equates to future production or lack of future production. Readings below 50% indicate business conditions are getting worse. The US dollar stumbled on the news and it marked the 8th straight week the Smart Money reduced their long bets on the US dollar. Also, yesterday, President said China was noncommittal about a forthcoming agreement but said Beijing wants to find common ground. Yet, Trump also said he prepared to levy more duties on Chinese goods in the absence of a trade deal…an additional15% tariffs on consumer goods from China beginning Dec. 15th. Then this morning, President Trump says a trade deal with China might have to wait until after the 2020 election. <blockquote> “In some ways, I like the idea of waiting until after the election for the China deal, but they want to make a deal now and we’ll see whether the deal’s gonna be right -- it’s gotta be right,” Trump told reporters in London where he was attending a NATO summit, adding that he has “no deadline” to complete an agreement. The president’s comments come less than two weeks before the U.S. is scheduled to place tariffs on about $156 billion of Chinese goods. The duties would mark the latest escalation in a 17-month trade war that has seen the two countries -- the largest economies on the planet -- slap levies on hundreds of billions of dollars of each other's goods. </blockquote> <center><a href=https://www.foxbusiness.com/markets/trump-says-us-china-trade-deal-could-after-2020-election”>Source</a></center> On the news the DOW dropped 450 points, its biggest fall in two months. So what about the USD/JPY, where is it heading next, lets go to charts? Monthly Chart (Curve Time Frame) - monthly supply is at 121.000 and monthly demand is at 101.000.  Weekly Chart (Trend Time Frame) – the trend is sideways, with a bias to the upside.  Daily Chart (Entry Time Frame) – the chart suggests to play the extremes at the daily demand and supply zones.  This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

👍 moeenali, stmdev, coredump, dtrade, botony, haxxdump, abh12345.leo, jk6276.leo, leovoter, mindtrap-leo, bearjohn, flipstar.sports, babytarazkp, tonimontana.leo, tonimontana.neo, exe8422, laissez-faire, khaleelkazi, smartbee, leo.curator, cryptopassionleo, anti-fraud, limka, nin4i, ziomalek, chapaj, krotow1989, erihon, sinistor, kira32, buggedout, steempope, astil.codex, ilias.fragment, leo.syndication, leo.voter, flauwy, pearltwin, francis.melville, edkarnie, nealmcspadden, therabbitzone, steem.leo, zaku-leo, thebilpcointrain, bilpcoin.pay, enison1, toofasteddie, teutonium, freemanjaro, gmlrecordz, bruleo, shortsegments, znnuksfe, scaredycatguide, no-advice, blocktvnews, mitchelljaworski, sebas04, newageinv, plook, felander.leo, neal.leo, purefood, jk6276, damla.leo, sra976, leotrail, famigliacurione, w4d, xiaoq, vxc.leo, ph1102.leo, spinvest-leo, annabellenoelle, felixpower, edgmer, missmodness, hamsa.quality, goinvesting, cn-leo, neovoter, queenvictoria, discordiant.leo, kaili, crookshanks, carrinm, moserich, timm-caja, timm, escapeamericanow, fortinbuff, heyimsnuffles, ervinneb, mitrin, mrbullishsail, anotherjoe, scripsio, pcste, okean123, astral, shaunmza, siriusgaia, alexrickard86, kiokizz, paulo380, liberlandpress, avisk, sm-lvl1, sm-starter-beta, darhainer, espni, investorsclub, anthrovegan, desmond41, apofis, witcher73, megavest, baling,